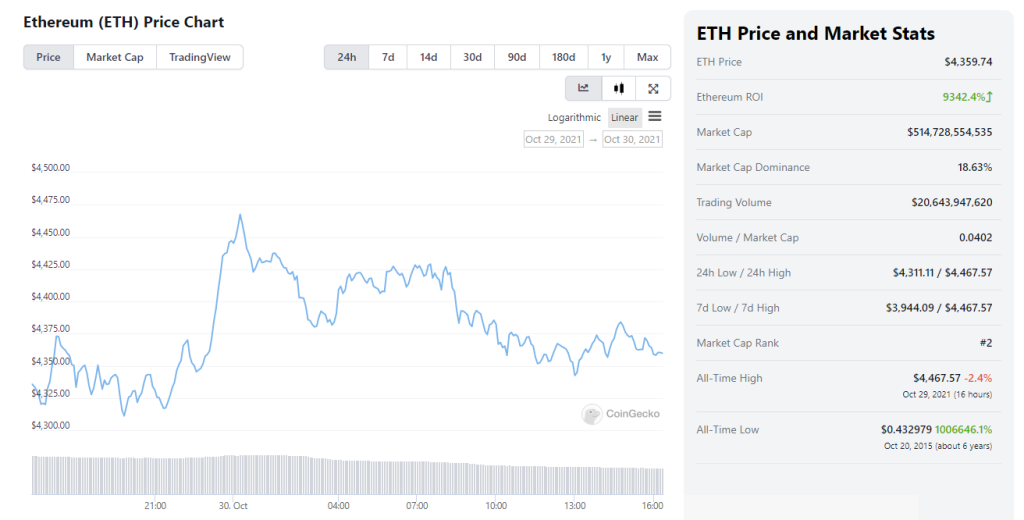

In 2021, Ethereum enjoyed a tremendous run up in its coin price as it hit a high of over $500 billion in market cap at the time of the writing.

As an open source project, the Ethereum Foundation has shared some key financial data of how the cryptocurrency has performed in the third quarter of 2021. Here are some highlights when compared to one year ago.

Revenue and transaction volume

Compared to a year ago, the network revenue of Ethereum grew to over $1.96 billion, a 511% year on year increase.

As Ethereum introduced more staking avenues, the total Ethereum staked grew to over 7.5 million Ethereum staked.

Since its introduction of the EIP 1559 burning mechanism, a total of over $.13 billion in Ethereum has been burned and removed from supply.

Decentralized finance had also been growing on the back of the adoption of the Ethereum blockchain. The DeFi TVL on the Ethereum network has grown 1242% from just $9.23 billion to over $123.9 billion in one year.

Metrics across the board for Ethereum has been largely positive, showing that the main decentralized finance blockchain continues to grow despite problems and challenges associated with the high transaction fees on its blockchain.

Notably, this year Ethereum also saw a huge growth catalyzed by the popularity of NFT platform OpenSea. Sales of OpenSea was at $4.7 million in the third quarter of last year, but exploded to $6.7 billion this quarter, an increase of 141847%.

Ethereum is now powering thousands of decentralized finance applications, and has definitely proved that it is more than just a speculative cryptocurrency.

Source: BlockWorks

Also Read: An Introduction To Ethereum Layer 2 Scaling Solutions

Editor’s Note: Chain Debrief provides the latest industry news and on chain analysis for major cryptocurrencies in the world. We are looking for contributors and team members to join us. Do write in to admin@chaindebrief.com to find out more.