Most crypto protocols have built in revenue models to incentivise users to keep coming back. Protocols are basic sets of rules that allow data to be shared between computers. For cryptocurrencies, they establish the structure of the blockchain — the distributed database that allows digital money to be securely exchanged on the internet.

Crypto protocols that manage to withstand the test of time are more likely to stay here for the long haul. Here’s a look at a few crypto protocols with over a billion dollars in revenue:

1. Bitcoin Blockchain

Bitcoin as everyone knows it, is the first ever cryptocurrency. It was founded on 3 January 2009, and at more than 12 years old, it is the “oldest” cryptocurrency.

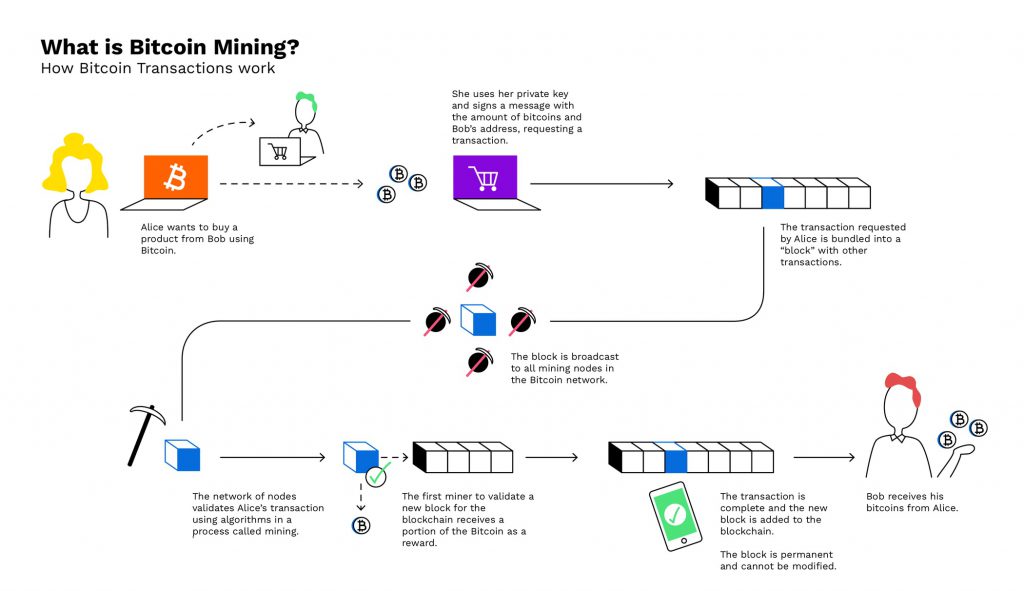

The Bitcoin protocol is built such that anyone can “mine” and earn bitcoin in exchange for running the verification process to validate Bitcoin transactions. These transactions provide security for the Bitcoin network, which in turn compensates miners by giving them bitcoins.

Since 2009, the total revenue generated on the Bitcoin network is over $1.1 billion dollars, making it the first crypto blockchain to hit over 1 billion dollars in revenue.

2. Ethereum Blockchain

Ethereum is the second largest cryptocurrency by market capitalization, and is popular for its ability to enable smart contracts. Smart contracts on the Ethereum blockchain allow the blockchain to flourish, giving rise to a whole suite of decentralized applications and the decentralized finance movement.

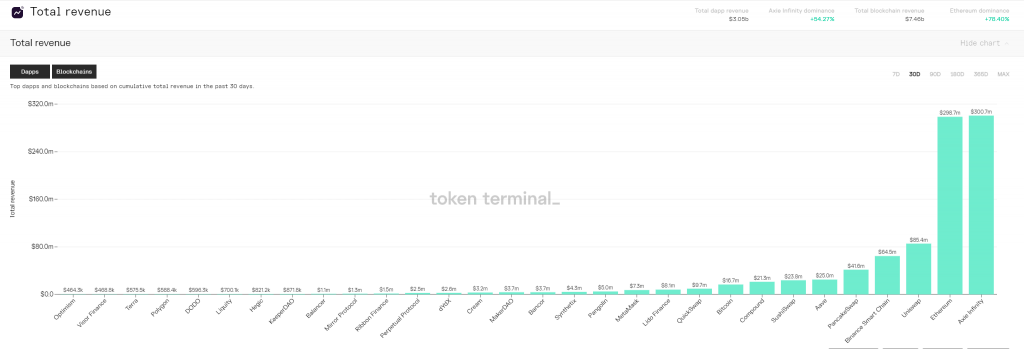

Because of this, the total revenue generated on the Ethereum network is over $4.4 billion, making it the crypto blockchain with the highest revenue by a large margin.

Ethereum’s revenue model is based on a proof of work mechanism. Similar to Bitcoin mining, miners use their time and processing power to solve cryptographically hard puzzles. If successful, the miners will be able to add blocks to the Ethereum blockchain and earn a reward in return.

3. Uniswap

The third protocol that passed $1 billion in fees is Uniswap. Uniswap is the first automated market maker where users can swap crypto pairs with one another.

In Uniswap, there are liquidity pools where users can provide their liquidity in. Liquidity providers then earn a fee whenever someone trades the token pair on Uniswap.

Currently, the transaction fee paid out to liquidity providers is 0.3% per trade. By default, these are added to the liquidity pool, but liquidity providers can redeem them at any time. The fees are distributed according to each liquidity provider’s share of the pool.

Earlier today, Uniswap became the first protocol to surpass 1 billion in fees.

@Uniswap just became the first protocol to surpass $1B+ in fees ?

— Lucas Outumuro (@LucasOutumuro) August 10, 2021

Congrats to @haydenzadams and team ? pic.twitter.com/pnA10t41Yo

Special Mention: Axie Infinity

Over the past few weeks, NFT game Axie Infinity has exploded in popularity. As more and more users hop onto Axie Infinity, Axie Infinity also announced that is had reached a transaction volume of $1 billion on its marketplace. Its total revenue generated so far is about $350 million.

Congrats on 1 b in lifetime Axie sales!

— The Jiho?? (@Jihoz_Axie) August 7, 2021

This is a fundamental shift in how games are played.

This is the evolution of games to their final form: digital nations.

Axie Infinity makes money through a 4.25% marketplace fee as well as from breeding fees whenever users breed Axies. In the past 30 days, Axie Infinity generated over $300 million in revenue, overtaking even the total revenue of the Ethereum blockchain, according to data from Token Terminal.

Ethereum overtaking Axie? ?? pic.twitter.com/cVnuR1vcgm

— Token Terminal (@tokenterminal) August 8, 2021

As crypto adoption picks up, we expect to see more blockchains and protocols hitting the billion dollar revenue mark.

Also Read: Crypto Valuation Model: Market Cap Over TVL Shows Some Crypto May Be Undervalued