On February 28, 2025, Bitcoin took a sharp dive, falling to $78,197. However, it quickly reversed course, bouncing back by over 5%, rising past $82,000. This swift recovery came after the release of positive US economic data, with the PCE index for January showing inflation concerns were easing.

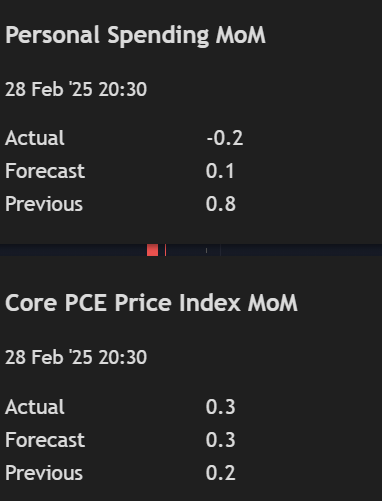

The market responded positively to the recent inflation data, with the Core PCE Price Index coming in at 0.3%, as expected, signaling inflationary pressures were easing. However, Personal Spending showed a slight decline of -0.2%, below the forecast of 0.1%.

This contributed to a weakening of the US dollar, which further boosted optimism in the market. As a result, analysts are hopeful that Bitcoin’s recovery will continue into March, with the cryptocurrency climbing above $82,000 and possibly starting a new upward trend.

Looking at the chart, Bitcoin’s bounce from $78,197 to over $82,000 illustrates a 5% recovery in a short period. This movement has sparked optimism that Bitcoin could continue to rise, especially if broader market conditions remain favorable.

Analysts See Bitcoin’s Potential for Continued Growth

With financial conditions improving, Bitcoin’s growth outlook has become more promising. Experts, including Julien Bittel from Global Macro Investor, believe that Bitcoin has already priced in the effects of past financial tightening.

There’s a lot of noise in the market right now – conflicting narratives everywhere.

— Julien Bittel, CFA (@BittelJulien) February 28, 2025

But here’s the reality – or at least my take on what’s really going on:

Everything happening in markets right now, especially in crypto, is a direct consequence of the tightening of financial… pic.twitter.com/iLPqiyw3LX

Despite the volatility, Bitcoin’s low RSI indicates it could be an excellent time for accumulation. With inflation concerns subsiding and the US dollar weakening, many analysts predict Bitcoin could break past $90,000 in the coming weeks.

At the crucial $80,000 support level, Bitcoin’s RSI of 23 signals it might be oversold, making this an attractive buying opportunity. If the market stabilizes, Bitcoin could see a solid upward move.

You can also read this Metaplanet’s Aggressive Strategy for Bitcoin Investment

Bullish Sentiment for Bitcoin Remains Strong

Despite the recent dip, Bitcoin’s bullish trend remains intact. The drop below $80,000 is seen as a typical correction in an ongoing bullish market. Technical indicators, like the Stochastic RSI, suggest Bitcoin is currently oversold, presenting a prime opportunity for accumulation.

With the Stochastic RSI at low levels, the chart indicates Bitcoin could soon rebound. As long as Bitcoin holds key support levels, analysts are optimistic it will break through resistance and possibly surpass $90,000.

Overall, Bitcoin’s outlook remains positive. The bullish sentiment is expected to carry into March, setting the stage for further growth as long as key levels are maintained.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

You can also read this Pump.fun X Account Hacked to Promote Fake $PUMP Token