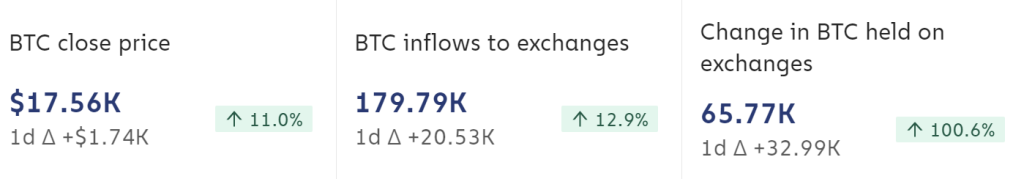

With the collapse of FTX and Alameda Research, net inflows of major cryptocurrencies to popular Centralized Exchange Binance has skyrocketed.

However, the saga has left a taint on many users. Furthermore, rumors are being spread that other major exchanges have exposure to FTX and could be in financial trouble.

I'm hearing from reliable sources that @cryptocom, @kucoincom, and several big OTC desks had huge exposure to FTX and are basically screwed

— Dmitriy (@Dmitriysz) November 11, 2022

Many have also been scarred by FTT, the native exchange token of FTX, due to its misuse by both the exchange as well as sister company Alameda Research.

With major inflows into Binance and a general, growing distrust in exchange tokens right now, let’s take a closer look at BNB, and whether it will go down a similar path as FTT.

Also Read: CZ And SBF Make Love Not War

BNB is Not Just an Exchange Token

$BNB is the native exchange token of centralized exchange (CEX) Binance. However, it also exists as the gas token for Binance’s own blockchain, the Binance Smart Chain (BSC).

Not only does it provide the typical exchange-token utilities such as lowered trading fees, it is the core token to an entire on-chain ecosystem.

Current Total Value Locked (TVL) on the BSC ecosystem stands at $5.19B, a fifth of that on Ethereum.

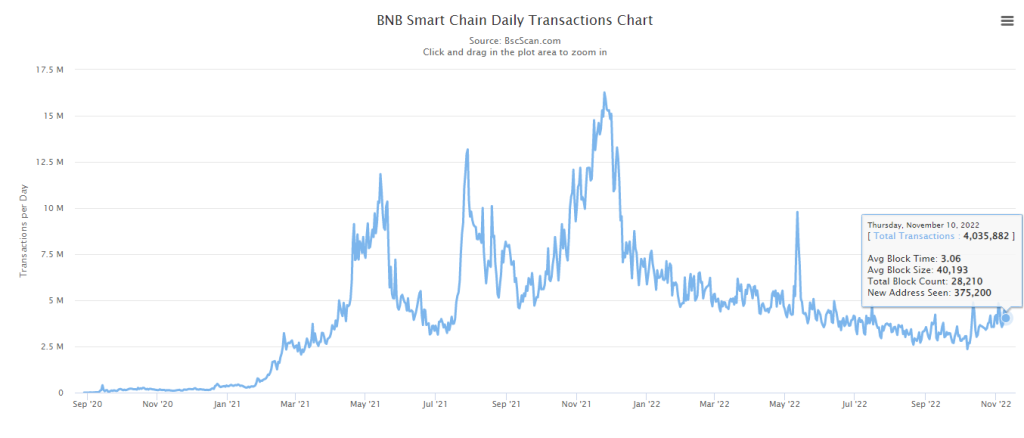

BSC also averages approximately 3 million on-chain transactions, and sees almost 300,000 new addresses daily.

BNB also allows users to access exclusive token sales on the Binance Launchpad, granting users the ability to participate in ICOs.

Even if Binance goes under, BNB will still have a use case on-chain, albeit there are close ties between the exchange and the ecosystem.

BNB is Not “Low Float, High FDV”

Before we dive in, let’s break down the terminology.

Float essentially means circulating supply, i.e. low float –> low circulating supply.

FDV, or Fully Diluted Market Cap, multiplies supply by the token’s current price, i.e. if token Z is worth $5 and there are a total of 1 million tokens, FDV would be $5 million.

If you’re still confused, we have a full read HERE.

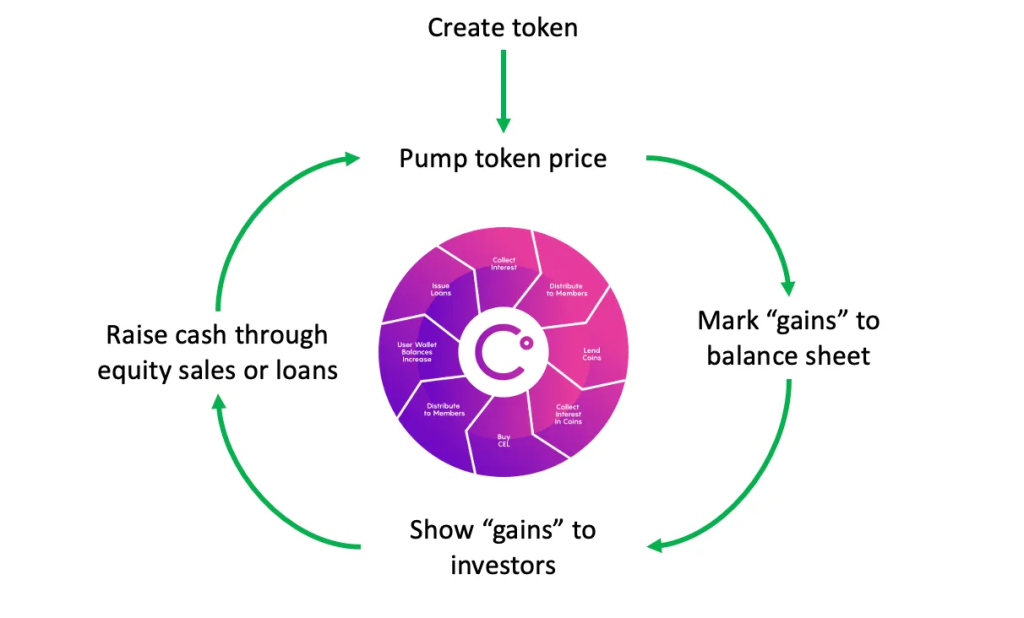

One of the major catalysts for FTX’s implosion was their ability to borrow recklessly against their FTT holdings.

While FTT is currently trading at approximately $3, it was floating around the $20 range last week. However, this does not mean that *every* token can be cashed out for $20 each.

In fact, only 38% of its total supply is currently circulating in the market, with Alameda and FTX controlling a majority of the remaining supply.

https://t.co/R8zegXKtku

— SBF (@SBF_FTX) October 3, 2022

it's that time again!

(not investment advice) pic.twitter.com/OvDA2ODv8g

By supporting FTT’s price through buybacks, it was able to prop up its own balance sheet.

This had a twofold effect, namely:

- FTX appears solvent

- Alameda is able to borrow against FTT/ not go under

However, 80% of BNB’s supply has already been released into the markets.

While the centralization of BNB is a whole other topic, not having a high FDV means that it is harder for a single entity to control prices. It also means that it is harder to inflate the valuation of BNB, and that it is trades closer to its “real” market price.

Binance is Publishing Proof of Reserves

While not directly linked to BNB’s tokenomics, Binance’s credibility establishes a lot of trust for BNB. Should Binance maintain their status as a leading exchange, confidence amongst holders will remain high.

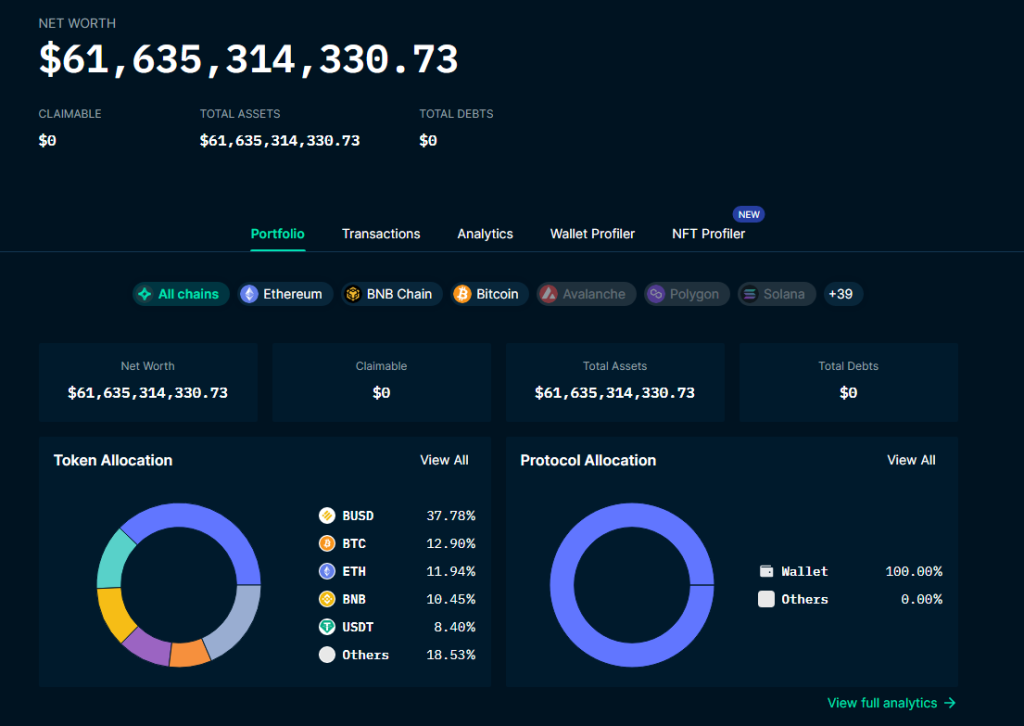

Binance and CZ have worked with Nansen to publish a full, transparent breakdown of their current allocations.

They currently have over $61B in holdings, and no debt obligations.

#Binance published cold wallet addresses and balances for 6 of our 600 coins. More to come.

— CZ 🔶 BNB (@cz_binance) November 10, 2022

475K BTC

4.8M ETH

17.6B USDT

21.7B BUSD

601M USDC

58M BNB

These were public before anyway, but organized together for your ease of viewing.https://t.co/Jm6dVoDqM5

While the exchange is still working on a full proof of reserve, they are committed to establishing transparency and trust with customers.

Data on the exchange’s main wallets were also already available for anyone to view.

This includes:

- ~456,000 BTC (~USD$8B)

- ~23 Billion BUSD

- ~5 Million ETH (~USD$7B)

- ~21 Million BNB (~USD$6B)

and more.

Closing Thoughts

The main differentiator between BNB and FTT is its use case.

Post FTX implosion, it was revealed that FTT was printed out of thin air for SBF and Alameda to borrow against, and to bolster its balance sheets.

By utilizing this flywheel, they were able to market themselves as solvent in order to continue daily operations. BNB, on the other hand, is simply being used to reap rewards on the Binance exchange and participate in the BSC ecosystem.

Furthermore, Binance has no debt, meaning it has not put up BNB as collateral to borrow against. Despite the top 100 BNB wallets holding >98% of supply, many of these are likely to be exchange wallets, which congregate individual user holdings.

While the bull case for BNB and Binance is extremely strong at this stage of the market, net exchange inflows are peaking as users seek to cash out form the crypto ecosystem. Despite this not impacting BNB directly, growing distrust in crypto translates to potentially less revenue for Binance, which could hurt their buyback programs for the token.

Also Read: Will There Be A Bank Run On FTX?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief