DefiLlama has launched a new product called Delta Neutral Yields to bring farming profits to users up to 20%.

Gone are the days when you need to source for high yields personally. With an abundance of options now, DefiLlama adds one more to the list. A product that they have been working on for months, they launched their Delta Neutral Yields more than a week ago.

Through the use of their massive database, you will find opportunities where you borrow a token and proceed to farm with it. With this, users can get over 20% APY on blue-chip such as BTC and ETH. Of course, everything comes with risk and the higher risks will usually yield higher rewards.

Today we're launching a product that's been in the works for months: Delta Neutral Yields

— DefiLlama.com (@DefiLlama) October 22, 2022

It uses our huge DB to find opportunities where you borrow a token and then farm with it

With this you can get >20% APY on BTC, ETH, USDC…

Thread on how to get that APY + examples

1) Leveraged farming of AVAX staking

Leveraged yield farming is a mechanism that allows farmers to lever up their yield farming position, meaning to borrow external liquidity (money from liquidity pools) and add it to their liquidity to yield farm it. As a result of having more liquidity, higher return volume can be expected.

In simple words: it is the practice of using borrowed money for yield farming. If yield farming with X yields you Y returns, then yield farming with 5X yields you 5Y returns. In other words, borrowing funds to ramp up your position X, while using leverage multiplies your profits.

This method nets you an APY of 21.96% on your BTC with only exposure to Aave and AVAX liquid staking.

- Deposit BTC.B on Aave

- Borrow AVAX

- Stake it to get sAVAX

- Deposit on Aave to borrow AVAX again

- Repeat this to leverage the farming

2) Arbitrage between lending protocols

Arbitrage exists as a result of market inefficiencies and it both exploits those inefficiencies and resolves them. Arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from tiny differences in the asset’s listed price. It exploits short-lived variations in the price of identical or similar financial instruments in different markets or in different forms.

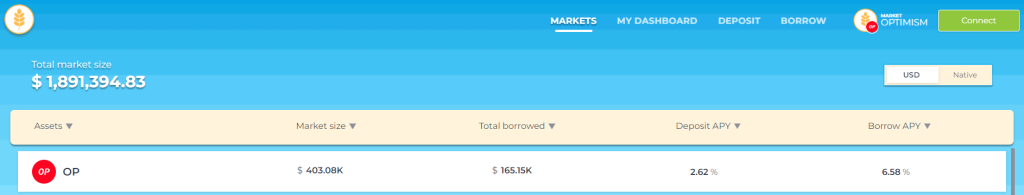

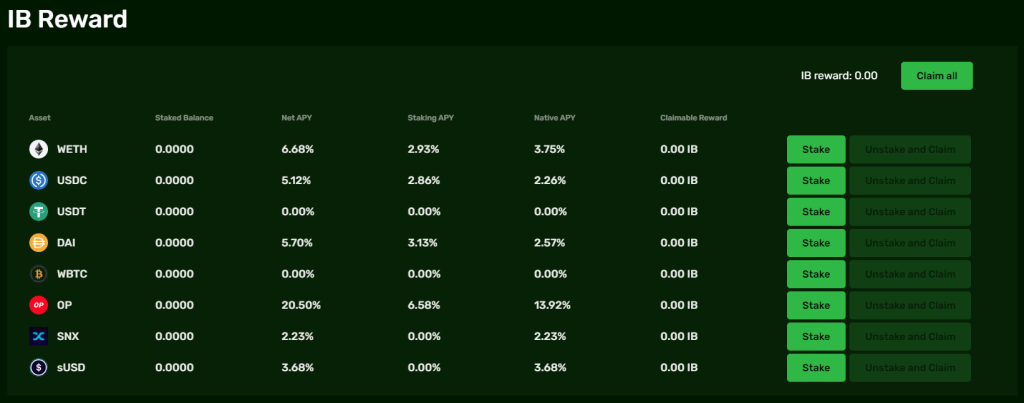

Borrowing OP on Granary Finance costs 6.58% while supplying OP on Iron Bank nets you 20.5%. What you can do here is to borrow OP from Granary and deposit borrowed OP into Iron Bank.

Excluding rewards in IB tokens, users still get a sweet 13.92% back in OP which means a profit of 7.34% after subtracting borrowing costs.

So the method here is simple: borrow in one and deposit in the other to arbitrage the rates and earn a profit off this market inefficiency.

However, do note that this opportunity will not last forever and require active monitoring to ensure that you do come out profitable. Arbitrage resolves inefficiencies in the market’s pricing and adds liquidity to the market, and is often acted upon quickly eliminating the opportunity for any latecomers.

3) Arbitrage against a yield aggregator

We just had an example of arbitrage between lending protocols, but wait, there are more arbitrage opportunities. This time, arbitraging against a yield aggregator.

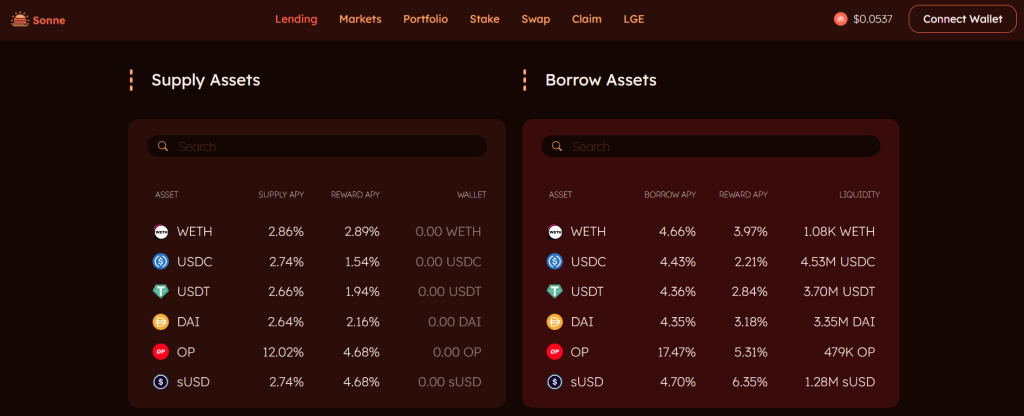

- Supply OP on Sonne Finance for 12.02%

- Borrow DAI paying 4.35%

- Deposit borrowed DAI on Reaper Farm for 18.28%

Now you are earning sweet rewards on your OP and DAI.

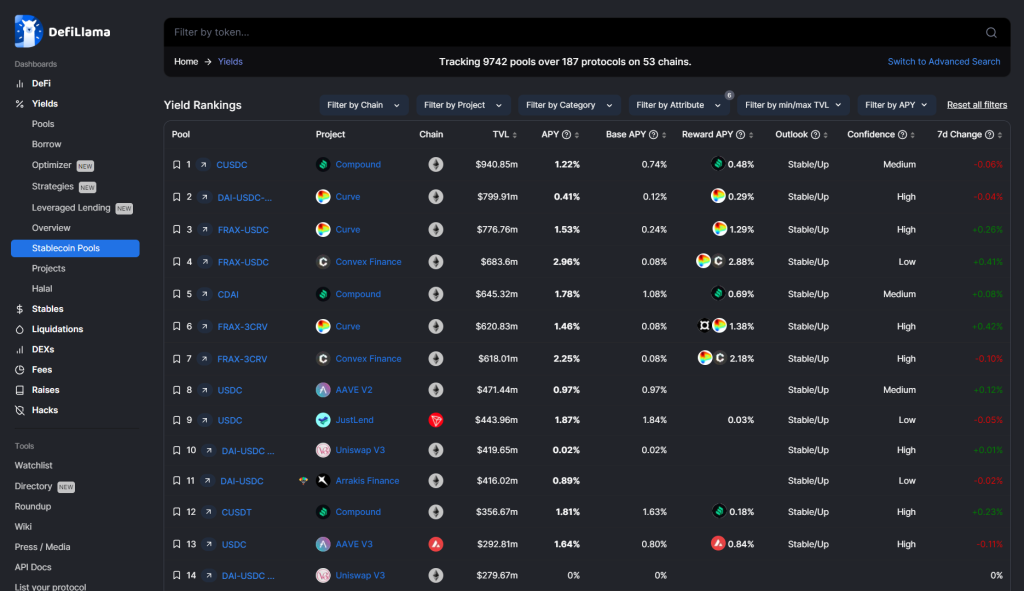

4) Stablecoin farming

Don’t worry if you are 100% stable and are still waiting to deploy those weapons of yours. Why not let them do some work for you first?

Ranking by the highest TVL to the lowest, most stablecoin farms range from 1.5% to 3% APY these days. Well, at least it’s something rather than letting your assets sit idle.

Conclusion

There are thousands of other strategies to make a profit in the yield dashboard. It is important to note that these are not set and forget farms. They all require active management to ensure a healthy ratio that users’ loans stay above water and do not get liquidated. Therefore, users need to consider this carefully before implementing any of the mentioned strategies.

The dashboard is now live and available for free over here. So get your cryptos ready and start putting in the work to get those juicy APYs that you’ve missed out on since last year!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: No More Ponzis: Solving The DeFi Recapture Problem For Mainstream Adoption