If you’ve been active in the crypto ecosystem, one thing you would have noticed is the rise of Canto, a permissionless layer-1 blockchain that is Ethereum Virtual Machine, or EVM-Compatible.

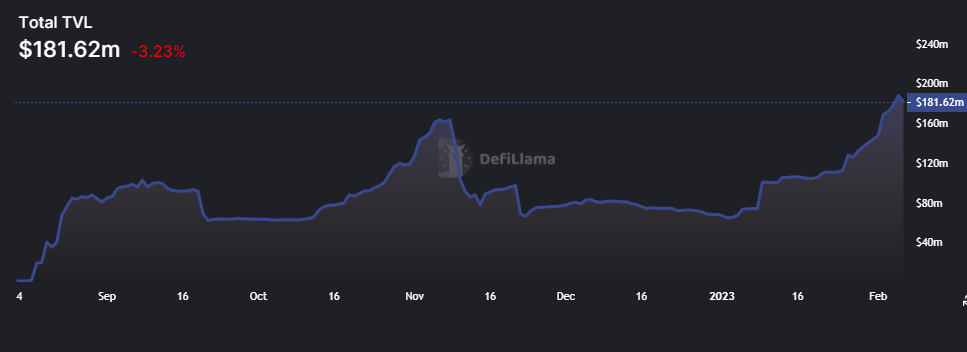

Aiming to provide many facets of DeFi as “free public utilities”, the Cosmos-based Proof-Of-Work blockchain recently broke it’s all-time-high Total Value Locked, at $181M.

With the massive rise in TVL alongside a utilitarian goal of Defi as Free Public Utilities, the current atmosphere around Canto is reminiscent of DeFi summer, where on-chain transaction skyrocket in a bid to chase the next shiny thing.

And what better way to indoctrinate Canto into the leagues of DeFi hall of fame than an Olympus Dao Fork.

Also Read: Missed Out On The Aptos Airdrop? Here’s 3 Projects You Cannot Afford To Miss

The Birth of CantOHM

Aiming to “Build a DAO to support future Canto Development”, CantOHM is the first DeFi project build on the Canto network, founded in January this year by anonymous developers.

Final testing and revision to F/E skinning. We think Cantonian's are going to dig it. $COHM $CANTO #canto pic.twitter.com/lF8KrKAtz2

— cantOHM (@imgonnacohm) February 1, 2023

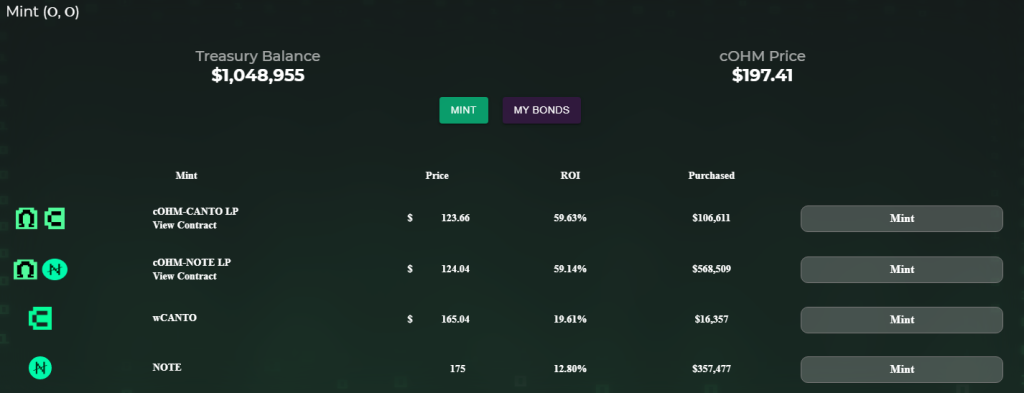

Similar to Olympus DAO, CantOHM allows users to either buy their native token $cOHM on the public markets, or mint them at a discount to market price.

Currently, users can deposit these liquidity pairs for discounted minting:

- cOHM-Canto

- cOHM-NOTE

- wCanto

- NOTE

$NOTE is a stablecoin native to the Canto network, governed by the Canto DAO. Currently, $NOTE can only be obtained through the Canto lending market or by purchasing them on various Decentralized Exchanges.

Although there has yet to be a clear goal for CantOHM, it’s current 14,000,000% APY has been a successful incentive for users to attract liquidity, already increasing their Total Value Locked (TVL) to $1.6 million in under a month.

The likeliest use case will be to use the protocol’s treasury to support the growth of the Canto network.

This makes CantOHM the third largest protocol on the Canto network by TVL, surpassing DEXes Cantoswap and Forteswap, as well as yield aggregator Y2R.

Alongside the liquidity incentives on Canto, new memecoins and NFT marketplace, over $120 Million in assets have been bridged over to the network since the start of the year.

Is Defi Summer 3.0 Here?

The first DeFi Summer was kick-started by liquidity mining incentives, with projects offering million s in tokens simply for staking or trying out various protocols on-chain.

Following a slump in growth, DeFi Summer arguably resurged thanks to Olympus DAO and it’s thousands of forks, which offered a paradigm shift for how we saw DeFi and the power of game theory.

Since the collapse of Wonderland and a general increase in awareness of inflationary cryptocurrencies, many have been averse to multi-digit APYs, and rightfully so. However, the emergence of an Olympus DAO fork that managed to take the no.3 spot on a booming network may be a sign of things to come.

I am reliving every bit of my early #BSC days on Canto

— 💐Guru 💐 (@CoinGurruu) January 31, 2023

Moreover, chains like Optimism and protocols like Celer Bridge have been offering extremely lucrative opportunities for yield-farmers that don’t necessarily involve a 14,000,000% APY. For example, providing $USDT on the Celer Bridge currently yields 148% APY, paid out in $OP tokens – the native cryptocurrency of the Optimism Network.

While I do not recommend yield-farming in this current environment, users bridging back on-chain in light of the distrust many centralized exchanges are facing could kick start DeFi summer, even in the midst of a tumultuous bear market.

Also Read: I Looked Into The Historical Cycles Of Crypto, Here’s What I Found

Note: The link to CantOHM’s documentation is currently broken. This article will be updated with relevant information once it is back up.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief