On May 2, 2023, Coinbase, the second-largest cryptocurrency exchange in the world, launched an international exchange, extending its services to non-US institutional clients. This move is a testament to Coinbase’s commitment to the international markets.

Coinbase International Exchange is designed to provide non-US institutions with access to BTC and ETH perpetual futures contracts. This allows them to trade digital assets with more flexibility – and with “less friction and leverage”.

Coinbase International is only available to institutional clients in certain jurisdictions outside the US. The launch of this offshore exchange follows Coinbase’s regulatory license approval from the Bermuda Monetary Authority (BMA).

In this article, we’ll take a closer look at the all-new Coinbase International Exchange and how its introduction could impact the cryptocurrency industry.

Also Read: Coinbase Launches An Ethereum Layer 2 Blockchain, But No Token Included

Coinbase International Exchange

Coinbase International Exchange is an offshore trading platform that enables institutional clients in eligible jurisdictions outside the US to trade perpetual futures. A perpetual futures contract, also known as a perpetual swap, is a type of derivative financial instrument that allows traders to bet on the price movements of various digital assets without owning them.

In traditional futures, traders are obligated to execute a transaction on a set date irrespective of market conditions. Perpetual futures, on the other hand, do not have an expiry date, which means that buyers and sellers can hold their positions indefinitely.

Please note: Coinbase International Exchange is currently available to non-US institutions in select jurisdictions. Informational and educational purposes only. Not investment advice.

— Coinbase International Exchange 🛡️ (@CoinbaseIntExch) May 4, 2023

According to the US-based crypto exchange, perpetual futures accounted for almost 75% of global crypto trading volume in 2022. With such a staggering figure, establishing a global perpetual futures exchange for digital assets seems just like the right move by any centralized exchange. Moreover, it helps the crypto giants bring their trusted products and services to digital assets users domiciled outside of the US.

As of the day of launching, Coinbase International listed only BTC and ETH perpetual futures contracts on its platform. All transactions on the platform are to be settled in stablecoin USDC, meaning that no fiat on-ramps are required. What’s more, the perpetual futures contracts initially offer up to 5x leverage.

Now, it is important to mention that Coinbase International Exchange is only available to institutional clients and is not available to retail traders. That said, there are plans to extend the platform’s services to non-US professional investors and advanced retail users in eligible countries.

Features on Coinbase International Exchange

Coinbase International Exchange provides institutional users with access to BTC and ETH perpetual futures contracts. But what sets apart this platform from every other perpetual exchange platform you know?

High Consumer Protection

Coinbase International Exchange offers a high level of protection to users on the platform. From a solid risk management framework to its high performance trading technology, there are a lot of measures put in place to ensure that users can execute safe and profitable transactions on this platform. Meanwhile, Coinbase International’s liquidation framework is set up in a way that fits all compliance standards.

Easy-To-Use API

Besides protecting the interests of users, Coinbase International Exchange offers top-notch functionality. For example, the platform features a high-throughput, low-latency API trading with a processing time of ~1 microsecond. This provides users with direct access to order placement and complete control over account management.

Liquidity Rewards

Coinbase International also features a liquidity rewards program. High-volume traders have the opportunity to earn additional incentives by becoming liquidity providers.

What Does Coinbase International Mean For Crypto?

Coinbase is currently the largest cryptocurrency exchange in the United States and the second-largest in the world by trading volume. While the company is based in the US, it also provides services to its customers outside of America. And building an international exchange is an excellent way to express its dedication to the international market.

In The United States

Moreover, this seems like a statement move by the company following its disapproval of the SEC’s regulatory approach to the crypto industry in the US. Indeed, Coinbase reiterated its commitment to the United States after the launch of this platform.. However, the organization seems keen to transition into newer markets, including countries with “responsible crypto-forward regulatory frameworks”.

As a result of its “crypto-hostile” environment, the United States has seen the mass exodus of cryptocurrency firms since the turn of the year. Several exchanges are moving to other countries that are looking to position themselves as crypto hubs.

Interestingly, only time would tell how the United States – and its financial watchdogs – would react to this strategic move by Coinbase. Going forward, many would expect them to walk back on their strict measures and rather take a friendlier approach to the crypto industry.

In The International Market

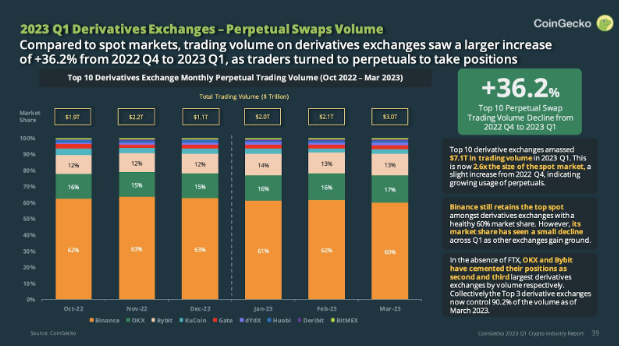

According to data from CoinGecko’s quarterly report, the top 10 derivative exchanges accrued $1.7 trillion in trading volume in the first quarter of 2023. This represents more than double the size of the spot market, signaling an increase in the use of perpetual.

This report also reveals that Binance continues to assert its dominance in the perpetuals market, with a significant 60% market share. However, this may be about to change, considering Coinbase’s latest foray into the offshore perpetual market.

With more available options for perpetual futures traders, there is going to be more competition in the market. As a result, we are likely going to see the introduction of better and more lucrative products for customers.

Also Read: All You Need To Know About GND Protocol

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Coinbase

This article was written by Opeyemi Sule and edited by Yusoff Kim