As crypto is widely known for its volatility and massive swings, it is not a place for the faint-hearted. Those who continue to build are likely the eventual winners. While many may call it quits after a major crypto market crash, Jeff remains convicted in the space, as “what is not dead will only continue to become stronger and stronger.”

By building DeFi strategy vaults which generate real and sustainable yield for investors, the CEO of Steadefi has stayed resilient in building new products that contribute to the betterment of the greater crypto space.

A team of engineers

With a diverse team of software engineers and DeFi veterans located across Hong Kong, Indonesia, Japan, and Singapore, Steadefi’s team is data-driven and experienced. This means that building various yield products and strategies comes naturally to them.

And this natural sense for DeFi can be easily seen in their sophisticated products and approachable UX. From delta-neutral leveraged yield farming to perpetual dex liquidity vaults, they can offer their users a wide variety of choices based on their market outlooks, all the while ensuring the strategies are accessible to the masses.

Where does the yield come from?

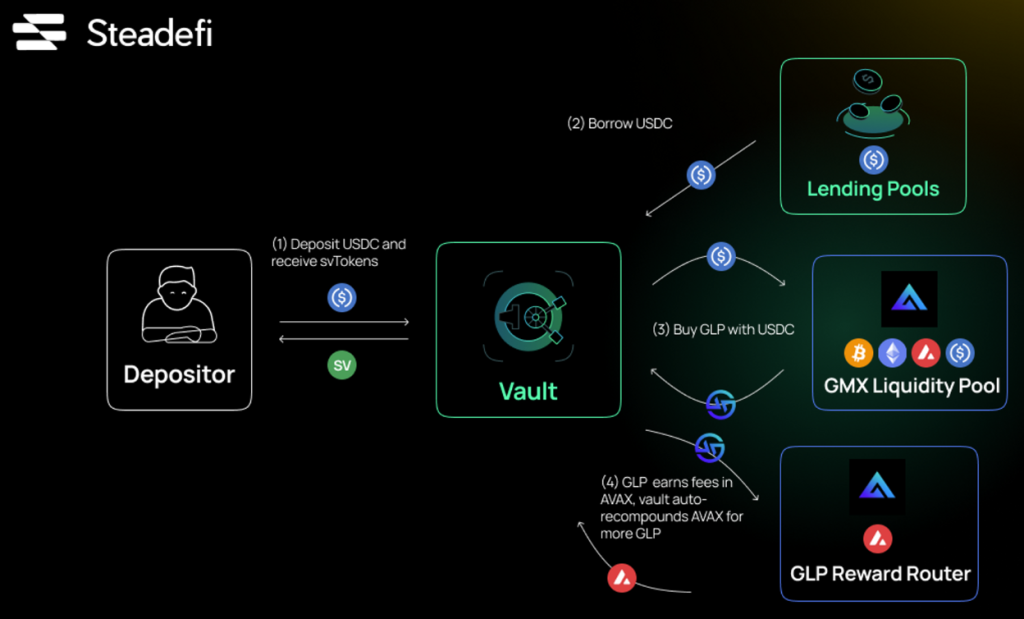

Here’s an example from their 3x Long GLP GMX strategy vault.

Using 3x leverage on deposits, this strategy earns boosted yields from GLP staking on the GMX derivatives protocol. The yields come from minting/burning, swaps, liquidation, and margin trading fees, and they are automatically compounded back into more GLP.

All the details about our innovative 3x Long $GLP Vault right here: https://t.co/D7afSaQiBD

— ⚖️ Steadefi 🔺 (@steadefi) February 10, 2023

Time to go long on #BTC, #ETH, and #AVAX while tripling the @GMX_IO #RealYield!

Furthermore, Jeff added that they “want to focus on generating yield from assets with high liquidity and market cap, which have relatively lower volatility across the entire market.” This indicates the team’s commitment to providing optimized yields while focusing on managing user risk.

On the topic of capital efficiency, they achieve this with the introduction of under-collateralised lending. Essentially, by putting a dollar in the 3x leverage yield vault, 2$ will be borrowed to amount to a $3 position. This $3 will be used to mint $GLP, which is also automatically staked while vault keeper bots in the backend auto-compound the AVAX yield into more GLP and do any rebalancing if necessary.

Rebalance: a “reset” of the vault’s assets such that the debt ratio stays within a healthy range and the delta exposure is true to the intended strategy. In the case of GLP, there are only rebalances in the debt ratio with a target of 66%.

While Avalanche was the first network of choice, the recent popular network, Arbitrum, was selected as their second. The Steadefi team is always exploring new ideas of yield sources in the future on different networks. With Arbitrium securely under their belt, they are already in the works for bigger things.

“We will also be multi-chain in the future. We already have the framework to do it”, Jeff added.

But with leverage comes the responsibility of managing risk, and Steadefi’s vaults do all that for the user.

Currently, the audit of Steadefi by Omniscia is successfully completed. This means security audits have ensured the project conforms to the latest standards and remediates critical vulnerabilities.

📌 We are PROUD to have worked with the following teams in February:@LOrealGroupe @eulerfinance @BosonProtocol @steerprotocol @sznsNFT @native_fi @Bolide_fi @steadefi @tangibleDAO @Wavelength_DAO @allianceblock @QANplatform @0xMetavisor

— Omniscia (@Omniscia_sec) February 28, 2023

Follow @Omniscia_sec for new updates!

Steadefi’s upcoming plans

While the market continues to give no clear signal as to which direction it wants to go, the builders in the space will continue to build. The Steadefi team is set to innovate new products continuously, including introducing new strategy vaults that users can employ to enjoy yield and exciting strategic partnerships in the near horizon.

1. 3x Long Curve Tri-Crypto Vault

By using 3x leverage on deposits, this strategy earns boosted yields from Tricrypto staking on the Curve Finance protocol. The yields come from swaps and CRV inflationary reward emissions as voted by veCRV holders.

Essentially, this vault works best when (1) BTC and ETH continue in an upward trend, (2) veCRV voters continue incentivizing the Tri-crypto pool of wBTC, wETH and USDC, and lastly, (3) as a short-term hedge to market downside.

Of course, users must understand the downside of a de-pegging incident occurring with any of the wrapped assets and considerable swings in crypto with its volatile nature.

2. Liquid Staking Strategy Vault

Riding on the narrative of LSD products, Steadefi will also venture into liquid staking products as part of one of the new strategy vaults. Here, the vault will essentially borrow ETH from Steadefi’s lending pool to form a 3x leveraged stETH-ETH LP.

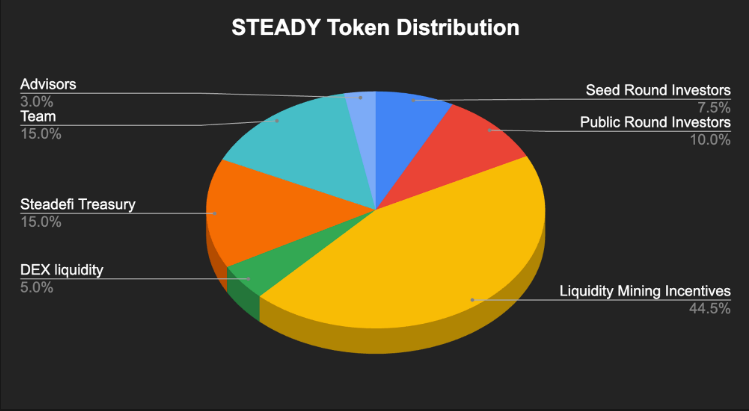

3. $STEADY/esSTEADY Tokenomics

The second major plan Steadefi looks to push out this year is their very own native token, $STEADY.

Now this token will be used as part of Steadefi’s liquidity mining incentives and can be bridged using LayerZero’s omnichain fungible token messaging protocol. The max supply of the $STEADY tokens will be capped at 200M across the two chains it supports, Avalanche and Arbitrum.

With the escrowed model in mind, every 1 $STEADY = 1 $esSTEADY.

The escrowed version of the $STEADY token can be earned from yield-generating staking positions or through direct $STEADY conversions. The primary purpose of esSTEADY is to be allocated towards a share of the platform dividends or towards boosting the user’s yield rates.

It is also good to note that the esSTEADY token will be used on the platform for governance.

Though profitable (for some), token launches can be stressful.

— Steadefi 🔺💙🔶 (@steadefi) March 30, 2023

And we don't like stress.

So how about we give you a way to earn our $Steady token before it launches?

Introducing the $esSteady Liquidity Mining Phase, briefly threaded below 👇#Avalanche #Arbitrum

1/3 🧵 pic.twitter.com/WNMaNqmUI1

4. ETH-USDC Strategy Vaults on Camelot

Lastly, there are two types of ETH/USDC strategy vaults users can employ, which will work similarly to the existing AMM swap vaults that they currently have on Avalanche; Long and Neutral.

The long vault will essentially involve earning swap fees and Grail/xGrailas, a yield source from an ETH-USDC swap pool on Camelot. Users can deposit ETH, and the vault will then borrow the two given assets, ETH and USDC so that the total value of assets is 3x of the initial value deposited.

The vault will auto-compound swap fees and Grail back into the position while using xGrail to boost yields. Those who are looking to accumulate more ETH could utilize this strategy vault to capitalize on $ETH trending upwards.

The neutral vault, in contrast, is for users who are only interested in earning yields on their position without worrying about the price of ETH. Using the 3x leverage on the deposits, this strategy earns boosted yield from $ETH-$USDC swap fees and the auto compounded Camelot rewards. This vault performs best in a crab or downward-trending market.

Chainlink BUILD program

The Chainlink BUILD program aims to accelerate the growth of early-stage and established projects within the Chainlink ecosystem. Ultimately, it is a platform which helps foster accelerated growth in existing Chainlink ecosystem projects.

Being one of the currently 25 projects on the BUILD program, Steadefi can tap into Chainlink’s top-notch services, expertise and community to bring forth its DeFi strategy to the masses.

Excited to announce that we'll be joining the #Chainlink BUILD program!

— Steadefi 🔺💙🔶 (@steadefi) March 22, 2023

As part of this program, we'll be able to tap into @chainlink's top-notch services, expertise, and strong #LINK community in order to bring our #DeFi strategies to the masses.https://t.co/mxAZnv1TqC pic.twitter.com/6218yJDsjJ

As part of BUILD, Steadefi now receives enhanced access to industry-leading Chainlink Web3 services, technical expertise, and community support from the Chainlink ecosystem.

By contributing 3% of their total token supply to Chainlink service providers as part of Chainlink Economics 2.0, the Steadefi team can further drive the adoption of its automated smart-hedging strategies.

“We are excited to join Chainlink BUILD, which we believe will greatly help drive the adoption of Steadefi’s next-gen DeFi automated strategy vaults. Chainlink’s Web3 services are essential for any protocol that values security and reliability. We plan to leverage the full suite of services that Chainlink can offer, such as Chainlink Data Feeds and Chainlink Automation, to support our strategy vaults. Ultimately, joining BUILD will help us provide more people access to Steadefi’s innovative, efficient, and safe strategies.”

Jeff Lam, Project Lead

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief