For cryptocurrency holders, one of the ways to earn passive income on your idle cryptocurrency is to supply them into liquidity pools and earn yields from these liquidity pools.

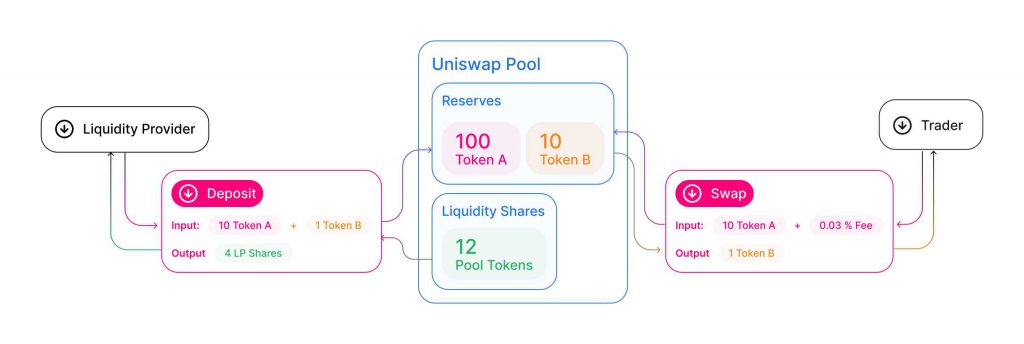

Here’s a simple illustration from Uniswap on how liquidity pool works:

As a liquidity pool provider, you will earn interest originating from the transaction fee generated whenever a trader or borrower executes a cryptocurrency trade.

For Harmony One, here are a list of liquidity pool provider or yield farms where you can supply your cryptocurrency into in order to generate a return on your digital asset.

| Pool Provider | Reward Tokens | Website |

|---|---|---|

| Mochi | hMochi | https://harmony.mochiswap.io |

| Viper | Viper | https://viper.exchange |

| Openswap | oSwap | https://app.openswap.one |

| Loot | Loot | https://lootswap.finance |

| Daikiri | Daiki | https://daikiri.finance/# |

As there are new yield farms being created everyday, please do your own research on the team’s background before committing large amount of cryptocurrency to a new farm.

As a rule of thumb, signs of a good liquidity pool include:

- The longer the liquidity pool is around, the safer it is.

- The more total value locked in the farm, the safer it is.

- The more cryptocurrency pair available for staking, the safer it is.

- High APYs (4 – 7 digit APYs) generally means the liquidity pool is relative new and less stakers to split the pool rewards.

- The more users staking their cryptocurrency (total value locked), the safer it is.

- The more protocols built on top of the liquidity pool, the safer it is.

Here’s a look at Mochi, one of the more popular liquidity pool provider for the Harmony One Network:

Also Read: The Full List Of Yield Farms On The Polygon Network