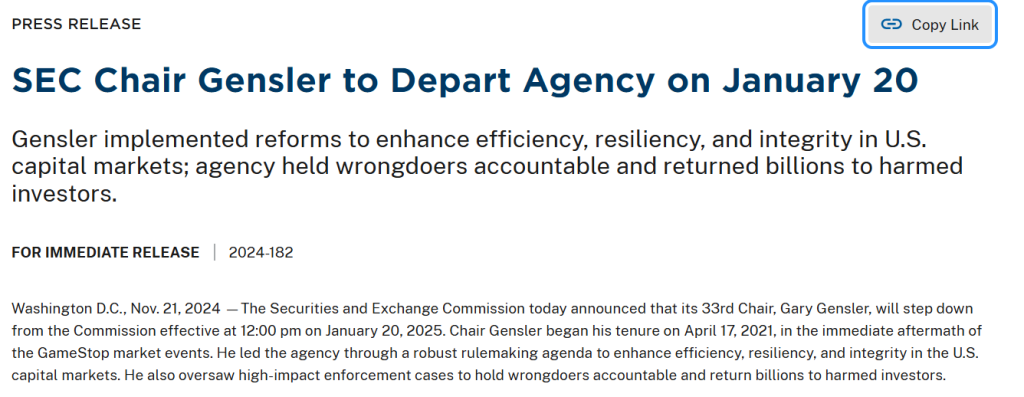

Gary Gensler, Chair of the Securities and Exchange Commission (SEC), has announced his resignation, effective January 20, 2025. The announcement coincides with the inauguration of Donald Trump as the 47th President of the United States.

On January 20, 2025 I will be stepping down as @SECGov Chair.

— Gary Gensler (@GaryGensler) November 21, 2024

A thread 🧵⬇️

In his statement on social media, Gensler described his tenure as “the honor of a lifetime” and reaffirmed his commitment to maintaining the integrity of U.S. capital markets. This decision has sparked significant reactions in financial markets, particularly within the crypto sector.

During his leadership, Gensler became known for his stringent regulatory approach, including aggressive actions against major crypto companies like Binance, Coinbase, and Ripple. This approach was often criticized for stifling innovation within the blockchain ecosystem.

Gensler’s resignation also marks the end of one of the most controversial periods in the SEC’s history, especially regarding cryptocurrency regulations. Many market participants hope that his successor will adopt a more balanced policy that encourages crypto adoption while ensuring adequate investor protection.

Related Ripple CEO Reacts to Gensler’s Resignation

XRP Jumps as Gensler’s Exit Sparks New Hope

Shortly after Gary Gensler announced his resignation, XRP experienced a sharp price increase of nearly 27.47%, reflecting growing market optimism. This sudden surge is seen as a direct reaction to Gensler’s departure, which many believe could lead to a more favorable regulatory environment for Ripple and other crypto projects.

Ripple CEO Brad Garlinghouse responded to the news with a playful yet telling post on social media. “This Thanksgiving, I’m thankful for…” he wrote, sharing Gensler’s resignation announcement. The comment, though brief, speaks volumes about the tensions between Ripple and the SEC under Gensler’s leadership.

This Thanksgiving, I'm thankful for… https://t.co/FHDPaRnRkU

— Brad Garlinghouse (@bgarlinghouse) November 21, 2024

The friction primarily stemmed from the SEC’s lawsuit against Ripple, which accused the company of selling XRP as an unregistered security. The legal battle has been a major obstacle for Ripple, creating uncertainty and hindering XRP’s growth. Garlinghouse’s reaction reflects the sense of relief within Ripple’s community, as many believe Gensler’s resignation could pave the way for a more balanced regulatory approach.

With Gensler stepping down, investors are hopeful that the SEC might soften its stance on XRP under new leadership. Garlinghouse’s post has only added to the growing speculation that Ripple could achieve a more favorable resolution to its ongoing legal challenges.

Bitcoin Celebrates Gensler’s Exit by Reaching $99,000

As Gary Gensler announced his resignation, Bitcoin made its own statement by surging to an all-time high of $99,000. This record-breaking milestone reflects the market’s optimism about the potential for a more supportive regulatory landscape under new SEC leadership.

The surge also highlights Bitcoin’s ongoing appeal as a store of value and a hedge against regulatory uncertainty. Earlier this year, the approval of Bitcoin spot ETFs laid the groundwork for increased institutional adoption, and Gensler’s exit appears to have amplified the bullish momentum.

Reaching $99,000 brings Bitcoin closer to the coveted $100,000 milestone, a goal long anticipated by the crypto community. This rally is seen as a symbolic victory, not just for Bitcoin, but for the broader industry, as it looks forward to a regulatory environment that supports innovation and growth.

Gensler’s Legacy and the Crypto Industry’s Criticism

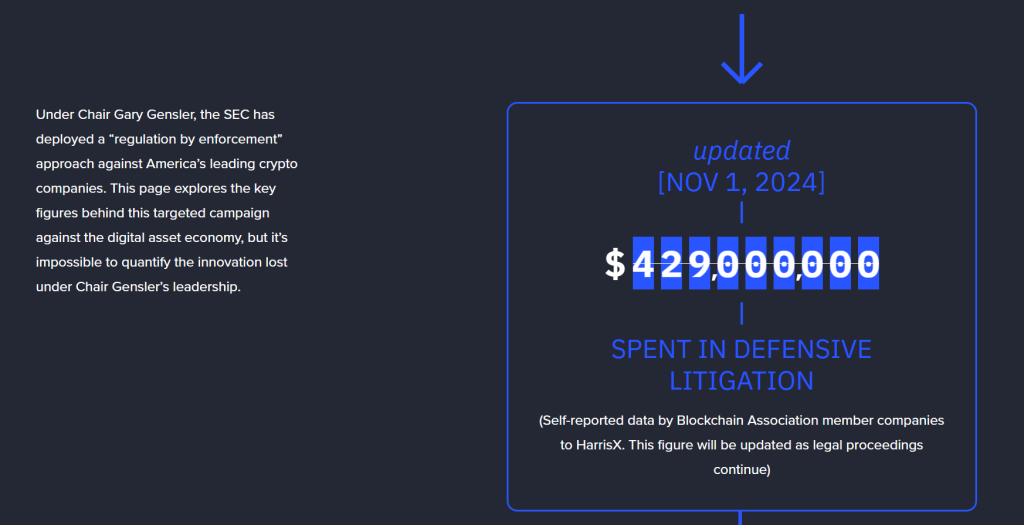

Gary Gensler’s time at the helm of the SEC was marked by an unprecedented focus on enforcement, with the agency targeting numerous crypto firms. This aggressive stance led to skyrocketing legal expenses across the industry, as companies sought to defend themselves against regulatory actions. By November 2024, the cumulative costs for defensive litigation had reached a staggering $429 million, underscoring the heavy toll of Gensler’s enforcement-heavy approach on the crypto ecosystem.

You can also read this Trump Pushes for New White House Crypto Role

Under Gensler’s leadership, the SEC initiated a record 104 enforcement actions against the crypto industry through 2023. These actions ranged from lawsuits against major players like Ripple, Binance, and Coinbase to smaller, lesser-known projects. The sheer number of cases highlights the SEC’s focus on enforcement over dialogue with the industry, a strategy that many believe hindered growth and innovation.

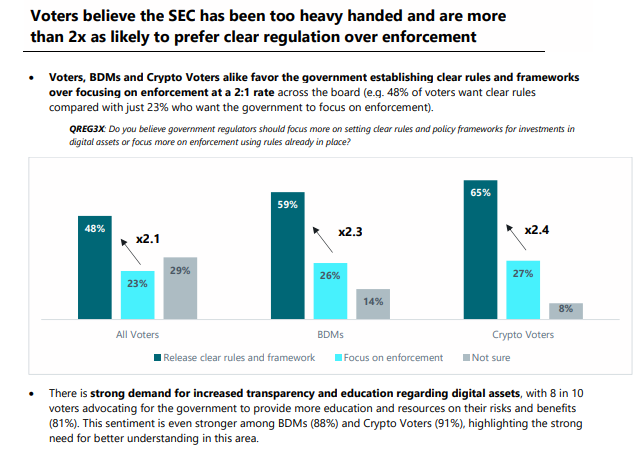

Survey results showcasing voter preferences on the SEC’s approach to regulating the digital asset industry | Source : blockchainassociation

Adding to the criticism, recent surveys show that 65% of crypto voters prefer a shift away from enforcement-driven regulation in favor of clearer rules and frameworks. This sentiment highlights the disconnect between Gensler’s policies and the industry’s needs. The data also reveals a strong demand for transparency and consistent guidelines, which are seen as essential for fostering growth and investor confidence in the blockchain sector.

With Gensler’s departure, the crypto community is hopeful for a more collaborative approach under new SEC leadership. Clearer regulations and reduced reliance on enforcement could create an environment where innovation thrives without sacrificing investor protection.

You can also read this Trump Pushes for New White House Crypto Role

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]