Centralized exchanges are a first step for many into the world of Web3.0. Love them or hate them, there is no doubt that they have become an integral part of the cryptocurrency ecosystem.

In light of that, centralized exchanges have to be a trustworthy and reputable gateway into crypto, something that has been etched in the minds of anyone affected by the implosion of FTX.

JB Graftieaux, who currently heads Bitstamp as Global CEO, likely knows this better than anyone, and has been working tirelessly to ensure users not only get a reliable platform into the world of crypto, but also excellent execution and a great user experience

Also Read: Marouen Zelleg Of ConsenSys On Metamask, Unlocking Web3.0, And Institutional Adoption

Leaving Paypal, eBay, for Web3.0

Jean-Baptiste (JB) Graftieaux is no stranger to the world of fintech, having previously led teams at Paypal and eBay for 10 years prior to being CEO of Bitstamp. With a focus on regulation, JB worked with governments to develop legislation around digital money.

However, he soon discovered a decentralized alternative – and the rest was history.

“When I discovered Bitcoin in 2013 where everything was decentralized, I got very curious and excited”

Having an entrepreneurial mindset, JB soon found himself at Bitstamp, which at the time was just “a start up in a garage”. While he did venture back into the Web2 world with eBay, JB eventually returned to Bitstamp, and now heads the exchange as CEO.

While in hindsight entering crypto was the obvious choice, leaving a comfortable role in the booming fintech industry for a volatile and emerging one is a testament to his conviction and dedication to the space.

It may have also helped that he started investing in Bitcoin at $200.

Understanding Bear Market Sentiments With Crypto Pulse

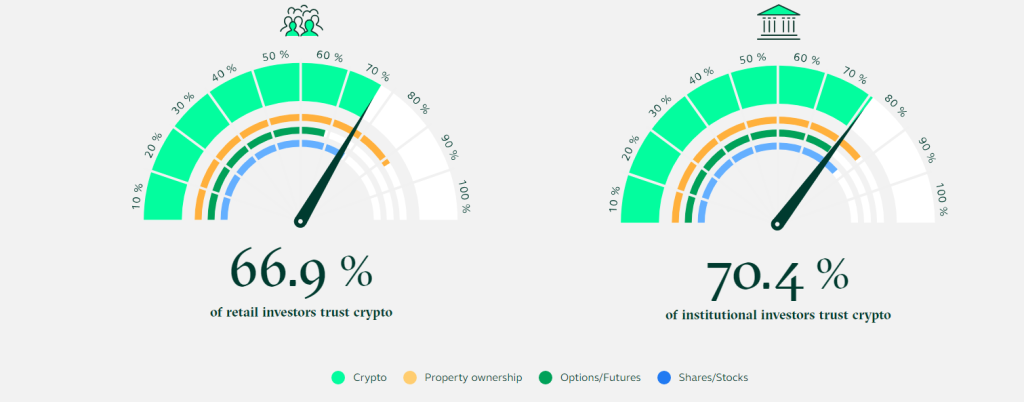

Being an exchange, Bitstamp finds it imperative to understand investor attitudes and the state of crypto. Thanks to their quarterly Crypto Pulse survey, which involves more than 28,000 retail and institutional investors, they are able to glean a deeper insight into the market.

Surprisingly, there has been increasing interest in cryptocurrency worldwide, with the number of active investors rising by 4% from Q1 to Q2 2022. In Singapore, the survey shows that more than a third of institutions were inclined to increase their crypto investments going forward.

Despite the bear market, their data shows that long-term confidence in crypto has been unshakeable, a positive sign for the future.

How Regulation Makes Crypto a Level Playing Field

With billions lost yearly to various crypto exploits, JB believes that regulation is pivotal to crypto’s progress. And while substantial progress has been made in that regard, more needs to be done to make crypto accessible to the masses.

“(It will) accelerate the adoption of crypto across the world and create a level playing field”

While Bitstamp builds on their principles of “trust, security, and compliance”, he notes that “some other companies are playing less by the book”, which has become all too evident with the collapse of FTX.

Regulation drives market development.

— Bitstamp (@Bitstamp) July 20, 2022

Read Bitstamp's APAC MD's piece in The Business Times about Singapore's and Hong Kong's regulatory approaches towards crypto. #cryptoregulation #singapore #HongKong https://t.co/pU1QkLNEyl

However, regulation does not come about easily.

Across borders, it becomes fragmented, which each country having their own take on legislation.

Even within Europe, crypto companies are still unable to passport their services, hindering adoption. “We are in the middle of a regulatory transition. It’s expensive, it’s fragmented, it’s complex. Nevertheless, we are trying to work closely with regulators to shape everywhere we operate.”

Being the longest-standing crypto exchange, Bitstamp has a wealth of experience to bring to the table, and JB hopes that they can set an example for all other players in the space.

We’ve Never Seen More Interest in Crypto

Despite the bear market, interest in crypto has been picking up for both retail and institutions.

“On the retail side, we open accounts everyday at Bitstamp.”

We continue to lower crypto fees. This time with:

— Bitstamp (@Bitstamp) December 15, 2022

– An 80% lower trading fees on all fiat/stablecoin pairs

– Lower maker trading fees for volume over $5M

– New tiers in our public rate card pricing on $50M & $250M

Get more info on our blog: https://t.co/igxhRRDjQ2 pic.twitter.com/JMIvZWLqSp

JB also notes that Bitstamp has “never seen such a high level of adoption” on the institutional side, something he attributes to their “Bitstamp-as-a-service” solution (BSaaS). By providing a full suite of tools and deep liquidity, institutions can help fulfill crypto needs seamlessly.

“It enables them to go very fast to market … we work with some stock markets which offers stocks, but also crypto to their end clients, and that’s the Bitstamp integration”

In fact, BSaaS is currently serving approximately 8 million end clients and has become a modular solution for any institution – a hassle-free alternative to building a crypto exchange from the ground up.

Bullish on Soccer NFTs?

Which aspects of crypto would you think that the CEO of a leading exchange would be most excited for? If your answer was anything but sports NFTs, don’t worry – I personally had him pinned as a cross-border payments guy.

While he has spent most of his professional life around compliance and fintech, JB notes his love for sports. “In the world, everyone (participates in) sports, so the combination of sports and NFTs … there will be a lot of interesting projects that will come to the surface”.

Moreover, he sees a world where gaming, sports, and the metaverse could co-exist in an exciting ecosystem, and admires how communities are build around NFTs.

While many NFTs received criticism for their jaw-dropping prices, he looks at the utility they can bring, such as meeting up with prominent athletes or receiving exclusive access to merchandise or events.

With the ongoing world cup shining a light on fan tokens, their adoption into the crypto ecosystem has potential, with some clubs allowing holders influence over their decisions. With athletes such as Steph Curry and Lamelo Ball even producing their own collections, sports NFTs could be a groundbreaker for communities in the future.

Upcoming Live Stream

Join us on the 12th of January at 5pm on our YouTube Live as Chain Debrief Studios host Bitstamp, BitGo and GSR representatives to discuss “FUD”, Security and Transparency in Web3.

Also Read: IOHK’s Romain Pellerin On Cardano, Disrupting Intermediaries, & The Vasil Upgrade

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief