When going long or short on an exchange, you may have noticed a “funding rate”, amongst various other indicators withing crypto futures. While there are many metrics to indicate volume, volatility, and more, most of them do not directly affect your position.

However, funding rates have a very real impact on trades but generally remain overlooked. Here, we look at perpetual swaps, funding rates, and how you can capitalize on them to profit in any market environment.

Also Read: Profiting During A Crypto Crash; A Beginner’s Guide To Short Bitcoin On FTX Pro (Mobile)

Understanding Perpetual Futures

If you are used to traditional finance, perpetual futures (perps) may be a confusing concept. First used by Bitmex for the cryptocurrency market, they let traders go long or short for an indefinite period.

This allowed for deeper liquidity and access to higher leverage in a 24/7 market, but came with its problems.

Traditionally, the price of a contract would converge with the spot price naturally as it expires. However, perps existing indefinitely requires another mechanism to achieve this.

What is Futures Funding Rate?

A funding rate is a periodic payment or tax, depending on if traders are long or short.

Longs pay shorts when funding is positive, and shorts pay longs when funding is negative.

This prevents large, lasting price divergences, especially in volatile markets. The periods and rates are calculated differently on each exchange, but several platforms help aggregate this information.

1/7 HOW TO USE FUNDING RATE TO PREDICT BITCOIN PRICE? 🔥🚀

— ₿ 𝗰𝗼𝗶𝗻𝗺𝗮𝘀𝘁𝗲𝗿 ₿ (@the_coinmaster) April 24, 2020

Funding rate is one of the best indicators to determine herd sentiment of the market. While this thread won't explain what exactly is futures funding rate but we will learn how to use funding rate to analyze where $BTC

Some traders effectively use funding rates to gauge market sentiment and volatility. For example, if funding is heavily negative but prices keep rising, it may indicate a top.

Capitalizing on Funding Rates

One of the ways traders may take advantage of funding rates is delta-neutral arbitrage.

Here, BTC perps are trading at a premium to spot, resulting in a positive funding rate (longs pay shorts).

Traders can buy 1 BTC spot, and short the equivalent on perps. This allows you to capture the funding rate while protecting against volatility.

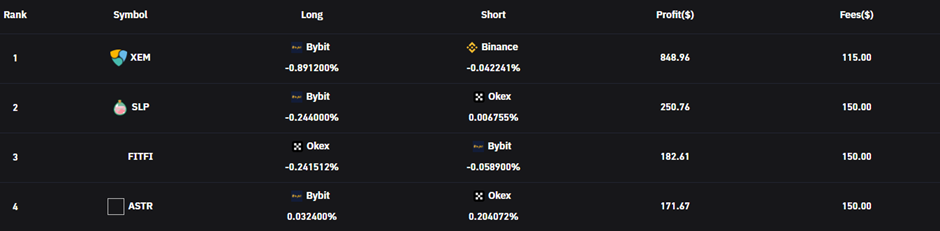

A more complex strategy would be to go long and short on different exchanges. As these platforms often contain varying market participants, their funding rates can differ strongly.

Here, going long $SLP on bybit while shorting on Okex leads to 2.5% more profits than simply sticking to one exchange. However, such strategies are are more complex as they carry liquidation risk.

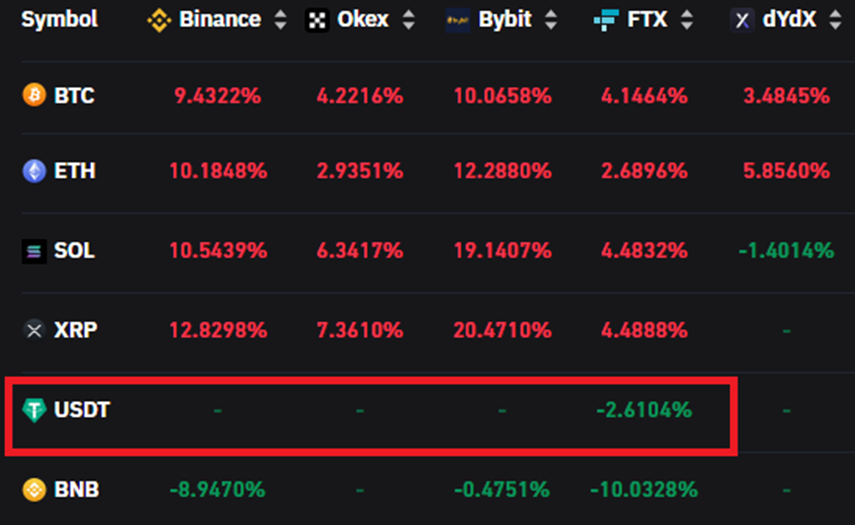

One of the simpler ways to use funding is a long position on stablecoins, such as $USDT. As institutions hedge risk, there is often negative funding in a generally stable asset.

At 5x leverage, this essentially turns a long position into a 13% APY stable farm. While returns can be multiplied using 20x or 100x leverage, $UST’s recent crash shows how even stablecoin positions can become volatile and get liquidated.

Being able to de-risk and protect capital is the most important part of delta-neutral profits, and therefore high leverage is generally avoided.

Read More: Profiting During A Crypto Crash; A Beginner’s Guide To Short Bitcoin On FTX Pro (Mobile)

Should I Do This?

Delta-neutral profits are best during a sideways market, much like the one we are in now. While it may seem like easy money, most funding is automated by bots such as Pionex, which usually carries a fee.

Including exchange fees, this can wipe out any gains from trades and proper calculations need to be done to determine the risk/reward, especially on smaller accounts.

That said, the cryptocurrency market is still extremely inefficient in performing arbitrage, leaving room for even retail traders to profit. Whether you choose to do it or not, learning about funding and how it can impact a position will be useful in any trading strategy.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Is Crypto Here For The Long Run? 5 Takeaways From Billion Dollar VC Firm a16z