The promise of huge profits and financial freedom has lured many into investing in cryptocurrencies without knowing how they work, which often leads to painful and expensive mistakes. Especially during the bear, it is more evident than ever that mistakes are consolidated and lessons are learned before the next bull run.

Here are the top 10 common mistakes that I wished I knew before I started my crypto journey:

1. Not doing technical analysis

I know many traders out there that swear by technical analysis as the holy grail for trading.

Technical analysis (TA) is the study of historical price movements to determine the current trading condition and potential price movement.

Past data can help spot trends and patterns to determine great opportunities to enter the market.

But do note that TA is used to determine the probability of the future direction of the price and it is not so much about prediction.

Also read: Triple Threat Trading Strategy: The MACD, Stochastic and RSI

2. Not diversifying enough

To diversify or not that is the question. While sticking to a cryptocurrency that you have a high conviction in could potentially make you rich, most of the time it is just going to leave you with many sleepless nights.

Diversifying your portfolio is a good way to manage risks as a strong dip on one token would not wipe out your whole portfolio.

But there is a limit on how diversified your portfolio should be as being too diversified have its con too.

Read Also: What Is $CAI? How Investing In AVAX Ecosystem Is Now Made Easy

3. Being too focused on altcoins

Well, it’s true that coins with a low market cap can easily see gains like 10x or even 100x, but the price can crash as fast as it gains.

It is important to keep your portfolio in check. A portfolio that is too aggressive on altcoins can see gains wiped out overnight.

A good way to reduce price volatility is to hedge it with some blue-chip cryptocurrencies like Bitcoin and Ethereum.

Also Read: All You Need To Know About Cap Finance And How It Brings Real Yield In DeFi

4. Not taking a profit

In a bull market, everyone is a genius. But a true genius knows when to take profits before prices starts to tank.

Prices of cryptocurrencies are still very volatile in nature and it could increase and decrease by a huge margin in a short time frame.

While it is easier said than done, it is best to keep emotions in check. Stick to a system or a plan and follow it strictly. Once the price increase by a certain percentage, time to lock in the profits.

5. Not cutting losses

On the flip side, not cutting losses is also another common mistake made by many.

If the token is already down 50% it might not be a bad idea to cut losses and start to rebalance the portfolio before it crashes even more.

While HODL is praised by many, it is a dangerous mindset as the ones HODLing are usually used as “exit liquidity”.

6. Pure ponzinomics

I can’t stress how many projects and play-to-earn games out there that are just pure ponzinomics.

The project/game is just like a pyramid scheme and depends on new cash inflow to pay existing investors. While you can earn money from a ponzinomics project, you have to enter early and cash out along the way.

Many investors that FOMO into ponzinomic projects/games have been burned and used as “exit liquidity” so please degen responsibly.

Also Read: No More Ponzis: Solving The DeFi Recapture Problem For Mainstream Adoption

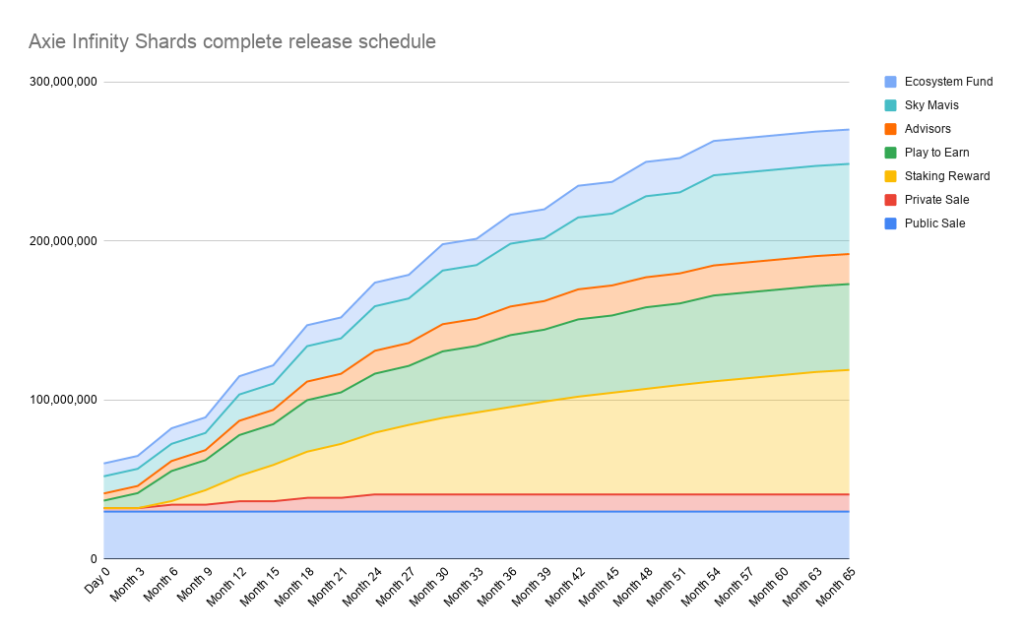

7. Not accounting for VCs dumps

Venture Capitalists (VCs) are the backbone of many successful projects. They provide both financial support and technical expertise that is able to help new projects grow and take shape.

VC-backed projects are also more likely to succeed, which is why VCs are able to get into a project earlier and purchase tokens at a cheaper price.

But when the VCs token are unlocked and they are able to dump the token, the price of the token will crash and burn.

Always study the project’s tokenomic and keep track of the vesting schedule for the various parties to stay on top of things.

Also Read: Should You Follow The Big Players? Cryptos VCs Are Holding During The Bear

8. Chasing farms with high APYs

Without a doubt, farms with high APYs would draw a lot of investors to ape into it. But the question is, is it really worth the risk?

Most of these high APY farms rely heavily on token emissions to generate those high APYs. This hyperinflationary economic model would inevitably cause the token price to crash in value.

In this case, you are much better off farming in a 19.5% APY stablecoin farm than participating in a high APYs degen yield farm.

Also Read: Earn Yield From Stablecoins: Where You Can Stake Them And How Much Interest You Can Earn

9. Impermanent Loss

Impermanent loss (IL) is something that most investors are familiar with, but might still be confused by.

To farm a liquidity pair, investors have to provide a cryptocurrency pair of equal value to the liquidity pool. Impermanent loss occurs when the value of one coin increase in value and the other do not increase in the same amount.

This could create a scenario where you might be exposed to so much IL that you’re better off not participating in the liquidity pool.

Also Read: A Guide to Liquidity Pools: Key Factors to Consider Before Getting Started

10. Trusting influencers

I’m sure I’m not the only one guilty of this but many new crypto influencers like myself would follow certain influencers for their so-called “Alphas”.

Some influencers have amassed such a massive cult following that projects would be more than happy to pay good money for them to shill their projects.

Investors have to beware that influences will promote such projects as the best thing ever and at the same time not disclose that it is a paid advertisement.

It is best to DYOR (do your own research) and not blindly follow the influencers as no one other than yourself is responsible for your own money.

Not sure how to DYOR? Check out this article here: DYOR: How To Do Your Own Due Diligence On Crypto Projects Before Investing

Closing thoughts

Making mistakes is a guarantee in life but in some cases, it can be costly.

Do play it safe when you’re starting out and do not be afraid of making mistakes as it can be an excellent learning opportunity.

When you recognize the mistake and learn from it, you will gain valuable wisdom that will help you progress to be a better version of yourself.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: Chain Debrief

Also Read: Here Are 4 Ways To Deal With Your Emotions When Investing In Crypto