With the explosion of GMX in recent months, the perpetual scene in crypto is starting to heat up. The entire derivatives market is often estimated at over $1 Quadrillion, with the size of the market 10 times that of the total world gross domestic product (GDP).

That is the total monetary or market value of all the finished goods and services of all countries. Take some time to think about that, it’s basically how much the world is worth, 10 folds.

The sheer size of the derivatives market paves new ways for alternative forms of income generation. Especially with derivatives products in crypto only starting to catch eyeballs, the blend between the two could create a sweet recipe for investors.

Whether or not the crypto investors are ready for these tools is an entirely different question to uncover but early builders have already started building the bedrock for some of these products.

It's always "What is GMX"

— Chain Debrief (@ChainDebrief) August 2, 2022

and never "How is GMX"

Here, we answer both questions

1/x 🧵👇 pic.twitter.com/m5xNvsGdDv

What are options and how it plays out in crypto?

Essentially, options are contracts which allow traders to speculate on the future price of an asset.

Trading options grew in popularity due to the many benefits such as a risk management tool in hedging, lowered cost in leverage and flexibility to execute customizable strategies.

In crypto, since there aren’t many experienced traders (yet), the market for options is comparatively smaller. However, as time goes on, and crypto participants master the art of spot/leverage trading, options are the next logical step for many of these traders.

Assuming the demand for options trading increases, the leading projects in this sector could capture significant upside.

“Options exchanges are like casinos, but they don’t have any customers yet.” Making a play on infrastructure before the masses come to play might land you your next crypto gem.

Furthermore, we can see how the flow of $BTC towards the derivatives exchanges compared to the total volume of coins transferred in the network is at the highest levels of the last 12 months. This shows a rising appetite in investors using derivatives exchanges.

Here are the top decentralized options projects that could capture the upside of this sector’s growth.

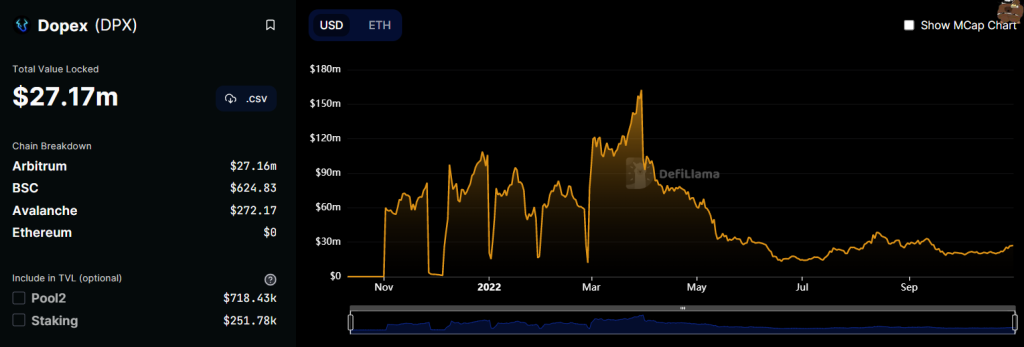

1. Dopex

Dopex is a decentralized options exchange on Arbitrum. They facilitate the decentralised trading of crypto-specific options.

In particular, they facilitate straddle options, which allow users to bet on asset volatility. This unique offering gives Dopex a competitive advantage over other exchanges.

/1 @dopex_io just launched Atlantic Straddles options.

— The DeFi Investor🦇🔊 (@TheDeFinvestor) August 11, 2022

For the first time in Crypto history, you can bet on volatility and possibly make a ton of money🤑

Here's why Atlantic Straddles are a big deal🧵👇 pic.twitter.com/Jw0VEPBBP0

With a market cap of $68 million, compared to the sheer size of the options market in traditional finance, is still relatively small.

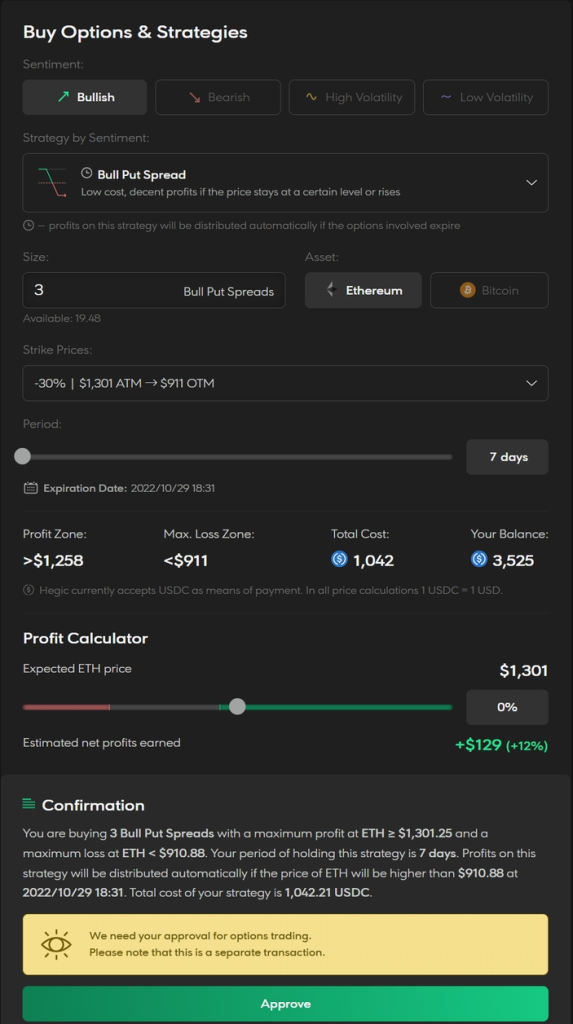

2. HegicOptions

Hegic is a decentralized protocol, that allows users to purchase calls and put options on $ETH and $BTC.

Call option = bet on the price going up. Put option = bet on the price going down.

They have relatively simple UI/UX, making the crux of options easier for the everyday folk to navigate.

Over the last eight months, a new Hegic protocol architecture HardCore was tested in beta.

Hegic HardCore has generated $471,272 in net positive P&L during its beta phase which is claimable by $hHEGIC holders, Hegic V8888 staking participants.

No token rewards or incentives were involved. Just options trading leading to pure cash flows

3. Premia Finance

Premia allows you to trade call/put options for a variety of tokens.

Premia stands out for being the only one that gives a “Robinhood-like” UI/UX experience allowing users to select strike/expiry & exercise them before expiry.

Check out this thread by the Babylonians who explain the fundamentals of how Premia finance works.

An ELI5 introduction🧵to @PremiaFinance. Most are betting this to be a small-cap gem on Aribtrum, $PREMIA mc is $15m~ & FDV is $144m~ as of writing, v3 is going to ship soon with 7/9 core components rdy + newly revised tokenomics from xPREMIA to vePREMIA, both coming soon in Q4 pic.twitter.com/ALvZEOq7a3

— TheBabylonians 🌴 (@The_Babylonians) September 13, 2022

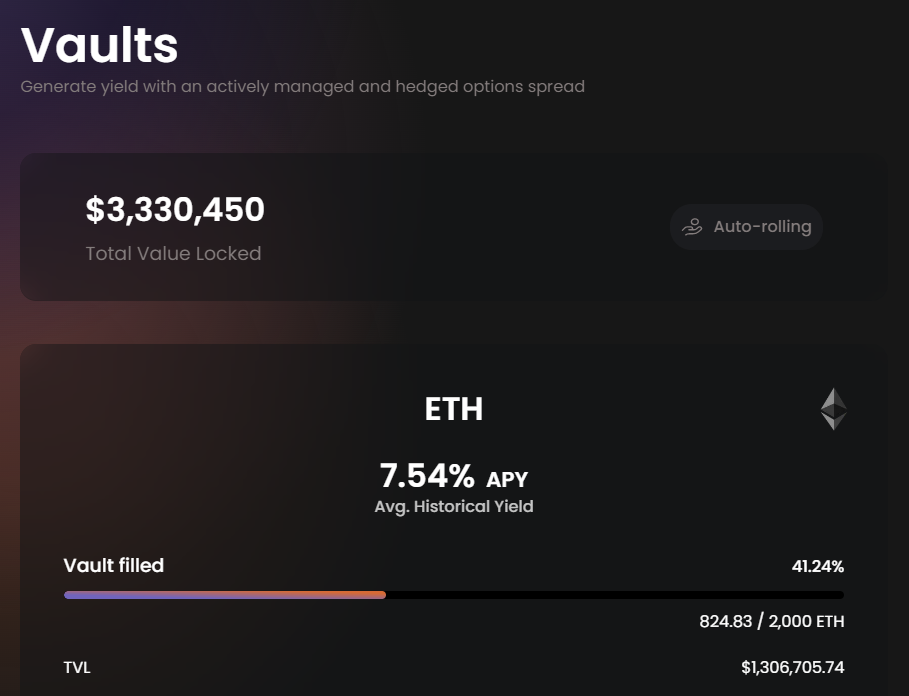

4. DAO Jones Options

Jones DAO is defined as a yield, strategy, and liquidity protocol for options. Their goal is to make options yield farms easier.

Their vaults offer multiple assets and risk profiles which will generate yield through options strategies deployed on the assets deposited in the Jones Vault.

Users will be able to access the best yields with actively managed and optimised strategies.

The ETH vault generates ETH yield with a proprietary hedged options strategy. The average APY for it is 12%, which is good for a strategy without impermanent loss risk.

Currently, they have over $7M in total value locked and are leading innovation in DeFi which manages options trading strategies for retail investors through their vaults.

5. Lyra Finance

Finally, Lyra finance. They are one of the leaders in the decentralised options space that uses synths to enable AMM priced options trading.

The Lyra Ecosystem is growing🌱

— Lyra (@lyrafinance) October 18, 2022

Let's look at four powerful protocols that use Lyra options as part of their product suite:

– @PolynomialFi

– @BrahmaFi

– @torosfinance

– @dHedgeOrg

🧵↓ pic.twitter.com/lBQvhrKfR4

The Lyra Protocol is a sustainable, always-on source of options liquidity that can and should be used by builders.

Over the inception of its token program start, Lyra has seen significant growth in its TVL, but struggled to see the heights it once soared.

However, positive signals from the initialization of the distribution of its rewards may instigate bullish reform in the months ahead.

Closing thoughts

While decentralized options possess tremendous upside potential, it is still unclear which protocol will take the throne. With many protocols gunning to capture a larger market share, two main networks are battling it out at that the top; Ethereum and Solana.

In true Ethereum killer fashion, devs look towards Solana as an alternative network for a cheaper and faster transaction speeds. While it stands as a lucrative alternative to Ethereum, Vitalk’s brainchild of a network still possesses a more vibrant place to build.

All in all, derivatives and crypto are a match-make in heaven, they are bound to be together. While options traders from various institutions await a clear leader to emerge, they stand at the sidelines ready to deploy funds as they are eager to get a piece of the pie.

And what do massive funds bring? potentially adoption.

This article was adapted from Mile’s Deutscher alpha trend on decentralised options.

If you missed perp DEXs like $GMX and $GNS:

— Miles Deutscher (@milesdeutscher) October 30, 2022

Then don’t worry, because there’s another narrative that’s just getting started.

Decentralised options.

Here’s why this sector could 100x over the next few years + my 5 top picks.👇

Also Read: What Does Elon’s Twitter Takeover Mean For Crypto?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief