Like many successful traders, Sharvin started off young.

So young, in fact, that he sought permission from his parents to use their brokerage account – and eventually found himself focusing on commodities and pharmaceutical stocks.

With the latter being known for its inherent volatility and immense amount of due diligence required when investing, it’s no wonder that Sharvin naturally found himself in the world of Web3.0. However, the lack of use cases and fundamentals in crypto fueled the skeptic in him.

“I hated the space back then, shorting everything in 2018 …. I even deposited more to cover my shorts when the markets moved “

Despite his initial doubts, one thing eventually convinced him to go all in on Web3 – Ethereum and its smart contract capabilities. “Before that, everyone viewed Layer 1s as currencies which made zero sense. Eventually some people started making legitimate use-cases on Ethereum”

While Sharvin still believed that “most of crypto was scammy in nature”, his thoughtfulness and meticulous personality eventually landed him a role as Chief of Staff at Saison Capital, the VC arm of Japanese financial Services company Credit Saison all at the tender age of 21 in June last year.

Apart from sourcing deals, Sharvin’s responsibilities at Saison include ensuring research is of the highest caliber to make fund and strategic decisions for the firm.

In just 24 hours since mainnet launch, Thala has already become the largest native protocol on @Aptos_Network with $12M in TVL and $3M trading volume!

— Thala (@ThalaLabs) April 7, 2023

Come earn $THL at https://t.co/K3wm16BtmY pic.twitter.com/Qa6T6qszCy

High throughput Monolithic blockchains with Modular Architecture are the future

Although Sharvin was red-pilled by Ethereum, it wasn’t long before he realized that a blockchain with 30 Transactions Per Second would struggle to reach mass adoption.

He believes that people play around with the words monolithic and modular too much and they don’t realize that a chain’s architecture can be modular too.

“I set out to find other chains which were faster… I wasn’t asking for too much in my opinion like who pays USD 80 for gas fees in bear markets for a very slow performance. If we wanna push for mass adoption, this will never work out. For example, the average monthly salary in Turkey is apparently USD 420. Would anybody be able to pay 19% or so of their monthly salary for gas?”

He initially set his sights on Avalanche and Polkadot, but decided to go “all in” on solana, citing its fast transaction times and high throughput. These metrics allowed cutting edge projects like serum to be deployed on the blockchain.

After all, which network could say that “This dapp can only function on our chain?”

Even with all the upgrades coming to Ethereum in the next few years, the young visionary already set his sights on it’s alternatives, eventually expanding his interest to include Aptos, Celestia, and BSC, apart from the aforementioned few.

“In the 1990s, dial up [internet speeds] was 56kbps, which was adequate back then. Bitcoin does 1mbps every 10 mins or so, and Ethereum/ EVM realistically for a normal validator did 3-4mpbs or so” says Sharvin. “Even if we increase the output of Ethereum, it doesn’t scale a lot with multicore performance, and it’s TPS and TTF is not going to be compatible with mass adoption since it wont be able to handle even hundred of thousands of transactions let alone millions as I believe the number is somewhere around 800 overall so it is also hard to see ZK rollups take off in terms of PMF”

In comparison, blockchains like Aptos, Sui, and possibly Solana in the future, leverage the MOVE programming language, and can scale linearly by adding more computational power.

During one test, developers on Aptos minted millions of NFTs within an hour through a 4-step process.

For Web3 to grow and build mainstream trust, there is an urgent need for verifiable, real-world benchmarks.

— Aptos (@Aptos_Network) April 28, 2023

A solution: Aptos has put forth the first fully-reproducible performance benchmark test.

Learn more and join the industry-wide conversation to establish consensus 👇🧵 pic.twitter.com/VNxde0Es0q

Furthermore, the barrier to entry for being a validator on alternative Layer 1s is much lower than that of Ethereum.

According to Aptos’s documentation, a non-optimized validator running on a Macbook Pro can execute and commit 120,000 TPS, a far cry from the 32 $ETH minimum to run a node on Ethereum.

“High throughput chains are able to take advantage of the leaps in multi-core performance”

Sharvin also identifies the ability for the blockchain to disrupt traditional technology solutions – such as data storage and clearing houses in multiple industries in Finance and Telecom to name a few.

Advantages pic.twitter.com/YUZwWTMNqL

— Celestia (@CelestiaOrg) February 14, 2023

Applications built on top of Celestia Network, for example, could potentially provide a seamless alternative to current cloud storage at a third of the cost.

Why MEV is Necessary For DeFi’s Evolution

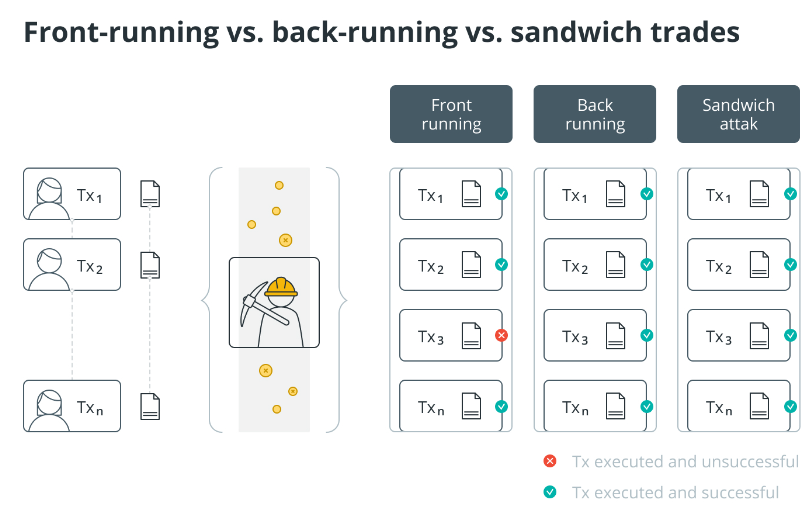

An aspect of crypto not getting nearly enough attention is MEV, more commonly known as Miner-Extractable Value. For those unfamiliar with the topic, Sharvin breaks it down in the following way:

“Economic value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block.”

For most crypto users, MEV actions are often seen as predatory, due to the their ability to front-run transactions. In one unfortunate instance, an MEV bot was able to siphon 2 million USDC from a trade on decentralized exchange Kyberswap.

However, MEV, or as Sharvin terms it, VEV (Validator-Extractable Value), presents novel use cases that are undermined by the negative press it releases.

“I’m against malicious MEV, it just disrupts everyone’s life for no reason. But these are mostly problems that Ethereum faces due to core architectural designs on wallets there as one of the factors too.”

Instead, focus should shift to “benign MEV”, that could make on-chain capital markets “more efficient.” With most blockchains, including Ethereum, now achieving consensus through reputation-based Proof-of-Stake mechanisms, stakers could also vote out validators performing malicious MEV.

Rather than siphoning value away, Sharvin believes that MEV could instead add value to communities through additional revenue streams or the funding of social goods.

Sharvin’s Advice For Crypto Investors

This past year has been home to some of the most tragic events, and not just for crypto. With even some of the most reputable banks failing, Sharvin advises to “always spread your baskets”, noting that he was lucky when it came to the collapse of 3AC and Luna, but was slightly impacted by FTX on a personal level, but not on a fund level.

Thankfully, he was quick to spot multiple arbitrage opportunities during the collapse of Luna, and carried them out “non-stop, thanks to a few savvy trader friends.”

Despite the catastrophes that befell Web3, Sharvin is optimistic when it comes to crypto’s future – especially with institutional adoption taking a step up. “Every chain has tried the B2C routes, but the numbers have not worked out. It is best to approach a B2B2C route as that route has worked well for new technologies that have mass adoption.”

The rise in on-chain trading protocols, risk markets, and capital efficiency through MEV also has strong potential to onboard some of the biggest funds in the world, previously kept out due to the differences between traditional finance and DeFi’s structured products.

Additionally, he suspects that layoffs happening in the current market downturn could be a blessing in disguise for crypto as a whole.

“During the bear market, a lot of talented people get fired. That’s when you try to find and back them + valuations sort of are low and affordable for the best founders/ teams without high numbers found in the bull market.”

But uncovering these diamonds in the rough – that’s where it gets challenging and fun!

For example, the recent Aptos Seoul Hack 2023 was a great opportunity to network and discover some exciting hidden gems as well. “More than 30% of on-chain TVL comes from Korea. They’re really involved in defi or “on-chain finance” as some call it.”

Seoul, that's a wrap!

— Aptos (@Aptos_Network) February 5, 2023

Thank you to the rockstar hackers who made the first stop on the #AptosWorldTour such a success.

We're blown away by the talent, ideas, and potential on Aptos.

This is where culture 🤝 building.

Where to next? Stay tuned. pic.twitter.com/2v1HRC2Vqy

Likely the best way to highlight this was a partnership with SK Networks, a subsidiary of one of the largest Web2 companies in South Korea, for the hackathon.

Not only did this showcase the popularity of crypto in the region, but also the potential for a major B2B2C partnership that leverages blockchain technology and quite a decent size of early engineers from the biggest companies there coming in and hacking at the Aptos hackerhouse.

Aside from his insights on how to protect your portfolio and where the best opportunities lay, Sharvin also gives tips on major red flags for Web3 projects:

1. Companies or chains that try to acquire random companies with the buzzwords at cheap prices when their core team may not be competent with the technology.

2. Vague “partnership” posts on social media.

3. Check out the top 100 wallets in the ecosystem to assess whether top wallets are not ponzi wallets as is the case on some well advertised ecosystems.

4. Avoid high reorganization rate chains as those may be unstable due to various technical reasons.

On a final note, he emphasizes the need for users to understand what they’re investing in. “There is a difference between Chains that are secured by ETH and Side chains that just do not have any reliance on security of ETH. People should do homework on that for the sake of their own safety and financial security.”

Also Read: We Asked 5 Industry Leaders For Their 2023 Market Outlook

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief