Last week, in our Chain Debrief Telegram community group, one of our community members asked about our crypto allocation strategy and portfolio breakdown. This is a hard question, especially since there are so many projects and protocols to back as crypto is growing at a phenomenal rate.

There are many ways to allocate your crypto portfolio. Here’s a look at my crypto portfolio breakdown and the thought process behind it:

Crypto portfolio allocation

Here’s a look at the breakdown:

| Crypto | % Allocation | Theme |

| Ethereum | 30% | L1, Crypto Blue Chips |

| Arweave | 15% | Infrastructure |

| Terra | 15% | L1, Programmable Stablecoin |

| Algorand | 10% | Infrastructure |

| Avalanche | 5% | L1 |

| FTT | 5% | CEX |

| Cosmos | 5% | L1 |

| Lukso | 5% | NFT |

| SAND | 3% | NFT |

| One | 3% | L1 |

| Others | 3% | DEX, Oracles, NFTs |

For my crypto portfolio, the base allocation is Ethereum, which I consider as the “blue chip” crypto to hold. Ethereum is the foundation of all decentralized finance and applications, and has the biggest number of developers as well as applications built on top of it.

Ethereum for me is a long term hold and now sits in Hodlnaut earning a 4.2% effective APY for me. I have no intention of selling Ethereum until we see the full potential of decentralized applications across multiple industry or when another Layer 1 blockchain overtakes Ethereum in terms of number of applications as well as total network value (total value locked).

Other than Ethereum, the rest of the 70% of my portfolio is rotated into various themes based on the sector rotation in order to capture the most short term value.

Theme 1: Layer 1s

For example, the current theme of the month is Layer 1s, which are alternative blockchains competing with Ethereum. Some example of the Layer 1s which I have exposure to are Terra, Avalanche, Cosmos, and Harmony One.

Layer 1s are looking to create higher transactions per second and lower fees, both of which is a huge problem for the Ethereum network.

As Ethereum grew in popularity, the on chain transaction of Ethereum skyrocketed. As it was originally built around the “proof of work” concept, there is a limitation to how fast these transactions can be “cleared”.

With the popularity of the Ethereum network exploding, the network is unable to clear these transactions fast enough to meet the demand, leading to high transaction fees (gas fee).

To put things in context, the average fee per transaction for Ethereum is as much as $30 per transaction, compared to less than $1 five years ago (3000% increase in fees).

Theme 2: Infrastructure

Other than investing in Layer 1 related coins, a significant part of my portfolio is allocated towards infrastructure play. Infrastructure related protocols provide the backbone to which other blockchains operates.

Cryptos focusing on interoperability can also be categorized as infrastructure tokens. Their goal is to provide a way to link multiple blockchains together and allow users to transact across these networks.

Example of infrastructure tokens include Arweave, which is a cloud data token, Algorand, blockchain infrastructure as a service, and even Chainlink, the leading blockchain oracle.

Theme 3: NFT

Another portion of my portfolio is invested into NFT related tokens. NFTs have grown by a huge margin over the past 3 months, and as more organizations explore the various use cases of NFTs, it is definitely here to stay.

My exposure with NFT tokens is with gaming metaverse SAND, as well as digital consumer goods and fashion NFT Lukso.

The use case for NFT is most successful with gaming, and SAND is in a good position to capture that space. For Lukso, as we move into utility based NFTs, fashion related NFTs may be the next vertical to look out for.

Of course, there are many other ways to structure one’s portfolio, just as there are tens of thousands of stocks out there. Other than these themes, there are also other themes such as exchanges, stablecoins, derivatives, lending, synthetix, and many other blockchains to invest in.

There is therefore no one-size-fit-all strategy and it depends on your conviction level and which crypto protocols are you most comfortable in backing.

Hence in crypto investing, it is recommended that you do your own research and come out with ways to evaluate which cryptos are worth holding on.

For me, I tend to look at the project’s ecosystem, how fast it is growing, who is the team behind it, what is the total value locked of the project as well as what is the sentiment around the project.

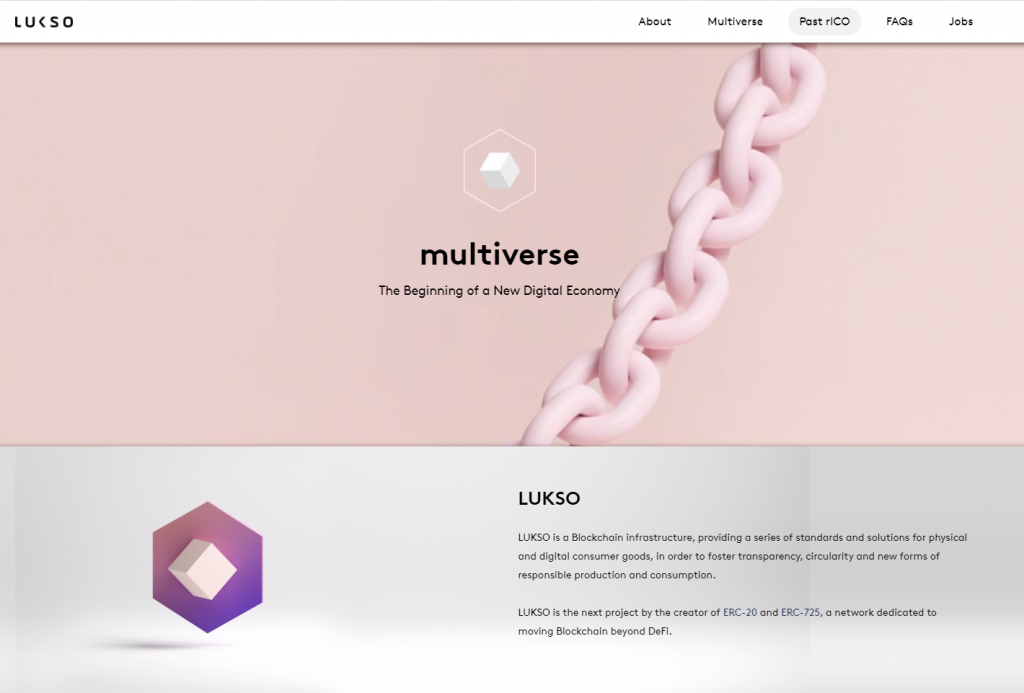

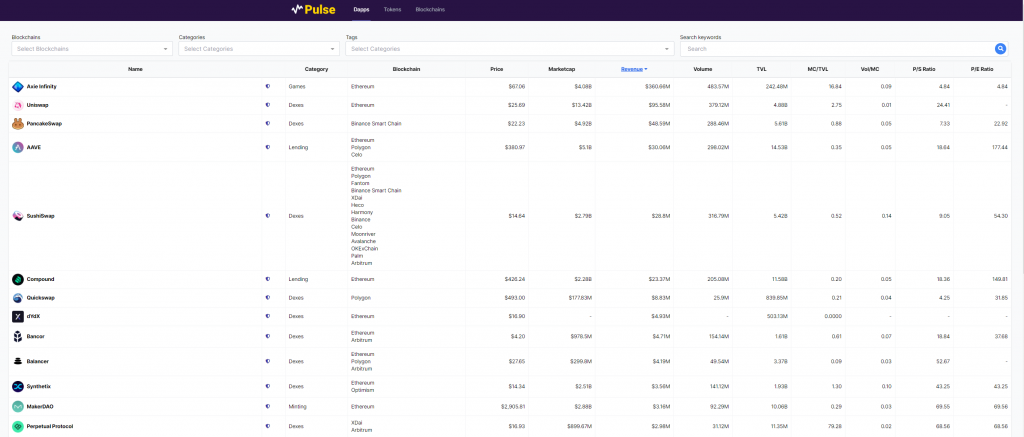

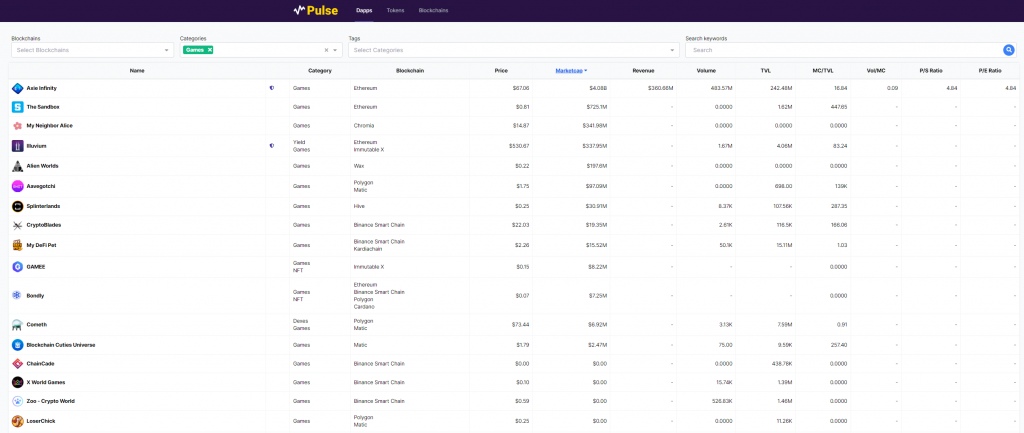

At Chain Debrief, we are also building a research tool called Pulse for users to easily discover the various projects and protocol.

All in all, it is recommended that you spend some time thinking about your portfolio strategy and which part of the whole decentralized world you want to put your resources to work into.

Also Read: Crypto Valuation Model: Market Cap Over TVL Shows Some Crypto May Be Undervalued