GMX is a decentralized spot and perpetual contract trading platform that supports low swap fees and zero price impact trades allowing users to leverage up to 30x on their trades.

The protocol first went live on Arbitrum in September 2021 before launching on Avalanche at the beginning of 2022.

Trading is supported via a unique multi-asset liquidity pool that generates rewards from market making, swap fees, leverage trading (spreads, funding fees & liquidations) and asset rebalancing which are channelled back to liquidity providers.

What’s with the hype?

Recently, there have been rumours of a potential airdrop for users on Arbitrum.

ARBITRUM ALPHA for $ARBI 🦅🔵@arbitrum recently published a series of on-chain quests.

— olimpio.lens ⚡️ (@OlimpioCrypto) August 27, 2022

I think this is currently the best chance of getting an $ARBI airdrop, besides the Odyssey, which is coming soon

A thread: how to prepare 🧵

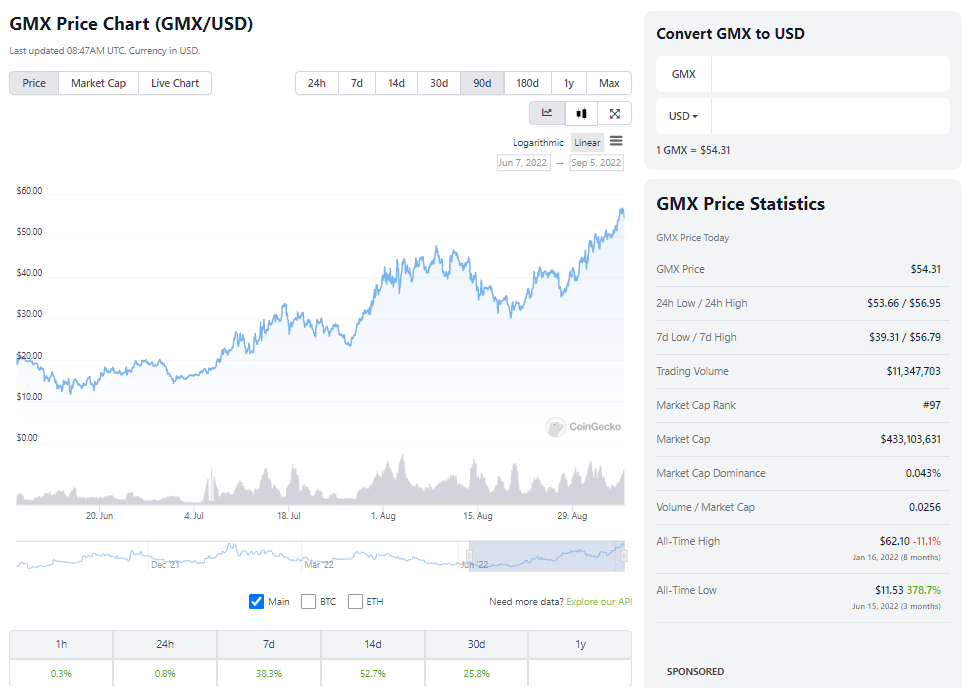

GMX, being the number 1 protocol in terms of TVL, naturally saw a new wave of funds flowing in with a 23.47% increase in the past month alone. This also explains the recent surge in $GMX price as new investors start accumulating the token, thus increasing the demand of it.

The recent run-up of GMX seems to ignore any bear market sentiment. If you picked up some $GMX just 14 days ago, you would have been up 52.7% today. Or if you’ve invested a month ago, you would have doubled your investment comfortably.

Founding team

Let’s start with the founding team.

GMX is founded by a completely anonymous team. However, it is known that the team has a track record of two other successful protocol launches in XVIX and Gambit.

The team is also in the process of diligently building a new AMM called X4.

To my understanding, X seems to be the lead developer.

Why GMX?

There are multiple competitors within the DeFi space that also offer perpetual futures. At the same time, there is the looming threat of centralized exchanges that will always have a portion of the market share.

So what makes GMX special?

Due to their unique value proposition, GMX is positioning itself to be a leader in this derivatives product offering space because of two main points:

1) Strong value accrual to token GMX holders and liquidity providers, denominated in ETH

2) A non-inflationary tokenomics model: GMX liquidity model (GLP) doesn’t require inflationary (farm and dump style) token incentives

The problem GMX solves

On every centralized exchange, liquidity is achieved from a traditional order book model which is reliant on market makers. An order book lists the quantities of the asset being bid on or offered at each price point, or market depth.

This is not just limited to centralized exchanges. In fact, some decentralized exchanges (dYdX) use the same exact model.

Here’s an example: Suppose that you wanted to buy $BTC at USD $10,000. In order for this to happen, someone must be willing to sell their $BTC at that price on that platform. If there is no willing seller, your buy order would not go through.

Order book models thrive on multitudinous buyers and sellers present in the market. However, there are tons of flaws in this model, especially for crypto. They are costly to run and also require market makers, who must be incentivized in some way.

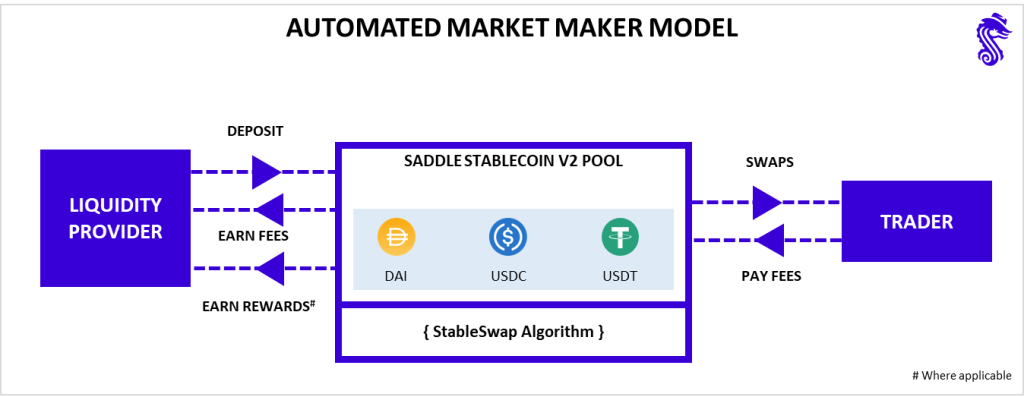

Here’s the solution: Automated Market Maker (AMM).

AMM allow digital assets to be traded in a permissionless and automatic way by using liquidity pools instead of a traditional market of buyers and sellers. On AMM, users trade against a pool of tokens known as a liquidity pool. AMM users supply liquidity pools with crypto tokens, whose prices are determined by a constant mathematical formula.

Through an AMM, there will always be a willing counterparty at a given price as long as there is enough liquidity in the pool.

Demand for GMX

The perpetual futures market space is colossal. Just think of how many degens there are out there, even in a bear market, trying to leverage their way to riches. (Yup, you may even be one of them.) The sheer size of the derivatives market is orders of magnitude much greater than the spot and thus, competition is immense.

In 2021, there were roughly USD $57T perpetual swaps traded, almost a 6x increase from the previous year.

Since its inception, GMX has done well in volume growth and has managed to capture a fraction of dYdX’s pie. The average daily traded volume has surpassed USD $150M since the start of the year.

For comparison, dYdX daily traded volume comfortably surpasses USD $500M but it does fluctuate drastically and can range between USD $1B-3B.

GLP Liquidity Model

With a unique method for incentivizing and bootstrapping liquidity on its exchange, GMX stands out from its competitors. This is done via the use of $GLP, the protocol’s liquidity provider token.

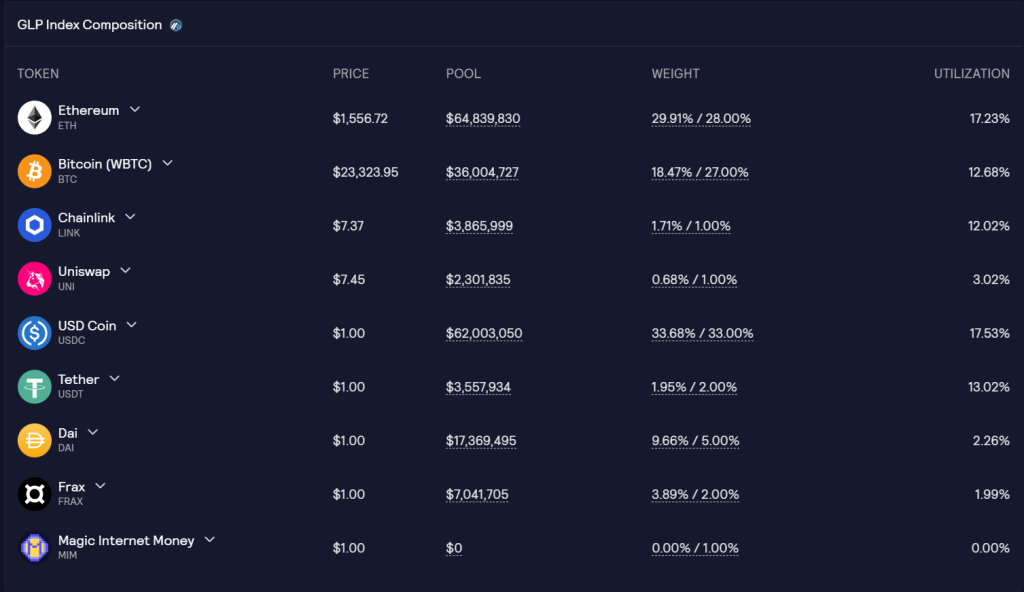

The GLP Index Composition consists of an array of assets used for swaps and leverage trading. $GLP can be minted by depositing any index asset and burnt to redeem another.

$GLP holders have exposure to all of these assets, as well as trading fees and some rewards in the form of $esGMX tokens.

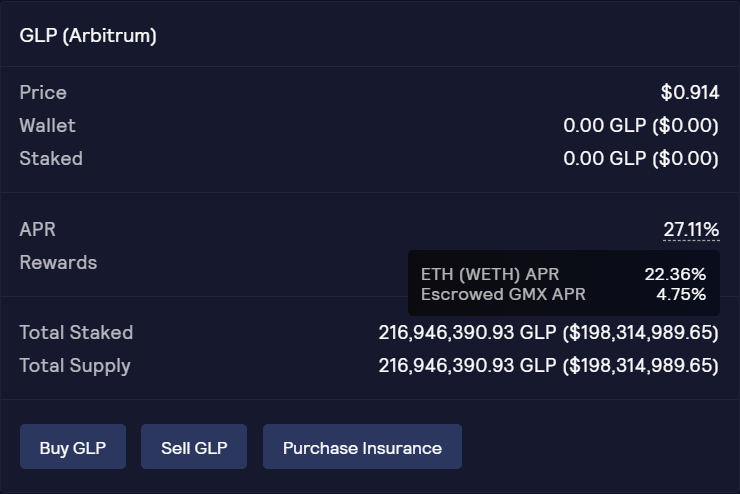

On Arbitrum, $GLP holders earn escrowed GMX plus 70% of platform fees in the form of $ETH.

On Avalanche, $GLP holders earn escrowed GMX plus 70% of platform fees in the form of $AVAX.

Minted GLP tokens must be held for a minimum of 15 minutes before they can be redeemed. More info about GLP mechanics can be found here.

Note: GLP on Arbitrum and Avalanche are not interoperable and non-transferable between the two chains.

GLP Revenue

Protocol revenue is split 70/30 between $GLP and the other protocol token $GMX. In addition to getting the larger share of protocol revenues, $GLP holders also get all the collateral when positions are liquidated which leads to a fluctuating but over-time growing inflow of revenue.

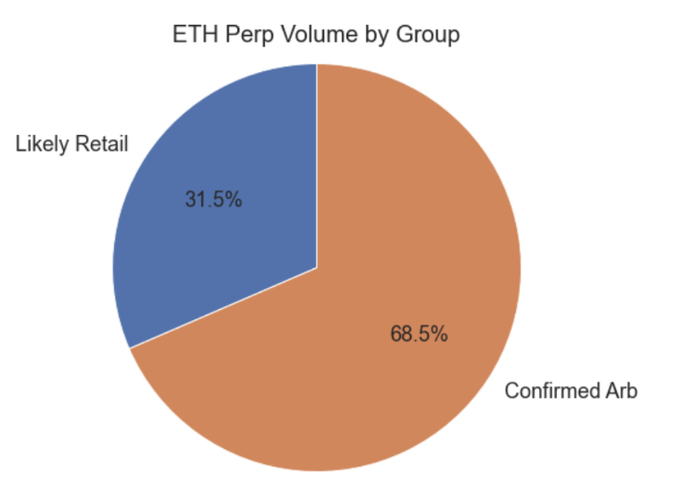

A study by Twitter user @crypto_noodles found that retail traders accounted for 31.5% of ETH perpetual volume on the protocol — the highest of all DeFi perpetual protocols analyzed likely due to the concentrated liquidity. With approximately 80% of GLP revenue coming from margin trading, this indicates that GMX’s profitability is the result of a sizable number of retail traders.

$GLP holders take the other side of the trades made out of the platform. Successful traders are paid out by the liquidity pool and on the flip side, unsuccessful traders payout to liquidity providers.

Since the beginning, traders’ net PnL on GMX has been on the negative side of things. At the time of writing, the cumulative loss equates to more than USD $33M.

In fact, this is consistent across other perpetual exchanges, proving that a long-term inverse position to traders could be a profitable option, especially when factoring in other rewards (trading fees, liquidations) from traders.

The rewards earned for $GLP holders are distributed in $ETH and $esGMX on the Arbitrum network. The current APR is at 27.11%; 22.36% for $ETH and 4.75% for $esGMX.

Tokenomics

$GMX is the protocol’s utility and governance token. $GMX has a forecasted maximum supply of 13.25 million tokens, which can be increased if there are more products launching and liquidity mining is required. But that will be subjected to a governance vote before any changes.

Here is how the 13.25M of $GMX token will be distributed:

- 6 million GMX from the XVIX and Gambit migration.

- 2 million GMX paired with ETH for liquidity on Uniswap.

- 2 million GMX reserved for vesting from Escrowed GMX rewards.

- 2 million GMX tokens to be managed by the floor price fund.

- 1 million GMX tokens are reserved for marketing, partnerships and community developers.

- 250,000 GMX tokens were distributed to the team linearly over 2 years.

The largest share of the tokens (45.3%) was allocated for the migration of XVIX and GMT (Gambit) token holders. The migration process involved swapping the original assets (XVIX, XLGE, & GMT) for $GMX at a price of 1 $GMX = USD $2.

The $GMX token has a special feature, called the Floor Price Fund. This fund is denominated in $ETH and $GLP and grows in two ways:

1) GMX/ETH liquidity is provided and owned by the protocol, the fees from this trading pair will be converted to GLP and deposited into the floor price fund

2) 50% of funds received through Olympus bonds are sent to the floor price fund, the other 50% is used for marketing

The floor price fund helps to ensure liquidity in GLP and provides a reliable stream of $ETH rewards for those who staked $GMX.

As the floor price fund grows, it can be used to buy back and burn GMX if the (Floor Price Fund) / (Total Supply of GMX) is less than the market price of $GMX. This results in a minimum floor price for $GMX in terms of $ETH and $GLP.

Is $GMX worth investing in?

A leading decentralized perpetual protocol has not exactly been established yet in my opinion. Interest in the crypto market is manifestly fading in the midst of the current bear market.

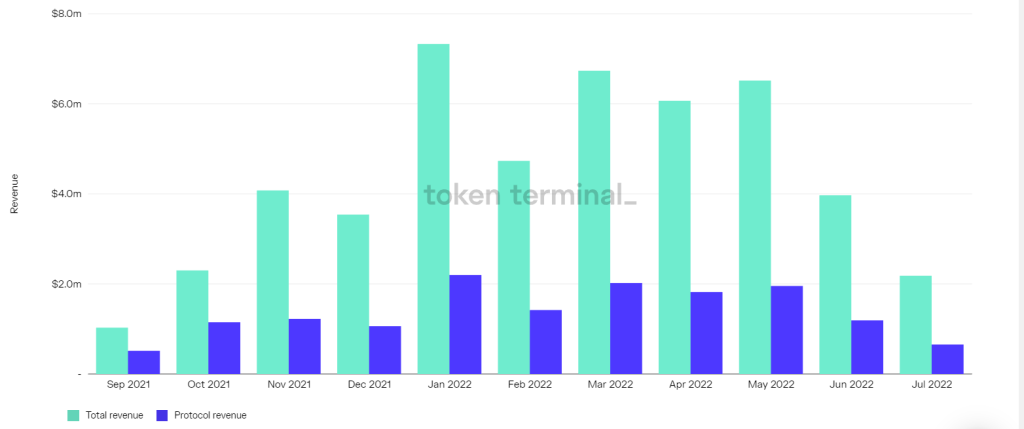

However, this did not deter GMX’s growth in any real way thus far. Since the start of 2022, GMX averages a protocol revenue of USD $2M per month.

Strong revenue sharing, a liquidity pool model, and a fast-shipping team is spearheading GMX’s mission to the top.

When the market kicks off again, we are destined to see a massive influx of retail traders which will lead to a gargantuan increase in volume. This will translate to a surge in $GMX and rewards paid out to liquidity providers on the platform.

Closing thoughts

The derivatives market is the largest market in the world. Crypto derivatives make up 61.7% of the market share in terms of crypto volume traded (as of May 2022) and continue to grow. This shows that the appetite for derivatives products such as perpetual remains strong despite the sour outlook of the current market.

Therefore, GMX is well positioned to continue growing its platform with its low fees and fast transactions pivotal to user experience and stickiness. The upcoming X4 should provide opportunities for other projects to build on top of GMX, allowing it to increase the protocol’s reach and user base.

Additionally, 86% of the current circulating supply is staked on the platform showing investors’ trust in the project despite the bear market.

Having a vast amount of the circulating supply staked associates with lesser panic and unnecessary selling in the market. This is evident as GMX is currently trading at only 54% off its ATH as compared to the rest of the market which has plummeted an average of 80% from their ATH.

As the bear market continues, investors will be looking for protocols with real users and sustainable revenues. In my humble opinion, GMX fits the bill and will be the front-runner when the market is headed back up again.

Feel free to dive in deeper into analysing GMX here.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: What Is dYdX? A Beginner’s Guide To Crypto Perpetuals Trading