The cryptocurrency markets have hit a two-month high, led by Bitcoin’s immense 10% move just this week. While the overall market has been in a 10-week long downtrend, the recent surge has managed to reclaim almost all of the losses since crypto’s YTD peak.

But with the SEC’s crypto crackdown not relenting, how has Bitcoin managed to return to $29,000?

TradFi Refuses To Shy Away From Cryptocurrency

While the regulatory landscape in the United States has not been favorable for crypto, it seems that traditional finance institutions are taking the opportunity to not shy away, but enter Web3.

Following Blackrock, a leading asset management firm, filing for a Bitcoin SPOT ETF, two other asset managers have officially put forth proposals for similar financial products.

Blackrock, Citadel, Fidelity, Schwab, WisdomTree, Invesco, Deutsche Bank all entering the market within 2 weeks of both a downside decoupling from stocks and Binance and Coinbase both getting sued. pic.twitter.com/2RguxHMBFf

— Will Clemente (@WClementeIII) June 21, 2023

EDX Markets, a cryptocurrency exchange launched by Citadel securities and backed by some of the heaviest hitters in capital markets, also launched yesterday (21st June), with four cryptocurrencies being offered on the platform.

Internationally, Germany’s largest bank, Deutsche Bank has applied for a digital asset custody license, which could make cryptocurrency more accessible for its more than 27 million customers.

Investment Giant BlackRock Files For Bitcoin SPOT ETF: Here’s Everything You Need To Know

Weakening U.S. Dollar a Good Sign For Bitcoin Price

The U.S. Dollar Index, also known as the DXY, recently hit a monthly low of 102, close to the bottom of its 52 week range.

Historically, Bitcoin and other risk assets have traded opposite to the DXY, with a low DXY correlating with bullish crypto price action.

With more countries shying away from the U.S. Dollar, with some even choosing to settle the majority of their trades in other currencies, the Dollar’s strength has started to wane.

#FOMC – ALL YOU NEED TO KNOW:

— Doctor Profit 🇨🇭 (@DrProfitCrypto) June 14, 2023

– No rate hike increase this month

– Rate cuts are unlikely in 2023

– FED goal remains 2% inflation

– FED signals possible rate increases this year

– Two rate hikes with .25bps expected by FED this year

Overall, hawkish statement.

Furthermore, while the U.S. Federal Reserve has yet to make any rate cuts, their recent decision to pause rate hikes during the previous FOMC meeting could be a good sign for crypto.

Equities, Tech Stock Rally Heralds Crypto Resurgence

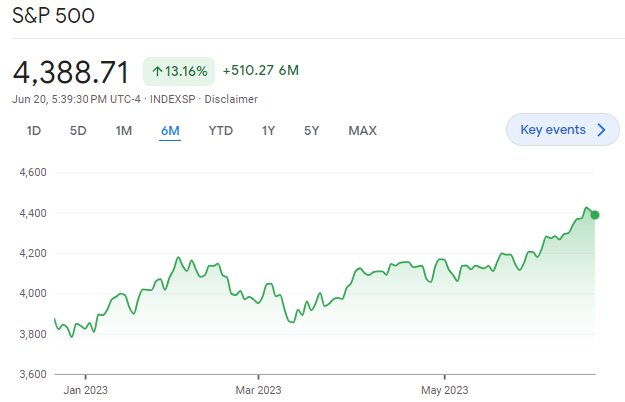

While the cryptocurrency market continued to trend downward in Q2 2023, with the S&P 500 leading the way with a 13% rally over the first half of the year.

Companies like Apple and Microsoft also saw significant gains in the same period, but their growth were dwarfed by Nvidia, which saw a massive rally following their April earnings release, and swiftly rose to claim a $1 trillion market capitalization.

With tech stocks being historically correlated with the cryptocurrency market, its resurgence may have been a key catalyst for crypto’s current trend.

Also Read: Could Bitcoin’s 10 Week losing Streak Finally Be Broken?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief