Earlier this year, Bitcoin’s rally brought it to an all-time high of around USD$65,000, more than 10x since the March 2020 crash, prompting many to call for upwards of a $100k bitcoin by end of year.

Since then, the leading cryptocurrency has fall from those heights and has been trading in the $40K to $50K range, no thanks to Elon Musk’s antics, and FUD (Fear, Uncertainty and Doubt). B

But as we approach the new year, will those $100K predictions ring true? Or will the FUD win out and let $65K remain Bitcoin’s all-time-high?

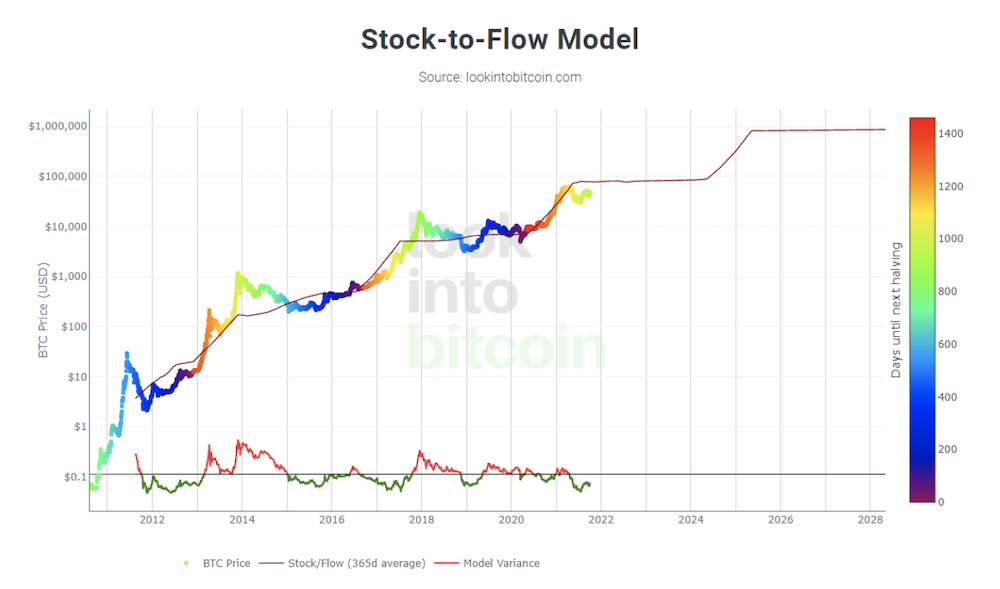

Stock-to-Flow model

Many of the predictions for $100K by end-of-year relied heavily on the Stock-to-Flow model. This indicator model derived in 2019 by PlanB, a popular cryptocurrency figure on twitter, treats Bitcoin as a ‘store of value’ commodity like gold or silver and evaluates them based on current stock against new production.

The model rang true among the crypto community due to Bitcoin being heralded as the new best store of value, due to its scarcity and demand inflows despite a lack of utility. Back tested, the Stock-to-Flow model tracks the value of Bitcoin surprisingly accurately, especially near Bitcoin halving events.

In late June, the model predicted a $98K Bitcoin by November which many speculators used to confirm their lofty prediction. However, Bitcoin’s price as since slightly derailed from the Stock-to-Flow model and signals a longer time horizon for the $100K price target, only hitting upwards of $80K by end of year.

#Bitcoin Sept closing price $43,834 .. like clockwork pic.twitter.com/nCZNaJJ2Fy

— PlanB (@100trillionUSD) October 1, 2021

PlanB, however, states that the Stock-To-Flow model is still on track for a $100K Bitcoin, but warns that if Bitcoin does not exceed that price target or even simply peaks at the mark, the model itself may become outdated and not as useful for future predictions.

Yeah, same for s2f. But I like to point out the current delta between the models and I really look forward to next couple of months. Price must increase >100k (to make a 100k average) or s2f is dead.

— PlanB (@100trillionUSD) September 23, 2021

Smart money hodling Bitcoin

Quantitative easing during the Covid-19 pandemic has compounded problems regarding rising inflation rates while negative yields pervade bond markets. As smart money looks for increasing returns, there is a flight to cryptocurrency for returns on spare assets to outpace inflation.

The 3rd largest #Bitcoin whale wallet accumulated 4,331 #BTC during the market downtown since Sept 7, for a total of $195M USD, this amounts to an average cost basis of $45k.

— venturefoundΞr (@venturefounder) October 2, 2021

As of today, all of these buys are in profit, with a total unrealized gains of $13M USD.#SmartWhale https://t.co/bHclBA9FfQ

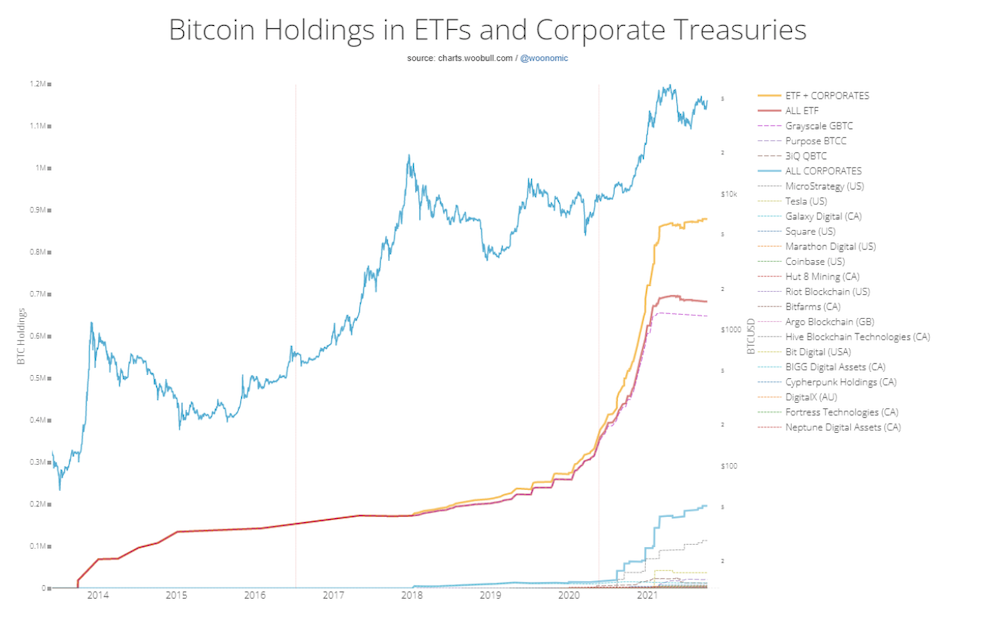

Not only are whales buying more and more Bitcoin, but long-term holders are also increasing their stack, leading to Bitcoin liquidity decreasing. Along with smart money, institutional investors have also started to hoard the coin, with Bitcoin Holdings in ETFs and Corporate Treasuries close to an all-time-high.

Given enough dips for smart money to accumulate as well as positive news, supply shocks can occur as they try to grab the asset before prices start rocketing up, driving Bitcoin ever closer to $100K.

With these Institutional Investors publicly or privately buying the dips, it only sets a precedent for others to do so, and even cities like Miami are starting to consider adding Bitcoin to their treasuries.

These buying patterns will set strong support levels at every dip and as their crypto goes into cold storage, only helping the bull case of a $100K Bitcoin and more eventually, if not by the year end.

Bitcoin ETF approval

The introduction of a Bitcoin ETF (Exchange-Traded Fund) would allow liquidity inflows from previously untapped markets who were not willing to purchase the underlying asset. Physical Bitcoin ETFs would also hold Bitcoin, making supply even more illiquid and possibly causing further supply shocks and dragging prices upwards.

Though ETFs are great for Bitcoin prices mid to long term, there still exists a near-term risk for Bitcoin’s price as they would cut into the premium that the Grayscale Bitcoin Trust, the world’s current largest digital asset manager, pays for Bitcoin. However, we cannot take away from the immense amount of money that would flow in as Bitcoin becomes even more accessible.

This year alone, there were more than 18 applications filed with the United States SEC (Securities and Exchange Commission) for Bitcoin ETFs. Though the SEC usually has a 45-day period to approve or disapprove such applications, it has instead chosen to delay the applications to year end, citing fraud concerns and volatility in the crypto space. However, SEC chairman Gary Gensler has said that that he would be open to considering futures-based Bitcoin ETFs given proper regulations.

Powell: No plan to ban crypto pic.twitter.com/HEPEFLAoSh

— Blockworks (@Blockworks_) September 30, 2021

Though the delays may be a cause for concern, they show that these ETFs are a possibility further down the road, with experts weighing in that they are more likely to occur in 2022 than this year. The Federal Reserve Chairman James Powell even mentioned recently that the U.S. has no plans to ban crypto – signalling a positive shift in sentiment towards the market.

Love it or hate it, Bitcoin is still the driving force behind the cryptocurrency market and when it’s green, the whole market celebrates. Though there may not be enough time for Bitcoin to rocket to $100K by end of year, early 2022 may see it finally hit that benchmark, and hopefully send the whole market to the moon.

Featured Image Credit: Web Pixer / Pinterest

Also Read: Why I Currently Do Not Hold Any Bitcoins In My Crypto Portfolio