Even the most optimistic of us must admit that we are currently in the depths of a bear market. As $BTC fell more than 50% in a few months, euphoria seems far away. In the meantime, a recurring thought may pop up in many of our minds: How low can Bitcoin’s price go?

With many shifting their views immediately from 100K to 10K, it may be time to take an in-depth look at the topic.

Also Read: Is This Time Really Different? Lessons And Warnings From Previous Crypto Bear Markets

Understanding cycles

Bitcoin’s price has historically anchored around “halving events”, where miner rewards are halved. This results in three subsequent legs: bull, bear, and chop.

This model puts us near the start of the “large drawdown” phase and therefore indicates prices falling further before we find a bottom.

With the current economic situation, however, it may be good to map out three possible scenarios for $BTC, and what price action will look like in each.

Optimistic scenario

The best-case scenario is one where whales are ready to buy the dip with size, creating huge price floors. This has become even more likely with institutions and whole countries joining the space.

Central bankers and financial regulators from 44 countries enjoying their second day of talks about financial inclusion, banking the unbanked, and #Bitcoin adoption in @Bitcoinbeach and in El Salvador 🇸🇻 pic.twitter.com/OVgpwaUNyO

— Nayib Bukele (@nayibbukele) May 18, 2022

Nayib Bukele, president of El Salvador, recently hosted 44 global leaders to speak on Bitcoin. If even a few of them take the orange pill, it could easily trigger multi-billion (if not trillion) inflows into the market.

Whales 104-113 bought the 2018 bottom (within 2 weeks), the 2021 bottom (within 2 weeks), and they just bought #Bitcoin again today…

— Benjamin Cowen (@intocryptoverse) May 14, 2022

Some notable Bitcoin whales have also started buying again. This could mean that prices are attractive enough for accumulation.

Reserve risk has also entered the lower bound of the buy zone. Historically, this has resulted in outsized returns, with high investor confidence relative to price.

The optimistic scenario here is that we are close to a market cycle bottom. While it may take a while for a full bull market, Bitcoin (and even Ethereum) holders may defend current levels strongly

Pessimistic scenario

With equity markets falling sharply and the macro-outlook worsening every day, it is important to consider the worst possible scenario.

Previous cycles saw close to 90% drawdowns, and that was without a recession. While institutional adoption is often seen as good, cryptocurrencies are still a risk-on asset. Should they need to preserve capital, it is obvious what would be sold first.

Tether also recently saw US$7 billion in redemptions, which could just be the start of a crypto mass exodus. As money exits the system, there will simply be less to buy the dip with.

$BTC dominance is currently struggling, indicating there is more pain to go. In bear markets, we usually see capital flowing into $BTC from alts. Being at lows means there is possibly a “mass fear” event for alts yet to come.

Bitcoin will not bottom until $21k where Saylor gets liquidated. This is how this shit works. It’s already written

— Not Jerome Powell (@alifarhat79) May 14, 2022

As price action continues to mirror tech stocks, a macro risk-off environment could lead to further capitulation. If we do get an 80% drawdown from the highs, 15K $BTC or lower could be a reality.

Most likely scenario

$BTC has never traded below a previous cycle’s all-time highs. With the previous run reaching US$20,000, it is likely we test those levels eventually, but not go under.

$ETH dominance is also climbing. This indicates not only a healthier market, but combined with $BTC dominance, a bottom may be close.

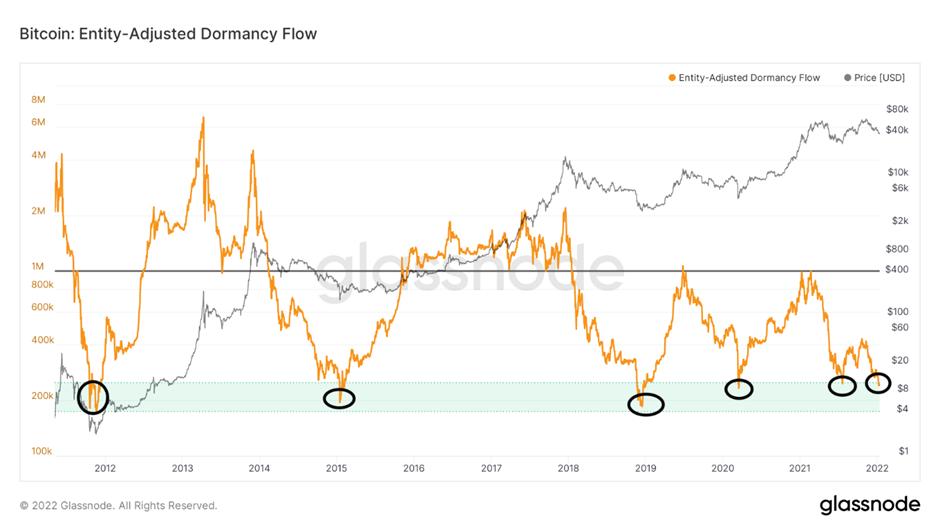

Most major models also indicate that we are currently at the upper bounds of generational buying opportunities.

Unless a full-blown market crash occurs, we probably see a grind down to mid or low US$20,000 until the next cycle.

Be greedy when others are fearful

I call this chart "we are still early".

— Willy Woo (@woonomic) May 5, 2022

Hodling for 4 years, BTC has always outperformed every other asset class. ALWAYS. Zooming out, things become clear.

When the blue trace moves into the cluster of the other assets, #Bitcoin will have matured. pic.twitter.com/56AklFf1DD

While it may not be the exact bottom, buying at these levels is extremely attractive as a long-term investor. Despite the general fear perpetrating the markets, having a plan and sticking to it will help you stay clear-headed in these conditions.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Also Read: Will Andre Cronje Bring Fantom Back From The Dead?

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!