One of the biggest draws of crypto and blockchain is the ability for anyone to be part of the decentralized world, as there is no central governing body or single entity regulating the space.

But that is also a push factor — the crypto space is full of bad actors that want nothing other than deceiving or scamming newcomers who are unaware of the risks associated with the plethora of crypto protocols promising asymmetrical returns.

Known as “rugpulls”, it is common for crypto developers masked behind anonymity to abandon a project and run away with investors’ funds.

Rug pulls are also common in NFT projects, and unfortunately, I fell prey to one such scheme as I did not do my proper research, and was blinded by the hype of NFTs and the hopes of making quick returns on my NFT purchases.

Project background

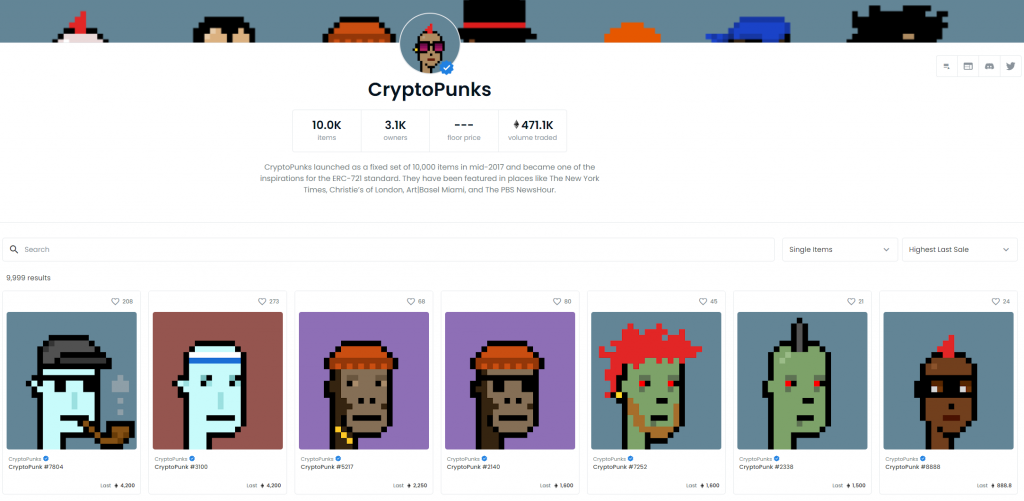

Two of the most successful NFT projects are the CryptoPunks and the Bored Ape collection, and both projects command high floor prices from any collectors looking to be part of the prestigious collectors club.

Both collections also have a limited number of 10,000 NFTs.

The cost to mint these collections were only a fraction of what they are worth now, and hence digital assets collectors are scrambling to hunt for the next 100x NFT collection.

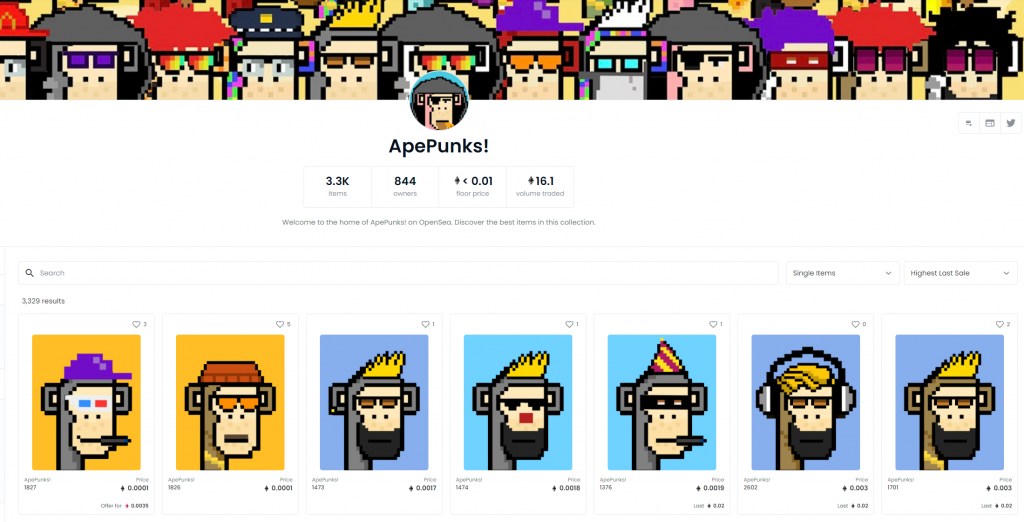

So, when the opportunity to mint a new ApePunks NFT collection came, I jumped on it without hesitation. The NFT collection only has 3,333 available NFTs, and combines the popularity of 2 of the best performing NFT collections.

Clouded by the potential of the project selling out in hours, I minted the NFTs without any hesitation, and felt smart and proud that I was now part of the cool NFT world.

Here’s a look at the NFTs that I managed to mint:

All I had to do was wait for the project to sell out and for the collection to hit 100 ETH each, and I thought I would be set for life.

Except it didn’t.

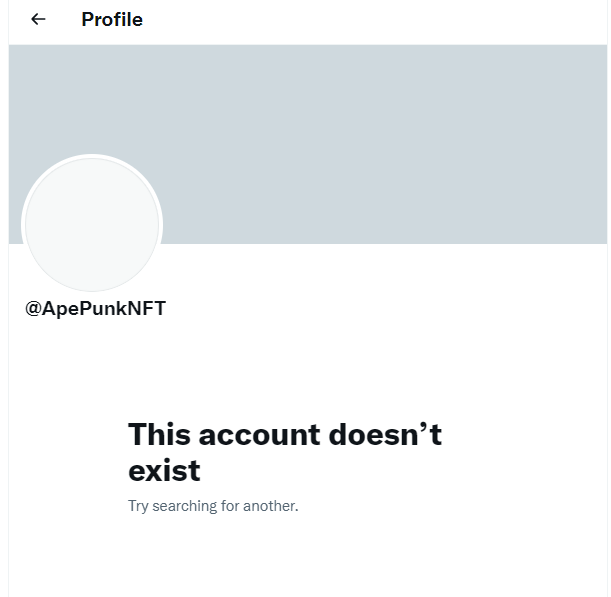

While checking the collection on OpenSea three days after it was launched, I found out that there was no one interested in the project. I was then notified by a fellow owner of the NFT collection that the website had disappeared, and the twitter account was no longer available.

It then hit me – I was rugpulled.

Without the team and community behind it, essentially what was left were computer generated JPEGs that are truly worthless.

The floor price of the collection hit rock bottom and there is probably close to zero chance of us getting any money back.

What I learnt

While it has been said to death, one of the biggest takeaways I got from this experience is that one needs to do proper research before buying any digital assets.

Here are some traits of an NFT project that you should consider before investing in it:

- Scarcity – how many NFTs are available for minting?

- Community – who is involved in the community championing the collection?

- Quality – is the collection generated by a computer or hand drawn? How much effort is being put into the work?

- Future roadmap – what future plans are there for the NFT holders?

Looking back, the ApePunks collection had only scarcity – 3,333 available as opposed to 10,000 NFTs like what the popular NFT collections offer. It did not have any community (no discord channels), no quality (artwork randomly generated by computer), nor did it have any future roadmaps.

For anyone looking to purchase your first NFT, do perform your due diligence and do not be a degen like me.

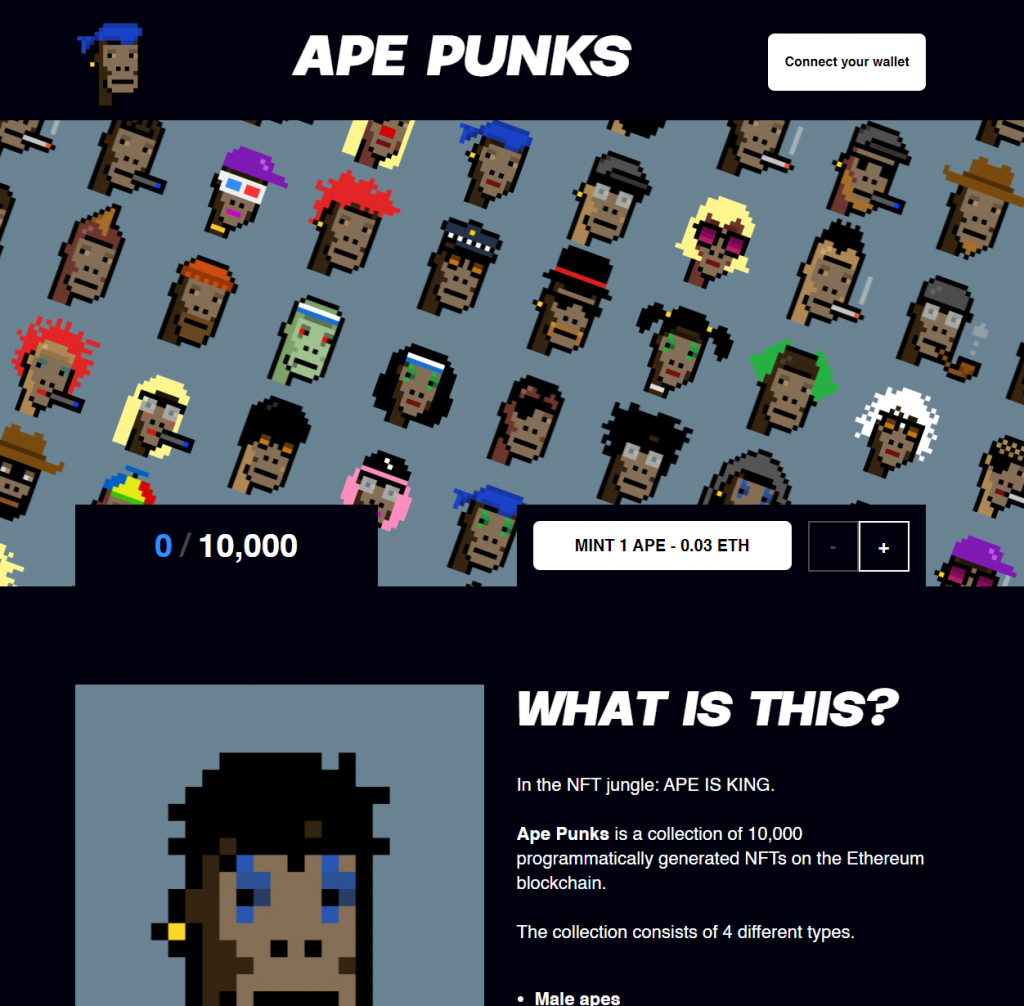

Also, interestingly enough, there is a similar Ape Punk NFT collection available for minting now, which is an exact copy of the rugged ApePunks collection that I fell prey to. Here’s the live website:

While the team behind this project claimed that they are not the same team behind the rugged NFT collection, the similarities are uncanny.

At the time of writing, 3 days after the NFTs was made available for minting, a total of 1252 ApePunks were minted out of the total collection of 10000.

1 APE PUNK just minted!

— APE PUNKS (@apepunksnft) September 4, 2021

1,252/10,000https://t.co/lHOS6J6aQZ

????https://t.co/y6NyN4scvv pic.twitter.com/mLlFP8jt0z

Let’s see if they will still be around a few weeks later.

Featured Image Credit: The Chain Bulletin

Also Read: I Minted NFTs For The First Time: Here’s What I Learnt

Chain Debrief is a new Singapore publication dedicated to cryptocurrency and blockchain content. Follow us on Facebook, Instagram and Twitter for more stories like this.