Ve(3,3) is a decentralized finance (DeFi) tokenomics design first proposed by Andre Cronje, founder of Yearn Finance, who combined the aspects of the Curve vote-escrow mechanism with OlympusDAO’s (3, 3) staking.

Mr Person of the Year In 2020 materialised this innovation with the release of Solidly Exchange, which to this day, is still running even after he announced leaving DeFi on 6th March 2022. The also co-founder of Fantom drafted his calculations on how ve(3,3) tokenomics model could play out in the future. Find his writings here.

Before we go any further

We need to look at traditional DEXs and how they generate yield. Their primary source of yield generation was through swap fees. But that is not enough; these DEXs had to find a way to show their decentralization and simultaneously have high APRs to attract liquidity.

That gave birth to governance tokens, allowing token holders to vote for new proposals for the project’s future. But when whales scoop up large amounts of tokens and then possess a bigger voting power, does this go against the idea of decentralization?

We saw this with a16z, a crypto VC, who had 15M in Uniswap tokens to vote against the deployment of Uniswap V3 on BNB Chain, amounting to 64.13% of the total share.

But that gives governance tokens value, but when used in saturation, it only gives these types of tokens two fates. Either a whale is coming in to buy a huge bag when token prices are low, or the prices of the tokens stay low, leading to its eventual death.

A high token price means the liquidity pools (farms) have high rewards. This attracts farmers, and they stick around while things are good. Conversely, a low token price means liquidity will go elsewhere – Mercenary Capital.

So protocols must innovate new tokenomics models to combat this downward trend. This can be seen in rewards being in other tokens, making it attractive to buy, which increases the token price and farm APRs.

Some protocols even implemented “lock-up periods”, forcing stakers to commit their tokens over time. What is locked cannot be dumped. This is good news to reduce the selling pressure, but how do protocols incentivize farmers to token their tokens with them?

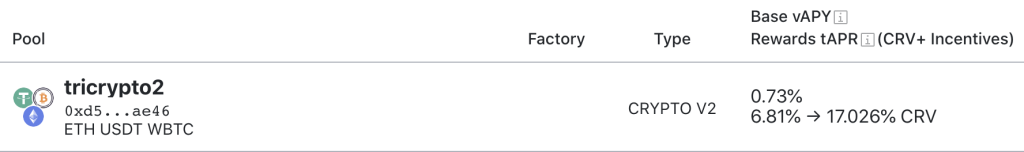

Curve finance leads the way in this department; their model is not as simple as providing higher yield (likely crazy inflationary token models, which is not ideal in the long term). Instead, they incentivise locking governance tokens even more than rather than simply farming for rewards.

With governance tokens locked, you get X farming rewards. But with enough governance rewards, you can get up to 2.5x farming rewards, so locking in an investment that will pay itself back over time.

This is where the idea of governance tokens with emissions came about. Locking your tokens gives you voting power to direct governance tokens to specific LP pools. This is where anyone can run more tokens to their pools.

But, with that concept in motion, protocols got competitive in an attempt to get the most votes. The protocol resorts to bribing in the race to get the most votes. Why? Capital efficiency.

By bribing token holders to vote for their pools, they can lower their incentive costs. This is because 1$ dollar in bribes typically translates to multiple $ worth of emissions to a pool. So instead of $100k worth of $FXS, they bribe with $50k $FXS and direct $150k price.

Confused? Understand The Curve ($CRV) Wars and What It Means For The Curve Ecosystem.

The birth of DeFi 2.0

Andre took all of the above and went on a pursuit of finding if there. It is a way everyone along the value chain can be incentivised. For example, what if locked tokens would no longer receive a portion of all protocol swap fees, but only for the pools they voted for?

This would mean people will be incentivised to vote for productive pools. This way, pools will see a higher inflow of liquidity, higher swap volume and higher bribes, while the low-productive pools will, in time, fade away.

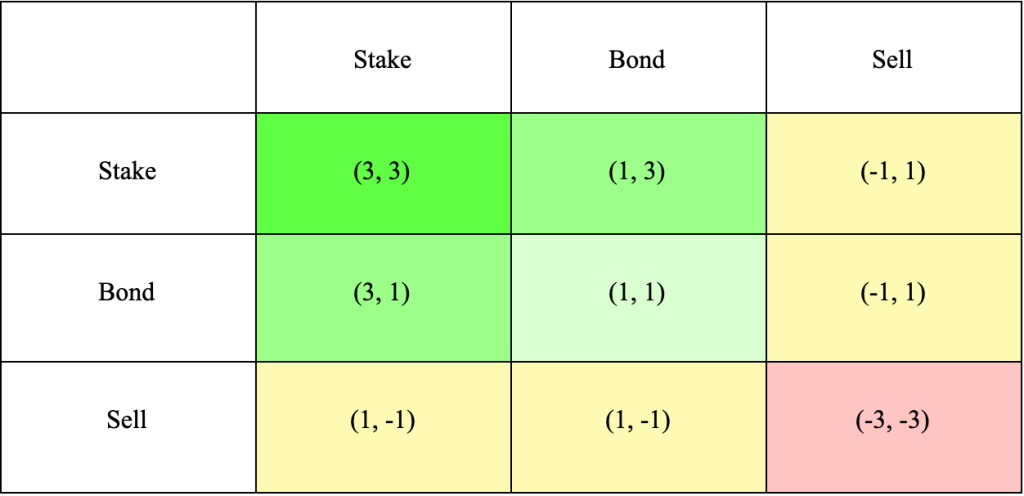

The (3,3) model, popularized by Olyumpus and its forks, taught us dilution. It refers to your share of the protocol. Imagine you double the number of tokens of a protocol in a year, but what if the inflation of that token is 600%?

This means your share of the protocol goes down, but that is where anti-dilution came about. If you own 1% of the protocol tokens and you lock, you will retain that 1% of protocol tokens. Because as new tokens are emitted, you get your relative portion of that, so your share of the total remains the same.

This anti-dilution means you should be early. The rebase prints massive amounts of tokens for you over time. However, the consensus is that full anti-dilution may be TOO POWERFUL and likely to disincentive new entries because you start from a massive disadvantage.

Therefore, ve(3,3) explores different rebase models from 0-100% anti-rebasing.

The ve(3,3) model

Bring them ups, “ve” stands for “vote escrow”, meaning you can vote when you lock tokens. (3,3) is a concept of game theory, if everyone stakes, everyone wins; if everyone sells, everyone loses.

So the idea of ve(3,3) encapsulates all of the abovementioned (swap fees, bribes, rebases (anti-dilution mechanic from 0-100%), control over emissions). Ve (3,3) are designed to align incentives for farmers, stakers, and protocols to the DEX itself.

These ve(3,3) DEXs are one of the top performers this year. But how should we play it?

The way to play this is the age-old mercenary token strategy. Provide liquidity, farm the token, and compound back into the pool. Because these ve(3,3) DEXes are doing so well, their token has good prices and high APRs.

Closing thoughts

Ve(3,3) tokenomics design should help protocols decrease their dependency on large liquidity providers, which was common during the first development phase of DeFi. Unlike most protocol designs, ve(3,3) should incentivize liquidity provision and fee generation.

This approach aims to create an optimized system where the incentives of a protocol’s users and stakeholders are better aligned. That could be incredibly valuable because the two groups often have competing interests.

This means that these DEXs are incentivising long-term synchronistic behaviour. Playing the (3,3) game would likely be more profitable in the mid to long-term, but that would also mean a more significant risk exposure to sudden changes in people selling.

Also Read: Top 10 Arbitrum Protocols to Look Out for in 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief