Whales are the largest creatures on Earth, and that fact holds true for crypto whales as well.

It is common for them to manipulate markets, accumulating more coins while dumping on “shrimps”. Shrimps refer to those that own a smaller share of the market, mostly retail investors or traders.

So, are we simply doomed to the whims of whales? Let’s take a look at why we should track whale wallets, and how that can prevent us from making costly mistakes.

What are crypto whales?

Crypto whales refer to those who own a large amount of a cryptocurrency’s supply, and is therefore fairly subjective. For example, small-cap whales could simply own $1 million of it, while $BTC or $ETH whales usually own a few billion dollars of them at minimum.

How do crypto whales manipulate the market?

Panic selling is the primary way they move markets. Sharp drops in price are usually a good representation of this.

Further sell-offs are then triggered, either due to overleveraged traders or limit orders. Often, these sellers infer that whales have access to insider information and continue offloading their positions. Whales then come in and scoop assets at a lower price, increasing their profit margins.

This tactic is known as “rinse and repeat”, often done across various time frames and exchanges to obscure information.

Thankfully, as the market matures, manipulation is likely to simmer down. Whales being diluted by new entries, traders staying away from leverage, and understanding market activity all work towards this. The longer crypto stays around, the less control whales will have.

How do we track whale wallets?

To track whale wallets, we need to understand the types of transactions that can occur.

These include:

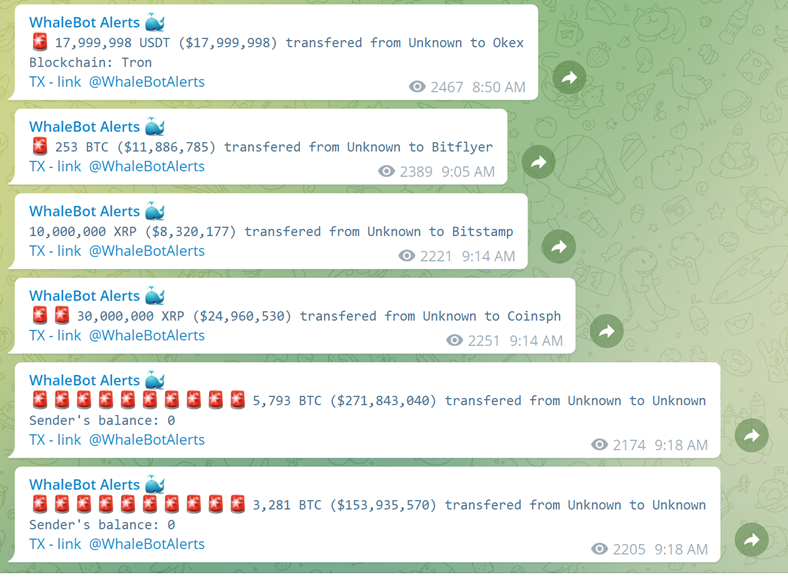

- Exchange to Wallet — Transferring between cold wallets and an exchange. Generally, outflows from exchanges mean higher prices and vice versa.

- Wallet to Exchange — Fast investments between a hot wallet and exchange. Depositing stablecoins generally indicates buying pressure while depositing assets indicates selling pressure.

- Wallet to Wallet — Generally indicates an OTC trade, generally for privacy and liquidity. These transactions generally do not affect the market that much, and sometimes happen just to trigger market reactions.

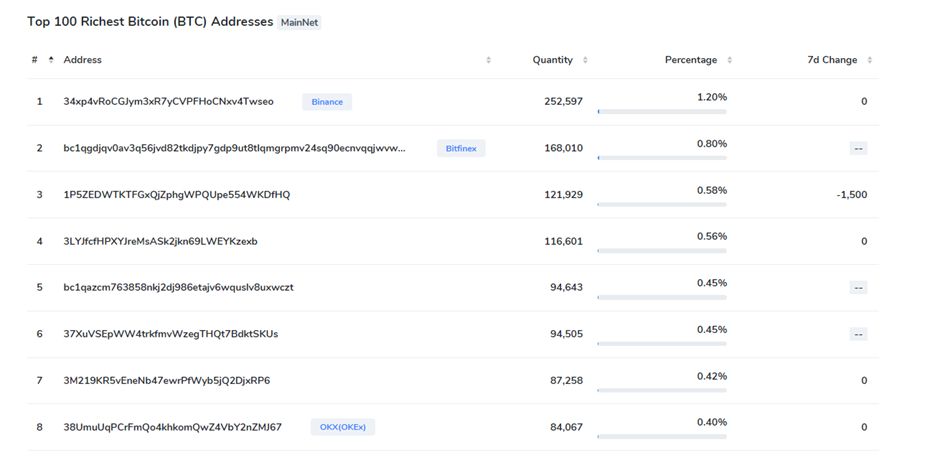

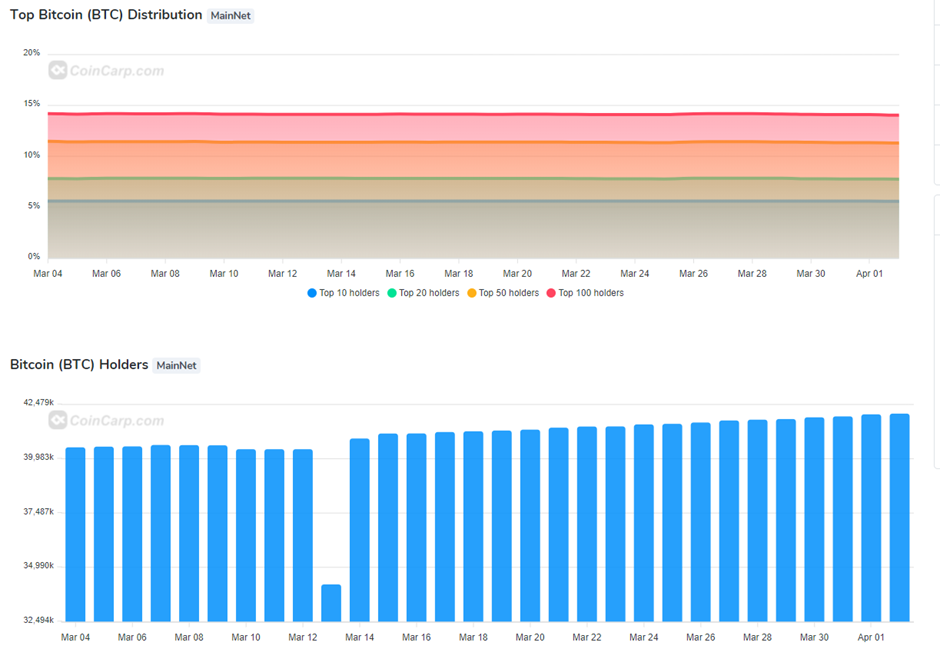

There are a few tools for tracking whale wallets. Users can use Coincarp Richlist and Coincarp Exchange Wallet Balance to search for the largest holders of Bitcoin.

This tool is useful for finding Bitcoin distribution, as well as the number of holders. Other cryptocurrencies’ statistics can also be found here.

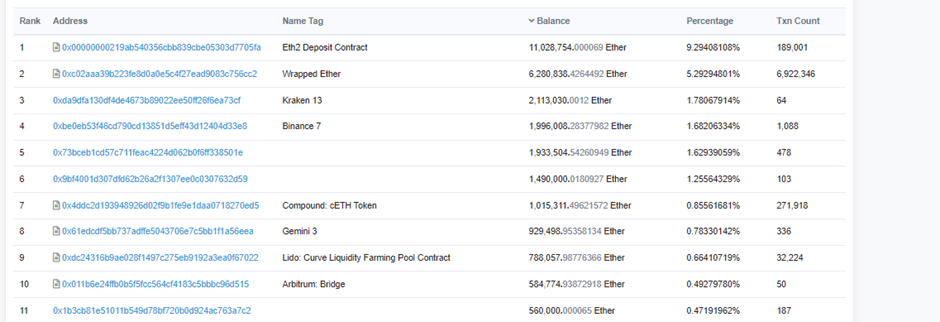

Blockchain explorers such as Etherescan are additional tools you can use for tracking whale wallets. Watchlists can be set up for specific addresses, setting off alerts when transactions are made.

Bots, such as whale alerts, are another useful tool to streamline this process.

Crypto criminals

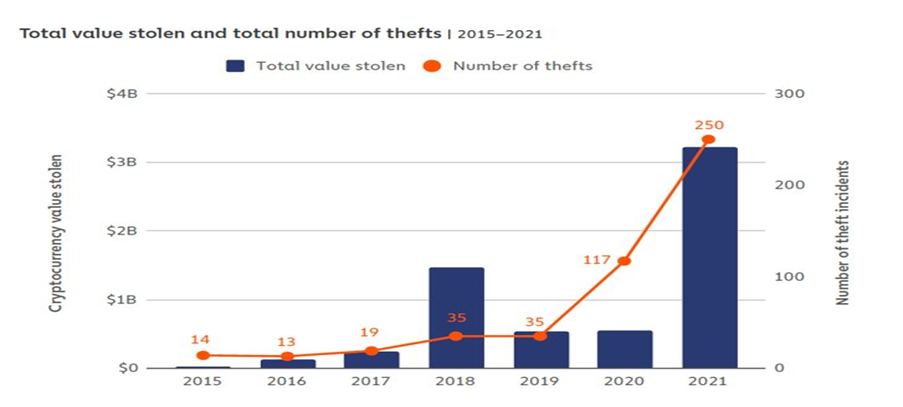

Theft in cryptocurrency is, unfortunately, on an uptrend. These entities who have stolen from various enterprises currently make up around 4% of whales.

The amount of stolen funds in 2021 was $3.2 billion, 6 times more than 2020.6 times more than 2020. Decentralized platforms were the largest victims, making up approximately 70% of lost funds.

Code exploits such as flash loans and price oracle manipulation were the main methods through which these attacks occurred. As regulations step up, tracking these wallets and what happens to their funds will become increasingly important.

Closing thoughts

Is it really necessary to track whale wallets?

At the end of the day, whales want the value of their coins to go higher. However, this is usually at the expense of others, falling victim to their market-moving waves. Tracking their wallets and understanding their motives is one good way to prevent this.

Furthermore, having a plan on where to enter and take profit helps you prevent impulsive mistakes. Have a clear goal of how much you are willing to make or lose, and act when targets are met.

Featured Image Credit: CoinCu News

Also Read: Is Crypto A Scam? Here Are The Top 5 Misconceptions About Crypto

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!