The decentralized SPOT and perpetual contract trading platform GMX was first launched on Arbitrum in September 2021, before going live on Avalanche in the beginning of 2022.

Since then, the platform has boomed thanks to both its stunning tokenomics as well as the distrust in many centralized options for trading. This has led to more users moving on-chain for their trading needs, reaching an All-Time High of $76 just last week, while the rest of the crypto market seems to peter around uncertain levels.

But is GMX a surefire bet for the rest of this market cycle?

Also Read: All You Need To Know About GMX – A Deep Dive Into The Next Crypto Derivatives Leader

A Recap on GMX, The Largest Decentralized Application on Arbitrum

Despite there being multiple competitors within the DeFi space offering perpetual futures, GMX manages to hold its own in the ring.

But what makes it so special?

GMX has taken a unique position, leading the way in the derivatives product space by moving away from the traditional “inflationary tokenomics” that are used to drive liquidity to the platform. Instead, it pays an honest yield from traders using GMX in the form of $ETH and $AVAX, depending on the network being used.

Fees on GMX recently reached an intra-day high of ~800K, and ~$50M to date.

— Chain Debrief (@ChainDebrief) August 2, 2022

8/x pic.twitter.com/3274pIHuQ7

Since the start of this year, GMX has accumulated $14 Million in fees alone from approximately $7 Billion in volume traded on the platform. Furthermore, they have increased their userbase by 100%, going from 20,000 to 40,000 in the same time frame.

With GMX continuing its up-only rampage despite the market lulls, it has established itself as a certified must-hold.

Right?

Potential Problems With GMX

One of the main reasons GMX has been so popular with users is their ability to pay out healthy APRs to stakers of $GLP, which serves as liquidity for traders on the platform. These APRs come from traders’ losing on their positions, as well as getting liquidated.

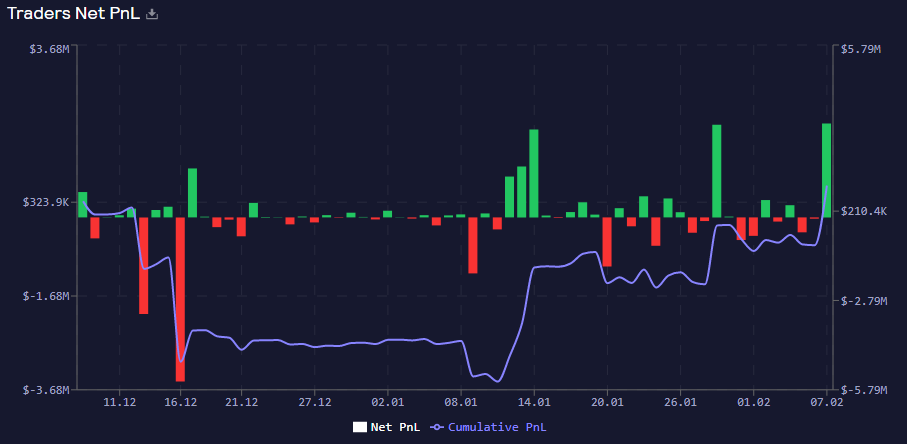

However, the bear market has apparently flushed out less sophisticated traders, causing trader’s Net PnL to slowly shift back into the green over time. As most participants on GMX seem to be long-biased, a continuous bullish trend could reduce the APRs of $GLP holders to near zero.

Additionally, liquidity providers for $GLP have almost doubled despite the bear market, going from a total stake of approximately $200 million late last year to $430 Million at the time of writing.

The rise of alternatives to GMX has also not been to its favor, with competitors like CAP finance slowing creeping up in market share amongst the slew of on-chain trading protocols available.

An interesting inflection between @optimismFND and @arbitrum happened last month pic.twitter.com/3C0nf4ZTBy

— Jason Choi (@mrjasonchoi) February 7, 2023

Another reason for the rush of funds onto Arbitrum has been speculation about a possible $ARBI airdrop, which has caused on-chain activity on the network to flourish. While Arbitrum has yet to confirm a date for a potential airdrop, users have been hungry for more free tokens after seeing how lucrative the Optimism $OP airdrop was.

Closing Thoughts

Only two things drive demand for Exchanges. Firstly, the ease of use, or UI/UX, and secondly the depth of liquidity available. While GMX currently offers both deep liquidity and a user-friendly user experience, there is no telling how things will be in the future.

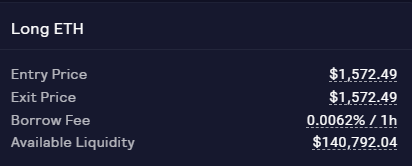

Furthermore, with the lack of short sellers on GMX, liquidity quickly dries up during manic periods. Just two weeks ago, there was only $140,000 in liquidity to long $ETH, despite $140 Million in Open Interest the same day.

Should Arbitrum’s airdrop be released, trust in exchanges be renewed and liquidity gets pulled from GMX, there may be less and less incentive to hold $GMX, especially if a shiny new network appears with a GMX fork promising similar rewards plus the potential of an airdrop.

Although I am very bullish on GMX in the near future, as I’m sure many of you reading this are, it feels very much like we are in the “uponly” phase for the token, something that has managed to burn me in the past many times.

Especially in a bear market, we should be wary of echo chambers and take a step back to view our favorite projects from another angle.

Also Read: Can You Really Make Money Shorting Jim Cramer?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief