A very common question asked by many — what is the difference between staking and farming? To answer this age-old question, we first must understand what is DeFi.

Decentralized Finance or DeFi is a term for a variety of financial applications built on top of the blockchain and is designed to recreate traditional finance systems.

DeFi brought an abundance of complex financial use cases like the famed DeFi money legos. The composability nature of DeFi enables protocols to stack like legos set and unlock incredible returns.

DeFi also birthed some of the hottest trends in the crypto world — in this case staking and farming. Both staking and farming allow investors to earn attractive returns unseen from traditional finance.

So what is staking?

Staking is one of the many ways users can earn passive income in the DeFi world. Staking is basically locking up the token in a smart contract and getting some rewards in return. It is akin to buying a bond and getting coupon payment in return for the deposit.

Staking is largely popularized by Ethereum 2.0. Ethereum 2.0 is an upgrade to the current Ethereum blockchain.

It aims to improve network efficiency, speed security and scalability. Ethereum 2.0 will see a shift from the traditional proof of work consensus to a far more energy-efficient proof of stake mechanism.

Currently, there is over nine million $ETH staked on Ethereum 2.0 smart contract. Staking it on the smart contract helps to enforce the network’s security and by doing so, the stakers are rewarded with tokens.

Let’s take staking on Ethereum 2.0 as an example. Similar to mining, staking ETH allows the user to validate transactions on the proof-of-stake blockchain. This will help secure the blockchain and at the same time validators are rewarded for keeping the chain secured.

The reward is given by the protocol and it is calculated based on a dynamic rule. If there are not a lot of ETH staked, more rewards are distributed to incentives stakers. Vice versa, if there are a lot of ETH staked, lesser rewards are distributed.

What is yield farming?

Yield farming was the hottest trend of DeFi Summer in 2020, there were endless farming opportunities with insane APY everywhere. Today, DeFi has evolved so much that there are multiple platforms and ways to farm yield.

The traditional way to farm yield is through providing liquidity into a protocol. It is essentially committing a cryptocurrency pair into a liquidity pool in exchange for yield. Liquidity providers are then able to earn a percentage of the pool reward based on the amount they contributed to the pool.

Liquidity providers have to provide cryptocurrency pair in equal value to the pool. For instance, if the liquidity provider wants to participate in the USDT-ETH pair, US$100 worth of ETH and US$100 worth of USDT must be deposited into the pool.

In return for providing liquidity to the protocol, liquidity providers earn trading fees and crypto rewards from the platform. Rewards are distributed based on the proportion of liquidity they contributed to the pool.

What is the difference?

Both staking and yield farming are so similar in nature, many use the term interchangeably. But it is fundamentally different and here are some key differences that set them apart:

1. Profitability

For starters, yield farming is significantly more profitable than staking. It is not uncommon to see yield farms providing a very high APY rate to attract users to their platform.

In the world of finance, there is a term called the risk-return tradeoff. It describes the relationship between the potential return and the associated risk. Using this principle, potential returns increases with the level of risk involved.

Staking, which is considerably safer than yield farming, usually sees an APY rate at the range of 4%-14%. At the time of writing, Ethereum 2.0 staking on Lido finance yield 4.5% APY.

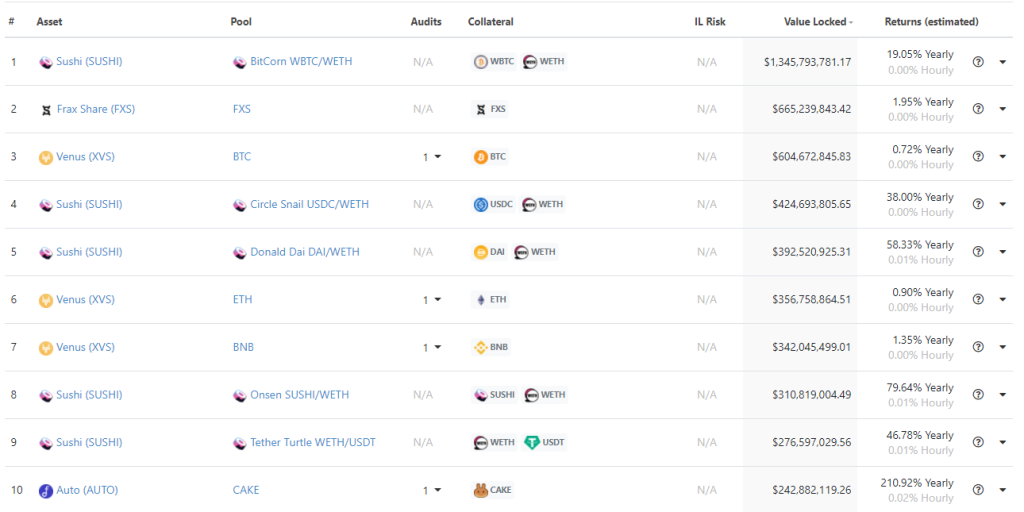

While on the other hand, yield farming which is riskier in nature tend to result in higher APY. If we take a look at CoinGecko, the APY of the listed yield farm range from a whopping 400% to as low as 0.19%. Newer degen farms can see preposterously high APYs in range of thousands.

2. Duration

The issue about staking is that most of the projects have a timelock function. When the token is staked, the token is locked up for a period of time and it can range from a short few days to a few years. Yield farming on the other hand doesn’t require the farmer to lock up the funds.

For example, those who stake on Ethereum 2.0 will have their ETH locked up until it combines with the mainnet Ethereum. Those who staked since the start of Ethereum 2.0 have seen their ETH locked up for over a year.

3. Impermanent loss

Impermanent loss happens due to the change in price to the deposited asset to when it was initially deposited. The bigger the price change, the more exposed the investor is to impermanent loss. It doesn’t matter which direction the price changes, as long as there is a price change, there will be impermanent loss.

It is important to note some liquidity pools are more exposed to impermanent loss. This is also the reason why most farms would provide higher APY to liquidity pools with more volatile assets.

Impermanent loss does not apply to staking as it is a single token stake and is not affected by price fluctuation.

4. Smart contract risk

Almost everything in DeFi revolves around the use of smart contracts. Without a doubt, smart contract risk is a risk that all DeFi participants have to take.

Smart contract risk is more prevalent in yield farming because it is usually coded by an inexperienced team. Any hole or mistake in the contract can be costly as hackers can gain access to the fund and drain out all the assets.

The risk in staking is much lower as it is usually coded by a more experienced team and the smart contract would be audited by an established firm.

List of established yield farms on different chains

Ethereum

Uniswap is the leading decentralised exchange (DEX) on the Ethereum blockchain. Launched in 2018, it is one of the OG DEX that is battle-tested and survived the test of time.

Solana

Raydium is the number one DEX on the Solana network. Unlike other DEX, Raydium is able to tap on to another protocol, Serum, for greater liquidity.

Binance Smart Chain

PancakeSwap is a fork of Uniswap but instead of Ethereum, it is built on the Binance Smart Chain. What set PancakeSwap apart from the other DEX is the gamified experience. There is a price prediction game and even a lottery system.

Avalanche

Trader Joe is the largest DEX on Avalanche. There are over 140 listed tokens with more than 500 trading pairs. Currently ranked among the top 10 DEX based on trading volume.

Conclusion

Overall, it all boils down to the investor risk appetite and duration of the investment. For investments with a shorter time horizon, it is arguably better to go with yield farming as it can generate high returns and doesn’t lock up the fund. A more risk-averse investor can opt to stake the token for a lower APY in exchange for greater peace of mind.

The bottom line is both staking and yield farming are very similar and staking can even be considered a subset of yield farming. Both approaches have their own advantages and disadvantages and there is no clear answer to which is the better approach.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Blockchain Layer 1 Vs. Layer 2: Will Layer 2 Solutions Be The Next Big Thing In Crypto?