For cryptocurrency holders, one of the ways to earn passive income on your idle cryptocurrency is to supply them into liquidity pools and earn yields from these liquidity pools.

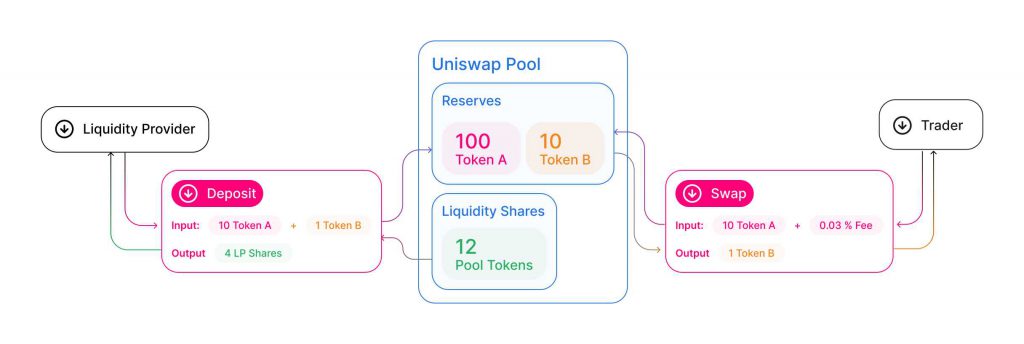

Here’s a simple illustration from Uniswap on how liquidity pool works:

As a liquidity pool provider, you will earn interest originating from the transaction fee generated whenever a trader or borrower executes a cryptocurrency trade.

For Ethereum, here are a list of liquidity pool provider or yield farms where you can supply your cryptocurrency into in order to generate a return on your digital asset.

The list is sorted by market capitalization, which is an indicator used to see how widely used are these protocols.

It is important to note that these projects are susceptible to rug pulls, so do perform your due diligence and research before committing to these farms.

Ethereum Farms

| Project | Symbol | Website | Market Cap |

| LIDO | stETH | stake.lido.fi | $1,286,034,589 |

| Alpha Finance Lab | ALPHA | alphafinance.io | $209,449,066 |

| Cream | CREAM | cream.finance | $120,000,715 |

| KeeperDAO | ROOK | keeperdao.com | $79,551,409 |

| Badger DAO | BADGER | badger.finance | $79,310,182 |

| Zero Collateral DAI | ZAI | zai.finance | $73,529,894 |

| cVault Finance | CORE | cvault.finance | $60,072,494 |

| Bella | BEL | bella.fi | $57,137,853 |

| Index Coop | INDEX | indexcoop.com | $49,524,407 |

| UnFederalReserve | ERSDL | unfederalreserve.com | $46,146,991 |

| Bao Finance | BAO | bao.finance | $42,152,602 |

| DefiDollar | DUSD | dusd.finance | $34,489,163 |

| Rootkit Finance | ROOT | rootkit.finance | $29,598,765 |

| Saffron Finance | SFI | saffron.finance | $24,053,352 |

| Armor.fi | ARMOR | armor.fi | $23,788,343 |

| Origin Dollar | OUSD | ousd.com | $19,225,280 |

| Stake DAO | SDT | stakedao.org | $18,533,066 |

| Glitch Finance | GLCH | glitch.finance | $17,805,517 |

| YFPRO.Finance | YFPRO | yfpro.finance | $13,348,188 |

| Indexed Finance | NDX | indexed.finance | $12,544,365 |

| Orai Chain | ORAI | orai.io | $10,731,678 |

| Ichi.Farm | ICHI | ichi.farm | $10,208,722 |

| BoringDAO | BOR | boringdao.com | $9,276,568 |

| Swerve Finance | SWRV | swerve.fi | $9,071,485 |

| PowerTrade | PTF | power.trade | $7,539,836 |

| Value DeFi Protocol | VALUE | valuedefi.io | $7,508,381 |

| OpenDAO | OPEN | opendao.io | $4,960,077 |

| Roobee Finance | ROOBEE | roobee.finance | $4,472,571 |

| OnX Finance | ONX | onx.finance | $4,199,728 |

| Basis Cash | BAC | basis.cash | $4,171,712 |

| Alpaca City | ALPA | alpaca.city | $3,854,655 |

| UniCrypt Network | UNCL | unicrypt.network | $3,381,480 |

| Dify Finance | YFIII | dify.finance | $3,038,419 |

| Octo.fi | OCTO | octo.fi | $2,989,366 |

| World Token Network | WORLD | worldtoken.network | $2,956,868 |

| YFDAI Finance | YF-DAI | yfdai.finance | $2,869,744 |

| Surf.Finance | SURF | surf.finance | $2,861,888 |

| Dracula Protocol | DRC | dracula.sucks | $2,855,245 |

| DeFi Yield Protocol | DYP | dyp.finance | $2,694,247 |

| Falconswap | FSW | falconswap.com | $2,481,279 |

| BiFi Finance | BiFi | bifi.finance | $2,389,605 |

| Gameswap | GSWAP | gameswap.org | $2,282,758 |

| SnowSwap | SNOW | snowswap.org | $1,921,437 |

| Pylon Finance | PYLON | pylon.finance | $1,410,508 |

| DeFiSocial | DFSocial | dfsocial.com | $854,151 |

| Akropolis Delphi | ADEL | delphi.akropolis.io | $788,068 |

| Gourmet Galaxy | GUM | gourmetgalaxy.io | $736,400 |

| Coin Artist | CRED | coinartist.io | $731,330 |

| Flashstake | FLASH | flashstake.io | $674,540 |

| Deficliq | CLIQ | deficliq.com | $638,567 |

| Pepemon | PPBLZ | pepemon.finance | $517,229 |

As a rule of thumb, signs of a good liquidity pool include:

- The longer the liquidity pool is around, the safer it is.

- The more total value locked in the farm, the safer it is.

- The more cryptocurrency pair available for staking, the safer it is.

- High APYs (4 – 7 digit APYs) generally means the liquidity pool is relative new and less stakers to split the pool rewards.

- The more users staking their cryptocurrency (total value locked), the safer it is.

- The more protocols built on top of the liquidity pool, the safer it is.

Also Read: The Ultimate 2021 Guide On Crypto Yield Farming And How To Get Started