NFTs have been a popular choice by both retail and institutions for hedging, especially with the recent crypto sideways market.

Many blockchains have also been developing a diverse and robust ecosystem. By far, while ecosystems like Solana have been impressive, Ethereum has still been the largest blockchain with the highest number of projects and users.

Similar to most DeFi sectors, the NFT sector has always faced the problem of scalability. Gas fees are also exceptionally high. For example, OpenSea guzzles up most of ETH gas fees.

Immutable X is a solution for this issue by offering an ideal place to deploy NFTs as an L2 of Ethereum. In this article, let’s dive into what you need to know about IMX.

What exactly is Immutable X (IMX)?

IMX is positioned as the first layer two scaling solution for NFTs on Ethereum. Its blockchain is supposed to remove Ethereum’s limitations, such as low scalability, poor user experience, illiquidity, and slow developer experiences.

Users benefit from instant trading with zero gas fees for minting and trading NFTs without compromising the user or the asset’s security.

Thanks to this revolutionary technology, users can create and distribute assets on a massive scale. Their vision is to create a world-class experience for both users and developers. IMX also has several core components, enabling projects to be built on Layer 2 Ethereum with fantastic developer and user experience. These include:

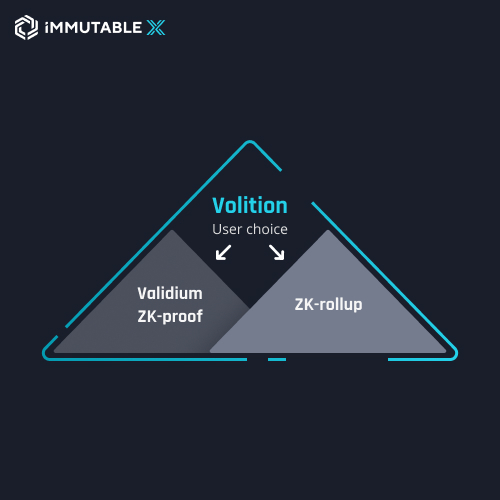

ZK-Rollup scaling engine — IMX benefits from being one of the first layer two that utilize ZK-rollups and focus exclusively on NFTs. IMX combines NFT-specific exchanges and proof logic alongside technology developed by StarkWare.

Rollups allow for extensive scalability and excellent user experience while retaining the robust security of Ethereum. This is done by batching large numbers of transactions to generate validity and submitting them to an L1 smart contract.

IMX is expected to allow more than 9000 TPS for NFTs and exceed the scale that mainstream NFT projects require. This helps to reduce the overload of a network and the excessive fees wasted in those gas wars.

Also Read: Optimistic VS Zero-Knowledge (ZK) Rollups Explained: What Are They And How Do They Work?

API abstraction layer — For accessible building of NFT applications, IMX wraps the scaling engine in a set of REST APIs. Every interaction is as simple as an API call.

This makes it optional for developers to interact directly with smear contracts. This is incredibly beneficial for new entrants, such as established gaming and content companies, who can launch projects better and faster.

NFT-enabled wallets — IMX also supports all types of Ethereum wallets and does not force the user to switch networks.

An intermediate layer is provided, which is known as the “Link”, and enables an NFT-specific wallet experience. IMX can also support a third-party marketplace ecosystem without posing a security risk.

Platform SDKs — Software Development Kits allow partners to integrate with IMX easily. For example, a Typescript SDK is currently available to incorporate the protocols into websites.

In the future, SDKs will support all common programming languages and development platforms such as Android, iOS, Unity and many others. These, combined with APIs, create an efficient and effective way to build NFT projects.

Shared Liquidity and Orderbook — IMX provides a shared global order book for protocol liquidity. Orders created can be filled in cross-market economies, which promotes effective bootstrapping and price discovery. This allows NFT marketplaces also to be built without a backend.

IMX token utility, emission and supply

Fees — 20% of the IMX protocol fee is paid in IMX tokens. This fee can be delivered directly in IMX, or IMX will swap the actual purchase currency for IMX on the open economy. Users do not explicitly have to hold IMX tokens to be able to transact on the protocol.

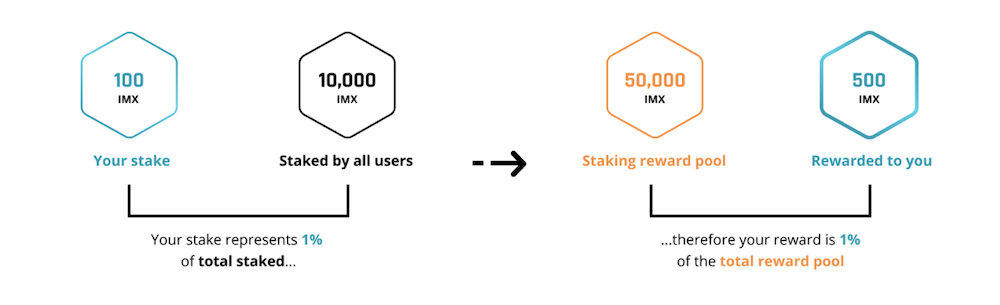

Staking — IMX tokens received as part of the fee capture mechanism will be sent to a pool. At regularly monthly intervals, this pool is distributed proportionally to all active stakes. There are also a few requirements for your IMX to be considered staked, and these include:

- Holding IMX on L1 or L2 scaling solution

- Voted on a governance protocol at least within the last 30 days

- Either hold an NFT on IMX or complete a trade in the previous 30 days

Rewards are variable and are dependent on protocol governance. In addition, users must have an L2 linked to their L1 wallet as rewards are distributed on L2.

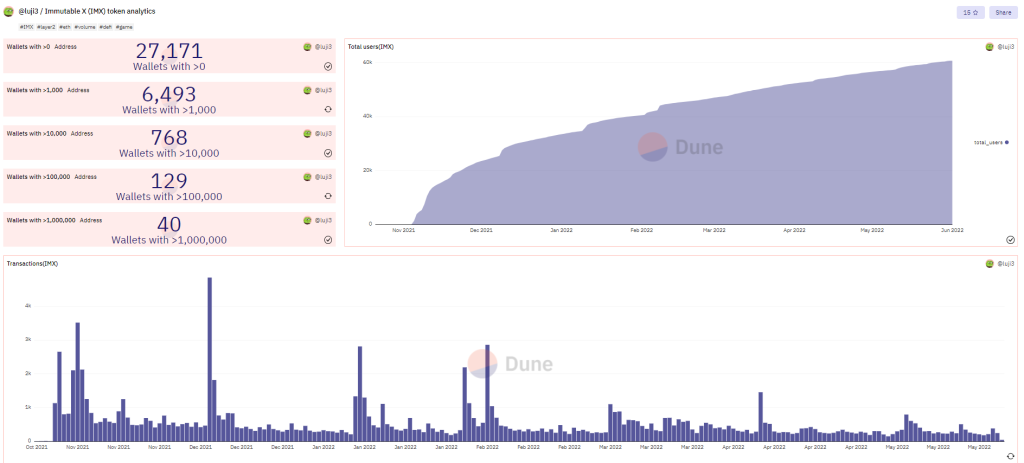

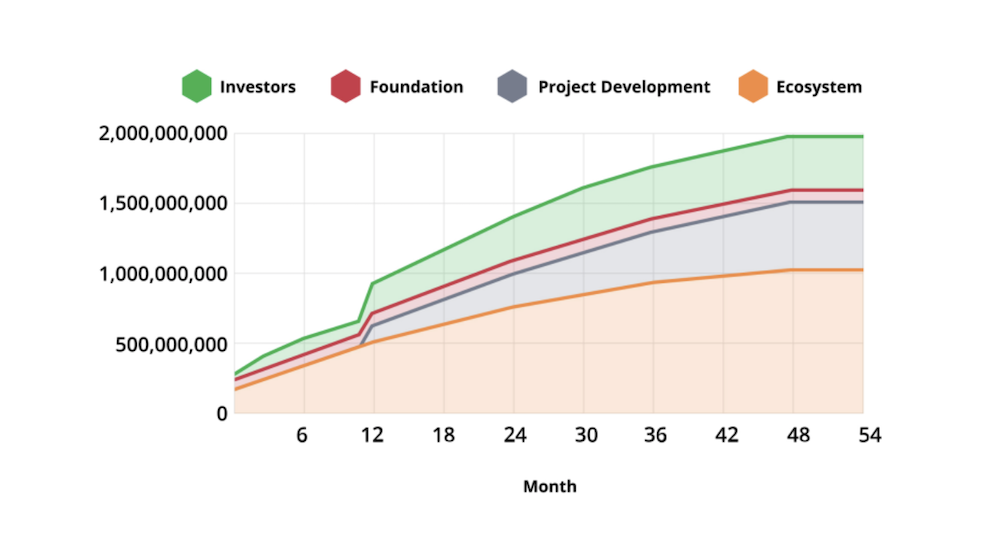

The circulating supply of IMX is also designed in a way to incentivize long-term growth and sustainability. The anticipated rate is shown below.

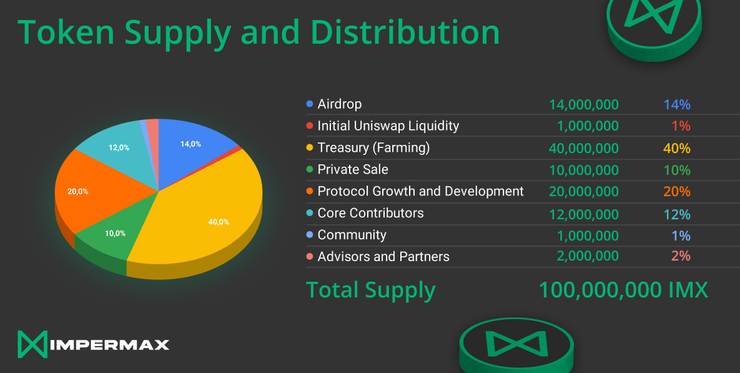

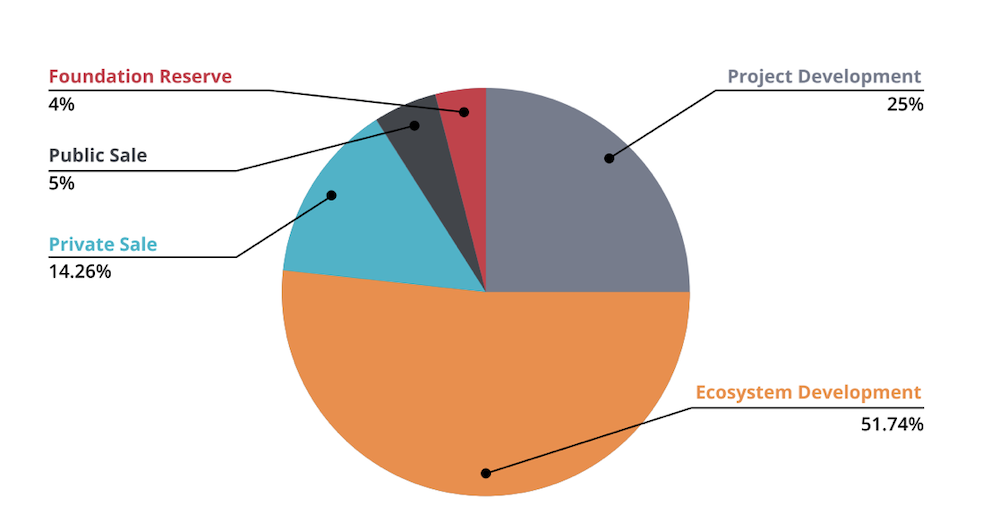

There are a total of 2,000,000,000 IMX tokens allocated in the following areas:

This is, however subject to modification and may change at a later date. Under ecosystem development, these funds are rewarded to those who conduct pro-network activities on IMX. This fund consists of two main initiatives:

Daily rewards — Users can earn points by doing activities such as trading, depositing and minting assets. Every 24 hours, the IMX rewards pool will be distributed to users based on their proportional share. 2/3 of it is subject to linear locking for six months to incentivize long-term growth.

Developer grants — Developer grants are also given to parties keen to develop on IMX. They are expected to deliver in certain milestones to ensure that developers contribute to the protocol. Some funds are allocated directly by the Foundation, and some are via decentralized governance.

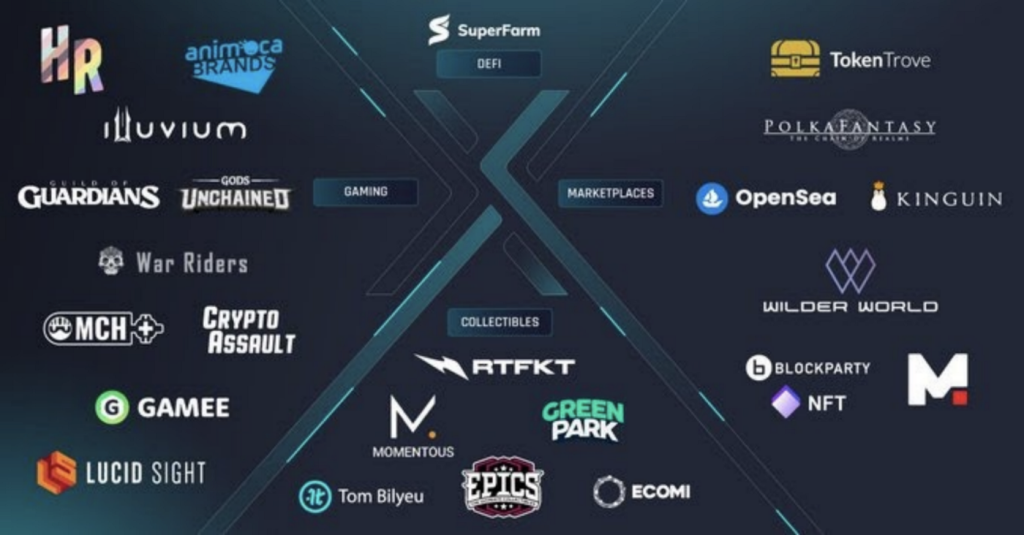

Ecosystem

IMX team

The IMX team has two very successful Forbes 30 Under 30 entrepreneurs. CEO James Ferguson previously led a software development team at a billion-dollar e-commerce company.

The team also comprises more than 100 members from varying expertise and backgrounds in finance, fin-tech and management consulting. In 2018, it raised a seed round and a US$15 million Series A in 2019 September. Its leading investors include prominent companies of:

- Prosus Ventures (formerly Naspers Ventures)

- Galaxy Digital

- Coinbase

- Apex Capital Partners

- Nirvana Capital

- Continue Capital

Is IMX a good investment?

IMX is undoubtedly something that has piqued many’s interests, especially given the current hype of the NFT market during the NFT boom.

This price is attributed to some of the most popular NFT collections including those like Bored Ape Yacht Club (BAYC) and its sisters collections like Mutant Ape Yacht Club. (MAYC)

However, we do not know if NFTs hype will last forever. Likewise, the hype could still continue thanks to many other new L1 blockchains such as Terra and NEAR, and there is still a huge increase in NFT projects. NFTs have also seen interesting developments like interactive NFTs and utility NFTs, creating a demand for NFTs by creating a practical use case instead of just a jpg.

IMX’s scaling mechanism could be something paramount for NFT expansion. Ethereum has also prioritized centralization over short-term scalability upgrades and has since suffered from problematic gas fee spikes and network congestion. IMX could be the solution to that thanks to its unique mechanism.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Immutable X

Also Read: Here’s A Step-By-Step Guide On How to Mint Your Very First NFT