According to Coindesk, US banking giant Citigroup is awaiting regulatory approval to begin trading Bitcoin futures contracts on the Chicago Mercantile Exchange (CME).

ICYMI: Citigroup is working with regulators to start trading bitcoin futures: reporthttps://t.co/4LpwBroHtQ

— The Block (@TheBlock__) August 24, 2021

A source familiar with the matter said that Citigroup is actively recruiting people to join a crypto-focused team in London. The source also added that Citi is likely to win approval to begin trading CME Bitcoin futures first, followed by Bitcoin exchange-traded notes (ETNs).

Given the many questions around regulatory frameworks, supervisory expectations, and other factors, we are being very thoughtful about our approach. We are presently considering products such as futures for some of our institutional clients, as these operate under strong regulatory frameworks.

A Citi spokesperson in an email to Coindesk

More big banks are venturing into crypto

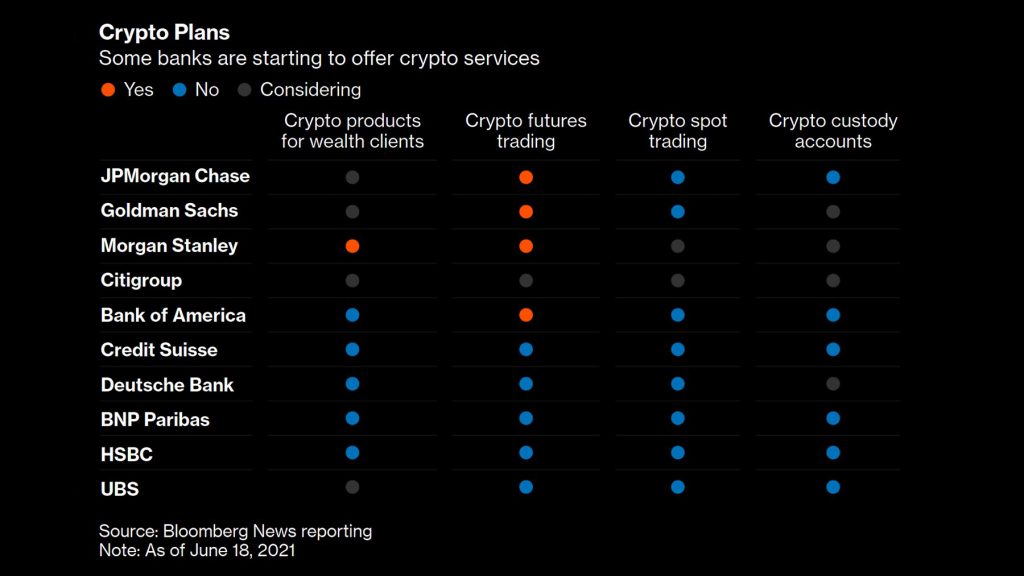

Citi will join fellow mega bank Goldman Sachs in offering Bitcoin futures trading once it has worked through the necessary regulatory approvals.

In July, The Bank of America, the second-largest bank in the United States, was reported to be establishing a team devoted entirely to researching on cryptocurrencies.

JPMorgan also told its advisors in a memo that they can buy and sell five crypto funds on behalf of a client. This makes it the first large US bank to allow its financial advisors to give wealth management clients access to cryptocurrency funds.

Bloomberg recently published an informative table showing how the biggest banks in the United States are involved with Bitcoin and what products were already announced by each of them.

Featured Image Credit: The Street

Also Read: How the biggest banks in the United States are involved with cryptocurrency