The collapse of FTX was one of the most unfortunate events of 2022, and its ripple effects are still being felt across the crypto industry today.

FTX, which was once valued at $32 billion and ranked as one of the largest crypto exchanges by trading volume, declared bankruptcy in November due to a massive increase in customer withdrawals.

Interestingly, FTX may potentially resume its services to customers. This possibility has been brought to light during the 12th bankruptcy hearing where relaunching the exchange was disclosed as one of several options being explored by FTX as a way to move forward.

In this article, we’ll go over the most recent developments on the FTX collapse, such as its relaunch plan, liquid assets recovery, and so on.

Also Read: Received The FTX “Scheduled Claims Information” Email? Here’s What You Should Do

FTX’s Plans for a Relaunch

Following an update to its 2023-24 roadmap, FTX may soon revive its operations. According to the statement by the firm’s lead attorney Andy Dietderich, FTX is actively pursuing a relaunch, with the company considering the possibility of restarting the exchange as soon as the second quarter of 2023.

BREAKING‼️ FTX lawyers considering a relaunch of the failed cryptocurrency exchange – Bloomberg pic.twitter.com/4LyPFRBqZ0

— Radar🚨 (@RadarHits) April 12, 2023

The story making the rounds is that the new FTX management are turning things around with their fresh roadmap, and they may even consider giving a stake in the company to customers who lost money due to the initial collapse.

However, they would have to assess whether relaunching the exchange would benefit FTX customers and creditors.

With the matter of the FTX collapse still in a Delaware bankruptcy court, there are many questions about how the proposed relaunch would work.

Specifically, the presiding judge of the bankruptcy proceedings, Judge John Dorsey, asked if FTX users would be able to withdraw their funds.

While the firm could not give a clear-cut answer to this question, it did reveal that the relaunch plan would entail significant capital raising.

According to the firm’s attorney, it is not clear where the required capital will come from; whether from the estate or third parties.

That said, FTX is considering introducing a form of interest to former users of the exchange. One of the things being considered is giving ‘options’ as some sort of interest to former customers of the company.

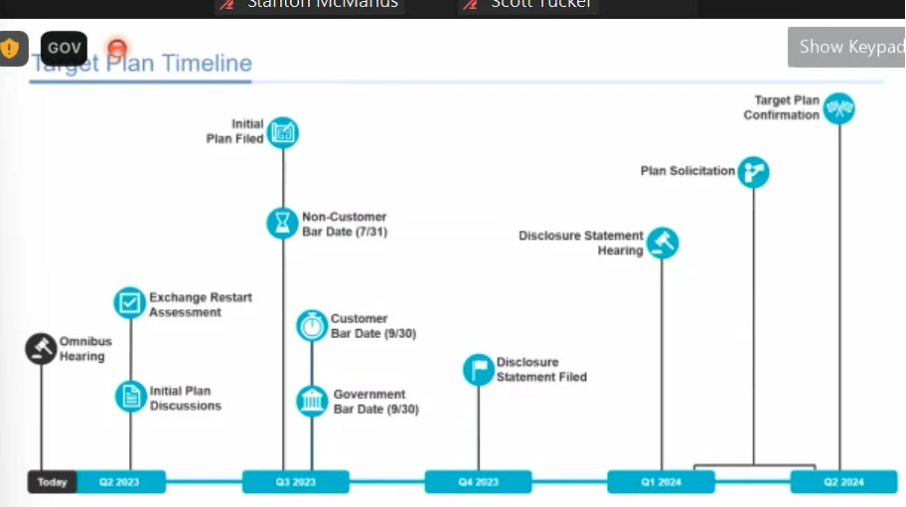

Going by the target plan timeline, FTX intends to file its initial relaunching plan by the third quarter of 2023.

While there is no specific bar date for customer claims, attorneys believe that the court case would move rapidly enough for the judge to set the bar date for non-customers by July 2023 and for customers by September 2023.

Assuming all things go according to plan and projection, the roadmap shows that FTX expects to have its relaunch plan confirmed in the second quarter of 2024.

FTX Recovers $7.3 Billion in Liquid Assets

During the 12th bankruptcy hearing on April 12, Andy Dietderich, FTX’s lead attorney, quickly pointed out that the company’s new management had done a lot to set the exchange back on the right track.

“The situation at FTX has stabilized, and the dumpster fire is out” he said.

One of the ways the new management has been able to achieve this stability is through its recovery efforts, primarily involving the conversion of FTX property into liquid assets. At the recent hearing, FTX attorneys said the firm has recovered $7.3 billion in liquid assets at the current valuation – a $1.9 billion increase since the January hearing.

JUST IN: Bankrupt FTX has recovered $7.3 billion in assets and is considering relaunching the exchange in Q2.

— Watcher.Guru (@WatcherGuru) April 12, 2023

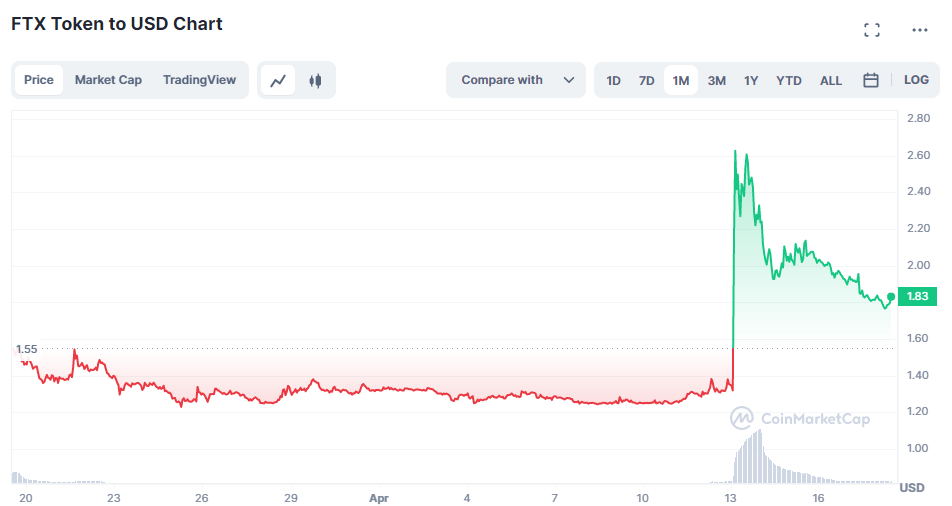

As a result of the recovery news, the price of FTT – FTX’s native token – experienced a bullish pull, gaining more than 100% in the wake of the news.

FTX could retrieve more funds by putting subsidiaries, like FTX Japan, on the market. Thanks to Japan’s strict protections for crypto users, FTX Japan was the only subsidiary that effectively ringfenced customers’ accounts from the parent company.

It is important to mention that FTX Japan has resumed operations, and users were able to withdraw all their assets from the exchange.

Ren Protocol Transfers Crypto Assets

According to a tweet by Ren Protocol on Wednesday, April 12th, the protocol has been directed to transfer all of its cryptocurrency assets to cold wallets controlled by FTX debtors for safeguarding, in advance of potential shutdowns of infrastructure and systems.

These crypto assets will be kept on distinct, segregated cold storage wallets different from wallets used for other debtors.

— Ren (@renprotocol) April 12, 2023

Ren protocol enabled users to transfer digital assets, such as Bitcoin (BTC), Ether (ETH), and Dogecoin (DOGE), across various blockchains.

Established in 2017, this platform became one of the most popular decentralized finance (DeFi) protocols in the 2021 DeFi explosion.

This protocol was acquired by Alameda Research – a sister company of FTX – in February 2022. But, in November 2022, Ren Protocol announced that it was affected by the FTX Group’s Chapter 11 proceedings and lacked the finances to survive beyond 2022.

Following this setback, Ren said that it would seek additional funding for the development and launch of ‘Ren 2.0’, which would be completely independent of FTX or any ties to the company.

A fast tracked vote has been launched to fund the launch of a legal entity for the #RENdao foundation.

— cowboy (@cowboy_oh_gee) January 18, 2023

Links below 🧵$ren #renvm #dao #DAOVERSE #DAOs #DAOLabs #DAOLabs pic.twitter.com/WPNt8wR5qp

There hasn’t been any public communication about the Ren 2.0 development in a long time. The last time such news was made public was in January, when Ren proposed a community governance vote to fund a new Ren Foundation to oversee the protocol’s future.

Final Thoughts

Plans to reopen FTX could be a blessing in disguise for crypto, especially for individuals and enterprises who lost money due to the exchange’s collapse.

It is possible for FTX to relaunch its operations and even become one of the leading crypto exchanges in the world – again. However, relaunching the exchange is just one part of the journey; gaining the trust of customers and investors is another.

To be able to instill confidence in its customers once again, FTX needs to provide clarity on how its operations will go on in the future.

The management – led by new CEO John Ray – must be ready to provide reassuring answers to every question that may arise due to the potential relaunch of the exchange.

Also Read: SOLAR (SXP) Gains 300% This Month – A Deep Dive Into The Sustainability-Focused Layer 1

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Opeyemi Sule and edited by Yusoff Kim