FTX is in no doubt under heavy scrutiny by media outlets, investors, and regulators. With CZ walking away from the acquisition, retail investors’ trust broken and SEC launching an investigation into FTX, left the crypto space in fear, disinterest and lack of trust.

Amidst all the drama, an unlikely hero emerged in an attempt to “save the day.”

About a day ago, Justin Sun made an announcement on Twitter that he is “putting together a solution together with FTX to initiate a pathway forward.”

Further to my announcement to stand behind all Tron token (#TRX, #BTT, #JST, #SUN, #HT) holders on #FTX, we are putting together a solution together with #FTX to initiate a pathway forward. @FTX_Official

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) November 10, 2022

What this meant, was FTX enabled TRX holders to be able to withdraw their tokens.

According to the official FTX account on Twitter, “We are pleased to announce that we have reached an agreement with Tron to establish a special facility to allow holders of TRX, BTT, JST, SUN, and HT to swap assets from FTX 1:1 to external wallets.”

What does Justin have to gain from this though? was it purely a marketing stunt or was there hidden agendas which, if fall through, will add a bucket load of salt to the open wound?

Even with SBF’s attempt to raise funding to bring liquidity to the market, many still view what he is doing now are all reactive measures instead of preventive ones.

The damage was done, and life savings were lost.

What it (could) mean for Justin Sun’s TRON

A summary of TRON’s involvement was summarised by CryptoQuant’s CEO, Ki Young Ju, revealing a possible underlying agenda by Mr Justin Sun.

Let me paint the scenario for you.

FTX enables withdrawals for TRX.

Anyone who got their funds stuck on FTX is desperate to get their funds out.

In an attempt to do so, users exchange assets with TRC to request withdrawals.

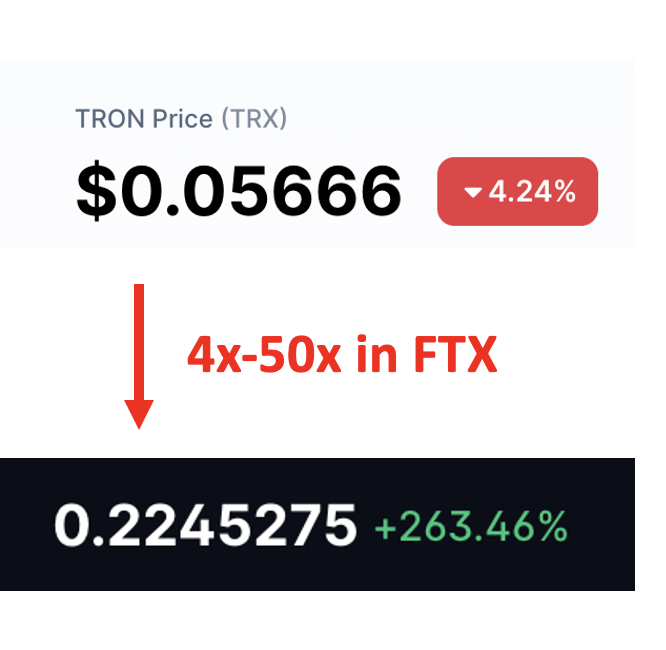

What this did was increase the demand for TRX on the FTX platform, prices go up 50x on FTX.

The pump in TRX price though was only on FTX while Coingecko, CoinMarketCap and other data aggregators all reflected TRX’s true value of $0.0566.

What I am going to say here is speculation, it has not happened, but with seemingly highly probable. Especially if anyone is in a position to gain from his “good intention” and has an ulterior motive.

With the spike in TRX prices, any individuals in the position to do so, could deposit TRX into FTX and sell them at sky-high prices.

However, this would only be done at the expense of those people whose funds are still stuck in FTX. This means if they do actually get their funds out, selling their converted TRX at its true value will incur a significant loss.

Money is still money, and people will take any opportunity they can get.

Exploiting this weakness is a textbook play by market manipulators, and they should not go unscathed.

Korean exchange: Withdrawals will be temporarily suspended.

— Ki Young Ju (@ki_young_ju) December 22, 2021

Market Manipulators: Fuck yeah 🍻 pic.twitter.com/p7juk2C28Y

However, given the benefit of doubt, Justin appeared on Bloomberg live to talk about his concerns for the entire crypto market.

“It is a sad day for the entire crypto industry…but it is a good moment to show the unity of our industry.”

Justin Sun also commented that his team has to go through various due diligence before they give the green light for the full bailout.

Closing thoughts

We need to let the dust settle, and let everything play out. Waiting for a “saviour” who may never come for rescue may just be a death wish.

Heightening your survival instincts right now is of paramount importance, don’t do anything reckless just for gains. If you have your funds on FTX, here’s what you should do.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief