Though the cryptocurrency market may seem up-only at times, violent 30-40% swings can bring your portfolio from all-time-highs to all-time-lows in a manner of days.

While we all would like to see Bitcoin rally non-stop, being able to protect against your down-side risk may lead you to more success in the long-run.

What is de-risking?

While everyone has their own way of lowering risk, personally, de-risking to me means taking profits at certain pre-set levels and moving them into stablecoins or blue-chip cryptocurrencies such as Bitcoin or Ethereum.

While the cryptocurrency I’ve invested in could continue to trend higher, de-risking means that I’ve secured my profits and moved them to assets that are less volatile and have higher conviction in, so that I can ride out a bear phase in the market without panicking.

Furthermore, If I had any leveraged positions, I may seek to close them, convert them to spot positions or hedge against them to prevent downside risk.

Benefits of de-risking your portfolio

When I faced my first correction in the cryptocurrency market, I saw my gains literally vanish when I woke up, with no money on the side to buy the dip. Being naïve, I thought that corrections would have played out gradually and I would have had the time to take profits.

The recent market crash was a good reminder of why you should always have a plan if the market corrects to the downside, with $BTC dropping by almost 20% and many alts dropping even more.

Cascading liquidations were one of the factors that led to the sharp decline, as over-leveraged investors saw their positions vanish, and US$1.32 Billion dollars of cryptocurrency assets were liquidated in less than four hours.

While de-risking protects your downside, it can also be a golden opportunity to earn a large amount of money in a very, very short period of time.

No matter what u buy at flush dumps you win pic.twitter.com/AJvQ5EwcEG

— Derivatives Monke (@Derivatives_Ape) December 4, 2021

Having a sizeable portfolio of stables means that you can quickly and easily grab the opportunities that come when the market dumps, not only earning from quick rebounds, but also a great chance to buy the dip on solid coins that ran up too far before you could get in.

The power of stables

While being relatively risk-off in traditional finance usually correlates to low reward, it actually pays quite well to hold stablecoins in DeFi (Decentralized Finance).

For example, one of the best places to farm stablecoins is on Anchor Protocol, built by Terraform Labs, who is also responsible for the cryptocurrency $LUNA.

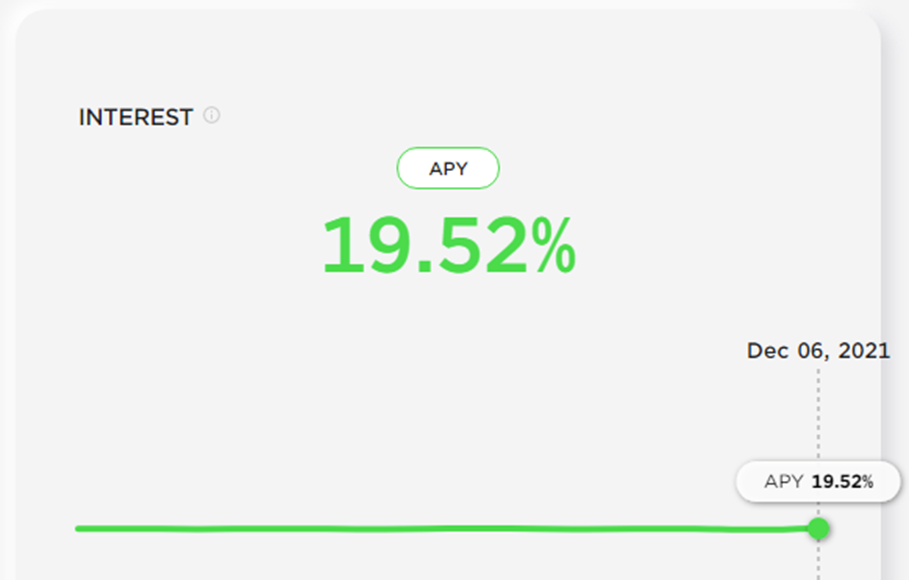

Being able to earn 19% APY on what is practically a risk-free asset means your stablecoin bags can grow while you are waiting for the next opportunity to deploy them.

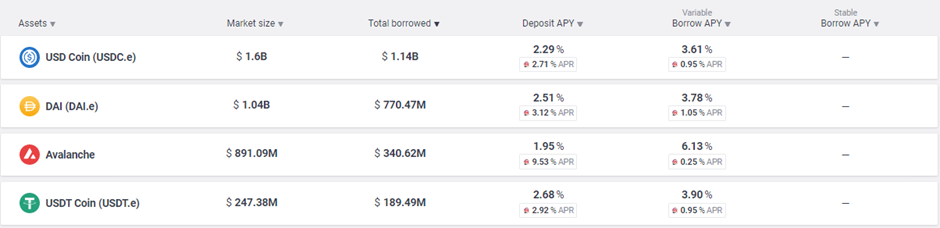

The opportunities for farming on stables are also endless, with protocols like Aave offering more than 2% APY for deposit rates, with further rewards thanks to liquidity mining incentives such as Avalanche Rush.

At the peak of liquidity mining protocols, you can easily earn more than 20% APY on stablecoins.

These rewards are often paid out in the native token of the protocol, and you can use it as a free way to gain exposure to them.

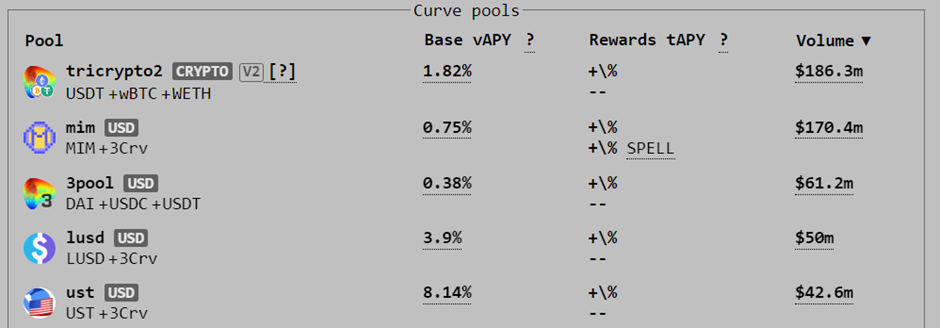

Curve Finance is one of the premier protocols for farming stables, where you can earn quite a sizeable amount on different pools. If you want to allocate to blue-chips instead of stablecoins, you can also provide them as liquidity on many of these protocols, such as the tricrypto pool on curve. However, gas fees on the Ethereum network may be a barrier of entry for some users.

Of course, there are many other strategies you can deploy for stablecoins to receive a much higher APY, but these usually carry a higher risk, which I generally avoid when trying to de-risk my portfolio.

Should I de-risk right now?

With the market dumping, there is a lot of uncertainty on where the run is taking us. While I wish there was a way to apply one portfolio type to everyone, how much risk you are willing to take on is truly a personal thing.

Though the markets have already corrected by a large amount, we could always trend sideways for the foreseeable future, or even correct more to the downside.

Personally, while I like to have a sizeable percentage of my portfolio in stablecoins, I have recently deployed them to buy the dip (Not Financial Advice, of course).

If you do not have any stablecoins currently, you may want to work out a plan to build up a stash, or take profits into them on the next run-up.

While the whole cryptocurrency space may still see more than a 2x from here, it is important to have a plan and stick to it. Just remember — no one ever goes broke taking profits.

[Editor’s Note: This article does not represent financial advice. Please remember to do your own research before investing.]

Featured Image Credit: Dignited

Also Read: Market Cycles In Crypto: How To Identify Tops and Take Profits