Centralized Exchange (CEX) Binance has gained dominance in the last few months following the collapse of FTX and other crypto institutions.

However, recent regulatory actions in the United States may pose a threat to the leading CEX and it’s CEO, Changpeng “CZ” Zhao.

Although Binance has already been hit by regulatory action from the SEC over it’s stablecoin BUSD, a recent lawsuit by the CFTC (Commodity Futures Trading Commission) may signal stronger intentions by the United States to clamp down on crypto in the country.

Also Read: Why The Crypto Market Is Down Today: 3 Key Factors Explained

CFTC Alleges Insider Trading, Clear Violations of US Regulation

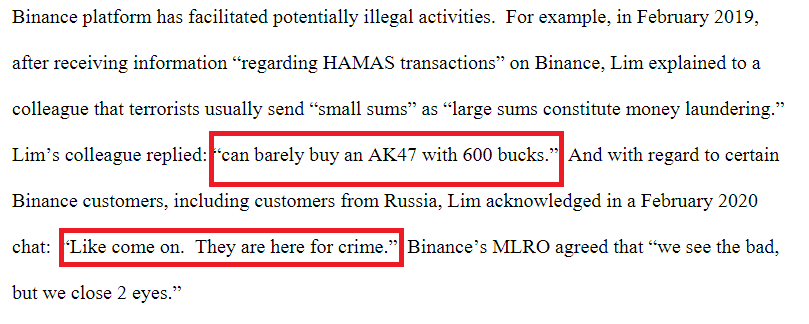

“We see the bad, we close 2 eyes”.

That was one of the chat logs recovered by the CFTC, which they have presented as evidence against Binance possibly facilitating illegal activities.

The 70-odd page report also notes that VIP customers of Binance, were sometimes warned in advance of possibly law enforcement inquiries.

“After the unfreeze … VIP team is to contact the user through all available means … do not directly tell the user to run, just tell them their account has been unfrozen and it was investigated by XXX”, read one chat log from amongst Binance personnel.

More concerningly for regular Binance users, the CFTC alleges that CZ and Binance controls approximately “300” house accounts, which are exempt from Binance’s insider trading polycy.

CZ has previously traded through two such accounts.

people really believed that their orders were getting frontrun on FTX because of Alameda but Binance somehow wasn’t doing the same shit 🤡

— hedgedhog (@hedgedhog7) March 27, 2023

FTX launchpad tokens also pumped inorganically but yeh all the Binance ones are organic user demand 🤡🤡🤡

Twitter Commentators have quickly drawn parallels to Alameda Research, which many believed were using insider information to trade against sister company FTX’s customers.

Another key point in the lawsuit was Binance’s apparent expansion into the United States through “marketing efforts including on numerous social media applications such as Twitter.”

‘Binance’s superficial efforts to limit trading by United States Customers and Intenal Recognition that compliance program was just “for show”‘

“I eat our own dog food” says CZ in Response to CFTC

Despite posting a cryptic “4” on Twitter immediately after the lawsuit, CZ’s public statement claims that Binance has been “working cooperatively with the CFTC over two years”, and that there was an “incomplete recitation of facts”.

4

— CZ 🔶 Binance (@cz_binance) March 27, 2023

The number “4” can be pronounced “si” in mandarin, which sounds eerily similar to the mandarin word for “die”, 死.

Regarding the insider trading allegations, CZ claims to “eat our own dog food”.

For the confused majority (including myself), the term “eat your own dog food” refers to a company using its own products or services for internal operations.

He explains that the internal Binance accounts were used for day-to-day necessities such as personal crypto holdings, his Binance card, as well as converting crypto to FIAT for personal expenses.

Internal regulations also impose a 90 day holding period on employees for all purchased cryptocurrencies, as well as a ban on any futures trading.

CZ also notes that they “intend to continue to respect and collaborate with US and other regulators around the world”, citing their over 750 person-strong compliance arm, and co-operation with US authorities to seize more than $185M in stolen funds so far.

Closing Thoughts

It seems that rumored Operation Chokepont 2.0 is continuing to widen it’s reach in crypto.

1) what pic.twitter.com/fY4E4nrrMS

— H.E. Justin Sun 孙宇晨 (@justinsuntron) March 27, 2023

This month alone, we have already seen Poloniex founder Justin Sun sued by the Securities and Exchange Commission (SEC), and CEX Coinbase being served with a Wells notice.

In addition to the BUSD clampdown and the current lawsuit by the CFTC, crypto is getting riskier from a regulatory standpoint – something that could turn away potential investors, both retail and institutional.

However, the clampdown on centralized entities could also inspire more on-chain activity, including a shift to on-chain perpetual trading platforms like GMX and dYdX.

The U.S. has lost its lead in blockchain developers & has gone from 40% to 29% market share of open source devs.

— maria ⚡️ (@MariaShen) March 24, 2023

We analyzed 200+ million code commits & 11k+ developer profiles to capture geography data.

Full analysis here: https://t.co/QPY32he5lL

Let's break it down 👇🏽

Regardless, continuous regulatory action could stifle incentives for US-based innovators and developers, decentralizing the concentration of builders in Web3 to other crypto hubs such as Hong Kong and Dubai.

Also Read: The Cheapest Way to Off-Ramp Funds on Exchanges in 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief