Even for the financially savvy individuals, getting started with cryptocurrency can be a daunting task, especially with news of people losing millions to scam projects. Another challenge when getting started with cryptocurrency investment is deciding which project to invest in, when there are more than 10,000 coins available on the market.

To solve that problem, you can choose to invest in a crypto index fund, similar to how you would invest in an exchange traded fund (ETF) such as the S&P 500.

A crypto index fund basically helps you invest into a basket of top cryptocurrencies, taking away the workload required to filter and manage an ever growing basket of cryptocurrencies. A crypto index fund also allows you to spread your investment over a larger number of assets, thereby reducing concentration risk for you.

Index Coop is one such crypto index fund that you can look at. Here’s a look at the various indexes available for you to invest in on Index Coop:

1. DeFi Pulse Index

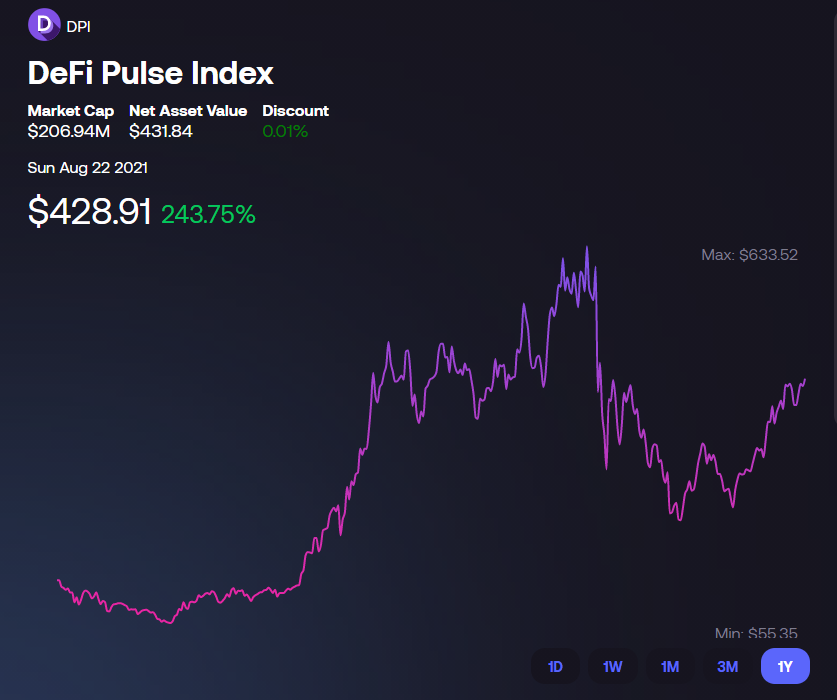

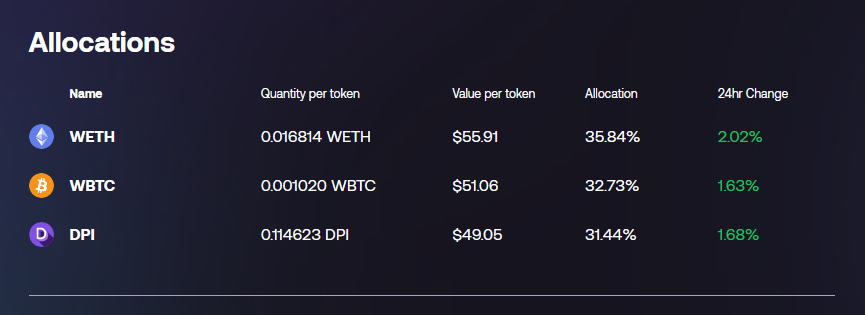

The first index you can invest in is the DeFi Pulse Index (DPI). The DPI tracks the performance of top DeFi projects, including Uniswap, Aave, Maker, Sushiswap and more. Basically, buying a unit of DPI token is equivalent to holdings all these cryptocurrencies.

Here’s the breakdown of the allocation.

The one year return for the DPI index is 243% at the time of writing.

2. Metaverse Index

The second index you can invest in is the Metaverse Index. The index is designed to capture the trend of entertainment, sports and businesses shifting to take place in virtual environments. Some of the projects under this index includes Axie Infinity, Enjin, Audio, Rarible and more.

Here’s the breakdown of the allocation:

The one year return for the Metaverse Index is 29%.

3. Bankless BED Index

Another interesting index is the BED index. Proposed by the Bankless community, the BED index basically allocates 33% of its allocation to Bitcoin, Ethereum and the DeFi (DPI) Index so that investors have additional exposure to Ethereum and Bitcoin.

This might be interesting to investors looking for exposure to the most promising use cases and themes in crypto: store of value (bitcoin), programmable money (ethereum), and decentralized finance.

The BED index is only launched a month ago, and its return to day is 68%.

Other uses of the Index Coop tokens

Beyond just holding these index tokens, you are also able to perform a variety of functions with them. On Index Coop, you are able to lend out your DPI tokens, earn yield on your DPI tokens by providing liquidity in liquidity pools, lend out your DPI token to other investors and earn and interest rate on it, buying and selling put and call options on these tokens.

How to buy your first crypto index fund on Index Coop

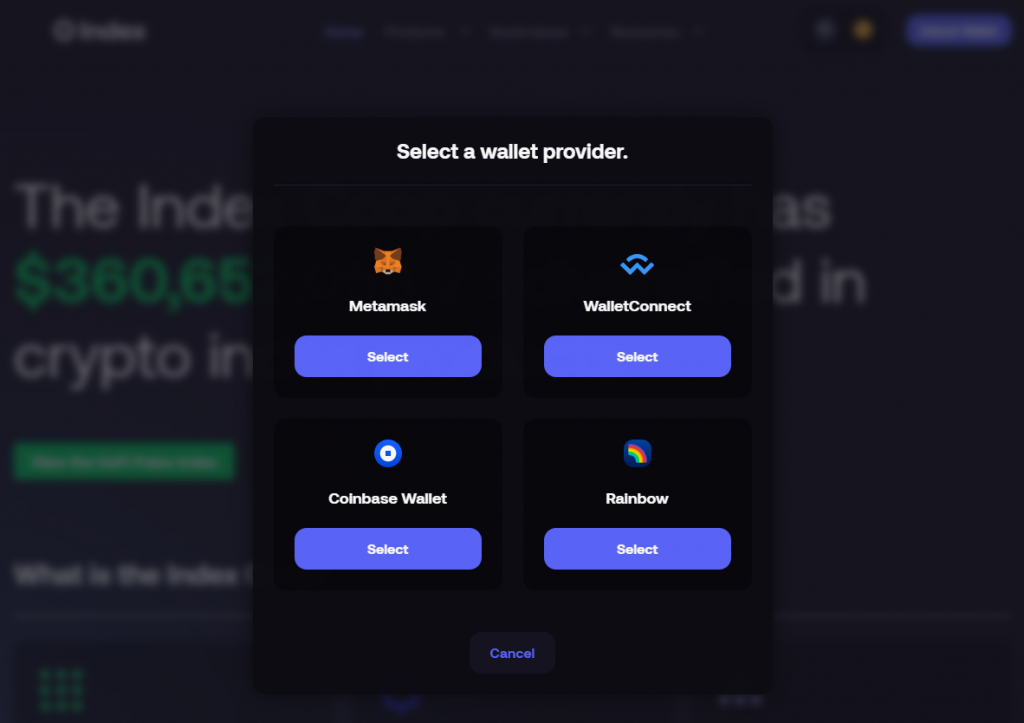

As with all decentralized finance applications, the first thing you need is a digital wallet that you can use to connect with Index Coop. The most commonly used digital wallet is Metamask.

You can connect your metamask with Index Coop.

Once you have connected your metamask with Index Coop, you will be able to purchase the index fund.

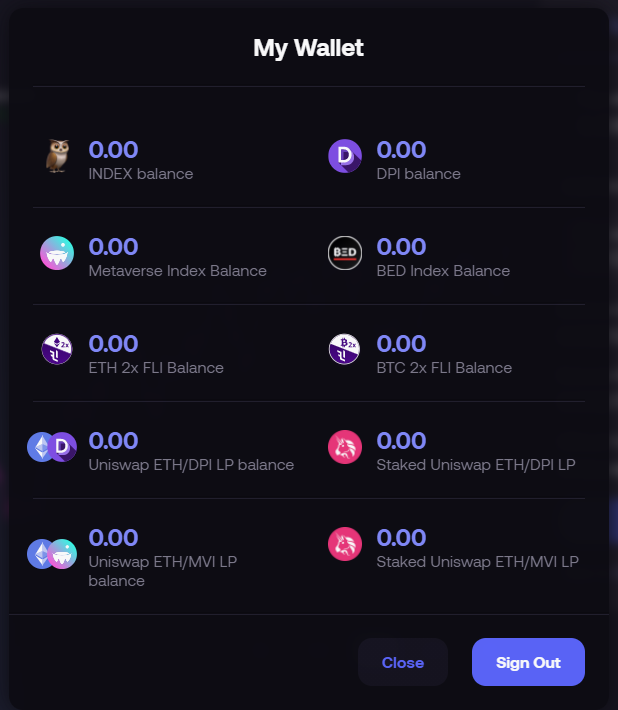

Purchased index fund tokens such as DPI will appear on your Index Coop dashboard.

Why invest in index fund

In times of a bull market, it can be more attractive and more convenient to pick up an index token, rather than tracking an entire sector than to individually pick cryptocurrencies.

Other than that, for new investors with smaller budget, it will be much more cost (gas) efficient to buy a basket of cryptocurrencies and get exposure to a basket of the best community governed DeFi projects as opposed to buying them one by one, incurring fees along the way.

Featured Image Credit: Index Coop

Also Read: What Is Crypto Yield Farming And How To Get Started