Binance, one of the largest cryptocurrency exchanges in the world, has reportedly let go of over 1,000 employees in their latest round of layoffs.

According to reports from the Wall Street Journal, their customer service division was most heavily affected by the announcement, with someone familiar with the matter noting that Binance could be at risk of losing more than a third of its staff.

Furthermore, the recent round of layoffs followed a previous downsizing, where Binance had already cut down to a slimmer 8000-odd person workforce.

The exchange is also seemingly seeking to reduce its physical presence in the United States, where it is currently under regulatory scrutiny – laying off or relocating approximately 150 of its staff there.

1/10

— Adam Cochran (adamscochran.eth) (@adamscochran) July 16, 2023

Hey @cz_binance if your layoffs weren't about cost cutting, why on June 19th did you announce on WEA that you suddenly cut extended benefits for all employees, & *tell them* it was because of "a decline in profit"?

Not exactly trust building to lie about this… pic.twitter.com/2MvP1ZPKEG

Leaked internal messages regarding the layoffs have also been circulated widely on social media, resulting in speculation that the current round of downsizing could be more deeply rooted than on first glance.

Twitter user Adam Cochran also pointed out that while Binance has publicly stated that they are still hiring, and that current measures are more a form of restructuring than anything, it seems that internal communications have signaled a temporary hiring freeze.

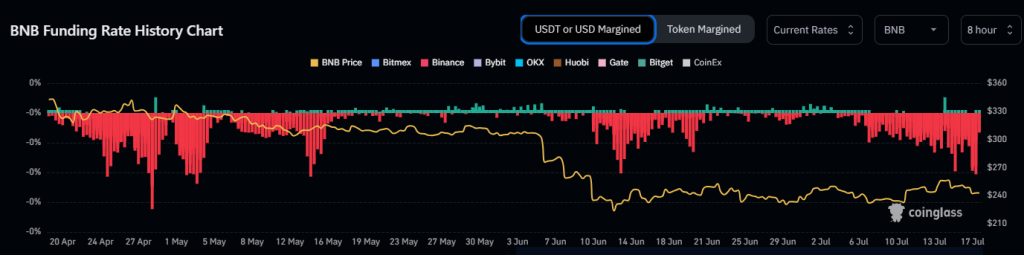

Following the news, $BNB – the native token of Binance and its Binance Smart Chain, quickly became the most heavily shorted token on the market, capitulating almost 20% since the start of last month.

Amidst poor liquidity and heavy selling pressure, funding rates on $BNB momentarily reached 200% APR on Binance, and up to 400% APR on on-chain exchanges such as Synthetix.

At the time of writing, Changpeng “CZ” Zhao, the CEO of Binance exchange, has yet to address rumors surrounding the layoffs. However, he has taken to Twitter to address withdrawal issues that users faced earlier.

Also Read: Upgrading BNB Network: ZhangHeng Hard Fork Unveils New Features

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief