Frax Finance is a protocol that creates a partially backed algorithmic stablecoin. It was the first of its kind to release such a structure of stablecoin, as stablecoins are usually issued via a central entity that backs it with real assets, over-collaterization, or Seigniorage style.

With the numerous failures of Seigniorage-type stablecoin protocols (ESD, Basis cash), it became apparent that this structure of stablecoin is insufficient as there is no float to back the stablecoin when it experiences a market downturn.

Also Read: The Stablecoin War: What Makes Them Different And Who’s Winning?

The design of Frax Finance was inspired by the Automated Market Maker (AMM) model where the ratio of asset X and asset Y have to be in a constant product.

The reason for a partially backed algorithmic stable coin is to solve the issue of capital efficiency and stability of the stablecoin.

Like the Seigniorage stablecoin, Frax Finance makes use of a two token model to maintain the peg of the stablecoin.

Frax (FRAX)

FRAX is the stablecoin with an elastic supply which is partially collateralised with USDC and algorithmically stabilised by Frax Share (FXS).

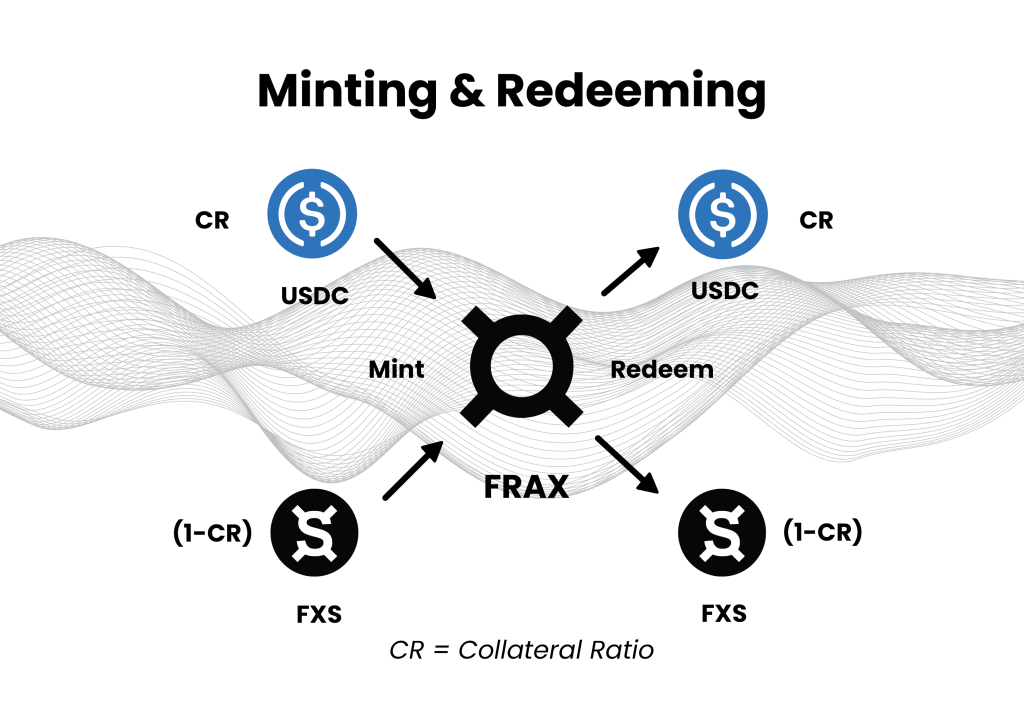

The collateralised ratio (CR) of USDC to FXS is adjusted according to the market demand of FRAX. This means that for a CR of 80%, a US$1 of FRAX can be minted with $0.80 USDC placed with Frax Finance and $0.20 FXS burned.

The redemption process is where US$1 FRAX will be taken out of circulation but $0.80 USDC and $0.20 newly minted FXS will be given back to the user.

FRAX is able to maintain its peg through this process of expansion and contraction of the supply of the FRAX token.

Contraction:

If the price of FRAX falls < US$1, arbitrageurs will market buy FRAX and redeem the FRAX for USDC and newly minted FXS according to the CR.

This in turn reduces the supply of FRAX on the market. Moreover, the protocol will increase the CR which in turn increases the amount of FRAX backed by USDC.

Expansion:

If the price of FRAX increases > $1, arbitrageurs will mint FRAX with USDC and FXS according to the CR and market sell the FRAX. This in turn increases the supply of FRAX on the market.

Moreover, the protocol will decrease the CR which in turn decreases the amount of FRAX backed by USDC as the market demand more FRAX.

This simple concept allows the protocol to ask the market "just how much supply of money are you ok with being unbacked?" The market responds collectively through the price of $FRAX. It's essentially a democratic way of voting for the capital requirement of the Fed/banks.

— Sam Kazemian (¤, ¤) (@samkazemian) April 8, 2021

Frax Share (FXS)

FXS is the governance and utility token that is also used for the algorithmic stabilizing of FRAX price peg. FXS undertakes the volatility of the stablecoin FRAX which can be a double-edge sword.

As demand increases for FRAX, more FXS will be burnt than minted which results in FXS supply being deflationary.

However, the opposite can also happen where demand for FRAX decreases and more FXS will be minted resulting in FXS supply being inflationary.

veFXS

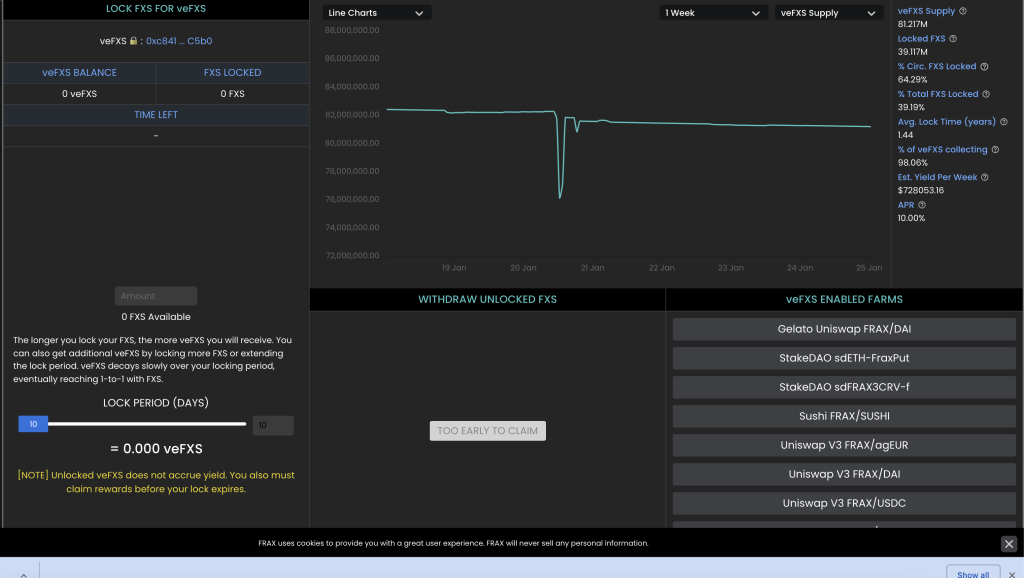

Frax Finance also introduced the vesting and yield system which is based on the Curve Finance veCRV mechanism. Users are able to lock up their FXS for veFXS which is a non-transferable token and signifies a person’s stake in the protocol and how long they are vested in it.

veFXS is used for the voting in the governance proposals and for the farming boost similar to the Curve structure. To ensure that users stay vested and interested in the protocol, the veFXS balance will linearly decrease as it approaches the lock expiry date.

Hence, users are forced to extend their lock time or be diluted in the decision making of the governance or for the farming boost.

What is the stabilizing mechanism behind FRAX?

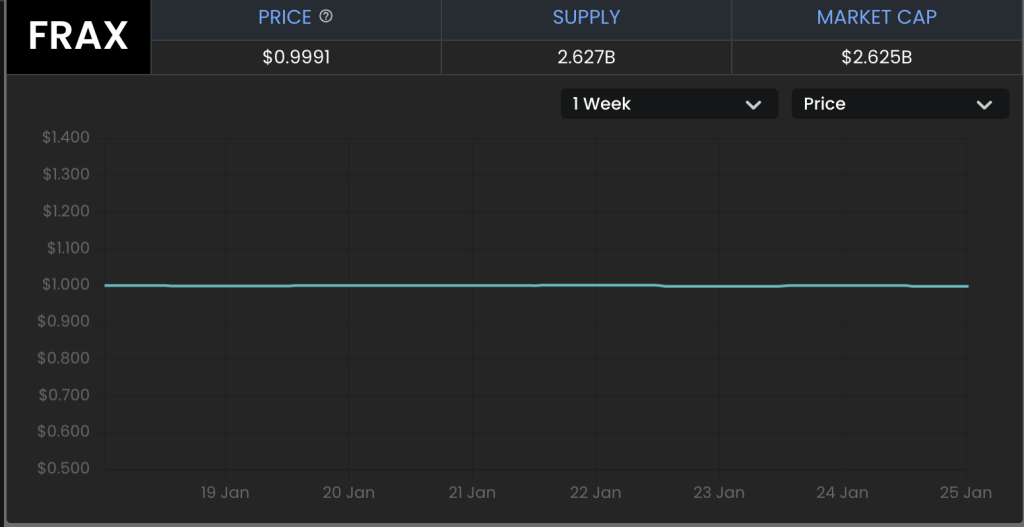

FRAX has maintained its peg throughout its inception and has entrenched itself as one of the most reliable stablecoin in the market as it has been battle tested in the various market crashes.

The CR is controlled by a PID controller that takes into account the FXS’s growth ratio. FRAX maintained its tight peg through the control of CR and algorithmic market operations that the protocol performs.

Growth ratio

Growth ratio is an essential metric that measures the amount of FXS liquidity to the overall FRAX supply. This metric allows the protocol to understand if it has the required FXS liquidity to handle FRAX redeems/ FXS dump without having any negative feedback loops on the protocol.

An example (taken from Frax Finance whitepaper) of how important the growth ratio is if there is $5 million worth of FXS liquidity in the AMMs with 50 million outstanding FRAX. The effect of people redeeming their FRAX and selling their FXS will not be as detrimental as the same amount of FXS liquidity and 500 million outstanding FRAX.

Thus, the growth ratio ensures that the FXS price will not collapse and low price slippage on FXS liquidity pairs.

Yield farming opportunities

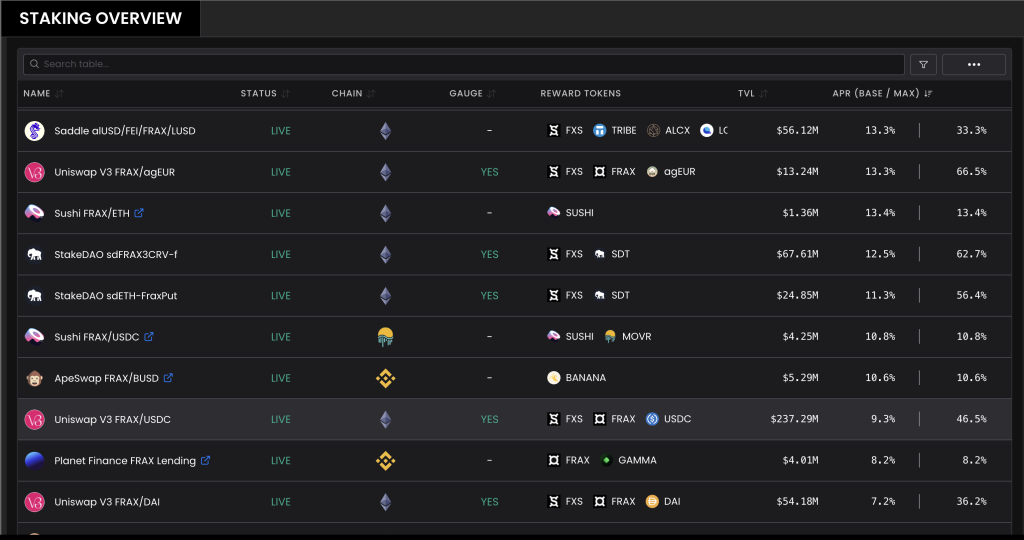

There are many Liquidity pools available for FRAX pairing and some offering high APR with Uniswap V3 FRAX/USDC offering 9.9% for the base APR and 46.5% for the maximum yield achievable. (which can be achieved by locking the Liquidity pool token and the required amount of veFXS for the maximum period)

For a stablecoin liquidity pool, 40+% APR is an insane amount considering that it is pretty much safe and impermanent loss free. (aside from smart contract exploit or anyone of the coin depegging)

As it might not make sense for someone with a small amount of FXS to lock up their FXS for four years and yield farm.

Convex is creating a Frax Finance vote escrowed (ve) flywheel just like how Convex is dominating the Curve market share and will be interesting to see how much of an impact will Convex bring to the Frax ecosystem. Thus, it allows efficient yield farming especially for smaller players.

Value accrual for FXS holders

Frax Finance have various strategies that generate income which is used to accrue value to FXS holders through buybacks and burning of the token. These strategies include buybacks & Recollateralization and Algorithmic market operations (AMO).

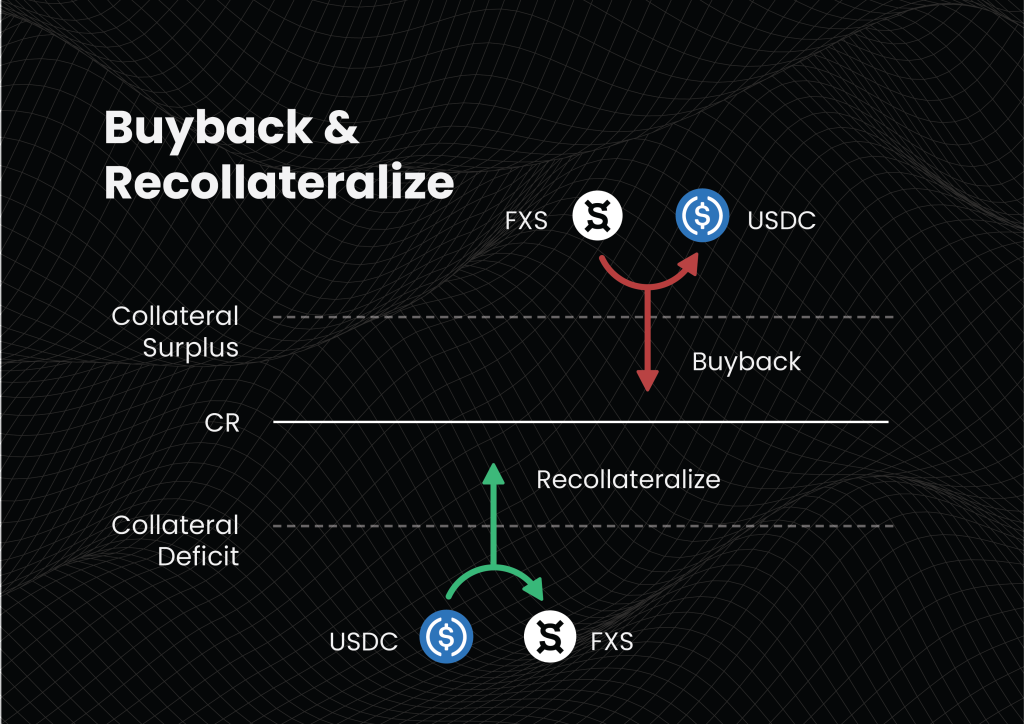

Buybacks and recollateralization

As the CR varies, there might be situations where the protocol is undercollateralized or overcollateralized. Thus, Frax Finance introduces the buyback & recollateralization to incentive users to bring the protocol back to equilibrium.

Buyback: This function checks if the protocol is overcollateralized and will use the excess collateral to market buy FXS and burn it. This accrues value to all FXS holders.

Recollateralization: This function checks if the protocol is undercollateralized and will allow users to add collateral to bring the protocol back to its equilibrium CR. The user will be given newly minted FXS at a discount rate of 0.20% in exchange for the collateral added.

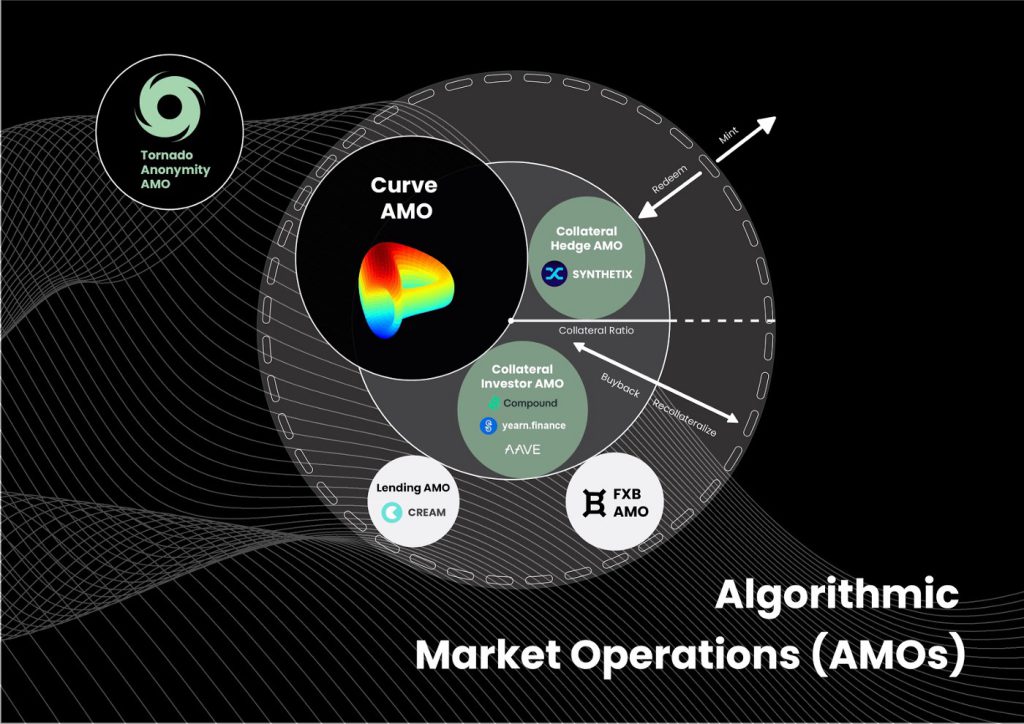

Algorithmic market operations controllers (AMO)

An AMO controller is a contract that enacts monetary operations and is bound by a tight constraint where it could not adjust the CR or FRAX price. There are many different AMOs and each has different purposes but all apply the FXS1559 mechanism.

The FXS1559 calculates the excess value in the system and uses it for the buyback of FXS. AMO controllers operate a modular design that optimizes the capital efficiency of the protocol and upgrades without compromising the protocol base layer.

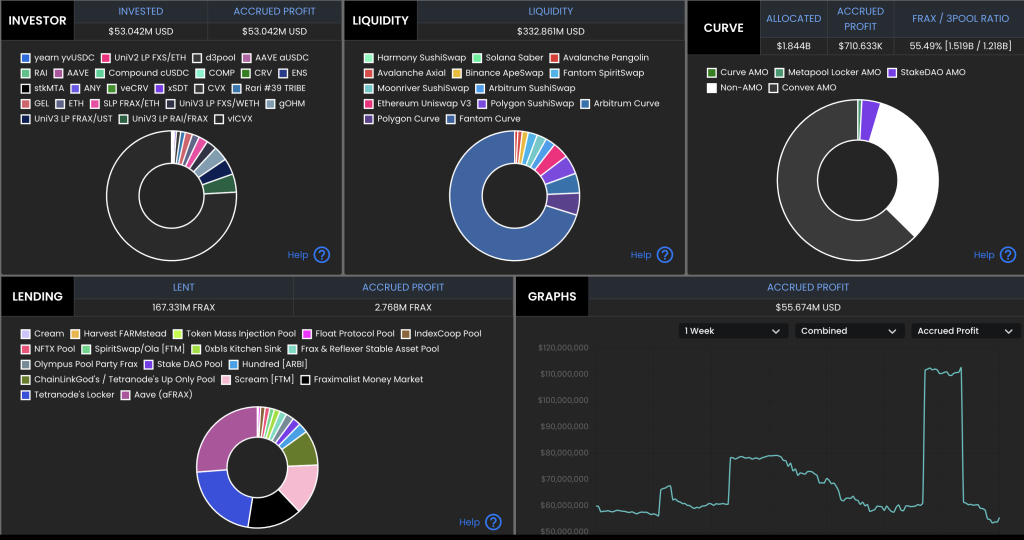

Most importantly, AMO controllers accrual value to FXS holders by maximizing the protocol revenue and innovation. Some notable AMO are the collateral investor, FRAX lending and Curve.

Collateral investor AMO

This strategy invests the idle USDC collateral to selected DeFI protocols that provide stable and reliable yield which increases the overall capital efficiency of the protocol.

The returns earned from this strategy is used for the buyback and burning of FXS which accruals value to FXS holders.

FRAX lending AMO

This strategy allows the minting of FRAX into the money market (Compound, Aave) where users are able to borrow FRAX instead of minting it conventionally. As the loan will be overcollateralized, it will not affect the CR.

The interest earned from the loan will be used for the buybacks of FXS. Most importantly, this AMO controller is able to increase or lower the interest rate making it more/ less attractive for users to borrow. Thus, this AMO controller is essentially like the Feds controlling the interest rate.

Curve AMO

This strategy uses the idle USDC collateral and FRAX (that the protocol is able to mint without changing the CR) to deposit inside Curve Finance liquidity pool increasing liquidity and reducing slippages.

Thus, Frax Finance is able to earn the trading fees from the pool and also reduces slippages which are plus points for the protocol.

Conclusion

Overall, the Frax Protocol is an innovative design and it is basically what centralised stablecoin should be looking into. As Frax is built on the blockchain and its investments/ strategies are all on-chain and available for anyone to cross check unlike its centralised stablecoin counterpart (USDC, USDT) where there is a constant doubt on if the tokens are truly 1:1 backed by an asset.

However, an issue that Frax has to solve eventually is the reliance on USDC for its collateral as it moves towards decentralisation.

Algorithmic stablecoin protocols are still an experimental product. However, Frax might be the success story for the Algorithmic stablecoin as it has proven itself in the various market crashes. Currently, FRAX aims to be the first CPI based algorithmic Index which can provide a reference point for Dapps.

This is an interesting development for the Crypto space, imagine a token that hedges against the current CPI reducing web3 economy reliance on the USD. Moreover, the FPI token is will be airdropped to veFXS holders and snapshot will be taken on the 20th Feb 2022 and will be an interesting catalyst for the protocol.

I agree with Vitalik on this 100%. Which is exactly why we're working to make the Frax Price Index the first CPI based algostable which can provide a CPI peg that onchain dapps can reference 🙂 $FPI https://t.co/5gr7kPaLpL

— Sam Kazemian (¤, ¤) (@samkazemian) January 1, 2022

Also Read: $MIM: Is Abracadabra’s Magic Internet Money Stablecoin Actually Sustainable?