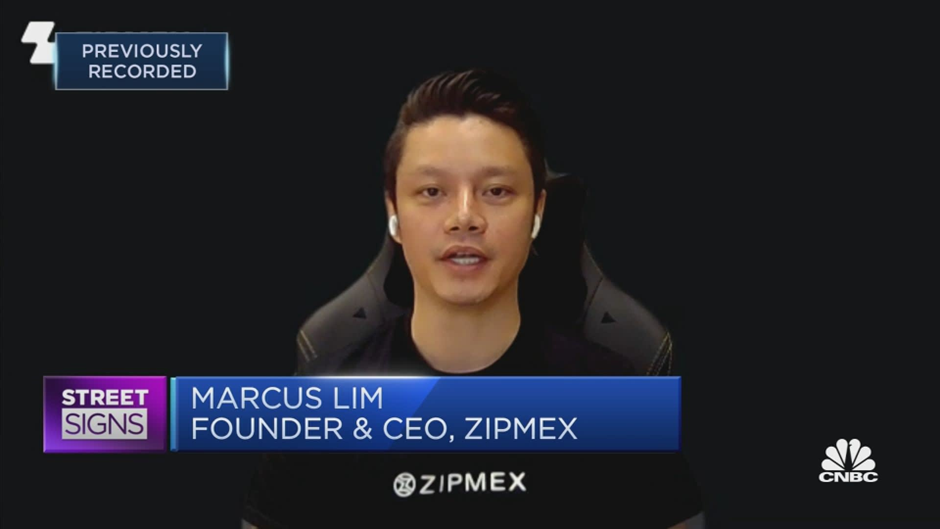

Zipmex, a cryptocurrency exchange based in Thailand, halted withdrawals earlier this month.

On Wednesday, July 27, they announced that Morgan Lewis Stamford LLC, their solicitors in Singapore, filed five applications. These were under S.64 of Singapore’s insolvency, Restructuring and Dissolution Act.

Also Read: Nobody Is Too Big To Fail; The Fall Of Celsius And 3 Arrows Capital

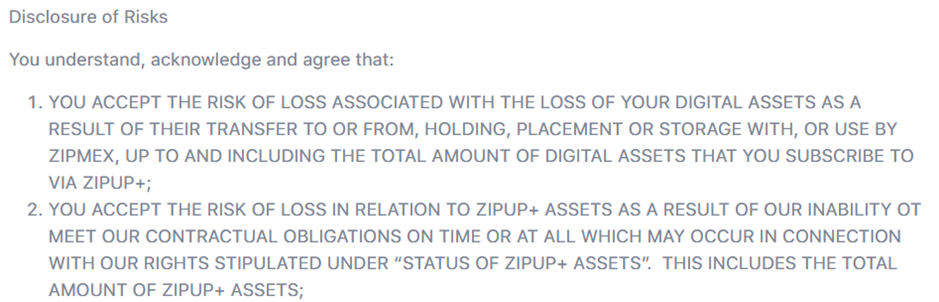

This comes after the collapse of Hong-Kong based crypto lender, Babel Finance, to which Zipmex had reportedly lent as much as $100 Million. These funds were lent as part of their high-yielding ZipUp+ program, which has no protection against loss of customer funds.

Furthermore, they had exposure to Celsius, which has since filed for bankruptcy.

However, the company has been granted an automatic moratorium, which means they have time to explore options. This includes restructuring, trying to raise additional capital, and pursuing Babel Finance.

While the company has reopened withdrawals for its trading wallets, features like transfers, deposits, and trading have been disabled till further notice.

These events come amidst a liquidity crunch in the crypto space, caused by the fall of Luna and Three Arrows Capital. Other crypto exchanges such as Vauld, Celsius, and Voyager, have also filed for bankruptcy or protection from creditors.

Also Read: “We Believed In Everything To The Fullest” 3AC Breaks Silence, Refuses To Disclose Location

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief