As the bear market rages on, many protocols have kept their heads down and continued to build. One of them is the Waves protocol, which recently announced a revamp in its roadmap. Going from Waves 1 to Waves 2.0, this plan includes increased interoperability, better EVM compatibility, and new governance models.

So, will Waves emerge from the bear stronger, or will it be swept up in the worsening crypto market?

Waves Refresher

Waves is an EVM-compatible blockchain that was founded in 2016 by Sasha Ivanov.

Reaching millions of users and more than $6 billion in TVL at its peak without VC funding, it was primed to be the next big thing.

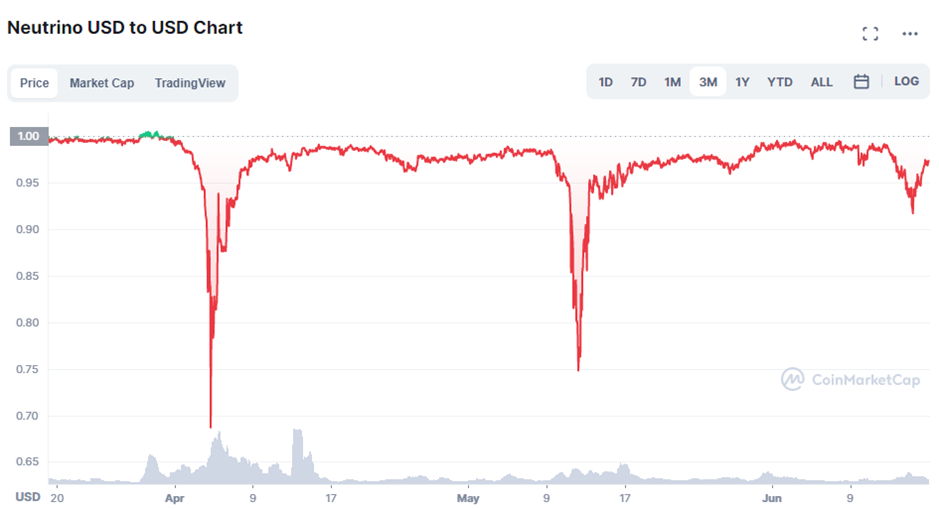

Their current ~ $1 billion TVL is largely led by Vires Finance, a decentralized money market, and more recently Neutrino. Neutrino’s main product is the Neutrino USD ($USDN), an algo-stable using the blockchain’s native token, $WAVES. However, much like $LUNA/$UST, there have been many fears of a bank run situation with $USDN.

While the stablecoin has mostly kept its peg, it is technically insolvent, with almost 130% market cap compared to $WAVES. With the recent Terra incident, Waves is seeking a brand change to revamp its blockchain.

Introducing Waves 2.0

The first step is geared toward compatibility with Ethereum, specifically Proof-Of-Stake on Ethereum 2.0. DeFi Blue Chips such as Aave and Yearn Finance may also appear on Waves eventually.

Next, DAO governance on the blockchain will require participants to have “skin in the game”. Launching this year, they introduce a success-evaluating mechanism, which would theoretically accelerate progress in the right direction. To do so, they will reward key participants who help improve the blockchain.

Waves are also seeking to incorporate bridges more heavily to increase the inflow of liquidity. Using threshold signatures, they will make bridging to not only EVM-compatible chains but also the Bitcoin and Solana networks, feel seamless.

💫 Gravity bridges will be built for users and applications to access assets on any EVM-compatible chains (Ethereum, Avalanche, Binance Smart Chain, etc.), Bitcoin, and Solana.

— Waves 🌊 (1 ➝ 2) 🐣 (@wavesprotocol) February 10, 2022

One of the main narratives of the previous bull market, layer 0 interoperability, is also a target for Waves. Specifically, they are looking to connect various metaverses, even cross-chain ones. Being the central point for the transfer of items, characters, and more as NFTs could bring palpable activity to the chain.

Lastly, the team has a $150 Million fund and an accelerator program to foster Web2 and 3 talents. This will be done via their recently founded US-based company, “Waves labs”, and also satellite incubators across the world, including Europe and Singapore.

DeFi Revival Plan

Alongside Waves 2, plans to protect their native stablecoin, $USDN, have also been formulated. During the $UST bank run, many sold their $USDN as well in fear of a contagion effect and a similar run in the Waves ecosystem.

I thought that $UST was similar to $USDN but it's actually not the case, it was very different. To dispel some misconceptions:

— Sasha Ivanov 🌊 (1 ➝ 2) (@sasha35625) May 13, 2022

– UST is literally not backed by anything. When you issue new UST you send Luna but IT IS BURNED. This is not the case with USDN, Waves remains locked.

At the time of writing, $USDN has yet to fully regain its peg, currently trading at ~$0.98.

The arbitrage opportunities between $USDN and $WAVES have been made easier to fix this. While this helped the stablecoin avoid a long-term massive de-pegging, more needs to be done still.

Daily $USDT and $USDC withdrawal limits were also set on the most popular AMM, vires finance. Alongside dynamic borrow/lend limits, these have helped bring stability to the ecosystem in illiquid market conditions.

Long-term believers are also rewarded. Vires offers increased rewards for those who lock liquidity for 3/6/12 month periods, with $20 Million immediately going to this cause.

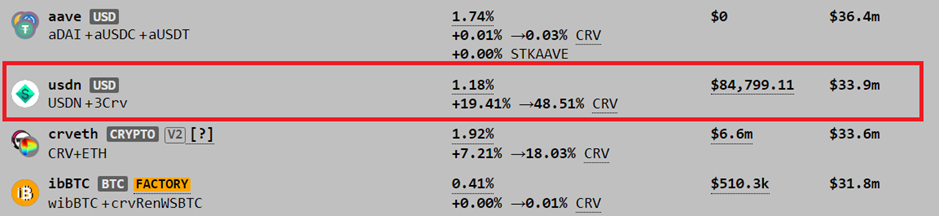

Waves staking profits are also being used to heavily incentivize the USDN-3Crv pool on Curve, in a bid to ensure deep liquidity. This also increases demand for $USDN, as users want to supply it for heavy staking rewards.

Waves Timeline

- March 2022: Inter-Metaverse Protocol litepaper release

- April 2022: MVP release of Inter-Metaverse Protocol with integrated games

- April 2022: DAO Litepaper release

- March 2022: US company foundation

- April-May 2022: incubator launch for US teams

- April 2022: Waves 2.0 litepaper release

- June 2022: Mother-DAO launch

- June 2022: Gravity Bridges MVP launch

Find out more on how Waves is transforming from 1 to 2 here.

Closing Thoughts

One of the narratives for Waves reaching its All-Time High was being a mirror play for Luna/UST. With most market participants staying away from algo-stables, the downfall of Waves may be a foregone conclusion.

Despite this, both its stablecoin peg and ecosystem seem relatively healthy compared to other Alt-L1 tokens. Furthermore, they have a large war chest to continue building during the bear market.

2️⃣ Liquidate large accounts, taking control over their collateral.

— Waves 🌊 (1 ➝ 2) 🐣 (@wavesprotocol) May 27, 2022

It is unfair that most users have to suffer due to a few large whales abusing the system. Sasha will liquidate the whale positions and slowly restore liquidity. https://t.co/mMKonJ57r9

One key thing to take note of is the seemingly heavy centralization of the project. While there are many validators and a myriad of governance voters, limiting withdrawals and liquidating whales cannot be healthy in the long term.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief

Also Read: “No Exposure To Them”; CEO of Hodlnaut Speaks Amidst CeFi Turmoil