Is this theoretically possible? For this to happen, three scenarios could happen: a case of ultra hyperinflation, a gargantuan investment in Bitcoin, or people just holding as people buy.

It all started with James Medlock, who tweeted, “I’ll bet anyone $1 Million dollars that the US does not enter hyperinflation.”

Balaji, who I’d say is a Bitcoin Maxi, jumped in to take that bet. Here was his response to the terms and conditions of the bet, with a Bitcoin thesis that it will reach $1M in 90 days.

I will take that bet.

— Balaji (@balajis) March 17, 2023

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/tcuBNd679T pic.twitter.com/6Aav9KeJpe

The five causes of hyperinflation

(1) Government over-printing money

(2) Rapid increase in money supply

(3) Loss of confidence in the economy

(4) Decrease in the supply of goods and services

(5) Wars and political instability

As we all know, the injection of money will not be made from taxpayers’ money, so where are they coming from? The simple answer, they’re printing it.

So the government saves the day by turning on its “money printer”, which gives temporal relief, but in the long-term, the outlook of things seemingly looks dark and sombre.

Overprinting will lead to a rapid increase in money supply, which means that the first two points of the hyperinflation list are already being ticked ✅✅.

While the idea of bank runs may seem foreign, in light of recent events prove that idea wrong. The implication of the banking failure caused a massive shift in confidence in banks. That leads us to check off point number (3), ✅.

The fourth issue is the decrease in the supply of goods and services. If there is a significant decrease and things are scarce, prices could go up only. Wait a minute, don’t Bitcoin fulfil this prophecy? Point number (4),✅. FYI the next halving is expected to occur in early 2024.

Lastly, we saw how wars and political instability disrupted supply chains. Over one year, the effects of the Russia-Ukraine war have yet to settle, with economies feeling the tremours. Point number (5), ✅.

The banking failure

Taking one step back, the tweet came after the US government had to step in to save the entire banking system. Instigated by the bank run of SVB, the contagion spread like wildfire, revealing 186 banks facing similar risks as SVB.

While it cost the government a multi-billion dollar bailout, Bitcoin is, seemingly for the first time, working as safe haven asset in response to the traditional banking system. As of writing, Bitcoin is up 28.6% on the 7-day chart.

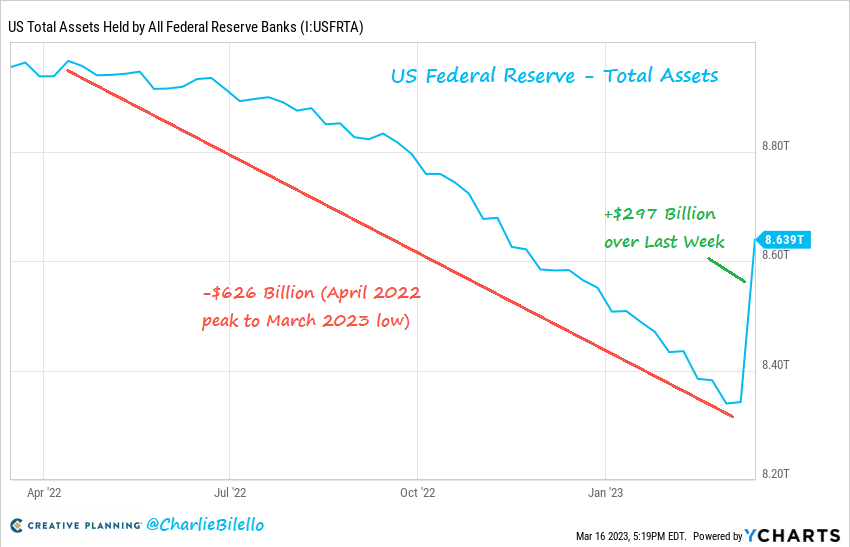

The ~$2T of fresh cash injection into the market was a necessary means to blockade a potential full system failure of the US economy. This led to the switch-up of the quantitative tightening since April 2022 was undone in a single week.

As seen in the US 2-year treasury note, yield at 3.85% goes down in history to be the biggest drop in yield rates.

And this means the FEDs, have to lower rates making risk assets more attractive.

Can Bitcoin actually reach $1M?

One thing is for sure among the madness, liquidity will be added to the system. But could that take the orange coin to a million?

According to InvestAnswers, there is still “plenty of Bitcoin” to go around. He also did the math on a scenario where $50B was to be used to buy Bitcoin, and the price of Bitcoin could skyrocket to ~$552K, assuming 1.9M was available.

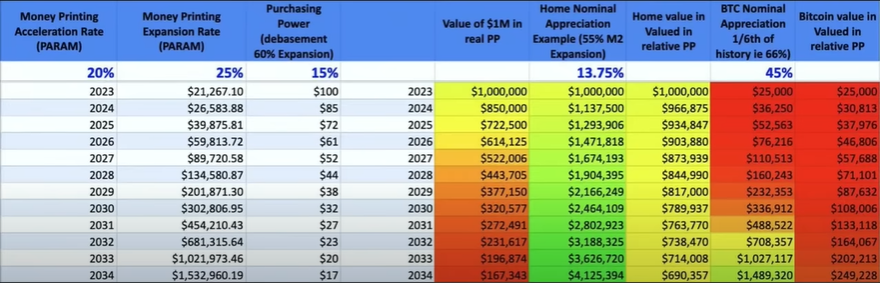

Bitcoin might not hit a million in 90 days, but maybe it will in 10 years because of the debasement of fiat. 1 million in fiat today would roughly be worth $690K in 10 years’ time, while $BTC at ~$28K right now will likely be worth $249K.

Could Balaji actually be right? Or is this just a marketing and pump-my-bags stunt?

Hypothetically, the main question to ask ourselves is, why would someone take this bet? Because it is almost sure to fail.

We think this stunt could be a way for him to earn, as the narrative he is bringing forth feeds into the echo chambers of investors. And it is these bunch of emotional investors, myself included, who could ape and move the market collectively.

Imagine Balaji opens a $10K trading account and uses a 100x leverage. He basically opens a position worth $1,000,000. If the price of $BTC ever so slightly moves by 1%, his position will double to be worth $2,000,000, with a gain of $1,000,000.

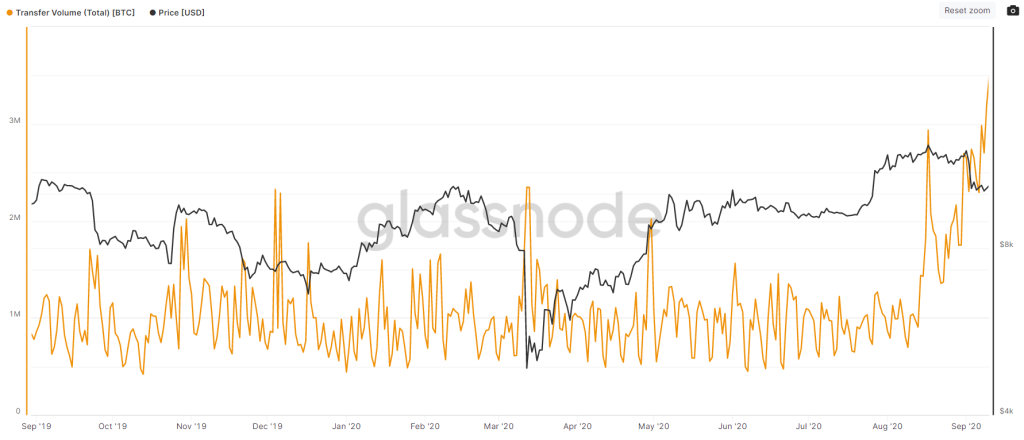

Secondly, Bitcoin whales dumped over $200M yesterday, while open interest has grown by 20K Bitcoin. It seems like investors are leaving the spot and, instead, leveraging up.

With that, there does not seem like there is a significant amount of spot accumulation besides stablecoins being converted to Bitcoin right now, proving Balaji’s bet to be probable not to work.

With Bitcoin up almost $8K in 8 days, we might be late to the party, but still early on the 10-year horizon. No one has enough Bitcoin.

Also Read: Why Real-World Assets (RWA) Are The Key To DeFi’s Future Growth

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief