The current State of DeFi

Most DeFi users will remember those legendary days when money markets and liquidity protocols were paying users to utilise their platform. For me, I started digging deeper into DeFi in May 2021 when AAVE had just arrived on Polygon and was paying users to both lend and borrow assets on-chain through their incentive programme.

Back when i started, DeFi summer was just around the corner. I got in at the first high, where DeFi saw a total TVL of $121B, a number which was up 50% just 5 months later to $182B.

Like many other degenerates out there, my strategy was a classic one; depositing $MATIC and using it as collateral to borrow $USDT, swapping the borrowed $USDT for more $MATIC to deposit back into AAVE and repeating this process.

The interest rates I earned through my deposits and the incentives I was rewarded with were more than enough to cover my borrowing rates. I was earning a yield of 10-15% APY through a recursive lending and borrowing process, and my exposure to $MATIC was also leveraged, just like a typical margin trader.

Problems with DeFi

While this is good in the short term for users like myself and for the protocol in terms of liquidity, this system is certainly not sustainable as it merely attracts ‘mercenary liquidity’ –liquidity that will instantly vaporise once the incentive programme ends.

Moreover, due to other traders borrowing these assets and driving up the interest rates, others who require capital urgently are left to deal with a higher cost of borrowing.

This is a highly salient discourse in the crypto world as DeFi was envisioned to be a fair platform where users from all walks of life could enjoy better rates by cutting out the middleman (banks) in traditional finance systems.

Yet this has been negated to satiate greedy traders and their recursive leveraging practices.

Motivation For Off-chain Credit Markets

Ostensibly, to eliminate ‘mercenary liquidity’, platform ‘stickiness’ must be present, which implies that there needs to be a use-case for the provided liquidity, a use case that goes beyond the promotion of degenerate activities like recursive leveraging.

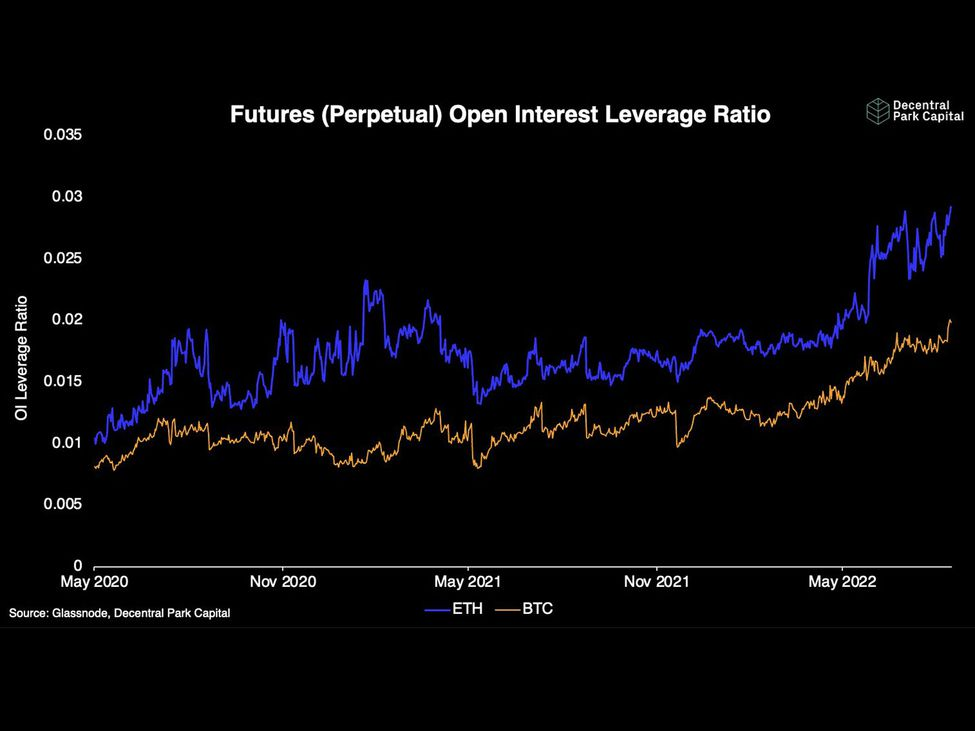

As you can see, the open interest leverage ratio on BTC and ETH has steadily been on a rise, which translates to increased activity of buyers and sellers out there. As leveraging was gaining traction, the need for a better use case for provided liquditiy became much more prevalent.

To engender greater fairness in the borrowing side of the house, there needs to be an element of ‘control’ to prevent traders from excessively borrowing the provided liquidity. And the solution here is to deploy the ‘borrowing’ business off-chain.

Off-chain Benefits

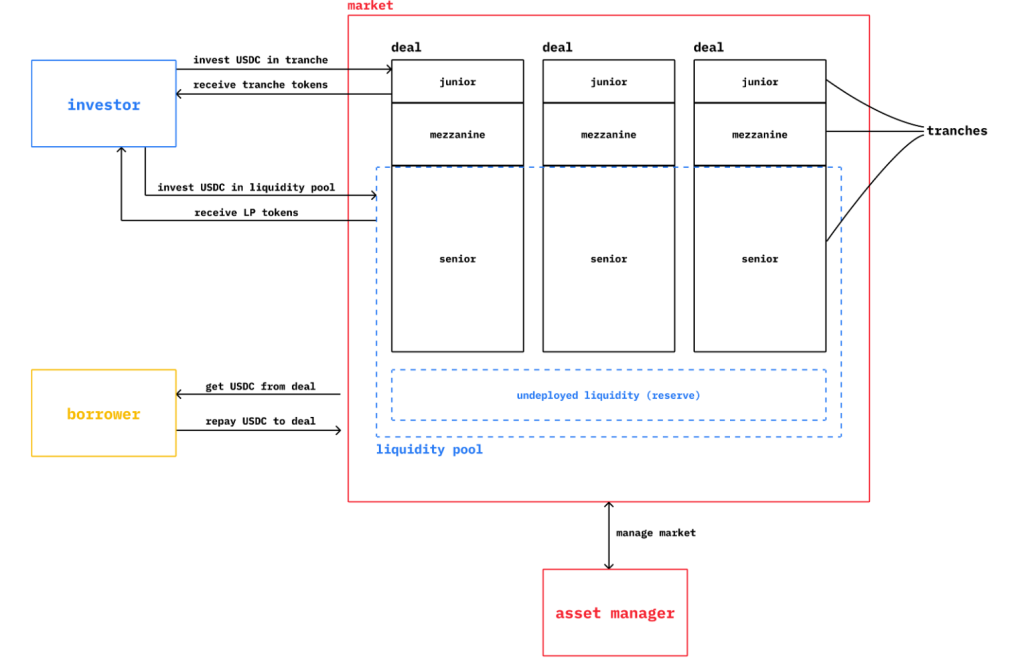

By moving the ‘borrowing’ off-chain, the main implication is that on-chain traders will lose their access to capital while opening up this capital to that off-chain. In particular, for platforms like GoldFinch and Credix, those who are able to gain access to liquidity are companies from emerging markets.

@goldfinch_fi is a decentralized lending/credit protocol with the mission to foster financial inclusion and expand access to capital for all 🌎

— Tanay Ved (@TanayVed) August 7, 2022

Learn how Goldfinch is bringing "crypto-loans to the real world" in this protocol overview: https://t.co/fscnS8kATb

Oftentimes, these companies are unable to secure funding typically due to the destitute financial infrastructure available in the country where these companies are incorporated in. By opening up opportunities and ready access to capital, these nascent enterprises will be able to grow and expand in a way that could never have been supported by traditional finance infrastructure.

Furthermore the cost to borrow this capital will be lower and less volatile as they do not have to compete with retail traders for liquidity.

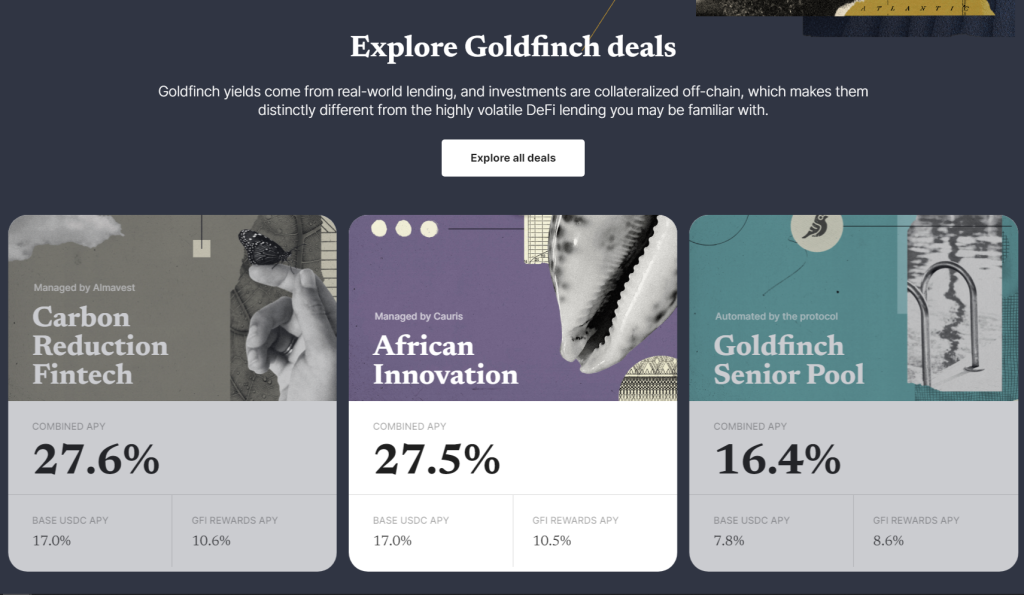

From the perspective of liquidity providers, the yield will be financed by the revenue generated from these companies which they are indirectly invested in. For instance, on GoldFinch, the average yield for liquidity providers sits at around 17% APY, higher than AAVE, even when taking into account the extra incentives!

This is because the liquidity provided has an actual use case and is borrowed by real companies, be it Web 2 or Web 3 businesses, that generate tangible cash flow and revenue. As an added bonus, because this liquidity is primarily prioritised towards companies that need capital the most (ie in emerging markets), the growth rate tends to be faster as compared to those in developed nations!

Drawing Parallels

Effectively speaking, this novel model of bringing credit markets off-chain can be viewed through the lens of the following thesis: businesses, especially those in emerging markets, are unable to raise funding to gain access to capital either due to geographical restrictions, political restrictions or lack of available financial infrastructure.

But by harnessing blockchain technology, these businesses can, in a manner of speaking, be tokenised. These tokenised assets can then be sold on decentralised marketplaces like GoldFinch and Credix to liquidity providers, and the capital raised in this process, which can be thought of as ‘debt financing’ in Web 2 terms, can provide these businesses with the resources and opportunity to reach its full potential.

DeFi markets will never be able to reach mainstream utilization without effective credit risk assessment.

— drew (@wandzilak_drew) August 31, 2022

The case for on-chain credit scoring (with help from a June 2022 report from BIS, DeFi Lending: Intermediation Without Information)

Let's dig in.👇 [Comments in brackets]

And from the perspective of liquidity providers, they are essentially akin to venture capitalists who have the chance to angel-invest in companies from emerging markets regardless of geographical boundaries, and the yield from this venture is unlikely to be matched by the traditional finance model.

Case Study

To illustrate this with an example, GoldFinch has an investment pool “African Innovation”. From the perspective of a liquidity provider, by depositing my assets (USDC) into the pool, I am effectively investing in African start-ups. This global reach will never be rivalled by traditional stockbrokers like DBS Vickers or even platforms like Robinhood.

And the yield, currently sitting at an astonishing 27.5% APY (way higher than a typical stablecoin yield), is sustainable as it stems from the companies’ real-world returns. This returns that are not correlated to the volatility ubiquitous in the crypto market.

Furthermore, because the deposits are in USDC, liquidity providers do not need to worry about any price volatility in their deposited assets. For the African companies, the sheer volume of capital they gain access to ($30 million USD at present), will certainly be of great assistance in their future endeavours.

Conclusion

Therefore, by creating a system that transcends geographical boundaries, benefitting both long-term investors and businesses from emerging markets that require critical access to capital, I believe that the “regression” of credit markets from on-chain to off-chain is in fact, a progression that seeks to bring DeFi back to its roots of making capital available to everyone globally.

Also Read: SEI Network; All You Need To Know About The Fastest Layer1 Blockchain Optimized For DeFi Trading

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief