One of the top ways to earn passive income on your idle cryptocurrency is to supply them into liquidity pools and earn yields from these liquidity pools.

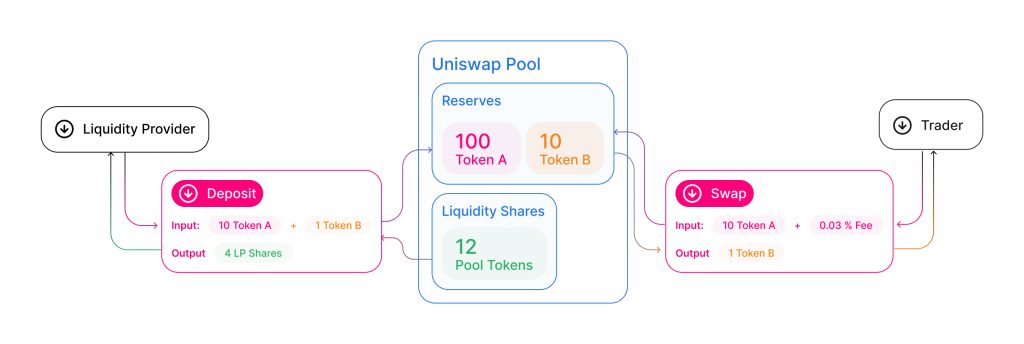

Here’s a simple illustration from Uniswap on how liquidity pool works:

As a liquidity pool provider, you will earn interest originating from the transaction fee generated whenever a trader or borrower executes a cryptocurrency trade.

Here’s a list of liquidity pool providers or yield farms where you can supply your cryptocurrency into on Solana, in order to generate returns on your digital assets.

| Pool Provider | Reward Tokens | Website |

| Raydium | RAY | https://raydium.io/ |

| Orca | ORCA | https://www.orca.so/ |

| Saber | SBR | https://app.saber.so/#/swap |

| Mercurial | MER | https://mercurial.finance/ |

| Synthetify | SNY | https://synthetify.io/ |

| Atrix | ATRX (Not released) | https://www.atrix.finance/ |

| Aldrin | RIN | https://aldrin.com/ |

A Yield Optimizer is an automated service that applies algorithmic strategies to obtain maximize yield.

| Yield Optimizer | Website |

| Francium | https://francium.io/app/invest/farm |

| Tulip | https://tulip.garden/vaults/ |

| Sunny | https://app.sunny.ag/ |

| Pole Finance | https://pole.finance/ |

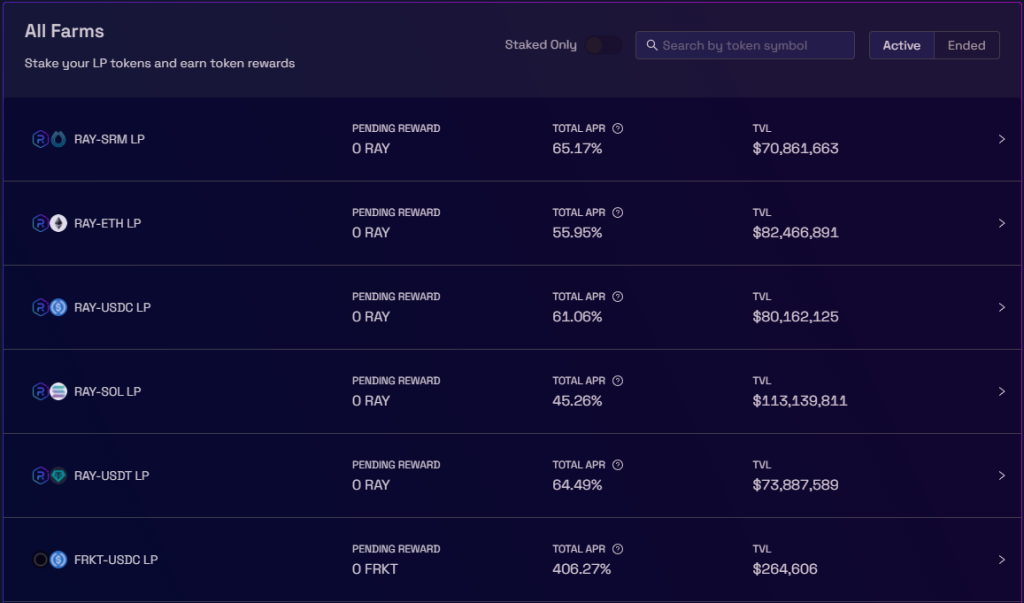

Here’s a look at the top three farms on the Solana ecosystem with the most Total Value Locked (TVL):

Raydium

Raydium is the first Automated Market Maker (AMM) on Solana with over US$1.7 billion in TVL and $US37 billion in trading volume.

It is by far the most established AMM on Solana and is leading by a large margin.

1) What is @RaydiumProtocol?

— SBF (@SBF_FTX) February 22, 2021

What makes it a step forward for DeFi?https://t.co/L8j6h2zm97 pic.twitter.com/I5YBzTPAIs

The issue with traditional AMMs is that users can only trade with the protocol’s native liquidity pool. For example, if someone is trading on Sushiswap for USDT/ETH, they can only trade on Sushiswap’s native liquidity. It cannot tap on other protocols liquidity like Uniswap’s pool.

Raydium is able to solve this issue as it leverages on a decentralised central limit order book. Essentially, this allows users on Raydium to tap onto the liquidity of other protocols supported by the ecosystem.

As a well established AMM with high TVL, Raydium’s farm is still able to produce attractive APR. Furthermore, together with Raydium’s native IDO platform, AcceleRaytor, it is able to offer Liquidity Provider (LP) farming rewards immediately after the IDO.

Participants in the IDO would be able to buy the asset during presale and stake it immediately to earn rewards.

Orca

Unlike conventional Decentralised Exchanges (DEXs), Orca is a human-centred DEX. It prides itself on being user-friendly through its simple yet informative interface.

To start, users would just have to deposit a liquidity pair on the Aquafarms. Liquidity providers would start earning a share of the trading fees and $ORCA.

Orca is currently backed by some of the biggest venture funds in crypto space from Polychain to Three Arrows Capital.

With so many high profile investors backing the project, Orca may take over Raydium to be the number one DEX on Solana in the near future.

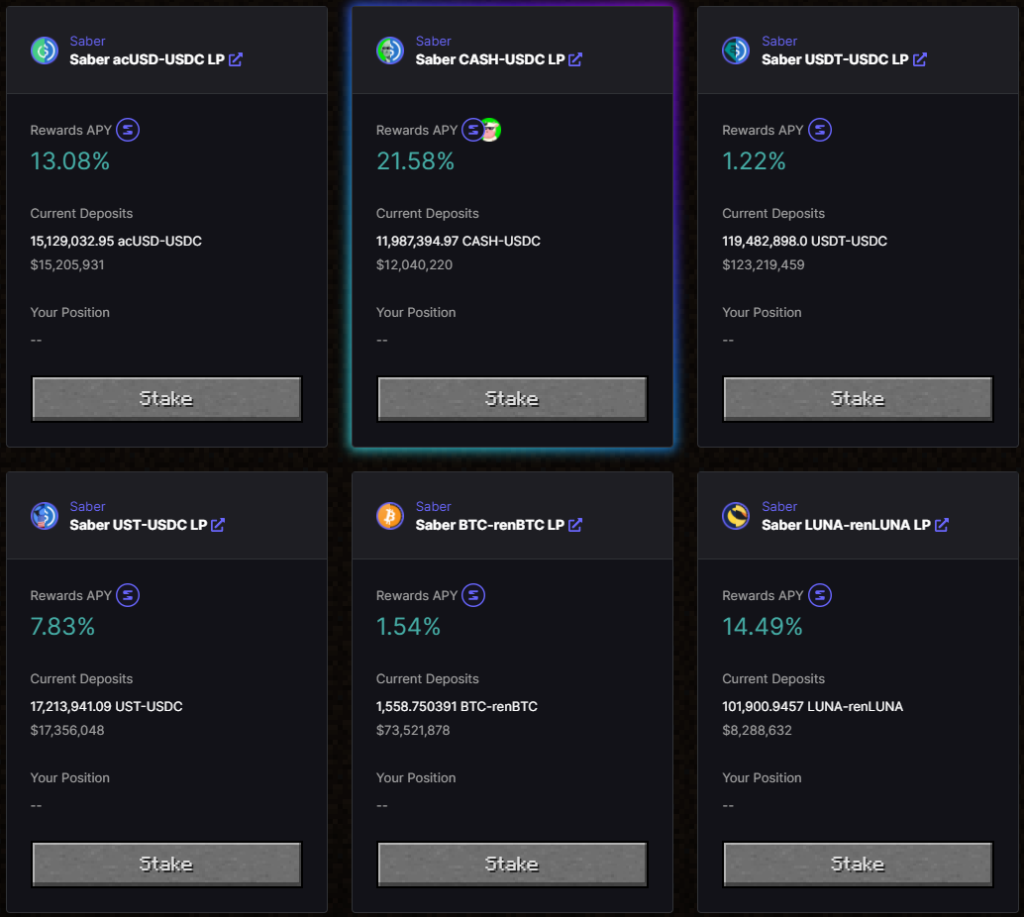

Saber

Saber started off as a low slippage AMM, StableSwap, and was revamped and transformed into Solana’s leading cross-chain AMM.

Its cross-chain liquidity network allows users to transfer assets between Solana and other blockchains.

At the time of writing, Saber Farm is offering attractive APYs considering both token pairs are stablecoins.

Currently, Saber is working with Solana’s lending protocol to enable Saber LP tokens to be used as collateral for lending. This positions Saber as one of the key players in the Solana ecosystem.

Conclusion

As there are new yield farms being created every day, please do your own research on the team’s background before committing a large amount of cryptocurrency to a new farm.

As a rule of thumb, signs of a good liquidity pool include:

- The longer the liquidity pool has been around for, the safer it is.

- The more total value locked in the farm, the safer it is.

- The more cryptocurrency pairs available for staking, the safer it is.

- High APYs (4 – 7 digits) generally mean the liquidity pool is relatively new and there are less stakers to split the pool rewards.

- The more users staking their cryptocurrency (total value locked), the safer it is.

- The more protocols built on top of the liquidity pool, the safer it is.

Featured Image Credit: BuyUCoin

Also Read: Here’s The Full List Of Yield Farms On The Cronos (Crypto.com) Network