The derivative markets have always outperformed SPOT volume because of leverage and hedging. However, Centralized Exchanges (CEX) still account for a majority of this volume.

Due to gas fees, low liquidity and contract risks, trading options on-chain have been okay at best. However, this narrative may be changing soon as protocols such as DopeX continue growing.

📍 TradFi options mkt volume is in the trillions

— dopex (💎, 💎) (@dopex_io) June 22, 2021

📍 Deribit options volume for $BTC alone did $14+ bln

📍 Current mkt of DEX options volume does only $2+ mln

The options protocol that can find product market fit will be a great if not the best asymmetric bet (x100) you'll find. https://t.co/4DjRK01wHv

The complexity of options markets usually keeps out retail. However, they can be useful in hedging positions, structuring products, and so on – and not just for institutions and experienced traders.

Protocols such as DopeX, Thetanuts, and Ribbon Finance are giving investors access to strategies such as DeFi Options Vaults (DOV). Options, generally inaccessible to the public, are the foundations for such strategies.

What is DopeX?

DopeX is a decentralized options protocol on Arbitrum (Ethereum L2) that aims to satisfy both option writers and options buyers. This is done using its 2 protocol tokens, $DPX and $rDPX. $DPX has a fixed supply of 500k while $rDPX’s supply is uncapped. $DPX allows for governance and accrues protocol fees, while $rDPX is the rebate token, used for protocol functions.

While their team being anonymous may raise some red flags, this is increasingly becoming the norm in the cryptocurrency scene.

Moreover, the core developers @tztokchad and @witherblock, are pretty well known in the space. Legendary anon whale @Tetranode is also backing this project.

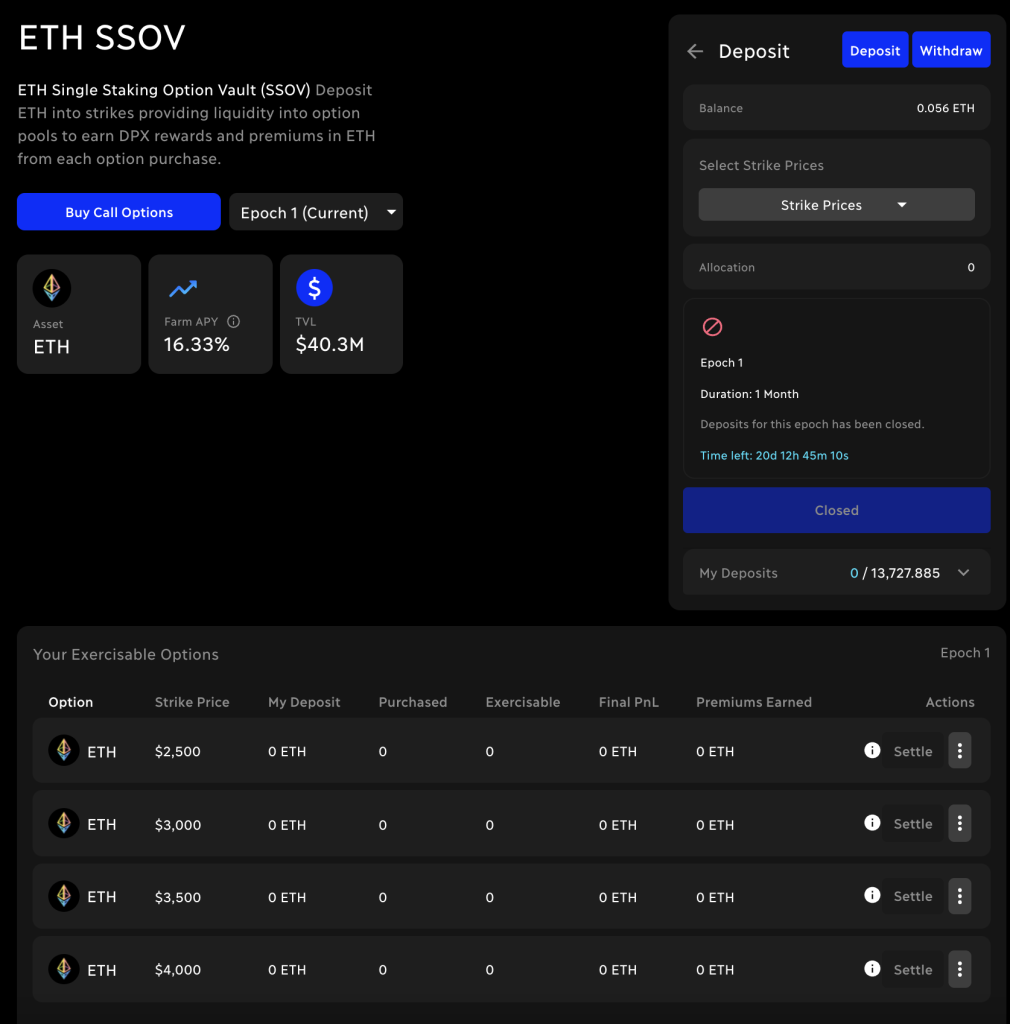

Introducing Single Staking Options Vaults (SSOV)

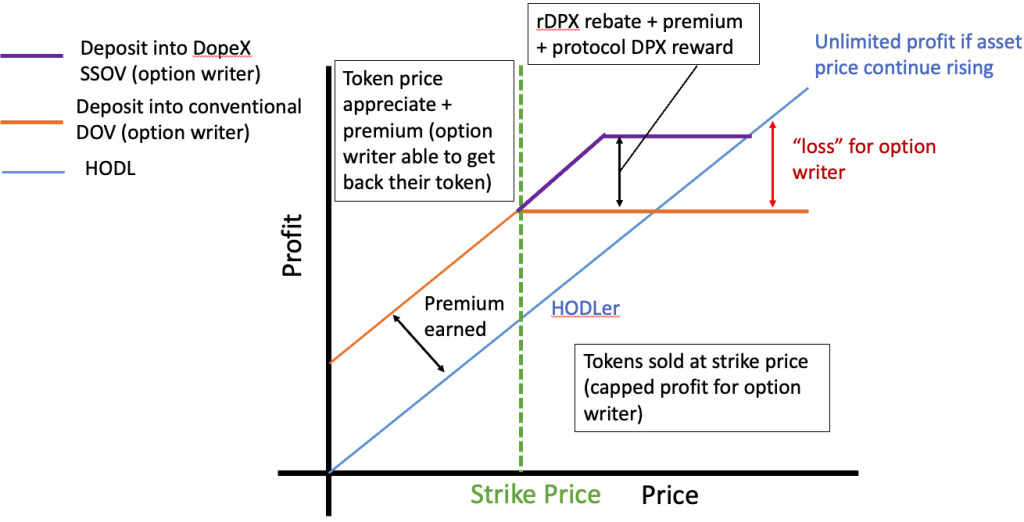

The DopeX team has developed Single Staking Options Vaults (SSOV), which function similarly to DOV. The difference between them is that option writers’ losses are minimized, while options buyers have access to deep liquidity and a fair price. The SSOV epoch will last for a month. During this period, option writers will be able to deposit assets and choose the strike price.

The vault will then deposit the asset into a staking pool and farm yield. Option writers will earn yields from both option selling premium and yield farming. Options buyers can then purchase these “European Options”. European Options can only be exercised after expiry.

Whenever a call option is exercised (Asset price>strike price), the option writer will lose out on profits (“loss”) above the strike price. However, DopeX will rebate them for 30% of losses via newly minted $rDPX.

Options writer’s losses are greatly reduced thanks to yield farming, compensations and premiums. Liquidity should then flow to the protocol, solving a persisting issue for on-chain exchanges.

11. The 2nd protection against risk for writers would be

— TzTok-Chad (💎, 💎) (@tztokchad) May 3, 2021

b) Fair option pricing

Unlike protocols making use of flat IVs and black-scholes pricing which usually results in incorrect pricing across strikes and expiries especially farther out of the money, dopex uses a combination

They will then quote multipliers (Options volatility) that affect option prices for an accurate market value. This helps options prices converge to their fair market value.

What is DPX?

Holding $DPX allows users to vote on these governance decision:

- Weight of $DPX rewards for each pool

- Rebate amounts in $rDPX for each pool

- Strike thresholds for option chains in pools

- Fallback for price multipliers in case of delegate failure

- Removal and slashing of delegates

DopeX has managed to add further value to their governance token by taking the Curve approach. $DPX can be staked as $veDPX, used as margin collateral for options and possibly minting synthetic assets down the road.

What is $rDPX?

$rDPX’s infinite supply would imply a farm and dump situation, much like with tokens such as $SLP. However, it has capped emissions. This is thanks to it only being minted from options writer’ losses and liquidity rewards.

Some use cases for $rDPX include:

- $rDPX will be a fee requirement for future app layer additions to Dopex (i.e. vaults)

- staking $rDPX accrues fees

- Dopex will support $rDPX as collateral.

- Minting synthetic assets using $rDPX as collateral

- There will be burn mechanisms throughout the protocol to create deflationary pressure on $rDPX

Source: https://blog.dopex.io/articles/bull-theses/-rdpx-bull-thesis-undervalued-or-misunderstood

The usage of $rDPX as fees and boosting staking rewards could bring forth strong buying pressure. Even though $DPX is also able to mint synthetics assets, the protocol will manage the collateralization ratio to incentivize $rDPX usage instead. Furthermore, the protocol is currently pushing out a v2 model to ensure $rDPX stays sustainable.

Future development

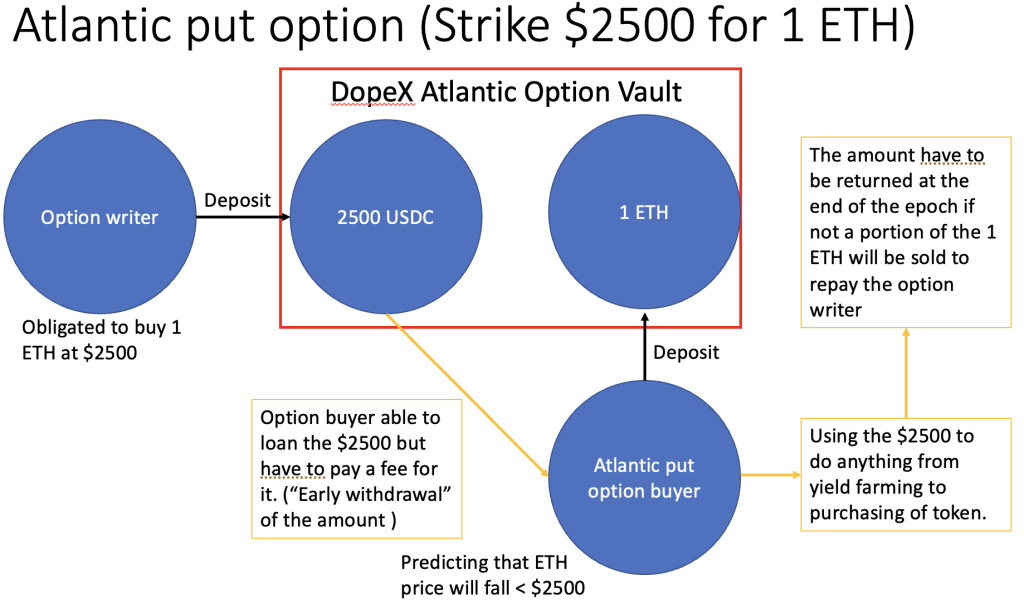

Atlantic options (Requires a clear understanding of option puts)

Atlantic options is a new DeFi innovation that will change the landscape of how protocols manage their treasury and capital efficiency. While they are more applicable to put options, they can also be used for call option strategies.

Writers follow conventional options logic while earning higher yields. This occurs as borrowers of the underlying token ($USDC for puts), will pay a funding fee.

Some key uses are:

- Borrowing of funds with no fear of liquidation

- Setting a price floor for tokens by protocol

- Increase Capital efficiency for protocol treasuries

- Capital raising

The docs also reveal many more use cases.

An example: I own one $eth and I want to use this as collateral. I deposit it and get some other asset (like usd) in return. At this moment $eth is worth 2500 $usd. If $eth drops to 1250 it will be liquidated = forceably sold. (4/x)

— Zuckerman (💎,💎) (@ZCKRMNDPX) January 27, 2022

As Zukerman states, Option writers are obligated to purchase $ETH at the strike price even if the underlying price is lower (puts-profit). This allows the option buyer to take an “early withdrawal” of the $USDC in the vault, as option writers will pay for the $ETH when strike < spot (puts-loss). The option buyer will return the $USDC to the vault as the $ETH is worth more than the borrowed funds. This ends up creating an entirely new lending market while negating liquidation risk.

Most protocols currently buyback only when revenue is high, meaning they are unable to guarantee buying the dip. When they require capital, especially in a crash, they will then have to market sell treasury tokens.

MakerDAO’s black Thursday is a prime example of protocols buying the highs and selling the lows. Instead, they can now write Atlantic puts options that earn higher yields and at the same time purchase them for a fair price. This helps protocols increase the capital efficiency of their treasury and set a price floor for their token, all while earning yield.

Protocols can also accept Atlantic puts instead of stablecoins for capital raising through the bonding of Atlantic puts. Of course, more use cases are constantly being discovered.

rDPX v2

The token remodel of $rDPX mimics the OlympusDAO bonding model, but with a slight twist where they introduce a process called double bonding. This increases protocol-owned liquidity while putting deflationary pressure on $rDPX supply. To increase the usage of their native tokens $DPX and $rDPX, DopeX realized the need for their own stablecoin. Therefore, $dpxUSD was born, using native collateral like DPX/WETH and rDPX/WETH LPs.

A user is able to deposit a bond with 50% rDPX/USD LP and 50% in either USD stable/out of the money (OTM) Atlantic $rDPX puts. This allows the protocol to be 75% backed by stablecoins, with the rest coming from LPs.

75% of bonded stablecoins will then be used to yield farm on Curve/rDPX Put SSOV, increasing capital efficiency of the treasury and ensuring a strong $rDPX floor. $rDPX deposited will then be burned and minted as $dpxUSD at a discount.

This in turn results in a deflationary cycle for $rDPX supply as users bond their $rDPX tokens for $dpxUSD. As the price of $rDPX appreciates, its emissions will also decrease thanks to less $rDPX being needed to pay for rebates each epoch.

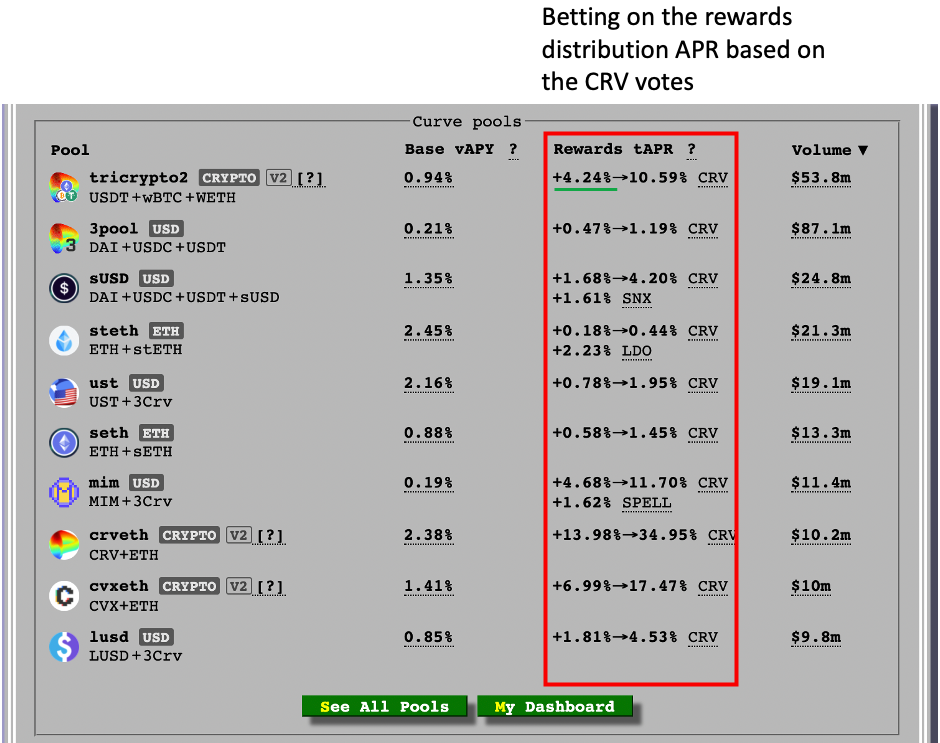

Redacted Vaults (interest rate options)

While the curve wars have been going on for awhile, Convex still seems to be strongly in the lead. With the introduction of the Interest rate options however, this may change. These options let anyone bet on the APR of certain pools, making the curve wars ever more exciting.

There are two ways to bet on the APRs:

- Call Interest rate option (Expecting APR for the pool to increase): Option buyer will receive the interest of spot rate while paying the interest of strike rate.

- Put Interest rate option (Expecting APR for the pool to decrease): Option buyer will receive the interest of strike while paying the interest of spot.

DopeX further allows up to 1000x leverage, which will help sway the tides of the Curve war. This allows large holders to sway votes in their favor while earning significant amounts from the options market. Moreover, $veDPX holders are able to determine the strike price for each epoch, controlling curve rewards.

Closing thoughts

As institutional and retail players continue piling in, DopeX has become one of the top protocols to watch.

The protocol is at the forefront for the various innovations that it has come up with (Atlantic options, interest rate option, etc). It will draw a large amount of liquidity and in turn increase the revenue and the value accrual back to $veDPX holders.

If you missed some comments from @tztokchad & @davidiach in @dopex_io discord on Atlantic options.

— PLZV_ (@PLZV_) January 26, 2022

"People who think 12 figure TVL is a meme are about to be surprised." @davidiach pic.twitter.com/gHyHehhyJ6

With Atlantic options and interest rate options, it could cause a huge turmoil in the DeFi space while protocols continue fighting for efficiency and liquidity.

Featured Image Credit: DopeX

Also Read: All You Need To Know About DeFi Options Vaults (DOVs) And How To Get Started