The beauty of the blockchain is its transparency. If you do not already know, there are platforms out there enabling you to track the wallet holdings of anyone, and today we take a look into the portfolio of “whales” in crypto.

CovDuk did extensive research in compiling this list and every credit should go to him/her. Before we go into the nitty-gritty details, here are some disclaimers

- These are the top 10 wallets according to Debank’s ranking

- These only include ETH & EVM chains

- These wallets represent 1 hot wallet. Whales have multiple wallets & spread them out. This won’t include all their holdings.

5. Miyazaki

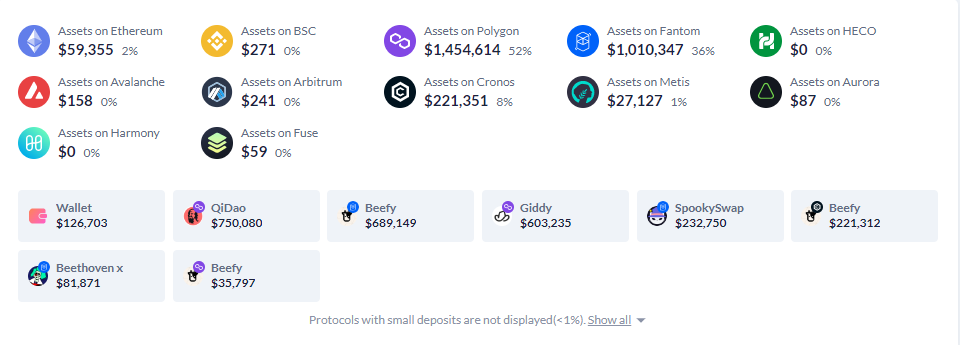

Chain breakdown

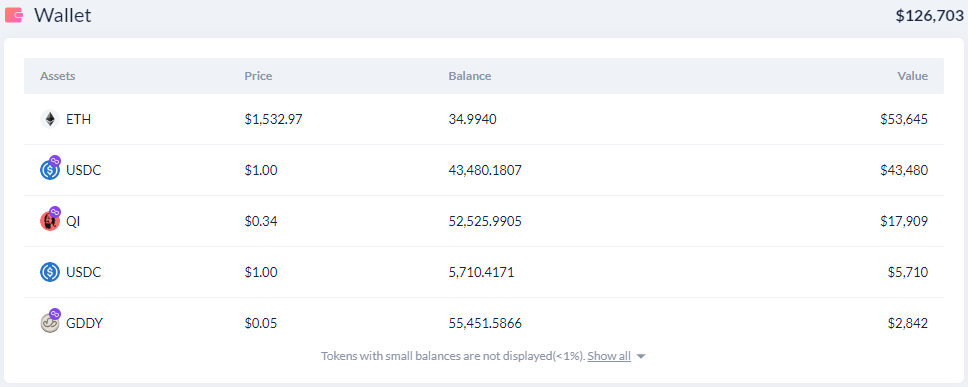

Wallet Holdings – $126K

Protocol deposits:

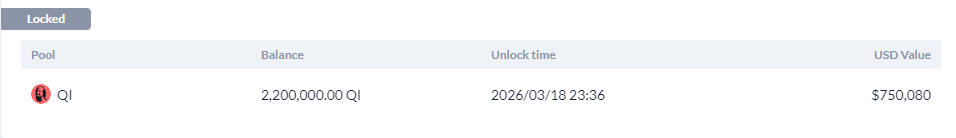

$750K in QiDAO (Locked) – $750K

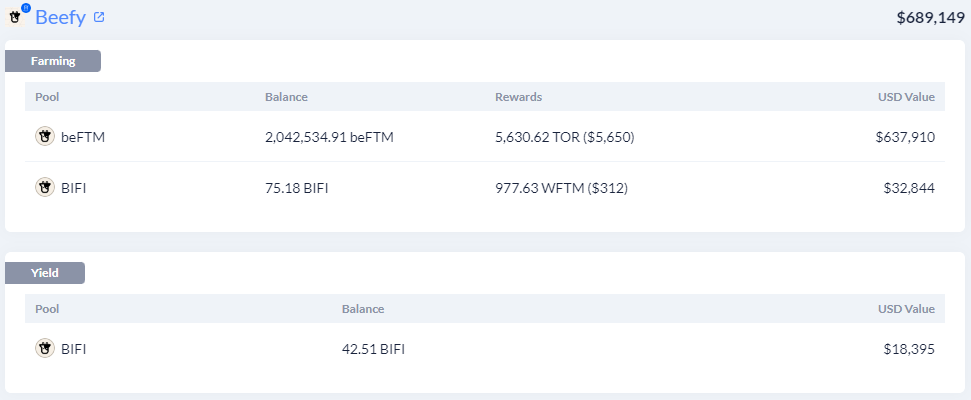

$689K farming on Beefy Finance (Fantom Network)

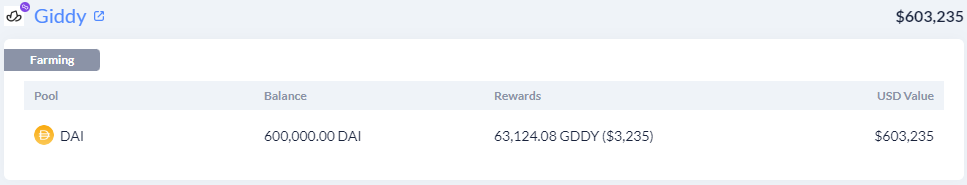

$603K farming on Giddy (Polygon Network)

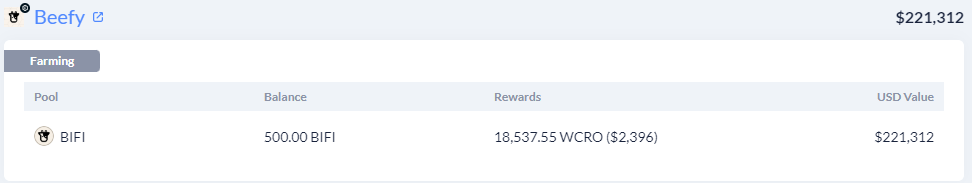

$221K farming on Beefy Finance (Cronos)

$232k farming on SpookySwap (Fantom Network)

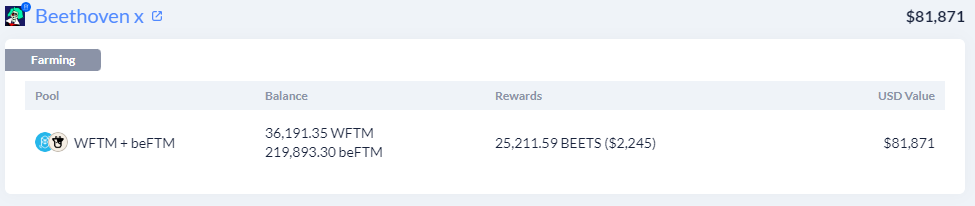

$81k farming on Beethoven X (Fantom Network)

Takeaways

- Polygon & Fantom bull

- When I analyzed Miyazaki’s wallet in April, the wallet was heavy in Fantom (85%) & had 17% of the portfolio in Polygon. Wallet tapered from 85%:17%, Fantom to Polygon holding to a 45%:55% respectively.

- Miyazaki is going big on QiDAO

Debank Profile for Miyazaki

4. vitalik

Chain breakdown:

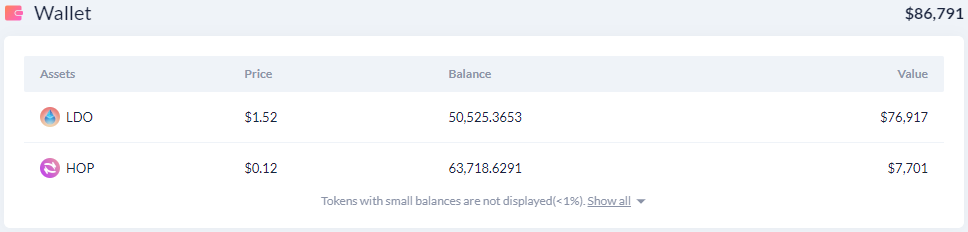

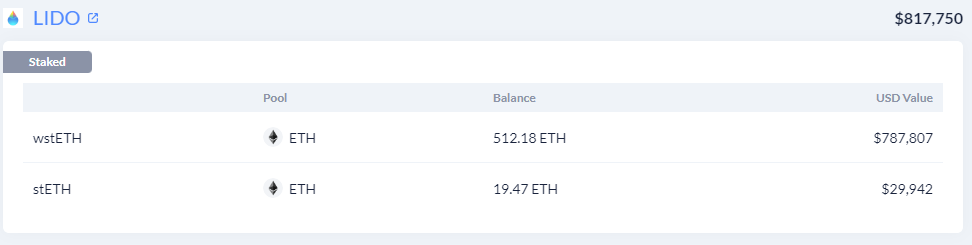

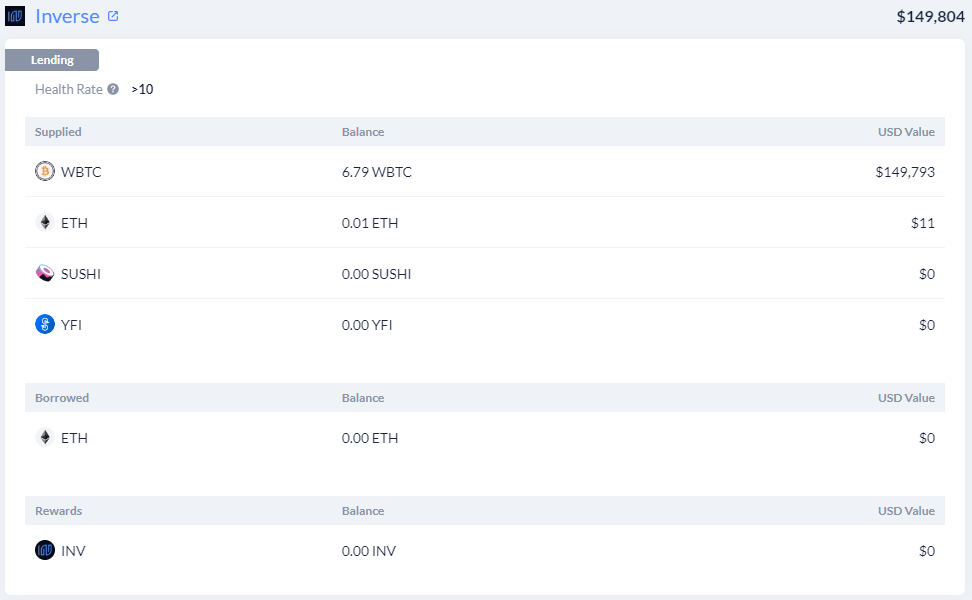

Wallet Holdings – $86K

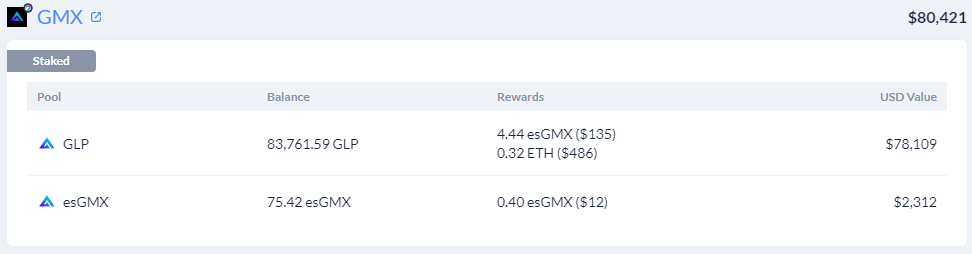

Protocol Deposits:

Takeaways:

- Primarily involved in the ETH ecosystem

- Holding a large position of MAGIC

- Staking ETH & eth backed coins

Debank Profile for vitalik

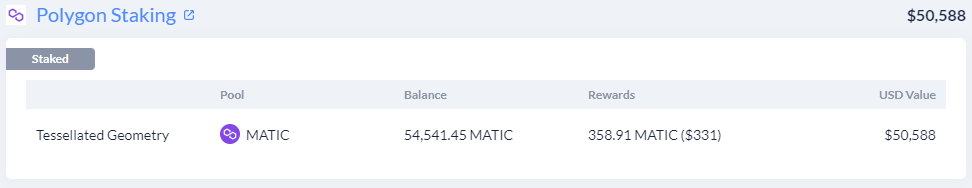

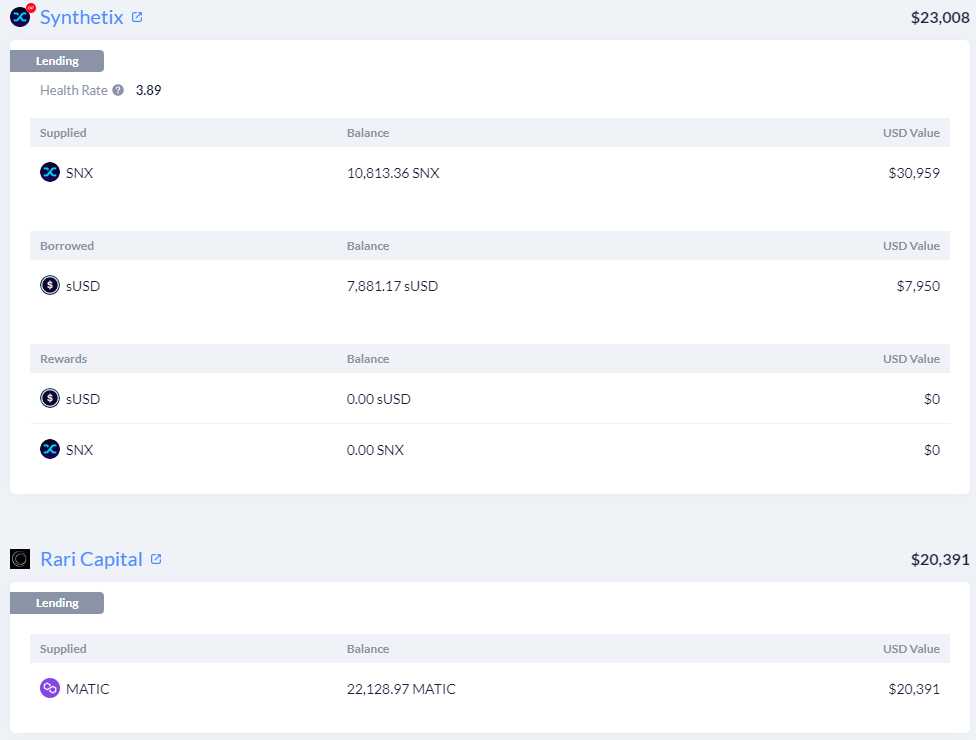

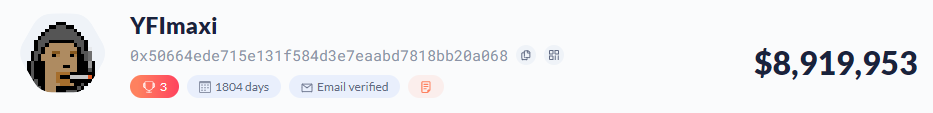

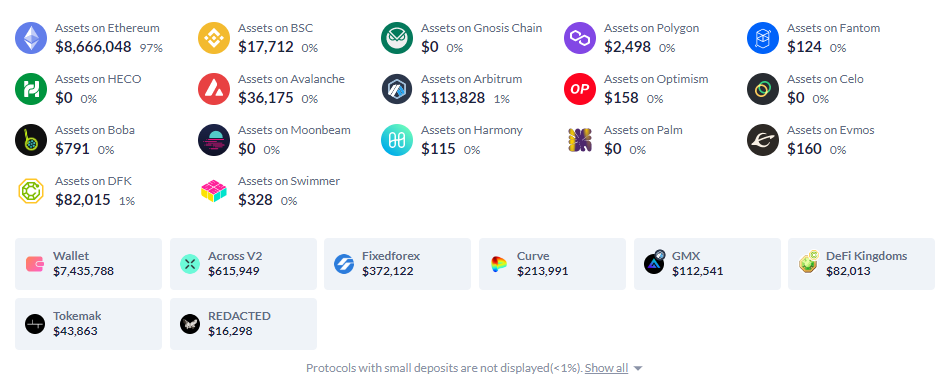

3. YFImaxi

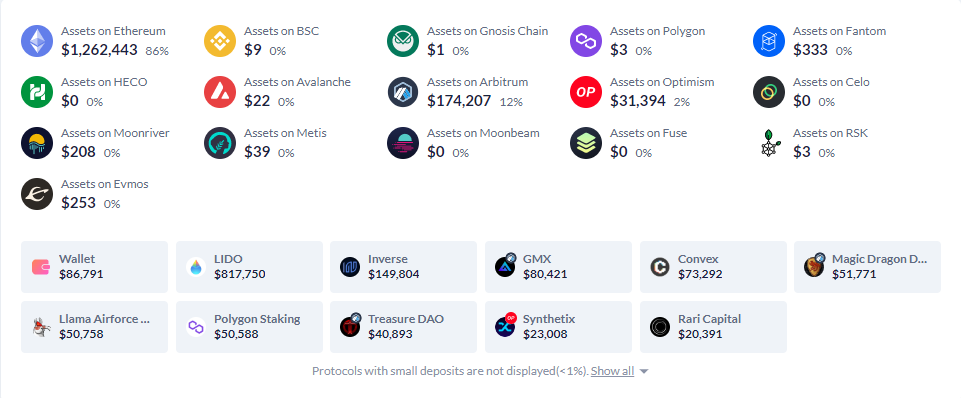

Chain breakdown:

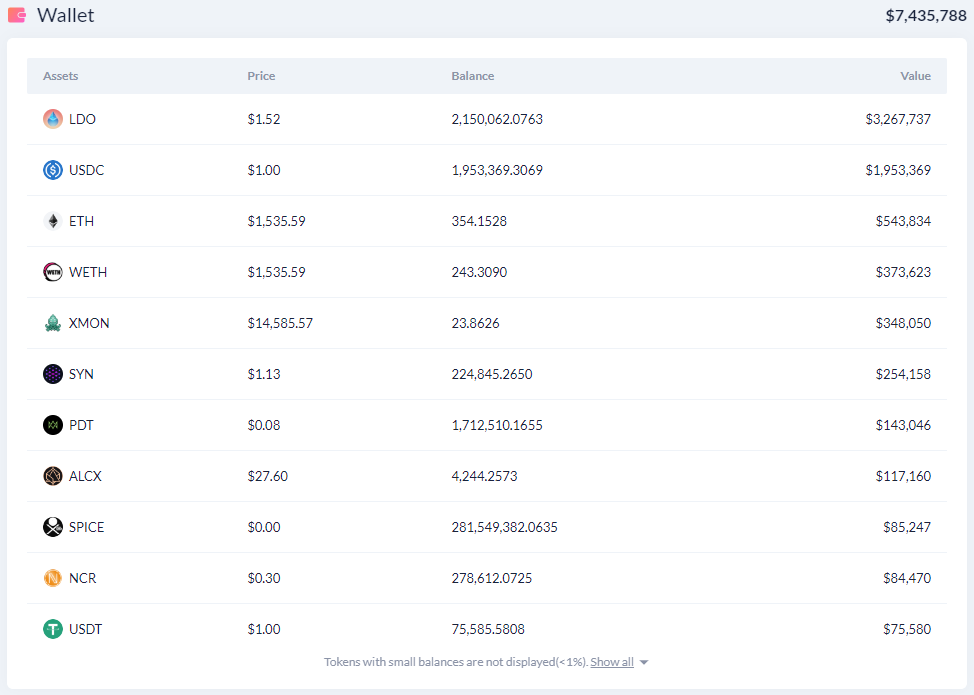

Wallet holdings – $7.4M

Protocol Deposits:

Takeaways:

- Primarily on ETH, rotated most of his funds to ETH and stables

- Lots of ETH staking & big position of LDO

Debank profile for YFImaxi

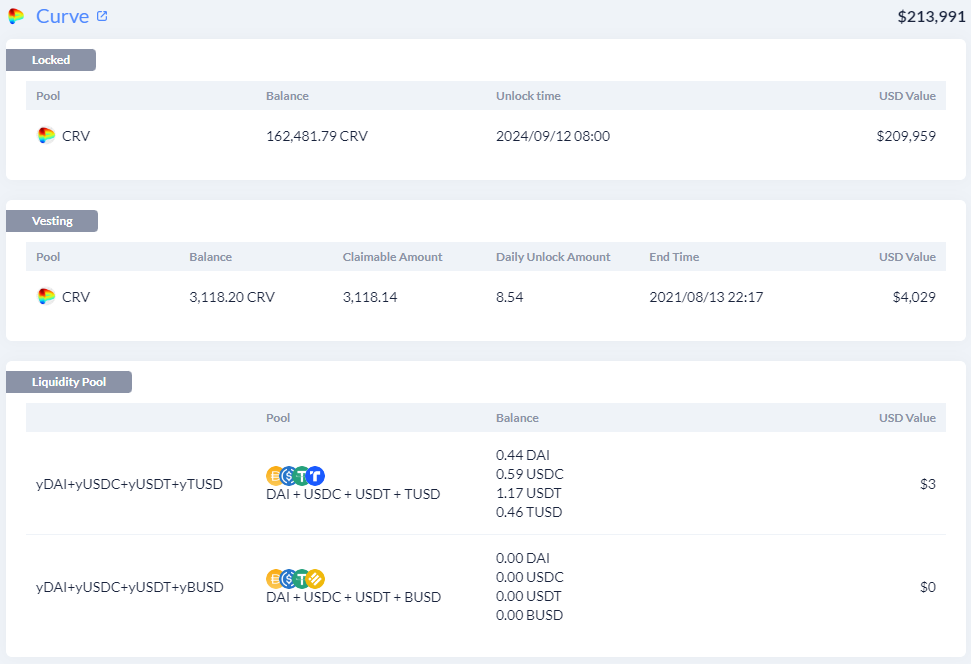

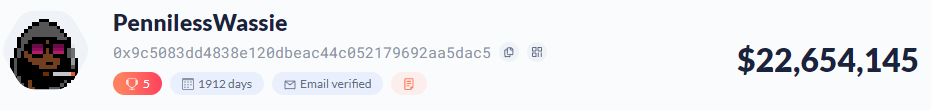

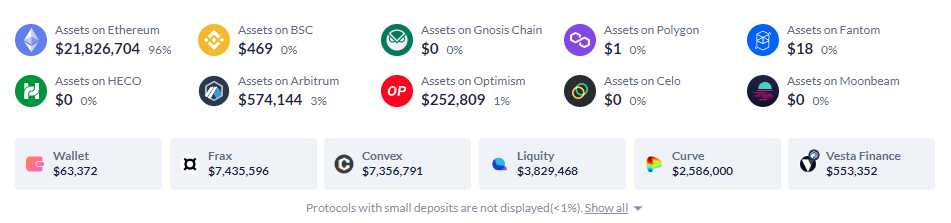

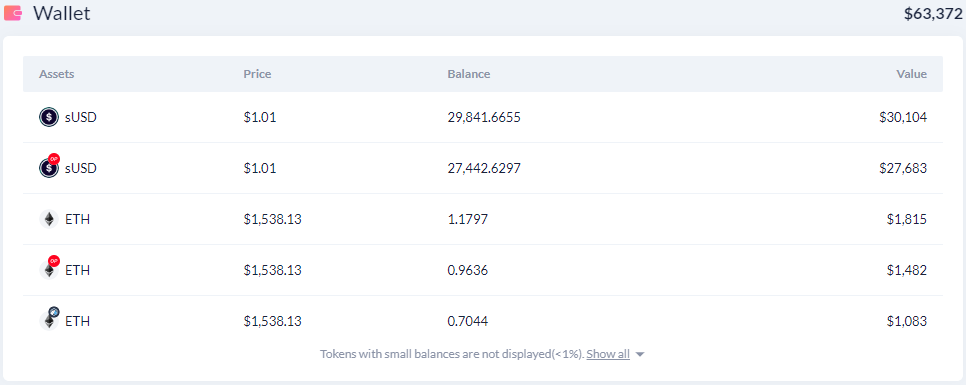

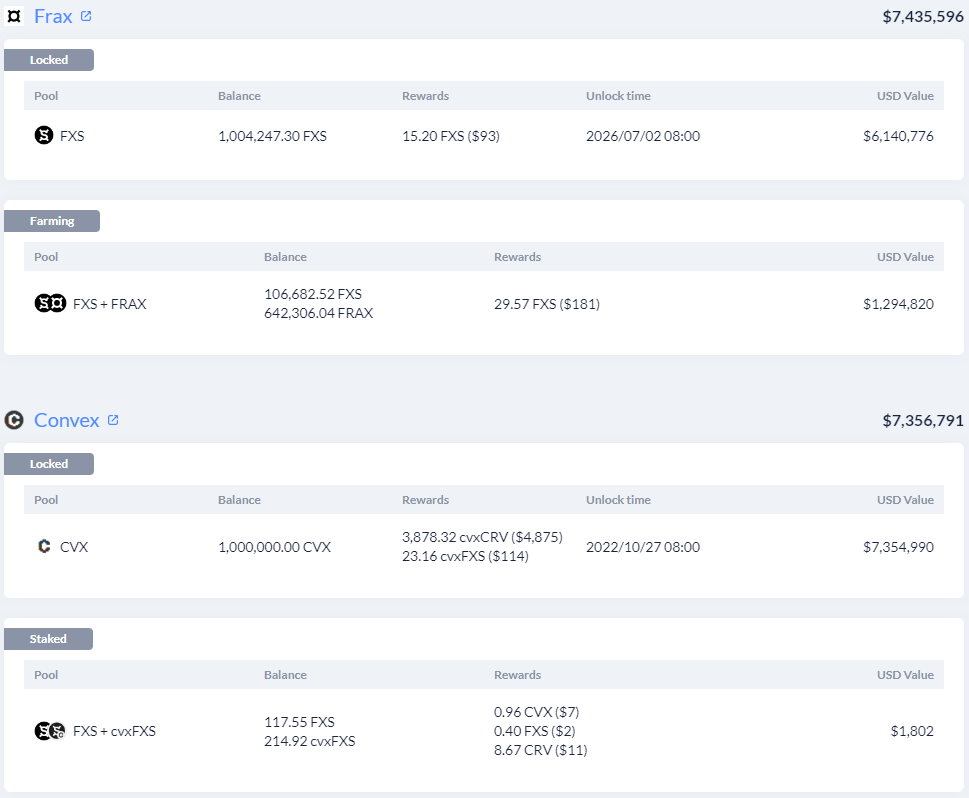

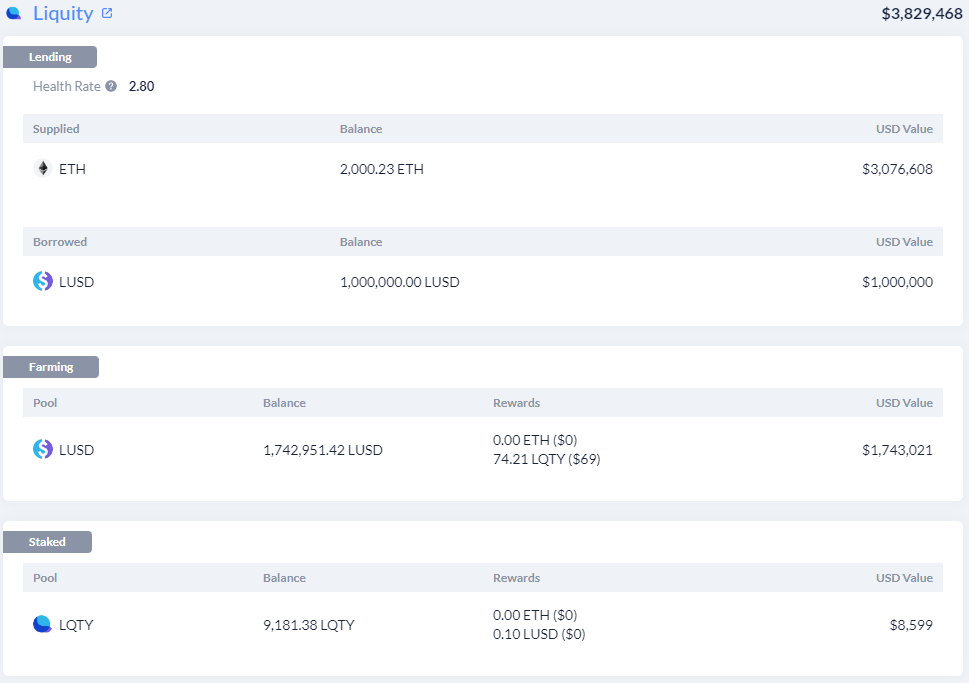

2. PennilessWassie

Chain breakdown:

Wallet Holdings – $63K

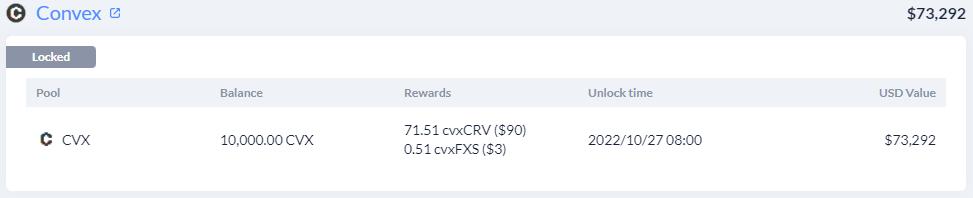

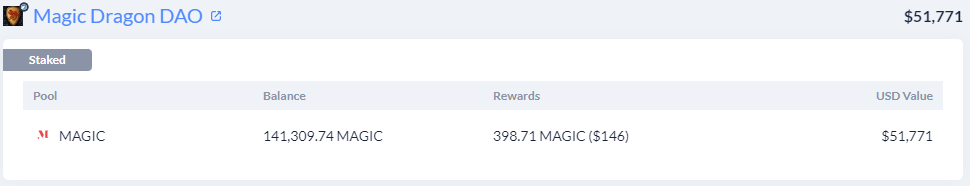

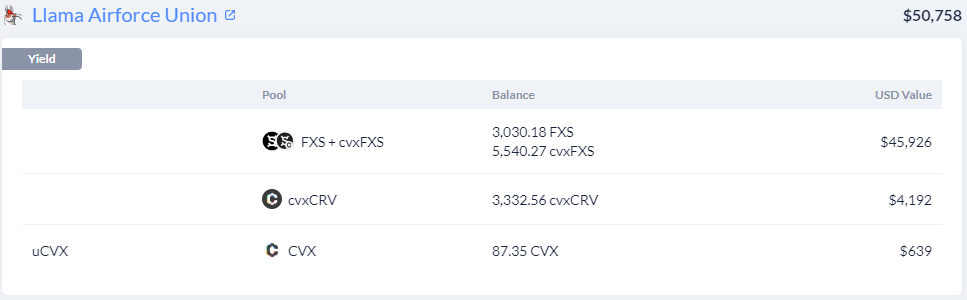

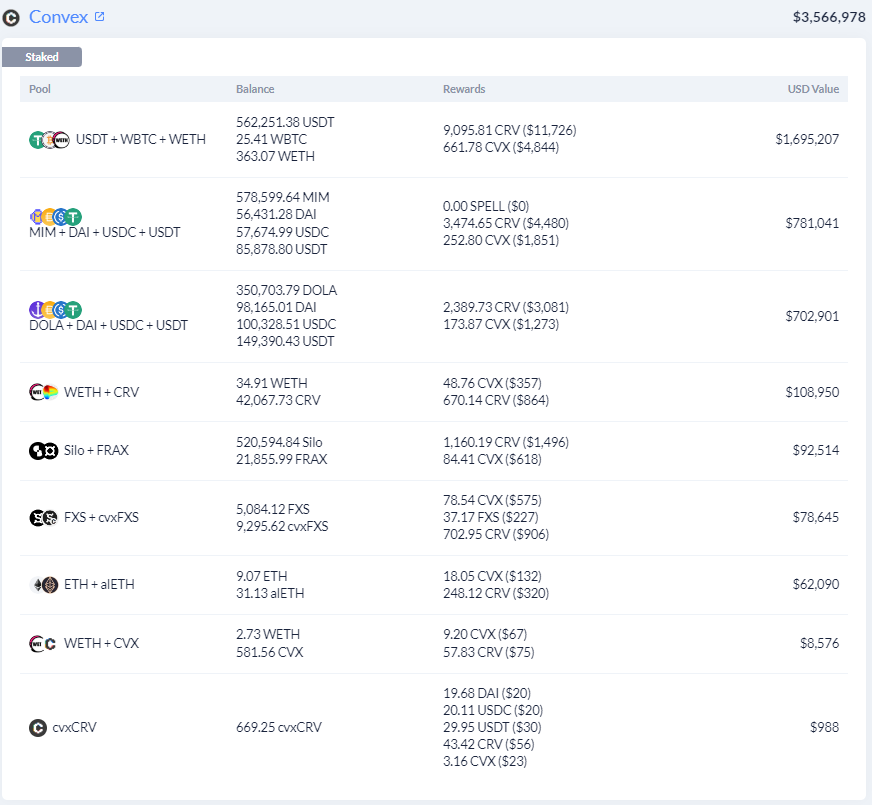

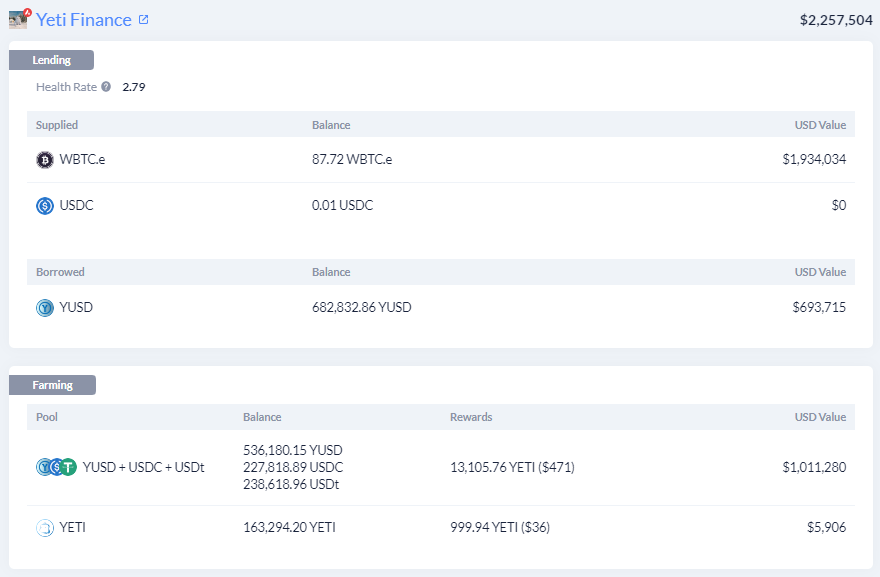

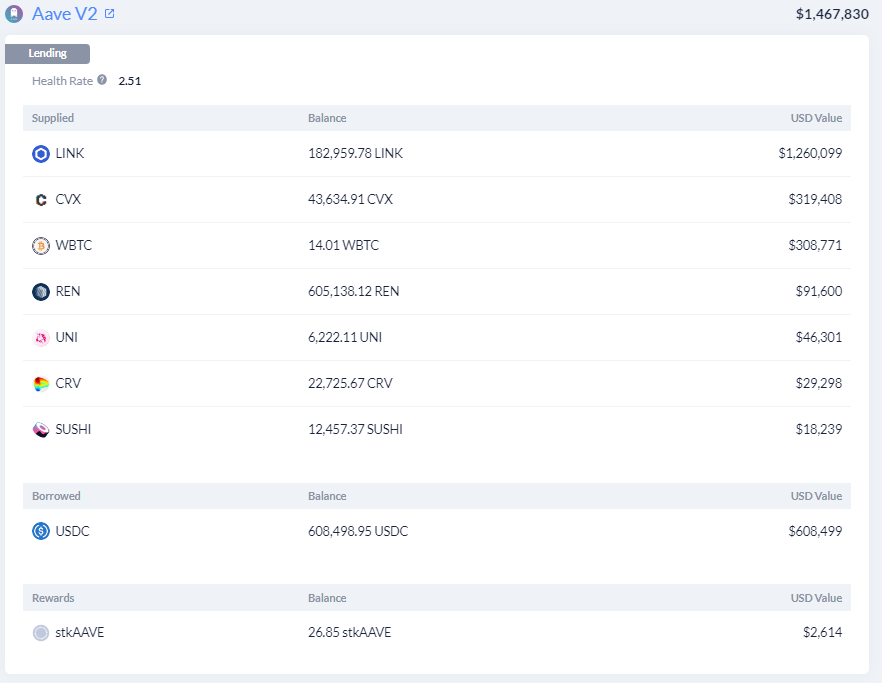

Protocol Deposits:

Takeaways:

- Primarily on ETH (96% of wallet)

- Most of the wallet is being put to work (Farming/lending)

- Heavy on Frax and Convex

- Farming stables on blue chip platforms

Debank Profile for PennilessWassie

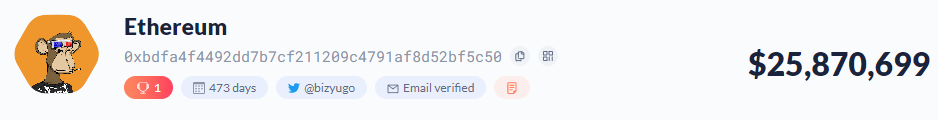

1. Ethereum

Chain breakdown:

Wallet holdings – $388K

Protocol Deposits:

Takeaways:

- Primarily on ETH (49% of wallet) & AVAX (35% of wallet)

- Large positions in a bunch of alt-coins

- Putting stables to work. Borrowing stables & farming them on various protocols

Debank Profile for Ethereum

Key takeaways

Ethereum is the chain of choice

In April, when I looked over the top 10 wallets, the chain of choice ( the chain where they’d a majority of their assets) was distributed. 6/10 wallets were primarily on ETH. But wallets had sizeable positions on different chains.

Things are looking different now, especially in the bear. Most of the wallets shifted towards accumulating ETH when sizable positions were instead on different chains back in April 2022.

Additionally, these whales have significantly increased their holdings of Arbitrum & Optimism (Layer 2 of Ethereum).

In this bear market, ETH seems to be what everyone trusts. Successful deployment of tenets may seem a viable option for whales to be holding ETH before the full roll out of ETH2.0.

Increase in Eth L2s

There was also a significant increase in ETH L2s. A lot of these whales now have positions in Optimism & Arbitrum. This is a natural investment as value accrual for L2s will go back to Ethereum.

With ETH being everyone’s pick in the bear market, it makes sense that ETH L2s are gaining more attention. Additionally, there seems to be a narrative shift overall from ETH killer L1s to ETH L2s.

Decrease popularity in Fantom

There was a significant decrease in popularity amongst the top 5 wallets. Though Miyazaki is still big on Fantom, we saw a decrease in holdings and network participation from 85% of his portfolio in April to 32% as of writing.

Stablecoins

All of the wallets have significant stablecoin holdings as seen in the large portion of each wallet holds. Stablecoins are presumed to be liquid & earn low-risk yield. This could be a sign that they are ready to deploy capital at an optimum time.

The bear market opens the opportunity for great discounts & amazing opportunities, and being liquid might be key. Whales also diversify within their stablecoin holdings, the most popular being USDC, USDT, FRAX.

Also Read: The Future Of Money; What Stablecoins Needs For Mainstream Adoption

Top Tier protocols

Most of the whales are almost solely in the top-tier deFi protocols ( Aave, Curve, etc). This is to minimize the risk of the protocol blowing up & earn some yield.

Also Read: DeFying The Bear – AAVE Launches New Stablecoin, MakerDAO Votes For $100M Loan To US Bank

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief