With the successful completion of the Shanghai upgrade on its testnet, the Shanghai upgrade is imminent and set to roll out this month (March 23). This upgrade will be monumental; the Shanghai upgrade will begin to allow users to withdraw staked Ether and any accrued rewards from staking pools.

Will there be an impact from the withdrawals?

Before determining whether the market will dump, we must backtrack to when it all started. The Merge was a piece of the puzzle which transmitted Ethereum from a Proof of Work consensus mechanism to Proof of Stake. ETH holders must stake their ETH to become block validators for this transition to work.

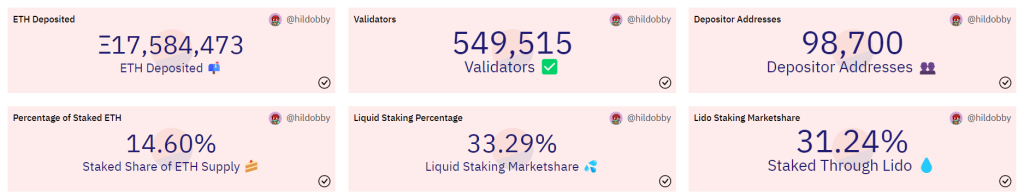

Now, this commitment of ETH was not done overnight but over two years before the completion of the merge. As of the time of writing, over 17.5M of ETH, accounting for 14.6% of the total supply, have been staked.

When an asset is staked, it removes its supply from the market. Now that is where the Shanghai upgrade aims to reintroduce these ETH back to the market. While there are concerns over these staked ETH flooding the market all at once, causing considerable selling pressure, this should not be true.

The deposited ETH cannot be withdrawn simultaneously; it even takes up to a year to withdraw the total stake value. But what does this mean?

There will be selling pressure, but to what degree is the question? From what I am hearing, price impact would be evident but not prominent. There will unlikely be a doomsday-like scenario; someone did the calculations if you still don’t believe me.

Yes, Shanghai means a lot of ETH is being unlocked,

— Westie 🟪 (@WestieCapital) March 1, 2023

but how much of that will actually be sold on the market?

I'll give you my estimates below 🧵

(Hint: it's probably not as much as you're expecting)

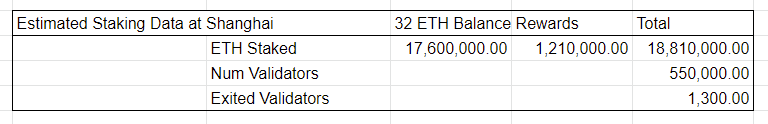

Taking reference from 1st March, I projected how that number would be if the Shanghai upgrade happened in mid-March. 18.1M Total ETH staked, and rewards would see a ~3% growth to 18.8M, the current 532,565 active validators likely to grow to 550k validators, and the number of validators who have already exited is likely to grow too, from 1,148 to 1,300.

This would mean 1.21M ETH of partial withdrawals will happen, along with 17.5M ETH for full withdrawals. Furthermore, 41,600 ETH is to be sold immediately.

Partial exits

Looking at partial withdrawals, any balance above 32 ETH is automatically sent to the designated execution layer address during network sweeps. You would therefore expect all partial withdrawals to be available within 4-5 days of Shanghai.

According to @benjaminion_xyz, an Ethereum core developer and product lead for CL client Teku, there is roughly 302,154 validators with 0x00 credentials, and 186,722 with 0x01 credentials on the Beacon Chain.

— Christine Kim (@christine_dkim) January 9, 2023

However, as of Jan 9, only 39% of validators had successfully updated their credentials from 0x00 to 0x01, leaving 61% unable to withdraw.

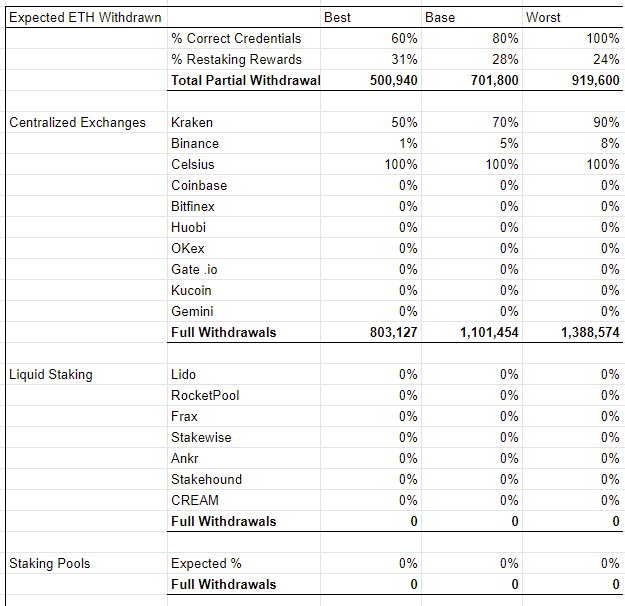

We should look at this with three different outcomes for validators with correct credentials ahead of the Shanghai upgrade. The higher the number, the worst off it will be as the selling pressure increases with the number of validators with correct credentials.

Worst Case (100%)

Mid Case (80%)

Best Case (60%)

We should also take into consideration the entities these rewards are going to. For liquid staking derivatives, some staking rewards returning to the protocol will be restaked as new validators, not leading to selling pressure.

Assuming the worst case is 70%, we can take the ~33.29% of rewards and reduce the number of immediate partial withdrawals by

33.29% * 70% = 23.3% (Worst Case)

33.29% * 80% = 26.63% (Mid Case)

33.29% * 90% = 29.96% (Best Case)

Based on the projected rewards of 1.21M ETH and the percentage of partial withdrawals with the correct credentials,

1.21M * 100% * 23.3% = 281,930 ETH (Worst Case)

1.21M * 80% * 26.63 = 257,778 ETH (Mid Case)

1.21M * 60% * 29.96% = 217,500 ETH (Best Case)

In this case, the lower the ETH calculated, the better due to less ETH potentially being dumped.

Full exits

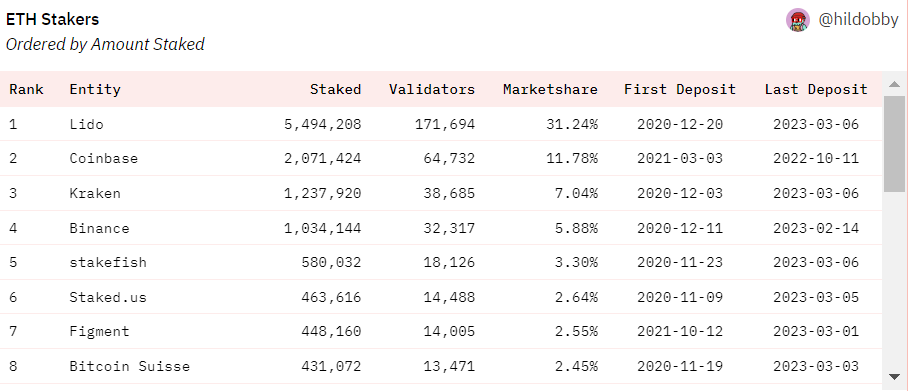

To calculate this, it is a little more tricky because we need to take a look at the different parties that are currently staked, and make estimates of exits within these categories.

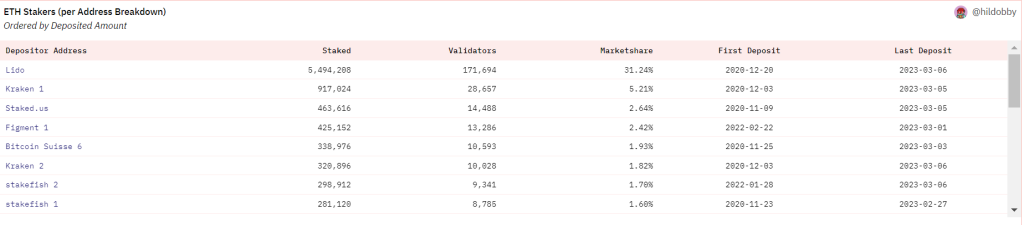

To calculate the full exits made by the biggest stakers are Lido, Coinbase and Kraken, we need an estimate of US customers, from the calculation below, we can see 1,101,454 ETH and 34,420 validators exiting for the mid-case.

Alternatively, you can look into the calculation made by Gigabrain Korpi below for other estimations.

Huge amount of $ETH, from ~3M to even ~6M ETH, will be withdrawn after the Shanghai upgrade.

— korpi (@korpi87) February 7, 2023

How much will be SOLD?

I broke down stakers into segments to understand their ability / willingness to sell and analysed different scenarios.

Read this thread to see what's coming: pic.twitter.com/rLdlRXFJPX

Stakers in profit/loss analysis

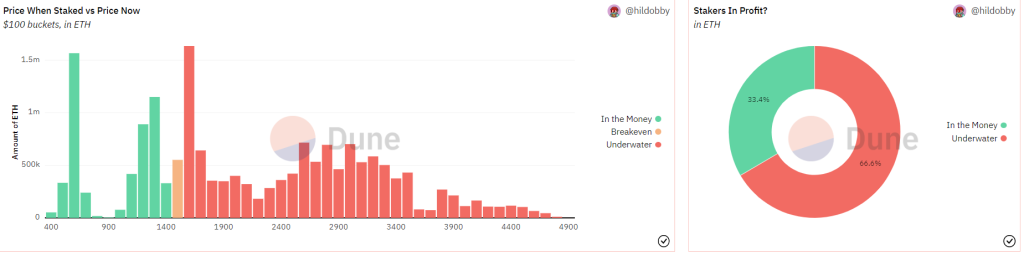

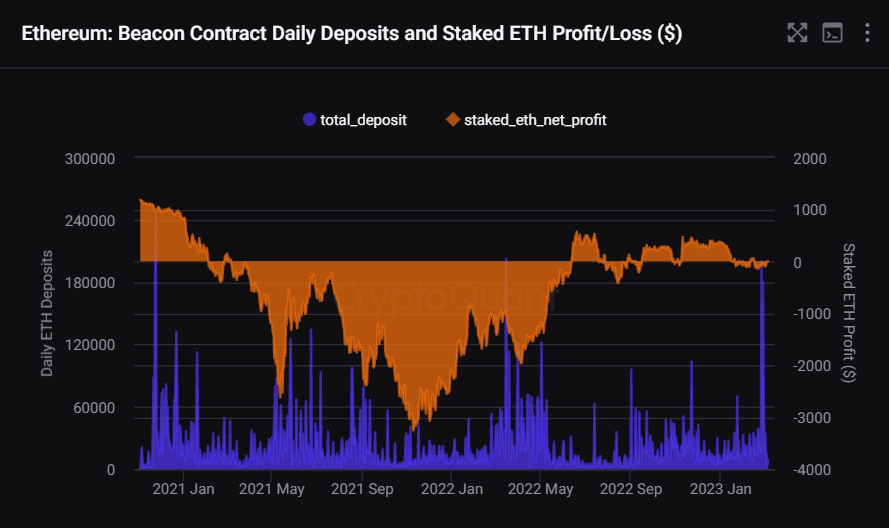

About 66% of the total ETH staked is currently at a loss. This will be representative of 11.6M of ETH out of a total of 17.5M ETH that has been staked so far. According to CryptoQuant, most of the staked ETH in loss was staked between March 2021 and June 2022, and in most cases, see a loss as low as -65% since it was staked.

Meanwhile, the other 5.82M of ETH is in profit, most up between 20-30%.

CryptoQuant’s data also shows that the average staked ETH holder is experiencing a 24% loss on its stake ETH holdings. This is shown by the stake ETH MVRV ratio (green line) of 0.76.

As the ETH price is below the realized price of staked ETH, the current staked ETH realized price stands at $2,157 vs the ETH price of $1,639.

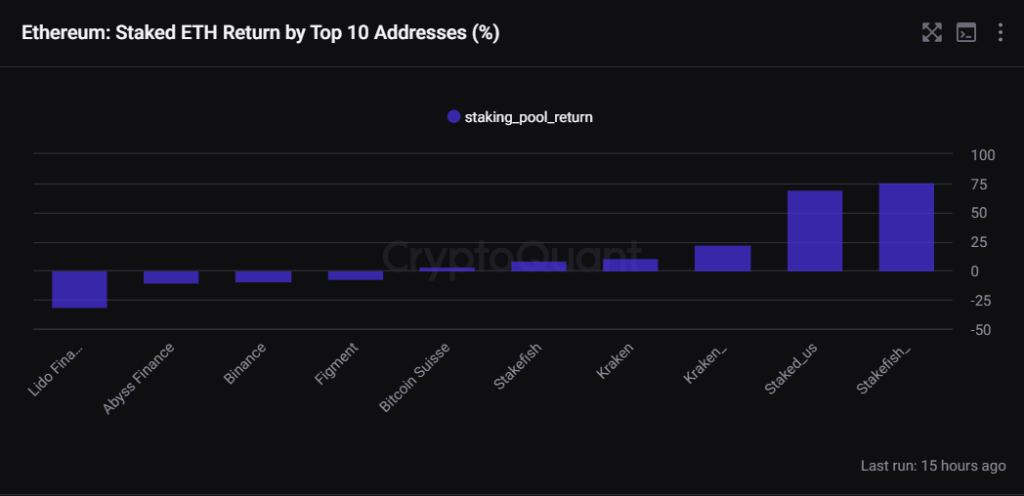

By looking at various staking pools, we see that the largest staking pool, Lido, holds ETH at an average of 30% loss. This can be translated to an average of $1,000 for entities across the pools below.

Pools with the highest positive returns on the ETH staked between 30% and 84% are pools that got most of their deposits at the start of the beacon contract when prices were around $600. Below are the top 5 pools and the profit/loss % of the deposits at the current price of ETH.

As most ETH staked is currently in a loss, the likelihood of the high selling pressure is extremely low.

Staking pool depositor analysis

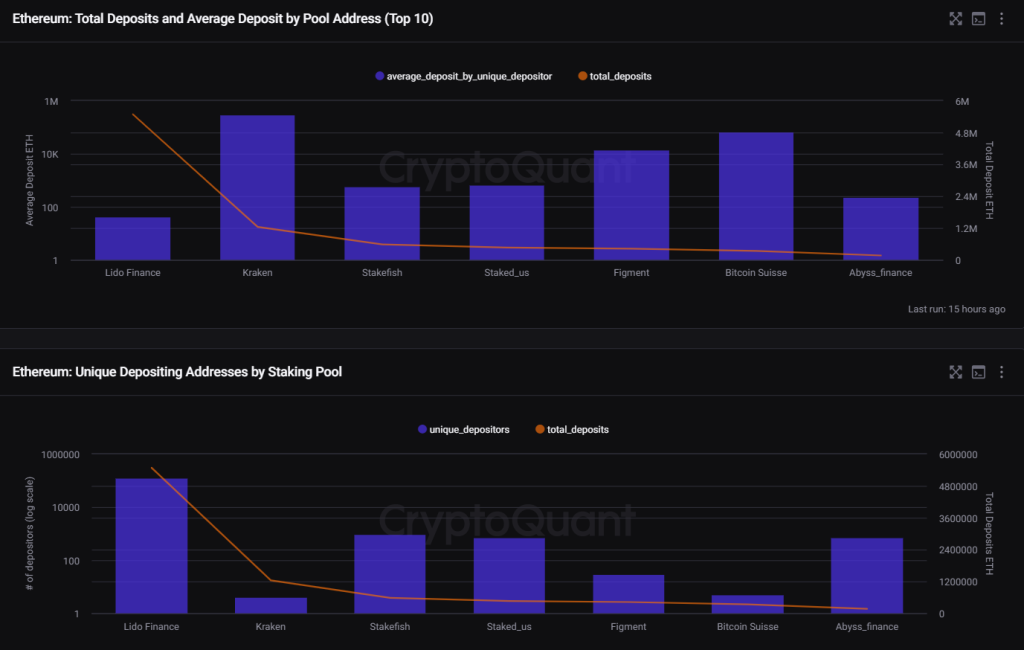

Apart from looking at the individual ETH staked being at a loss, the average depositor of the largest staking pools could also give us an idea of what depositors will dump post-Shanghai.

Lido staking pool (largest pool) seems to dominate smaller depositors more. The pool’s average inflow is 42.1 ETH from 130k different addresses.

Other addresses belonging to staking services like staked.us (0x39d) and Figment (0xf2b) show more extensive average deposits (655 and 14k ETH, respectively), which suggests larger dominance of larger ETH holders.

Addresses belonging to exchanges like Kraken and Binance also show large deposits, mainly as deposits are being batched before being sent to the ETH staking contract. For example, Addresses 0xa40 and 0xd40 (Kraken exchange) show few depositors and high average deposits. However, these addresses receive large deposits from another of the exchange’s addresses (0x267be1C1D684F78cb4F6a176C4911b741E4Ffdc0).

Smaller deposits from exchange users likely dominate the Kraken staking pool.

A similar case as Kraken can be seen for Binace’s address (0xbdd7), which has a single source of deposits. However, the deposits come from another address (0xf17aced3c7a8daa29ebb90db8d1b6efd8c364a18) linked to the exchange’s wallet.

With the average depositor of the largest staking pools also currently at a loss, it is likely that this will be another contributing factor to the low selling pressure of ETH after the Shanghai upgrade.

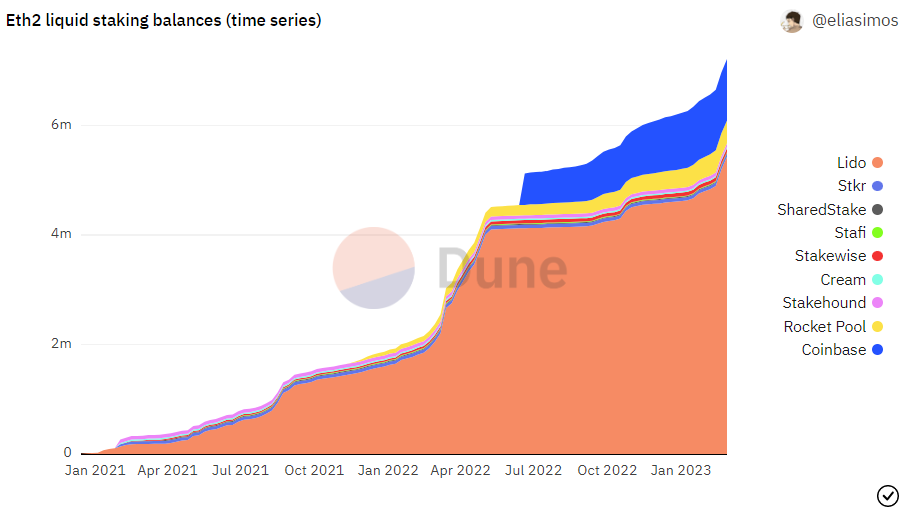

Rising LSD Narrative

Liquid staking has been a hot narrative alongside news of the Shanghai upgrade. The liquid staking market shows excessive growth, making up 40% of the ETH staking market. At the top, leading the charge is Lido, but competitors such as Frax, Rocketpool and StakeWise are on its tail, intensifying competition.

The idea for liquid staking blew up on the news for the Shanghai upgrade Ethereum plans to occur in March. But with that thought, the upgrade will not kill the unstaking queue and staked ETH will not become illiquid at once.

Knowing this could give you better sensing whether to ape into LSDs and stop the misprinting in the ETH LSDs. Even so, Ethereum LSDs are in an arena ever so competitive; betting on LSDs is a leveraged bet on the Ethereum ecosystem.

LSD is great for underwater stakers to continue their getting yield, this would make the outcome of them dumping their ETH very low. Furthermore, LSD will reduce sell pressure in the market, reducing sell pressure.

Closing thoughts

In my opinion, sell pressure will be present but to a degree not to crash prices entirely; it is unlikely to overwhelm the demand. Whether you think the price of ETH will go up or down due to the upgrade, it is essential to note that Shanghai is necessary for the network as a whole.

Instead, ETH staking will likely continue to grow as ETH’s staking ratio is lower than that of other altcoins and contributed by the ever-growing LSD narrative. I will closely monitor how this plays out, so stay tuned to how things will transpire for Ethereum.

Also Read: Here’s What You Can Expect From ETH Singapore

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief