Sometimes all we need is a good laugh in the bear market. You are not the only one that is down bad. The Twitter account @Coinfessions, features anonymous confessions from the crypto market worldwide.

While I am unsure of how accurate these tweets are, I believe we can take them in good fun and hopefully still learn something from them.

Some are hilarious, others weird, and some may even remind us of the things we did in crypto. Either way, here are some of my favourite coinfessions that we can even learn something from:

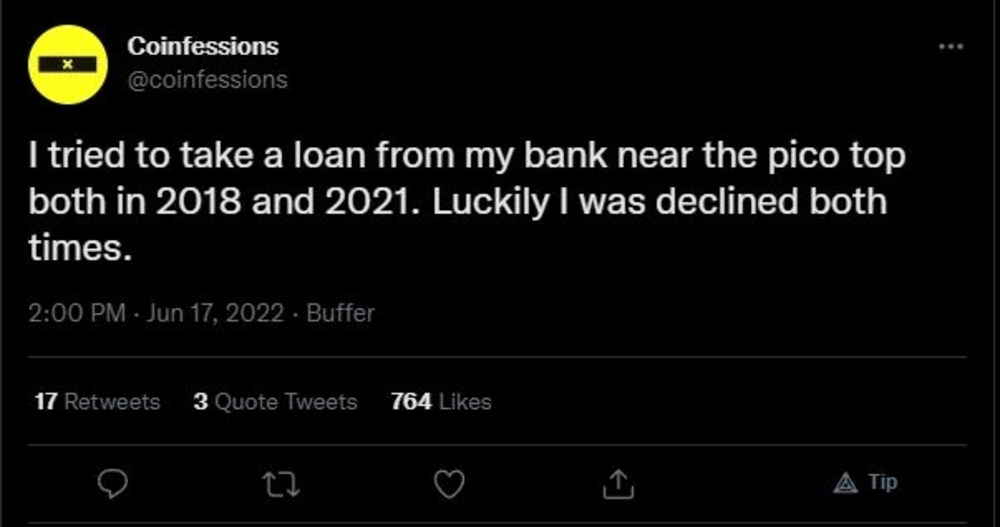

1. Lucky loans

Please do not use the money you cannot afford to lose especially when it isn’t yours. Taking a loan and reinvesting it into the crypto market might be one way to see your money grow fast, but it may not be the best strategy.

You might end up being two times richer, but at what cost? Potentially extending your period of debt? From this cycle, we have already seen significant funds and wealthy billionaires lose it all. If it’s not your money, do not risk it.

Also Read: Things To Consider Before Putting In Your Next $1000 In Crypto (Beginner’s Edition)

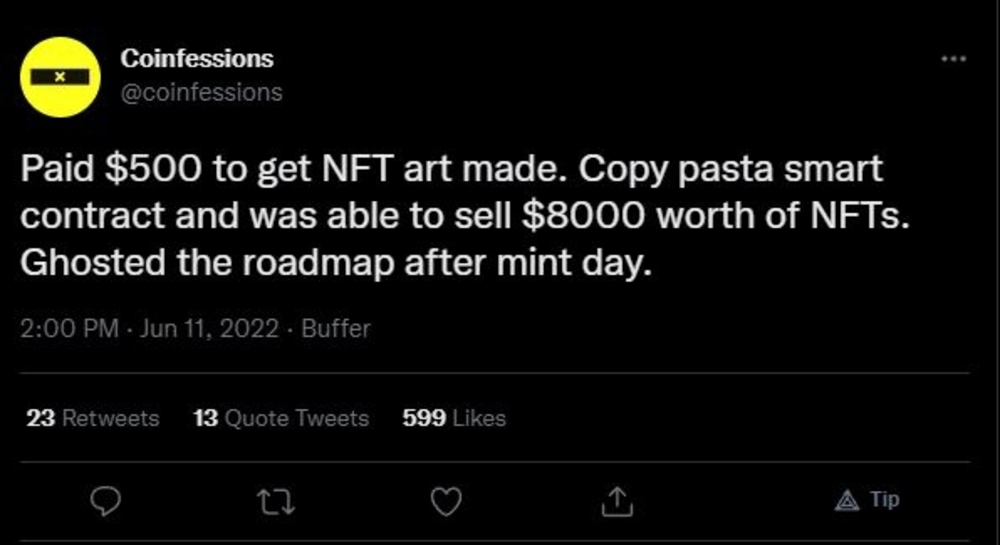

2. The hustle NEVER stops

What can I say about this? This anonymous person made the best of his situation, leveraged others’ skills and made it.

Ethical? Debatable.

Devilish? Perhaps.

Ingenious? Yes.

Whatever it is, there is always a way to make it in crypto. Whether working as a smart contract developer, deploying your product, hunting for airdrops, or acting even as a community manager, the possibilities are there for you to find.

Whatever it is, find your hustle, and you might find yourself landing a crypto opportunity even in the bear market.

3. Show your projects some love

From a builder’s perspective, it must be tiring to face the community’s demands every day. Show some love to your projects and communities; giving them a morale boost could even help these teams!

While it is understandable that the community and investors are essential to the project, how many of them are in it for the long term and want a quick short-term pump?

The team and the community must be aligned in their goals and not just build an additional ponzinomics layer if they want to succeed.

You might have hit the jackpot if you can find such a project.

4. Rugpulls…

There are bad actors in the space. Always be careful and start with a default position of scepticism. If the project does sound too good to be true… it probably is.

Always be on your guard, whether an NFT project, a DeFi project, or even a reflect token.

So how do you spot a rugpull? Well, here is a quick video that can get you started.

Also Read: I Got Rug Pulled and Scammed By A NFT Project, Here’s What I Learnt

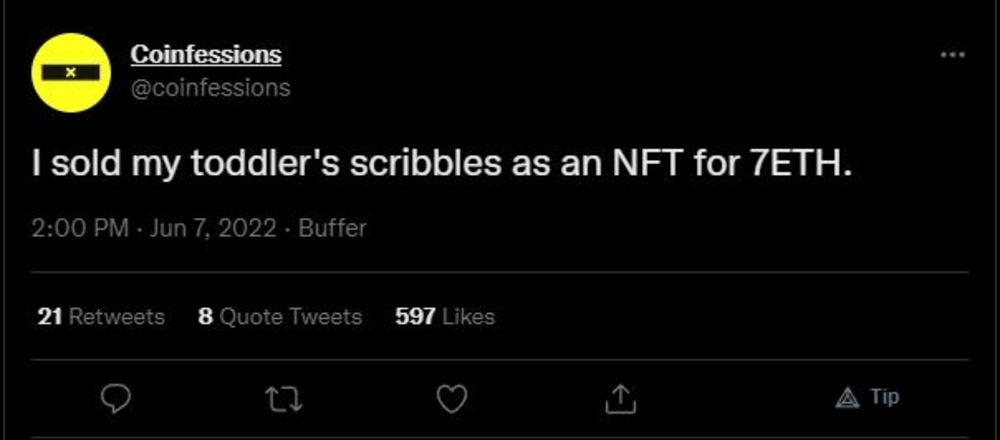

5. NFTs are absurd… accept it

Well, it is what it is. The value of NFTs can sometimes be absurd.

Who knows, you could launch your own set of toddler NFTs, and perhaps your project may go better than expected. On the other hand, you could work hard on your NFT project and try to make it fundamentally sound, only to end up like this post.

How do we tell if an NFT is ‘blue-chip’? How does one genuinely value an NFT and its utility in the market? Why do the strangest NFTs and memes tend to pump the hardest? Is it absurd, or is there an underlying principle behind them? These are some questions you should consider when investing in NFTs or building an NFT project in the space.

Also Read: A Crypto Scam Or Genius Marketing? Here’s How Goblintown Went Viral

6. Paid groups? Think again

People advertise trading signals, whale groups etc. – these often come with a subscription you must pay. Their actual yield is YOU.

Let me emphasize this, most of the best information on the Internet can be found for free. Stop wasting your time following calls, work on yourself and do YOUR research.

Here are some keys aspects of DYOR I would strongly recommend you look at:

- Who the team behind the project is. Are they doxxed or anonymous? If they are doxxed, what background do they have? How do they behave/deliver on their roadmap if they are anonymous?

- The product. Is it something that the space needs? Are they fulfilling a niche or have a strong product market fit into the space?

- The tokenomics. If the product gives value, how about the token? What is the vesting schedule like? Who owns the majority of the tokens?

- Rugpulls/smart contract vulnerabilities. Is the project audited/safe?

Also Read: DYOR: How To Do Your Own Due Diligence On Crypto Projects Before Investing

7. You can lose it all

Poor anonymous lost it in the LUNA/UST crash. We should account for scenarios of total failure and never assume that any coin is a sure thing. Be prepared to lose the money you put in and hedge accordingly, as crypto is a HIGH-RISK investment.

Lastly, continue investing in yourself to tide through the bear market and optimise how you make decisions could help you in the long run. Observe the mistakes that you tend to make, and learn from them!

Also Read: Things To Consider Before Putting In Your Next $1000 In Crypto (Beginner’s Edition)

8. Embrace the weirdness

Well, I will not judge what some people do in their free time.

However, as someone that has been around for some time, I can remember the vast amounts of shitposting and memes in crypto circles (Twitter, Discord, Telegram). I guess you have to embrace the weirdness of crypto.

Crypto culture is very dependent on memes and people poking fun at each other. Is that necessarily a good or bad thing? The truth is that it doesn’t matter – what you should know is that memes influence the space heavily. This affects who or what gets the majority of attention in crypto media.

This can lead to successful short-term marketing, but narratives come and go at the end of the day.

In the bear market, you will have a lot of time to reflect, think about the future trends and narratives, and of course, shitpost.

Embrace the culture, learn the language, and connect with others in the space. Embrace the long-term trends, find your thesis, and have fun.

Who knows? You may find the alpha you need.

Also Read: Is Crypto Here For The Long Run? 5 Takeaways From Billion Dollar VC Firm a16z

9. Incompetent projects are a thing

Every project starts promisingly with a bit of help from the buzz. As the bear market gets more brutal, things tend to change, and you might notice a trend where projects fail to deliver what they laid out in their roadmap.

In this space, it is an open secret that many teams tend to overpromise and underdeliver. It is also no surprise that in today’s bear market, we have seen big crypto companies engage in hiring freezes or, worse, retrenchment.

Some firms, such as the CeDeFi lending platform, Celsius, have even gotten rekt themselves.

This will not be different for projects in the space. How many of these will deliver? Is a new exchange listing or teasing a v2 (or v3, v4, etc.) enough?

To me, the survival of any project should come first in today’s bear market. Consider the following:

- Which projects have a good team that has consistently delivered on their roadmap, as

- Does your project have the treasury to last the bear market?

- Are there competitors that can eat your project’s lunch?

- Which projects are generating consistent revenue?

- Is there a use-case for your project currently or in the future

- If there is no use case, does it have a strong narrative or viral aspect?

Try to answer these questions before placing your faith (and funds) in a team/project.

Also Read: Surviving The Bear; 6 Aspects Every Project Needs For The Crypto Winter

10. Don’t shill projects to your friends!

I think most readers here might have had a similar experience.

We had friends around us that were curious about crypto and what tokens to buy. In our excitement, we told them about the projects that we were bullish on.

These tokens or NFTs you were bullish on (which your friend may still be holding) are probably down heavily now.

To make matters worse, some people shilled ‘safe’ yields like Anchor and Celcius supposedly to others.

Ultimately, while it is still your friend’s choice to invest, I would take personal responsibility and be careful of what I tell others.

What I would do would be to send them guides and let them know how crypto works. Sharing my own experience and tips and tricks might also be very helpful, but they should be equipped with the proper knowledge before making their own decisions.

I believe that in all cases, being someone that shares knowledge is much better than simply shilling a project/NFT without considering the financial situation of those around you.

Do feel free to check out our Beginner’s Guide section if you want a platform for introducing people to the world of crypto.

Closing Thoughts

Are the tweets real or fake? Could they be exaggerated or simply trolling?

I have no idea. However, I can say for sure that whether the tweets are real or fake should not matter.

Coinfessions remain my guilty pleasure and also entertain me when I am bored.

Some of the tweets are light-hearted and may even brighten up your day. However, there is always a learning lesson for each horrible experience, and you want to prevent the same thing from happening to you.

They can also be a sad reminder that people may be hurting out there or have lost more than they were willing to lose.

Let’s try to not make these mistakes in the future as well.

Also Read: Is The Future Of The Metaverse Certain or Does It Need A Reality Check?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief