The Ethereum Shanghai upgrade is set to take place in March 2023, allowing users to withdraw their staked ETH from the beacon chain for the first time since they staked in 2020. Regardless of how you plan to hold, trade or even buy ETH, this update will likely have some ramifications on the market demand for ETH.

What is the Ethereum Shanghai upgrade?

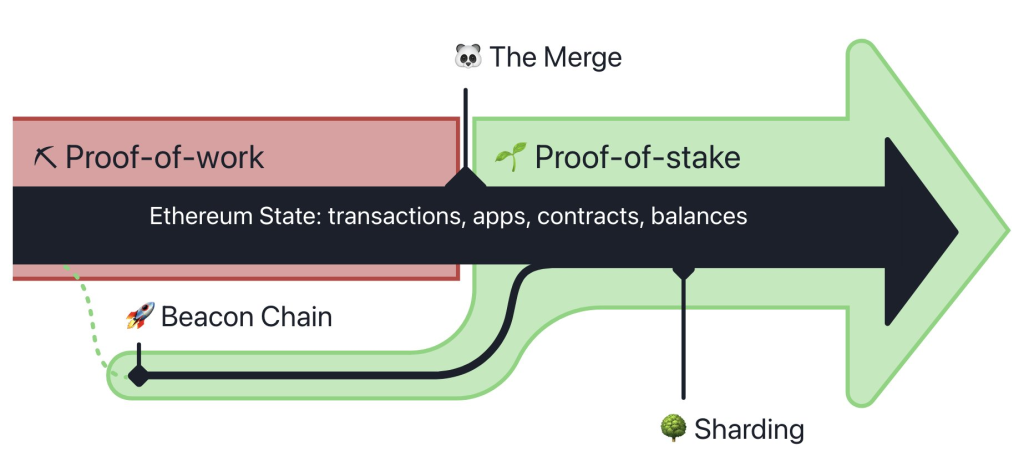

In September of 2022, Ethereum moved away from the energy-inefficient proof-of-work mechanism as the Beacon Chain took over the Ethereum block validation, completing ETH’s transition to Proof-of-Stake.

Since the Merge, which saw the Ethereum mainnet combine with the PoS Beacon Chain, users haven’t been able to remove their staked funds.

The Shanghai update (EIP-4895) resolves this issue and adds withdrawal functionality.

On January 5, 2023, Ethereum developers agreed to a March 2023 launch date for implementing the upgrade as a network hard fork. Users can test the update with a Shanghai-implemented public test network towards the end of February 2023.

How will the Ethereum Shanghai upgrade affect me?

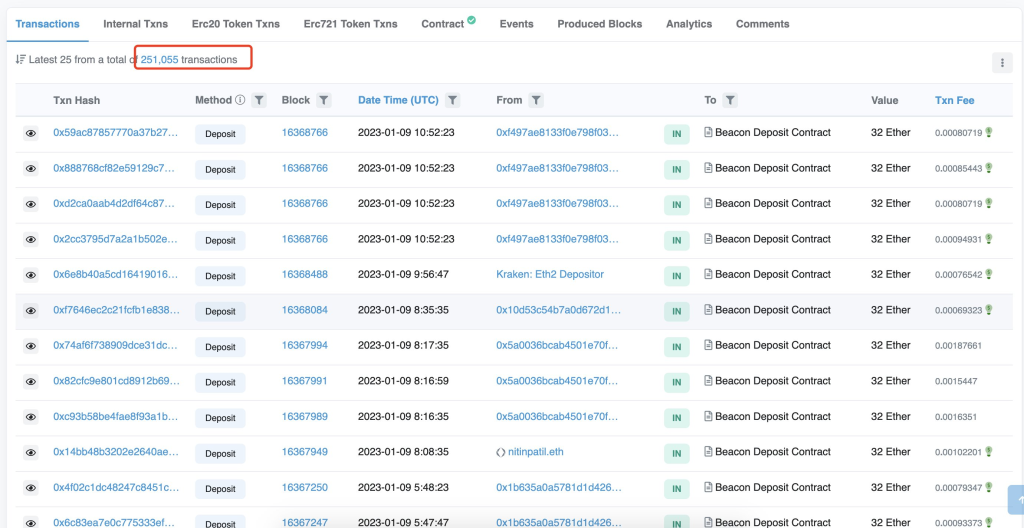

After the Shanghai upgrade, Ethereum validators grew to over 500,000. Now all these validators will soon be able to withdraw their earnings from staking, but what implications does that come with?

For one, we know a large number of ETH will re-enter the circulating supply, and the increase in supply will likely decrease the value of ETH.

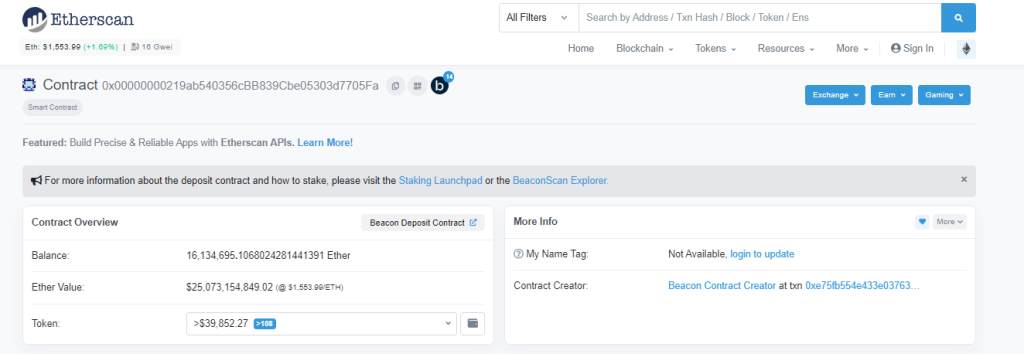

Currently, over 16M ETH is being staked, looking at the Beacon deposit contract, which amounts to over $25B at current-day prices of ETH being $1,555, being locked up.

Furthermore, the release of Metamask staking functions with ETH makes it easy for dummies to participate in the staking game without needing significant capital.

WEN STAKING?

— MetaMask 🦊💙 (@MetaMask) January 13, 2023

We are extremely happy to announce that you can now stake ETH with Lido or Rocket Pool through the Portfolio Dapp🎉

🔗https://t.co/HVLvcSDbw6 pic.twitter.com/9VkiU5jlsw

Lido and Rocket Pool let users stake less than 32 Ethereum to participate. In exchange for their deposits, they received liquid staking derivative tokens, called LSDs, which can be used to earn additional awards in DeFi.

This, the likely the reason for the LSD narrative to blow up. Read more on Liquid Staking Derivatives.

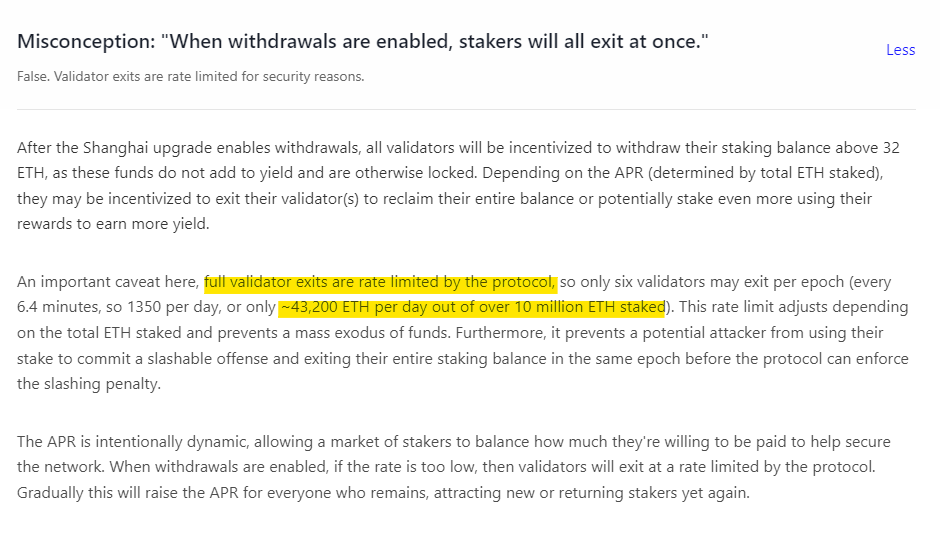

You might think that all these ETH entering the market at once will plummet the price of ETH, but that case is unlikely, especially when Ethereum is setting a cap on withdrawal limits.

Furthermore, Lokkonchain did an analysis of investors who deposited less than 5000 $ETH, and the average price they deposit ETH to the Beacon deposit contract is $2,260.

There are also limitations imposed on the number of validators entering or exiting the network, which depends on the current number of active validators. WestieCapital broke down how this works in the thread below.

3/ The exit queue is defined by a few variables:

— Westie 🟪 (@WestieCapital) January 12, 2023

– The full number of validators

– Minimum churn limit, set at 4

– Churn limit quotient, set at 2^16 (65,536)

What is next for Ethereum?

EIP-4844.

This will give birth to proto-danksharding. This Ethereum upgrade will reduce rollup fees by 10x-100x. This upgrade may unlock many new use cases in the scalability department and possibly leave Ethereum killers of their low-fees selling point invalid.

Don’t know what EIP-4844 is?

— rayzhu.eth🚯 (@rayzhueth) October 27, 2022

Here’s a simple explanation of EIP-4844 using public toilets🚽🧵 #L222

With the EIP-4844 opportunity on the horizon, roll-up activity can grow massively. Layer2 solutions like Arbitrum and Optimism are the ones to watch.

Eigenlayer.

This layer allows for a re-staking solution for ETH not only to be used to secure the Ethereum network but also other applications and services built on Ethereum. This is a win-win: ETH stakers get extra yield while infrastructure gets better and cheaper security.

This might be one of the next big things.

— olimpio (@OlimpioCrypto) January 2, 2023

New platform @EigenLayer, a "re-staking" solution.

No discord. No airdrop announcement. No token details. Not a lot, yet. Real alpha, hidden in Coinbase's 2023 Report.

🧵 What is Eigen and how it might revolutionize Ethereum: pic.twitter.com/4X5narCMKM

Also Read: What Is EigenLayer And How It Might Revolutionize Ethereum

Zero-knowledge EVM.

Imagine a virtual machine being powered by zero knowledge. If any, this could be the latest and baddest innovation on Ethereum this year. They will be dubbed the “Holy grail of Ethereum Scaling”. Opportunities like $MATIC, Scroll ZK and ZKSYNC are a few to watch, participate in their airdrops, and discords to get airdrops in the future potentially.

ZK-EVM:

— Jack Niewold 🫡 (@JackNiewold) July 22, 2022

A flurry of ecosystems have recently announced zero-knowledge, EVM-comptabile rollups.

I know, it's a mouthful.

So what do ZK-rollups mean for Ethereum? What does they mean for you as a user? And how could this tech transform crypto?

Today, we take a look:

Also Read: Key Takeaways From Messari’s Top 10 DeFi Trends In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief