Key Takeaways:

- Quant Networks uses their “Overledger” platforms for universal enterprise interoperability

- mDapps are used for horizontal scalability, allowing users to make transactions across multiple ledgers simultaneously

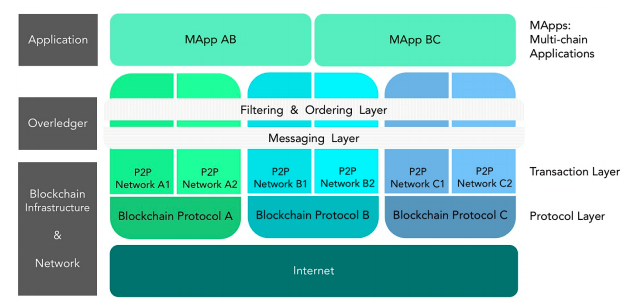

- To do so, the network leverages 4 main layers, namely Transactions, Messaging, Filtering & Ordering, and the Application Layers

___________________________________________

Ever since Bitcoin was invented in 2009, more than 10,000 different cryptocurrencies have been launched on different blockchains.

Although many improvements have been made, and each serves to achieve something different, they are still plagued by a number of issues.

One that’s frequently mentioned is the lack of interoperability between blockchains.

Every blockchain is built differently, which understandably impedes interoperability and compatibility between different networks. These blockchains are unable to share information and data amongst themselves unless they undergo a process that is tedious as it consumes time, energy and other resources.

Lack of interoperability is one of the biggest concerns to the mass adoption of cryptocurrencies around the world. With sanctions and clampdowns by many nations triggering skepticism, it’s only natural for investors to want an answer.

Enter Quant Network. In this article, we take a look at Quant and get a bit technical to evaluate its relevance to the crypto landscape.

Also Read: How This Network Uses “Proof-of-Meme” To Bridge Web3.0 With Real Businesses

What is Quant Network?

Quant Network was founded in 2015 by Gilbert Verdian, with its native token, $QNT, launching shortly afterwards.

From an idea in PowerPoint in 2013 to “overlay” different blockchains to interoperate, to establishing the ISO Standard TC307 & incorporating in 2015 and to today.

— Gilbert Verdian (@gverdian) September 28, 2021

Feel so proud of our company and team, doing our bit to help shape the world’s future infrastructure. Congrats! 🥂 https://t.co/MiAehaSbgN

Stemming from an immense passion for making the global exchange of information more efficient, Quant protocol was born. While working for the UK and Australian governments, Verdian identified a specific problem and discovered how useful Distributed Ledger Technologies (DLT) could be in solving the problems he was facing.

The Quant Network’s Overledger platform is a form of DLT designed for universal enterprise interoperability.

This enterprise blockchain platform envisions itself as a decentralized “network of networks” that can infuse existing enterprise technology with decentralized elements. By interconnecting private and public data while maintaining the security and speed required by global enterprise organizations, Quant expects to contribute to the development of a fairer and more transparent global financial system, while providing a whole new layer of value and utility for legacy organizations.

One of the ultimate goals of the Quant platform is to provide seamless interoperation such that the fractured world of ledger technology is evenly distributed. As a result, the Quant protocol is often referred to as an “operating system/software that connects all blockchains.”

How does Overledger work?

To remove the communication barriers between blockchains and support for the use of MApps as dApps running on multiple different ledgers, the Overledger team designed an architecture which enabled support for both interoperability and scaling.

To achieve this, the developers decided that organizing it based on the layers which perform individual tasks they are best suited to is the best way to achieve the platform’s goals, leaving the Overledger with the following components:

Transaction Layer: This layer handles the storage of transactions using ledger technology. It is home to all operations which are required to reach the consensus in several blockchain domains.

This process is made simpler by placing all of the related operations in a single layer. Yet, the scope of transactions made on a specific blockchain is limited to that domain, meaning that they cannot be made valid in other ledgers as well. This is why this layer is made up of both varied and isolated ledgers.

Messaging Layer: This logical layer tackles all information retrieved from the ledgers which are deemed relevant. Types of information involved include smart contract data, metadata and transaction data.

When it comes to metadata, the strings which are added usually represent the digest of out-of-chain messages which can be interpreted as the payload. This layer is also used for the storage of all transaction information and the digests of the messaging between multiple applications.

Filtering and Ordering Layer: This layer also handles messages, particularly those which are extracted and composed of the transaction information.

Messages referenced in the transaction via a hash which is exchanged out-of-chain undergo ordering and filtering. In addition to this, this layer is tasked with establishing connections between messages originating in the Messaging Layer.

This layer also validates out-of-chain messages for the metadata. The validation engine checks the application requirements which can be defined on the transaction data. For instance, an application in question can be set to accept only transactions involving a particular address or it may need payment in tokens which are to be transferred.

Based on the filtering done on this layer, the applications can take into account only the messages that involve transferring a predefined amount of tokens to a specific address.

Application Layer: Messages deemed valid based on having the required format and signatures can update the state of application relevant to them.

Various applications can share identical messages or make references to messages related to other applications. These references use one-of-the-kind hash pointers referring to the ledger transactions with the message digest.

These pointers essentially refer back to the storage location of a particular cryptographic hash. They also function as identifiers which can be used to pick out a transaction from a database and confirm its unchanged status.

Overledger DLT Gateway

The Overledger DLT Gateway is a communications protocol that sits on top of various types of distributed ledgers. The protocol is used without interacting with ledgers on any application level.

This means using the Overledger DLT Gateway does not create the need for consensus or fork requirements. The Gateway operates with no single-point-of-failure and without bottlenecking transactions.

Quant’s Overledger DLT Gateway can interact with multiple ledgers simultaneously allowing future-proof scalability for decentralized applications (dApps) and multi-DLT applications (mDapps).

Multi-DLT applications (mDapps)

Decentralized applications (dApps) are internet applications built using Web3 infrastructure.

The nature of these applications is decentralization, with no central governing party or single-point-of-failure. When referencing dApps, it generally infers the use of blockchain technology. The dApps are operating across a distributed network of nodes with transactions and data stored immutably on a single blockchain.

However, multi-DLT applications (mDapps) not only use blockchain technology but also implement various other types of DLT too.

While dApps are limited to a single chain or network, mDapps can facilitate transactions across multiple ledgers simultaneously. mDapps create a standardized application model allowing interoperability with multiple DLTs.

Moreover, with Quant’s Overledger DLT Gateway, developers can write their smart contracts in any programming language on any type of DLT including those that do not support smart contracts natively.

mDapps were designed to offer horizontal scaling for enterprise-ready distributed ledger solutions.

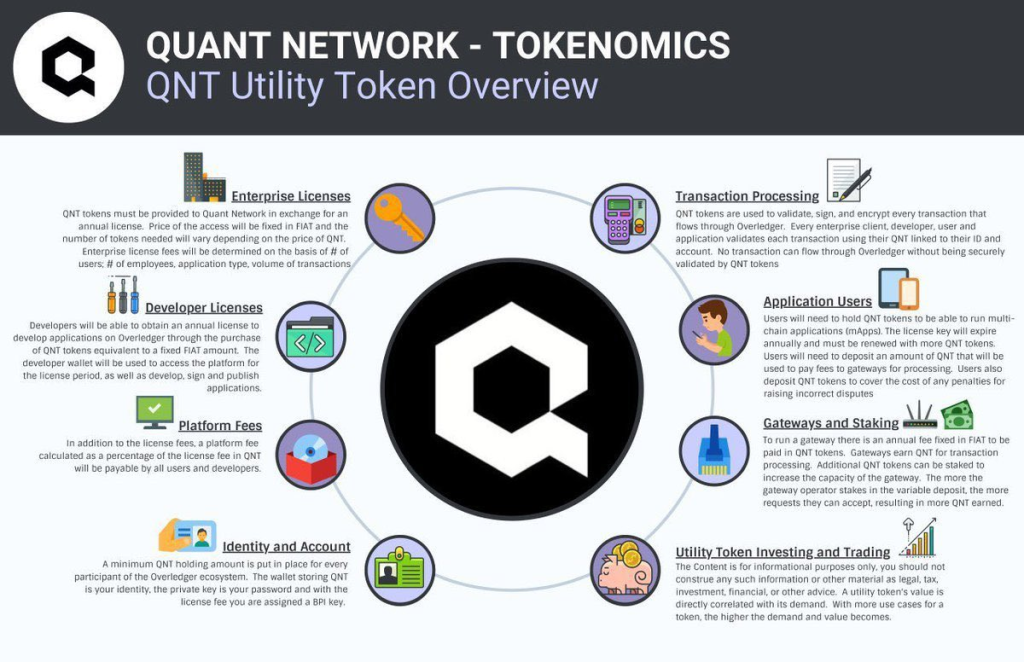

Quant ($QNT) Tokenomics

Now that’s way too much technical information and perhaps it is time to move on to everyone’s favourite topic – Quant’s token $QNT. Here are some data for $QNT:

- Market Cap: $2.6 billion

- Fully Diluted Market Cap: $3 billion

- Circulating Supply: 14.5 billion $QNT

- Maximum Supply: 14.6 billion $QNT

- Total Supply: 14.6 billion $QNT

$QNT is native to the Ethereum blockchain and is an ERC-20 standard token. $QNT is required for any developer that wishes to build on the Overledger platform. Developers use fiat money to pay for licenses to use Quant Network’s services. Then, Quant Treasury sets aside an amount of $QNT equal to the value paid by developers, which will be locked for 12 months.

$QNT is also used in a similar way by Overledger clients to pay for read and write activity and transferring assets across chains and DLT systems.

Similarly, fiat money is paid in exchange for $QNT. However, unlike when paying for licenses, paying for read and write activities does not require users to lock up their $QNT.

To gain access to the Quant ecosystem and interact with Overledger, users must hold an amount of $QNT. This is because the QNT token was designed to facilitate the creation, use of, and access to multi-chain applications (mApps) across the Quant network.

Conclusion

Is $QNT a buy right now? I would say not exactly but definitely one that will flourish in the future. If your investment horizon is beyond 5 years, it would be wise to pick up some now in my opinion.

To wrap this article up, I’ll leave you with a tweet that could hopefully help you understand Quant Network better if you are still confused.

$QNT.

— FF_CryptBros (@FF_CryptBros) October 22, 2022

Interoperability is the one main thing that’s holding us back from mass adoption.. $QNT can connect ANY legacy system with blockchain with just 3 lines of code..$QNT will connect everything..

By the time people realise how big @quant_network is, it will be too late. pic.twitter.com/VNaH7fiqiY

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Here Are The Top 10 Free Crypto Tools You Need To Have