Just this week, renown FDIC-insured Silicon Valley Bank ($SIVB) saw it’s shares fall more than 80% as rumors of insolvency emerged. Unfortunately for all those involved, SVB truly experienced a bank run, with regulators quickly shutting it down and trading of it’s stock halted.

However, the damage had been done – cash held in SVB by institutions, individuals, and corporations were inaccessible.

One of the institutions affected was Circle, the issues of stablecoin $USDC.

Also Read: U.S. President Clamps Down on Crypto, Capital Gains – A Complete Breakdown

USDC Held $3.3 billion in Cash With SBV

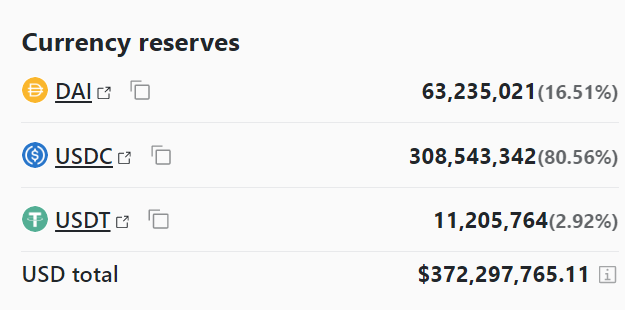

According to a statement by Circle, they currently hold reserves for $USDC in the following denomination:

77% Treasury Bills ($32.4 billion)

23% Cash ($9.7 billion)

While these assets are further spread out amongst multiple institutions, $3.3 billion, or 7% of their reserves, were held in SVB.

This revelation sent $USDC into a freefall, trading for as low as $0.87 on some exchanges. Furthermore, stablecoins collateralized with $USDC such as FRAX and DAI saw a similar dip in price.

The remaining 23% ($9.7bn) is in cash. Last week, we took action to reduce bank risk and deposited $5.4bn with BNY Mellon, one of the largest and most stable financial institutions in the world, known for the strength of their balance sheet and as a custodian.

— Jeremy Allaire (@jerallaire) March 11, 2023

$3.3bn of USDC’s… https://t.co/Bm1rZaTEPK

Thankfully, Circle CEO Jeremy Allaire has informed investors that $USDC is still fully redeemable at a 1:1 ratio. Furthermore, it’s slow return to peg was due to a short-term illiquid crunch over the weekend, as the U.S. Banking system only operates on weekdays.

USDC did not have exposure to SIlvergate, another bank that collapsed this week.

Crypto Investors Not Out of The Woods Just Yet

SVB held more than $200 billion in assets last quarter, with many of them from tech-based startups and companies. While Circle’s $3.3 billion in assets drew the most headlines due to $USDC’s depeg, many other crypto companies were affected as well.

1/5: A statement from the PROOF team regarding SVB:

— PROOF (🥃,🦉) (@proof_xyz) March 10, 2023

Many of you have seen the headlines this morning about the Silicon Valley Bank closure. The most important thing to us—in both good times and bad—is to communicate with our community proactively and transparently. 🧵:

While most companies like Proof, Yuga Labs, and Avalanche managed to come away relatively unscathed thanks to diversifying their assets, others have not been as fortunate.

So far I know, due to SVB:

— Zach Tratar (@zachtratar) March 10, 2023

– Startups who have their merger/acquisition delayed.

– Startups who can't access 95% of their capital. Will likely miss payroll.

– Startups who are entering fundraising and likely pausing. They're uncertain.

Everyone is affected.

While no major crypto-centric companies have yet reported major exposure to SVB, we are sure to see some level of fall out in the coming days.

Additionally, popular Decentralized Exchange Curve saw major withdrawals of $USDT in exchange for $USDC and $DAI during the de-peg.

During this period, many worried users hurrying to swap their $USDC also faced major losses due to MEV or other arbitrage mechanisms, like this transaction which saw more than $2 million in $USDC being swapped for a paltry $0.05 in $USDC.

Also Read: Interest Rates, GBTC & Mt. Gox: Here’s Why The Crypto Markets are Down Today

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Forbes