While the last week saw Bitcoin briefly going above $23,000 and the total cryptocurrency market capitalization finally returning to one trillion, any hopes for a continued rally are quickly being dashed.

So why has crypto slumped over the last few days, and are we in for a sub 20K Bitcoin?

Also Read: Slaying The Bear Market: 5 Skills You Need To Excel In a Crypto Downturn

Crypto Follows Tech Stocks Down Following Layoffs

It’s no secret that the cryptocurrency prices have a strong correlation with the equities market, and especially for the tech sector.

While both stocks and crypto rallied following the CPI announcements this month, long-term uncertainty over the state of the market has still remained. This has been especially true in tech stocks, which have seen a slump following massive growth during the Covid-19 lockdowns.

Crypto and stocks finally moving in tandem for the first time since FTX collapsehttps://t.co/Vol107tmoo

— Chain Debrief (@ChainDebrief) January 22, 2023

Significant layoffs in industry leaders have also contributed to a slight pullback in the technology sector. Microsoft, Amazon and Alphabet, the parent company of Google, have reduced cut 40,000 jobs cumulatively in just 2023.

Regulatory Concerns Continue To Plague Web3

While the markets quickly turned bearish following the Department of Justice’s signaling that they would take “International Crypto Enforcement Action”, it quickly retraced following the nothingburger that was Bitzalo.

However, the overarching lack of clarity that has been shown in the United States with regard to cryptocurrency regulation has been worrisome for both investors and builders in the space.

SEC charges @avi_eisen with securities manipulation of "so-called governance token MNGO"

— _gabrielShapir0 (@lex_node) January 20, 2023

with this, SEC declares war on pretty much all governance tokens https://t.co/YyUEP1yNXLhttps://t.co/id5KzZ9QK3 pic.twitter.com/sOEDV0Zq1d

Especially concerning has been the Securities and Exchange Commission declaring the governance token of Mango Markets, $MNGO, a security. This could have major implications on all cryptocurrencies that raised funds through token sales, including Ethereum.

The SEC has also charged now-bankrupt crypto lender Genesis and crypto exchange Gemini with selling unregistered securities under their Crypto “Earn” program, which many other crypto exchanges offer as well.

Although the pair did egregiously rehypothecate funds, the uncertainty regarding this ruling could cause fear in users using similar CeFi services.

While regulatory concerns could barely dent price action during the bull market, low liquidity paired with an already negative investor sentiment has shown that it is playing a larger part during the bear market.

Closing Thoughts

While the market has been sideways over the last few days, it is likely the sign of a healthy correction, where profits are taken and people are given the chance to accumulate or distribute before the next major move.

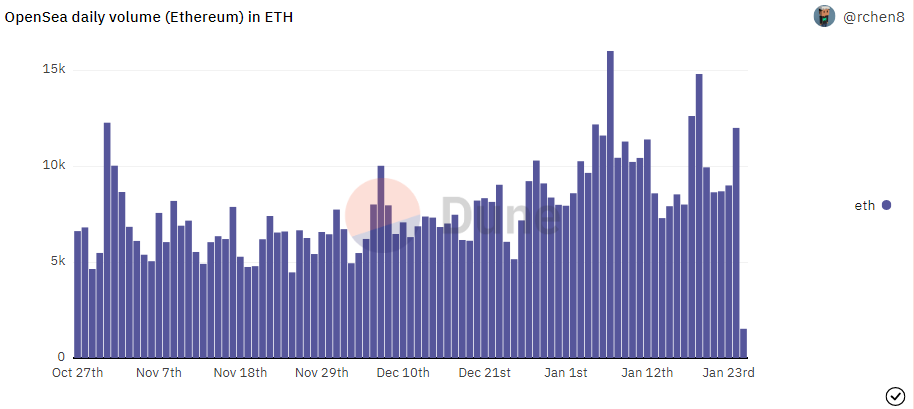

Alongside the major tokens, NFTs on OpenSea have continued their slow and steady uptrend, with a slew of exciting projects being released every day.

Gm, are you bullish or bearish this week?

— Chain Debrief (@ChainDebrief) January 25, 2023

Curious how other market participants feel? Check out our poll on Twitter to find out more!

Also Read: How To Get Started In Crypto (UPDATED 2023)

Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief