Bitcoin has been setting new all-time highs (ATH) almost every day this week. Based on the latest data, Bitcoin recorded several significant price surges, as marked by the red arrows on the chart. Each surge highlights strong bullish momentum amid heightened market enthusiasm.

On November 19, Bitcoin reached an ATH of around $94,600. This bullish trend continued on November 20, with the price climbing to $96,800, driven by increased demand from large-scale investors. On November 21, Bitcoin hit another ATH at $98,000 before experiencing a minor correction, maintaining an overall upward trajectory.

The peak came on November 23, when Bitcoin hit its highest price of $99,906, inching ever closer to the psychological milestone of $100,000. This remarkable achievement underscores market optimism, as Bitcoin appears to be on the verge of breaking through to new record levels.

Although there was a slight pullback after touching $99,906, the strong momentum driven by institutional interest via ETFs and retail demand continues to support the price. These daily price surges not only reflect the market’s confidence in Bitcoin but also indicate sustained buying pressure from diverse market participants.

Volume Surge and Stock-to-Flow Alignment

Bitcoin’s trading volume has shown impressive numbers over the past few days, reflecting a highly active market. In the last 24 hours alone, trading volume reached $2.86 billion, signaling strong interest from both institutional and retail investors.

This increase in volume serves as a key indicator of rising demand for Bitcoin. Strong buying activity is evident not just in trading volume but also in the growing positive sentiment among market participants. Sustained high volume is playing a crucial role in maintaining the stability of Bitcoin’s upward price trend.

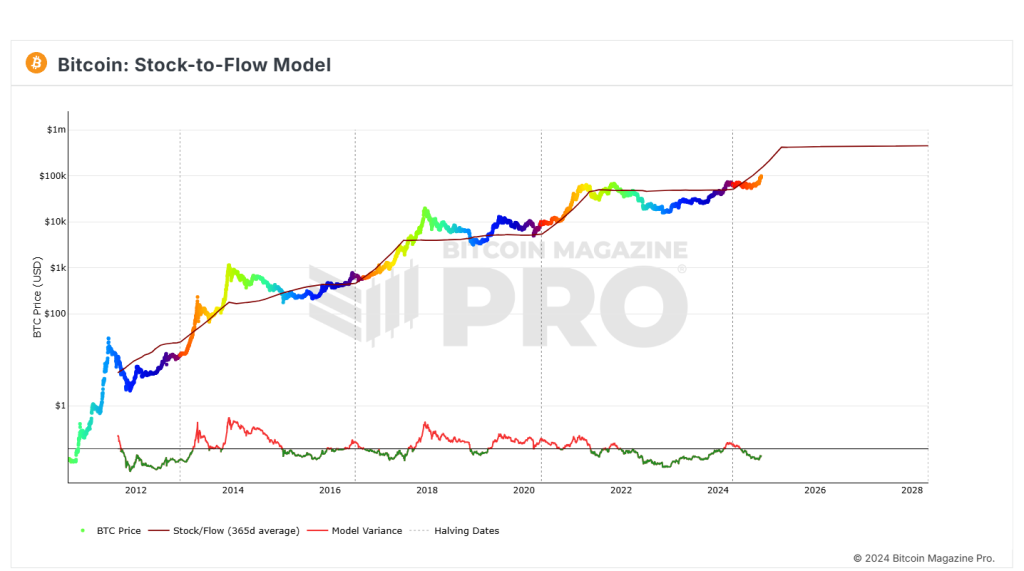

The Stock-to-Flow (S2F) model further validates this price trend. According to S2F, which uses Bitcoin’s scarcity as the core factor, the current price trajectory aligns closely with post-halving predictions. The model illustrates that after each halving, Bitcoin’s price tends to experience significant growth over the following months or years. Currently, S2F projects Bitcoin to reach $100,000 to $120,000 during this cycle.

The combination of high trading volume and validation from the S2F model provides greater confidence to the market. With these two indicators, Bitcoin showcases strong fundamentals to continue its trajectory toward the psychological milestone of $100,000.

Bitcoin Leads the Market as Ethereum Struggles to Keep Up

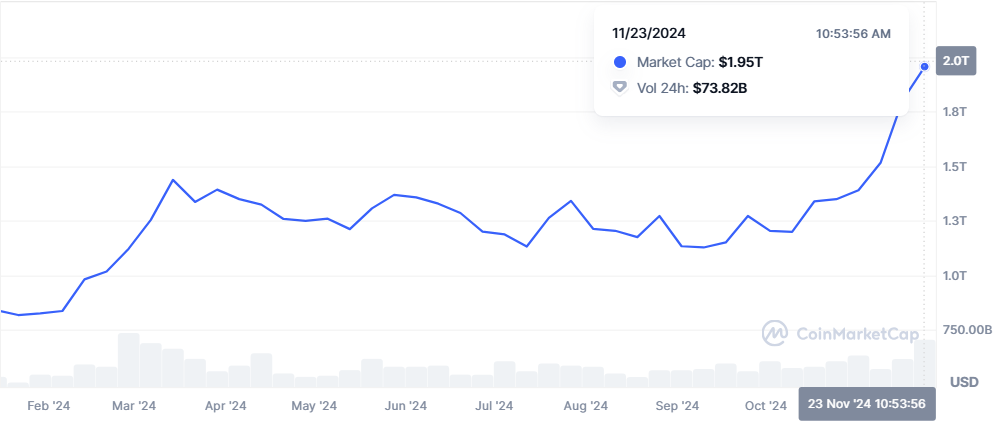

Bitcoin continues to dominate the cryptocurrency market with a market capitalization of $1.95 trillion, far surpassing its closest competitor, Ethereum, which holds a significantly smaller market cap of $401 billion. Over the past few days, Bitcoin’s market cap has consistently risen, fueled by its price rally nearing the $100,000 mark.

Bitcoin’s market dominance, currently at 59.67%, remains substantial despite a slight dip from its peak of 61%. This indicates that the majority of capital in the cryptocurrency market is still concentrated in Bitcoin. The recent decline in BTC dominance may be attributed to capital rotation into other cryptocurrencies, such as altcoins.

Related Bitcoin ETFs Take in $1 Billion as BTC Price Nears $100,000

Ethereum, on the other hand, is showing a declining trend in its dominance. ETH dominance currently stands at 12.27%, down from higher levels earlier this week. This decline suggests that Ethereum has not yet garnered enough momentum to challenge Bitcoin’s lead.

The disparity in market cap and dominance between Bitcoin and Ethereum highlights their distinct roles in the cryptocurrency market. While Bitcoin commands attention as “digital gold,” Ethereum focuses on innovation within DeFi and NFTs.

Top Crypto Gainers by Market Cap and Percentage

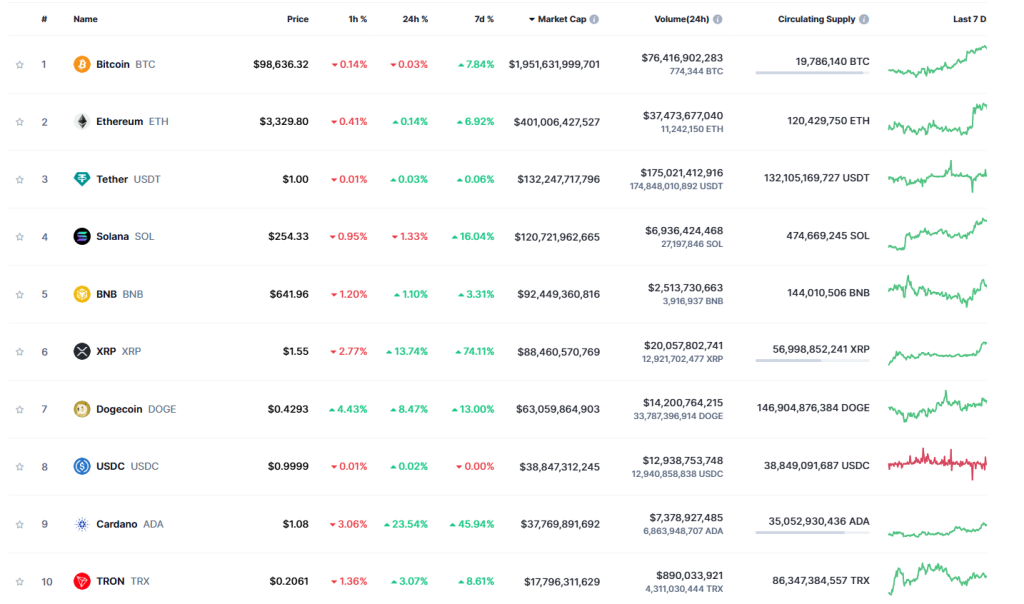

Building on Bitcoin’s dominance and Ethereum’s steady performance discussed earlier, the spotlight now shifts to how altcoins are carving their own paths in the market. While Bitcoin and Ethereum maintain their leadership in market cap, several altcoins are solidifying their positions with robust growth and increased adoption. Bitcoin remains unmatched with a staggering $1.95 trillion market cap, while Ethereum continues to play a critical role with $401 billion. Among the rising stars, Solana (SOL) and Binance Coin (BNB) have shown remarkable resilience, securing the 4th and 5th spots with market caps of $120 billion and $92 billion, respectively.

Other notable mentions include XRP, holding strong in the 6th position with an $88 billion market cap, buoyed by positive legal developments and key partnerships. Meanwhile, Dogecoin (DOGE) retains its appeal among retail investors, ranking 7th with $63 billion in market cap.

Top Percentage Gainers This Week

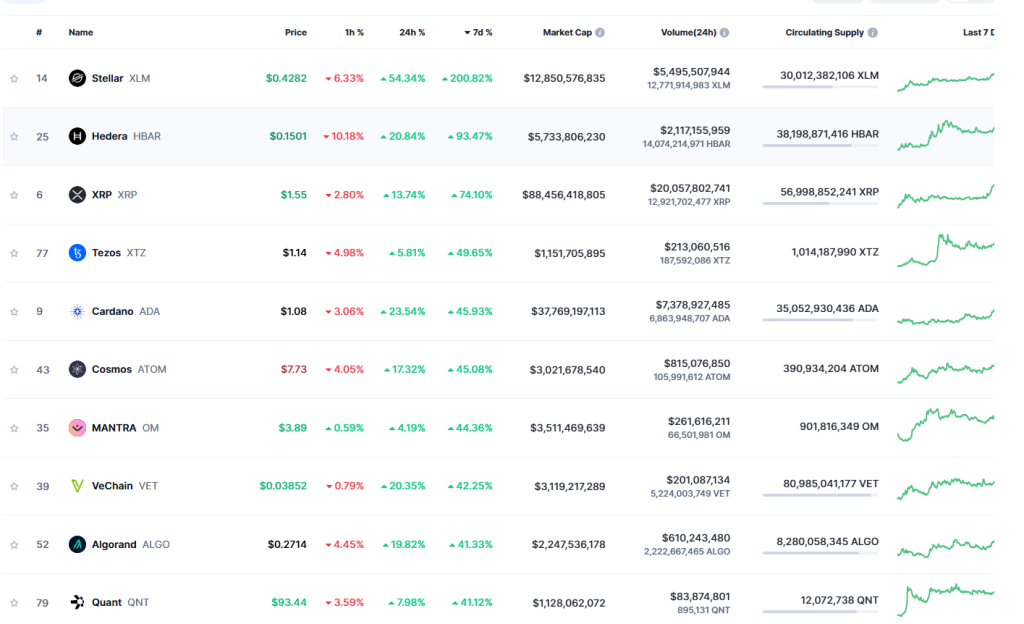

In terms of weekly performance, Stellar (XLM) leads with a remarkable 200.82% increase, driven by expanding adoption and strategic initiatives that boosted its appeal among investors. Hedera (HBAR) also made significant strides, gaining 93.47%, supported by its institutional partnerships and innovations within its blockchain network. Meanwhile, Cardano (ADA) recorded a solid 45.93% increase, reflecting its consistent technological progress and strong developer community.

Other standout performers include Cosmos (ATOM), which rose by 45.08% due to its growing influence in blockchain interoperability, and Quant (QNT), which gained 41.12%, driven by rising demand for its blockchain-based solutions in enterprise data integration. VeChain (VET) also saw a 42.25% increase, signaling renewed interest in its enterprise applications.

Related Bitcoin to $100K: A matter of when, not if

Bitcoin ETFs Fuel Price Surge Toward New Highs

Speaking of "100" milestones, the US bitcoin ETFs hit $100b in assets (altho more like $104b given the price surge overnight) w/ YTD flows flirting with $30b (double our estimate). They're now 97% of way to passing Satoshi as biggest holder and 82% of way to passing gold ETFs. pic.twitter.com/Y3070yW7Jx

— Eric Balchunas (@EricBalchunas) November 21, 2024

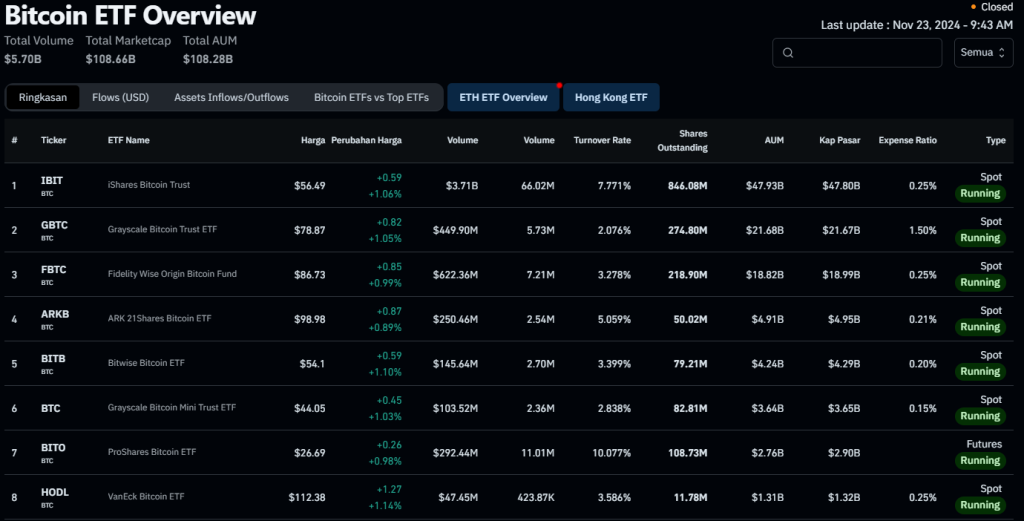

The surge in Bitcoin’s market dynamics has been matched by the rapid growth of Bitcoin ETFs, which recently achieved a remarkable $108.28 billion in total assets under management (AUM). Leading the charge is iShares Bitcoin Trust (IBIT), with an AUM of $47.93 billion, firmly establishing itself as the largest player in the space. Other ETFs such as GBTC and FBTC follow, showcasing significant investor interest, with volumes reaching $3.71 billion and $622.36 million, respectively.

This surge in Bitcoin ETFs signifies the growing trust in regulated investment products linked to Bitcoin. Funds like ARK 21Shares Bitcoin ETF (ARKB) and Fidelity Wise Origin Bitcoin Fund (FBTC) have gained traction, offering competitive expense ratios of 0.21% and 0.25%, respectively. Meanwhile, the consistent performance of ProShares Bitcoin ETF (BITO) and VanEck Bitcoin ETF (HODL) underscores the expanding variety of Bitcoin-related investment vehicles catering to diverse investor needs.

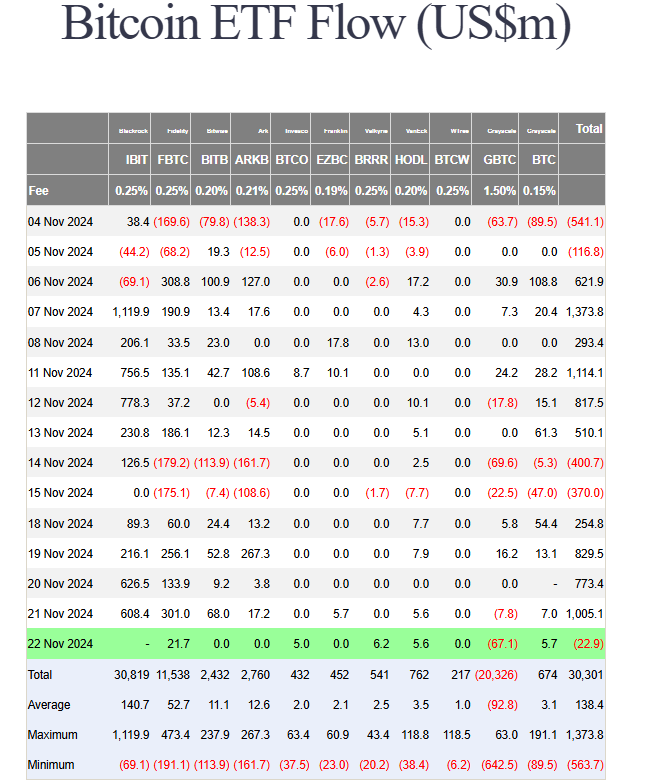

The ETF flow data further underscores this trend, revealing notable inflows across leading funds. IBIT, for instance, recorded a massive inflow of $1,119.9 million on November 6, 2024, the highest among all funds during this period. November 11 also marked a significant total inflow of $1,114.1 million across the board, reflecting a consistent pattern of investor confidence.

You can also read this Trump Pushes for New White House Crypto Role

Will Bitcoin Break Through 100K?

Bitcoin continues to showcase impressive performance, fueled by surging institutional interest and growing retail participation. Significant inflows into Bitcoin ETFs have become a key catalyst, driving its price closer to all-time highs. This reflects the increasing recognition of Bitcoin as a premier investment asset.

The prospect of Bitcoin reaching $100,000 is bolstered by a combination of factors. Steady inflows, the upcoming halving event, and its rising popularity as “digital gold” provide strong positive momentum. However, market volatility and regulatory risks remain hurdles that cannot be ignored.

While reaching the $100,000 level cannot be guaranteed in the short term, the long-term trend remains optimistic. Bitcoin continues to solidify its position in global finance, symbolizing transformation and innovation amidst the evolving economic landscape.

You can also read this Gary Gensler Announces Resignation as SEC Chair

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]