Key Takeaways:

- Gomu’s raised $5 million to power NFT liquidity incentives, backed by Coinbase Ventures, Defiance Capital, and Saison Capital among many others

- The NFT market is often illiquid in nature, high prices lead likely to steer novel investors away resulting in lower trading volume

- Gomu’s product, Collection.xyz, bridges DeFi liquidity pools with the NFT space, and liquidity providers will receive rewards from which they can stake vaults

___________________________________________

Gomu, the NFT infrastructure company has recently raised a $5 million seed round announced on the 12th of October 2022, Wednesday.

This fundraising saw participation from Coinbase Ventures, Defiance Capital, Saison Capital and several angel investors CoinMarketCap, Etherscan, and Coingecko among many others.

📢 Today, we’re excited to announce our $5 million seed round with participation from @Coinbase Ventures, @DeFianceCapital, @SaisonCapital and several angel investors.

— Gomu⚡️ (@GomuWeb3) October 12, 2022

This milestone marks the strength and potential of our Gomu NFT infrastructure and products.

🧵⬇️ (1/4) pic.twitter.com/wnRp4Or3mC

To date, Gomu has launched two of its main products, NFT hub and Collection.xyz, in an attempt to grow NFT communities and potentially solve the issue of NFT liquidity.

NFT Hub

NFT Hub allows startup collections to easily build an online space for their holders by providing a customizable marketplace for NFT projects.

Optimized for engagement, the NFT hub is a great tool for providing an end-to-end Web3 experience for any existing community.

“NFT communities can create custom marketplaces and token-gated communities in minutes, all without having any prior experience with blockchain technology,”

Collection.xyz

The other Gomu product, Collection.xyz, is a liquidity incentive protocol which makes NFTs more tradable.

This essentially brings the aspect of DeFi into the NFT space by allowing anyone to put up their NFTs and Crypto into a liquidity pool, and users receive a token for it.

“Anyone can reward users with ERC-20 tokens for providing the liquidity since it helps to promote a healthier market.”

Gomu CEO and co-founder Spencer Yang

By creating a liquidity pool on NFT DEX Sudoswap, users will receive a tokenized representation of their ownership which then can be staked in vaults for rewards.

The first vaults to fund the first round of liquidity incentives featured NFT collections from Azuki, Otherdeed, Memeland and Pudgy Penguins among many others.

At the time of writing, round 2 voting for vaults is open, which includes popular NFT collections like Doodles, MAYC, and even GloblinTown.

#CollectionXYZ_VaultsForRewards | Round 2

— 🎨 Collection.xyz (@CollectionWeb3) October 12, 2022

📢 Vote for your favorite NFT community to receive 500 USDC + 500 USD worth of WETH in each of the 8 winning vaults!

🗳️ VOTE NOW on our discord: https://t.co/CAbI9EucwD

⏰ Voting closes on Oct 14, 2022 @ 4:00 AM UTC pic.twitter.com/YSMdc2iaof

The current state of NFTs

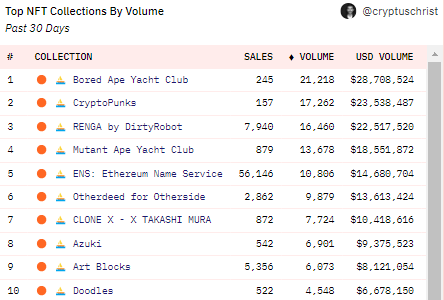

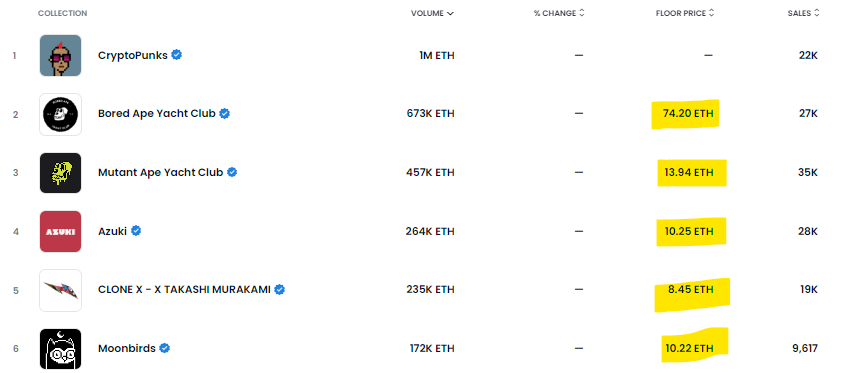

Despite the parabolic start of the NFT wave in 2021, the level of NFT transaction activity right now can only be described as dull compared to DeFi.

According to DappRadar, the top 15 NFT Marketplaces which constitute the absolute majority of the global NFT market share and yet it is trading at a subpar volume compared to decentralized crypto exchanges.

Oh, I have not included the volumes on centralized exchanges (CEX), as reported by yahoo finance, amounting to a $14 trillion market in 2021.

Furthermore, whales in the NFT space currently hold NFTs worth 1.67 million in ETH, occupying 17.11% of the global NFT market cap of 9.75 million ETH.

What does this tell us?

It tells us that the pool of NFT buyers is much smaller (as compared to those who trade ETH and SOL on DEXs and AMMs), which is reflected in a relatively smaller trading volume.

While this might be due to how novel the current NFT market is, it is still widely viewed as a speculative space with a little historical data point of reference.

Taking a look at my favourite NFT project, CLONE X by RTFK, we see the huge disparity in floor prices due to differentiating rarity stats. The two below differ in over 100 ETH, no prizes for guessing is the more expensive one.

Illiquid nature of the NFT market

There are some in the NFT game for the quick flip, but the majority of those holding pieces from the top 10 collections are likely to adopt a diamond hand strategy; holding on to their NFT and not selling.

While this would lead to an illiquid market, the high barrier of entry in prices is also likely to steer new investors away.

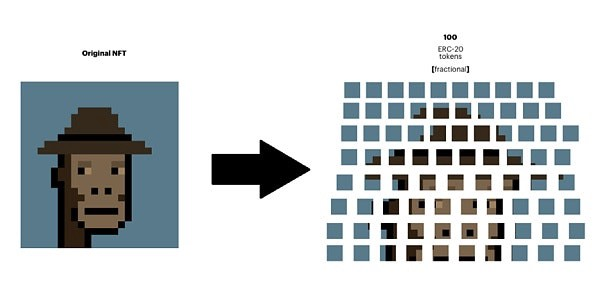

This gave rise to NFT fractionalization, where ownership is divided into smaller fractions among several people, making it more affordable and improving liquidity and activity.

Although I am not a big fan of this, whatever it takes to kickstart the next bull run right?

Could GOMU’s Collection.xyz solve the NFT’s liquidity?

The short answer is yes.

The key factor that contributes to the NFT liquidity problem is due to holders prefer to hold their NFT instead of selling them. By using the existing measures undertaken in the world of finance, NFT liquidity pools might be a viable solution.

Liquidity providers can enjoy faster time to liquidity by depositing NFTs just like what we know of DeFi. Furthermore, the LP tokens they would receive on Collection.xyz will automatically be staked into vaults for rewards.

Although there might be an issue with the risk of slippage given NFT’s higher volatility and speculation, the product GOMU is offering aims to ultimately solve the current issues in the NFT space.

We have seen businesses, celebrities to even sports and fashion brands curating their very own NFT collection and forming partnerships in an attempt to boost mass adoption. With great adoption will come great liquidity, but these trading platforms will likely become the subject of regulation across governmental bodies.

Also Read: Bullish Outages & Hacks: Here’s 5 Reasons Why Solana Will Remain a Top 10 Cryptocurrency

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief